dolgachov/iStock via Getty Images

Investment Thesis

Lemonade (NYSE:LMND) is an AI-powered insurance company that’s looking to disrupt a multi-trillion-dollar industry with its simplified policies and customer-aligned business model. Using its AI chatbots, Jim and Maya, Lemonade is able to quickly approve both claims and payouts, resulting less hassle for customers and increased satisfaction.

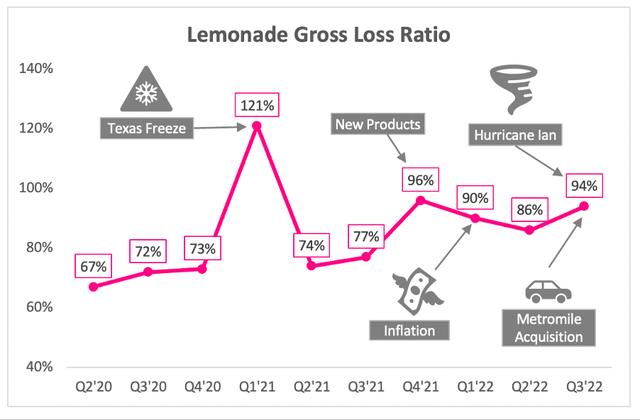

Lemonade has been launching products left, right, and center over the past year, with newer policies such as pet, life, and car insurance becoming a larger share of total in-force premiums. This has resulted in higher gross loss ratios, as Lemonade’s algorithms continue to learn more about how best to price policies for these new products. It’s tough for investors to get a feel for exactly how successfully Lemonade is underwriting these products, but the gross loss ratio trend provides some indication – it’s also one of the first metrics I look at when Lemonade’s earnings are released.

My personal investment thesis for Lemonade is this: There has to be a better way for insurance policies to be issued, and Lemonade is trying to achieve this by generating policies and processing claims in a matter of seconds. The business model has a bunch of economic moats that I highlighted in my previous article, so I have no doubt that Lemonade will succeed if it can get the technology right. The market is currently pricing Lemonade for failure, but if the company can execute on its plans, then it could make huge inroads into this multi trillion-dollar industry.

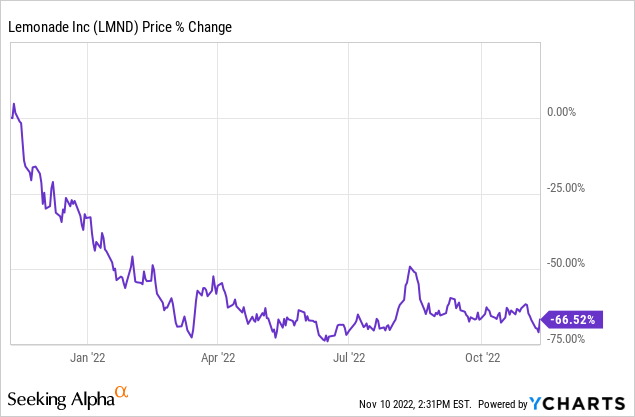

But it’s been a tough 12 months for Lemonade investors, with shares of the company tumbling 67%. This has been driven by erratically high gross loss ratios combined with a severe cash burn in a market that currently has no taste for unprofitable stocks.

Investors were looking to Lemonade’s Q3 results for signs of improvements, especially since this would be Lemonade’s first quarter including results of Metromile, following its bargain acquisition – and I use the term bargain quite literally. As management pointed out in the Q2’22 Shareholder Letter:

We spent approximately $145m-worth of stock on this acquisition, and in return we’ve received nearly 100,000 new customers, over $110m of additional IFP, over $155m in cash and cash equivalents, a second insurance entity with 49 state licenses, and precision data from about half a billion road trips. Downturns have their upsides.

So, $145m in stock for $155m in cash, plus a business? Not a bad deal, not bad at all.

Anyway, Lemonade released its Q3 earnings earlier this week. How did the company get on? Let’s take a look.

Lemonade Q3 Earnings Overview

Before getting into the earnings, it’s worth remembering that Lemonade will be reporting some impressive YoY growth rates due to the acquisition of Metromile. Management hasn’t provided us with too much information in terms of the split between Metromile and Lemonade, so just bear that in mind when reading these figures.

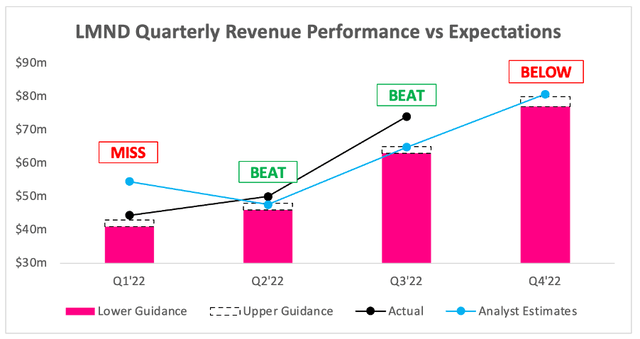

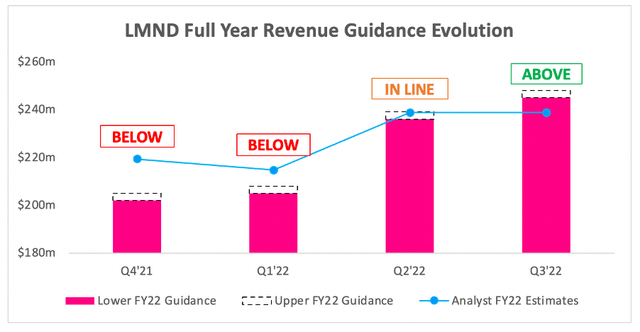

Starting from the top, Lemonade’s Q3 revenue grew 107% YoY to reach $74m, smashing past analysts’ estimates of $64.7m. Revenue also came in far ahead of management’s $63-$65m guidance, making this figure all the more impressive.

However it wasn’t all good news, as the company’s Q4 revenue guidance of $77-$80m came in slightly below analysts’ estimates of $80.7m.

On the plus side, thanks to this substantial Q3 revenue beat, Lemonade’s full-year revenue guidance of $245-$248m came in comfortably ahead of analysts’ estimates of $239m, which should give shareholders something to smile about.

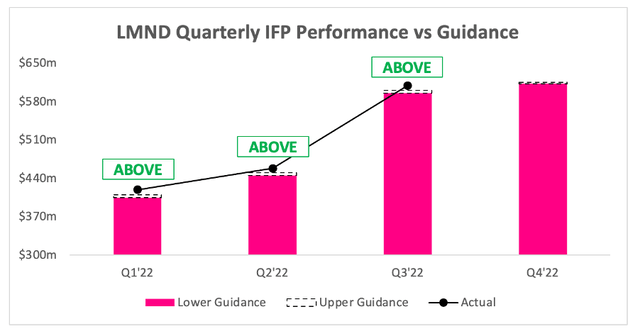

Taking a quick look at IFP (In Force Premium), Lemonade delivered YoY growth of 76% to reach $609m. This was just above management’s guidance of $595-$600m, with management once again under-promising and over-delivering. This is what I like to see from management teams, as long as they don’t under-promise too much.

Management did offer a little bit of guidance on Metromile’s impact here, stating that it added “32 percentage points for the quarter.” This would imply a 44% organic YoY growth rate for Lemonade’s IFP, showing a clear slowdown from the hyper-growth experienced by this company a year ago.

But management did warn investors last quarter that they had moderated growth spend and hiring pace in order to ensure that Lemonade’s existing cash lasts until the company reaches profitability. This is certainly sensible in the current environment, and at least partially explains the slowdown, although 44% YoY growth remains impressive.

All in all, as a Lemonade shareholder I’m pretty pleased with these numbers. While the revenue guidance for Q4 may have been slightly light, the company is exceeding analysts’ estimates for the full year, and it was yet another solid quarter when it came to Lemonade’s headline figures.

Gross Loss Ratio Spikes Once Again

It’s been a real journey for investors watching Lemonade’s gross loss ratios since the company came public, with a bunch of business decisions and outside forces wreaking havoc on the trends. In order to understand what’s going on (and so I don’t have to explain every spike) I’ve created the below graphic.

As you can see, Lemonade’s gross loss ratio jumped from 86% in Q2’22 to 94% in Q3’22, ending the downward trend that investors had been enjoying (note: gross loss ratios should be low; Lemonade’s goal is for a gross loss ratio below 75%).

This quarterly increase in gross loss ratio was, in part, expected. Management had warned us that the Metromile acquisition would cause a bump in the gross loss ratio, and Co-Founder and CEO Daniel Schreiber highlighted the drivers of this increase on the earnings call:

Our loss ratio had been coming down in recent quarters and Q3 saw a reversal in that welcome trend. The spike in loss ratio, however, was not unexpected. We had cautioned that the Metromile deal would have an adverse effect on loss ratios in the short term and Hurricane Ian added several points of loss ratio too.

With that said, we do anticipate the overarching downward trend to continue in the coming quarters, notwithstanding the occasional bumps.

There certainly have been the occasional bumps, which has caused occasional drops in Lemonade’s share price, but Schreiber is correct; management warned about Metromile.

The funny thing is, despite the headache that Lemonade has given me, management haven’t lost my trust – I do feel like they’ve managed expectations (at least my expectations) very well from quarter to quarter, and so I do expect to see a downward trend in gross loss ratios going forward.

A Welcome Deal, Plus International Expansion

The gross loss ratio hiccup should not take away from one of Lemonade’s most noteworthy successes in this quarter. The company entered into a strategic partnership with Chewy (CHWY). Initially an e-commerce company focused on pets, Chewy has since branched out into additional offerings in order to become the leading destination for US pet parents.

Starting in Spring 2023, Chewy customers will be able to easily and exclusively access Lemonade Pet on Chewy.com, and CEO Daniel Schreiber spoke more about how the deal will work:

Chewy is the foremost destination for Pet parents in the U.S. And in the spring, they will start selling Lemonade part to their 20 million customers. Chewy’s revenue share compensation consists of a few components but will be paid out primarily in the form of Lemonade equity.

We’re thrilled Chewy chose Lemonade and we’re thrilled they chose Lemonade stock. In addition to amounting to a huge vote of confidence in what we’re building, this structure aligns our interest with Chewy’s incentives to drive sales of Lemonade Pet and deliver long-term growth at an extraordinarily low cash burn for Lemonade.

While dilution doesn’t sound great for shareholders (and we don’t have any detail on the severity of this dilution), this deal is undoubtedly a positive. It means more revenue for Lemonade, access to millions of loyal Chewy customers, and a partner in Chewy that is now aligned to the success of Lemonade thanks to this investment.

There was more exciting news, as Lemonade began rolling out its insurance products in the U.K. (where I’m currently writing from), expanding into Europe’s largest insurance market. As Daniel Schreiber put it:

As followers in the U.K. at the risk of sounding too sappy, this is a meaningful step for us. Insurance as we know it hails from the U.K. and on a personal note, so do I. So both professionally and personally, bringing Lemonade to the U.K. is a homecoming of sorts.

Beyond the sentimentality of it all, the U.K. is the largest insurance market in Europe, and so represents a material addition to our total available market.

I’m also personally excited to try out Lemonade’s product for myself, once my home insurance goes up for renewal. So, while Lemonade remains a relatively speculative investment, it’s great to see the company making so much progress, and I have no doubt that both of these announcement should bring future success.

Lemonade’s Key Trends and Core Financials

I’ll also touch on some of Lemonade’s key trends, and in the insurance industry there are certainly a number of fun metrics that investors can choose to watch.

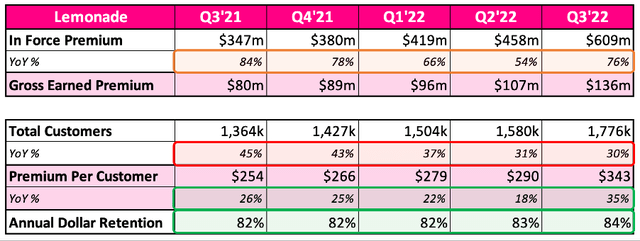

I already touched on the rapid deceleration of Lemonade’s in force premiums, even though there was a substantial YoY boost in Q3 thanks to the Metromile acquisition. As can be seen in the below table, a big driver of this IFP slowdown in the deceleration in customer growth, which has gone from 45% YoY in Q3’21 to 30% YoY in Q3’22, and that is including customers from Metromile – so, an even more substantial slowdown that the figures suggest.

Now, I will say this. At least Lemonade’s sales and marketing expenditure actually declined YoY by ~15%. There are plenty of companies that reported rapid deceleration this earnings season, despite sales and marketing expenditure growing by 20%, 30%, or even 40%.

Clearly this is aligned to management’s decision to slow down growth in order to focus on achieving profitability, although profitability won’t happen for a while – investors should find out more about Lemonade’s “path to profitability” during the company’s Investor Day in mid-November.

There were some positive metrics. Firstly, the annual dollar retention has continued to improve each quarter – in fact, this figure was 79% back in 2020, so to see it grow to 84% in Q3’22 speaks volumes to both the customer satisfaction and the cross-selling of multiple insurance products from Lemonade.

This cross-selling, and the acquisition of Metromile, also helped to continually grow Lemonade’s premium per customer. This grew 35% YoY to achieve $343, which is fantastic to see from an investor’s point of view.

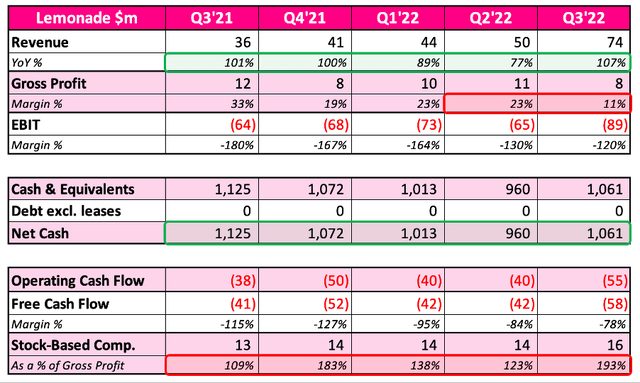

Taking a look at Lemonade’s financials isn’t exactly the most enjoyable thing in the world, but let’s do it anyway. I’ll start with an obvious caveat; I know, and I think all Lemonade investors know, that the company is unprofitable and burning cash for fun. I won’t talk much about EBIT and free cash flow margins; these are both horribly negative, but at least they have been trending in the right direction over the past five quarters.

On the plus side, Lemonade has a net cash position of $1,061m as of Q3, meaning this company has years to cope with its cash burn. Investors will find out more information on Lemonade’s Investor Day in terms of cash burn alleviation, but right now I’m not concerned about this company’s financial position – it has more than enough cash on hand.

A big concern amongst investors is the level of stock-based compensation, and I fully understand and support this. Lemonade’s management really does need to get SBC under control, as it was almost double Lemonade’s Q3 gross profit – yikes!

But, in truth, these are not terrible financials for a company at Lemonade’s stage of growth. Do I think it came public too early? Yes, but here we are, and the company is continuing to perform well and give me confidence going forward.

LMND Stock Valuation

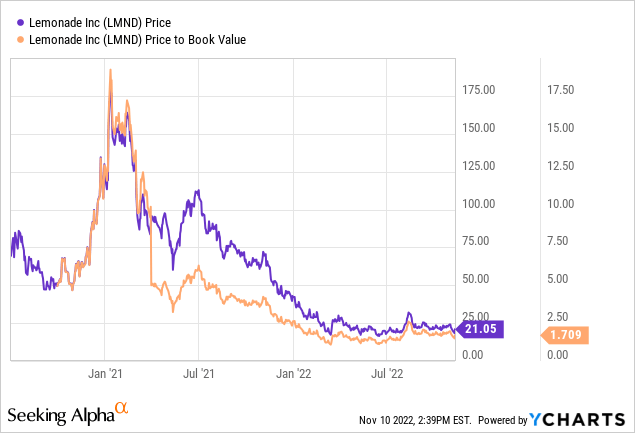

As I’ve said before, valuation really isn’t the issue with Lemonade right now. It currently trades for ~1.7x book value in an industry where most US insurance firms trade for 1.2x to 1.6x book value, according to data from Capital IQ.

On this front, Lemonade is slightly overvalued, but it has much, much higher growth potential than most of its incumbent competitors. That’s part of what makes Lemonade such a tough stock to put a price tag on, and we’ve seen its multiples and share price hit dizzying heights since it came public.

Investing is rarely a zero-sum game, but with Lemonade I think it is. If the company successfully executes on its vision, then shares at the current price will likely prove to be a successful investment. If the company does not execute on its vision, then it doesn’t really matter what you pay – with cash burn like this, Lemonade stock will head down to zero within the next decade.

Bottom Line

My investment thesis for Lemonade is still very much on track, and I’m fully aware that this is a multi-year long journey that investors such as myself will have to go on. I still believe that the co-founders will be able to execute on Lemonade’s vision, and that’s critical for an investment such as this.

There are plenty of trends that are also heading in the right direction, and the shrewd Metromile acquisition combined with the Chewy partnership shows a business that’s continuing to get stronger.

Yet investors should be well aware of the risk that this investment carries, and should therefore give Lemonade an appropriately small position size in their portfolio.

Given everything I’ve seen in these Q3 results, I will reiterate my previous “Buy” rating on Lemonade shares.

Be the first to comment