Dilok Klaisataporn

Lemonade (NYSE:LMND) reported better than expected Q2 results a few weeks ago and raised their revenue guidance, reflecting their recent acquisition of Metromile.

And while management commented on their longer-term profitability ambitions, it may take several years until the company actually reaches breakeven levels. Just in the last quarter, the company reported an adjusted EBITDA margin loss of over 100%.

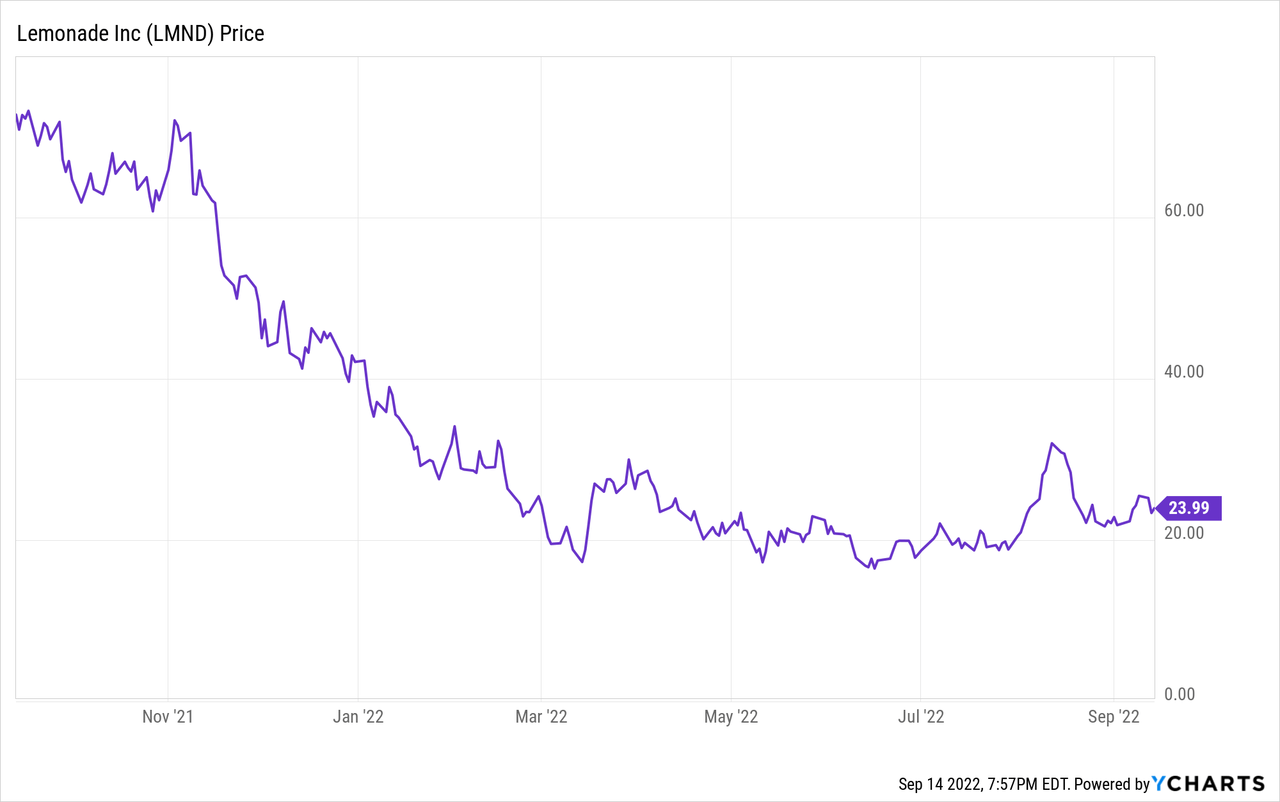

While the stock initially popped over 10% after reporting earnings, recent volatility has pushed the stock down around 15% compared to pre-earnings levels as investors continue to digest the macro environment and place more emphasis on profitability metrics. This is also evidenced by the stock falling over 40% so far year-to-date and with fears of interest rates continuing to rise, LMND’s valuation may continue to remain under pressure for the foreseeable future.

I do believe the company provides a unique value proposition that differentiates themselves from traditional insurance models and with the company continuing to expand into different areas of insurance, I believe growth may remain in the double-digits for a while.

However, given ongoing heavy losses and investor sentiment remaining negative towards companies with no line of sight into profitability, I believe LMND shares may remain pressured.

Financial Review and Guidance

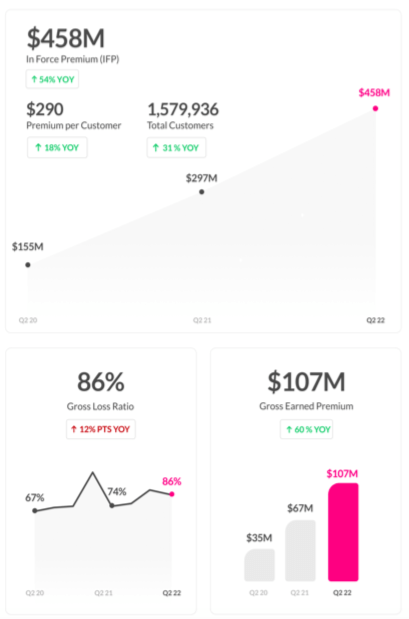

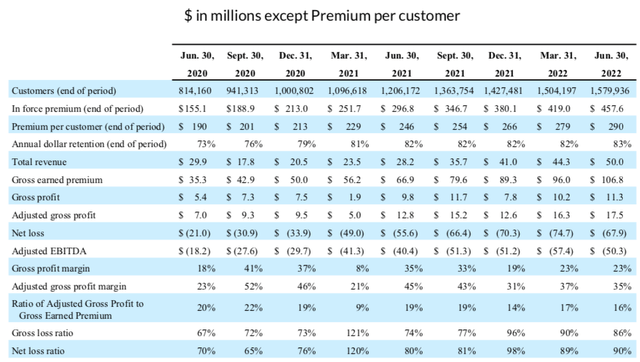

A few weeks ago, LMND reported Q2 results with revenue growing 77% yoy to $50 million, which was better than consensus estimates for 69% yoy growth to $47.6 million. In addition, the premium per customer ended the quarter at $290, which grew 18% yoy. With customer count growing 31% yoy to 1.6 million, revenue growth was driven by a healthy balance of both factors.

LMND

Additionally, LMND added $38.6 million of in-force premium during the quarter to end at $458 million, representing 54% yoy growth. In the end, adjusted EBITDA loss during the quarter was $50.3 million and which lower than the $40.4 million loss in the year ago period. Nevertheless, it should be noted that the company’s adjusted EBITDA loss is more than 100%, meaning they lose more money than they generate in revenue.

However, Q2 sales and marketing expense declined over $1 million compared to the year ago quarter, which helped drive an EPS beat during Q2.

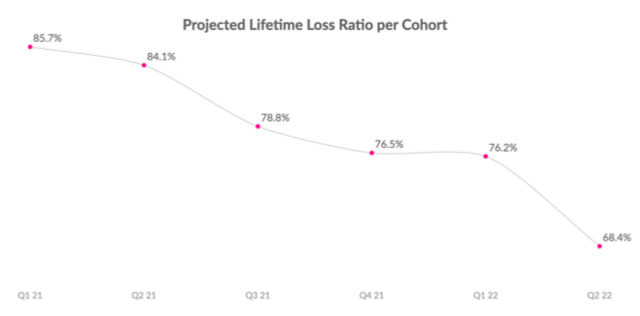

As seen in the chart above, the company added 76k net new customers with gross loss ratio also improving to 86% during the quarter. I do believe that longer-term, we should see loss ratios improve as the company’s customer base becomes more mature.

Importantly, the company started to lay out a path towards profitability, but I believe this remains a long-term show me story. With adjusted EBITDA losses coming in more than the company’s actual revenue, I believe it may take several years until the company gets close to breakeven.

We are fast approaching the tipping point where the return on our earlier investments outstrips the costs of new investments. It’s not just that more and more of our sales are zero-cost cross-sells or upsells, it’s also that more and more of our book consists of seasoned products and customers.

The upshot is that even as we continue to launch new products in new territories to new customers, we have turned a corner. We expect our losses to peak this quarter (Q3), and to continue to shrink thereafter, charting a clear path to profitability.

Importantly, this phase-change, from growing losses to shrinking losses, is occurring naturally. It as an outgrowth of sticking to our strategy through the years where our book was small and new, and our investments were disproportionately high. The business, in other words, is doing what it was designed to do.

Yes, the outline provided above is a starting point, but it may take another 5 years until the company starts generating a profit.

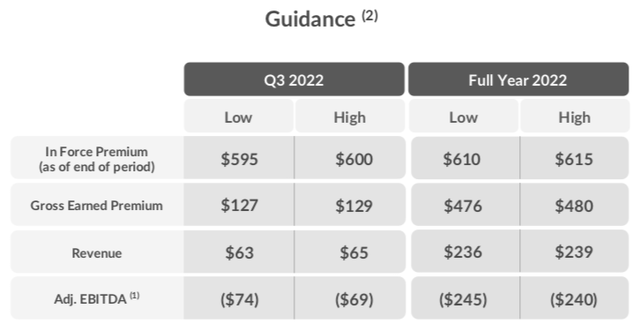

With a little over $1 billion in cash/investments, the company is quickly burning through their cash, as seen with their guidance for adjusted EBITDA loss of $240-245 million for the year. At this rate, the company may need to seriously consider an outside capital raise in order to drive future revenue growth.

Guidance for the full year now incorporates the company’s recent acquisition of Metromile. Revenue guidance is now expected to be $236-239 million with adjusted EBITDA loss of $240-245 million. Again, this reiterates my point that the company is losing more in adjusted EBITDA than the company generates in revenue, meaning adjusted EBITDA loss of over 100%.

In force premium for the year is expected to be $610-615 million and gross earned premium is expected to be $476-480 million. While these are both higher than the company’s prior guidance range, this is largely due to the Metromile acquisition contribution.

The chart above clearly shows that as the customer cohorts become more mature, projected lifetime loss ratios improve. With over 70% of the company’s premiums coming from customers who have been with LMND for less than 2 years, this can cause higher loss rates in earlier cohorts. I do believe that there remains ongoing improvement over time, but as the company intends to slow down marketing spend and customer acquisition costs, I believe it remains a show-me story on how the customer growth trajectory and expected losses play out.

Valuation

While the stock initially popped over 10% after posting earnings as the company laid out longer-term ambitions of profitability, ongoing macro pressures have pushed the stock 15% below pre-earnings levels, quite a big swing over the past few weeks.

Yes, by laying out the long-term framework of profitability expectations, I believe investors initially applauded this commentary. However, adjusted EBITDA losses remain over 100% of revenue, meaning that even if revenue were to maintain strong double-digit growth levels over time, it may take several years for the company to achieve breakeven levels.

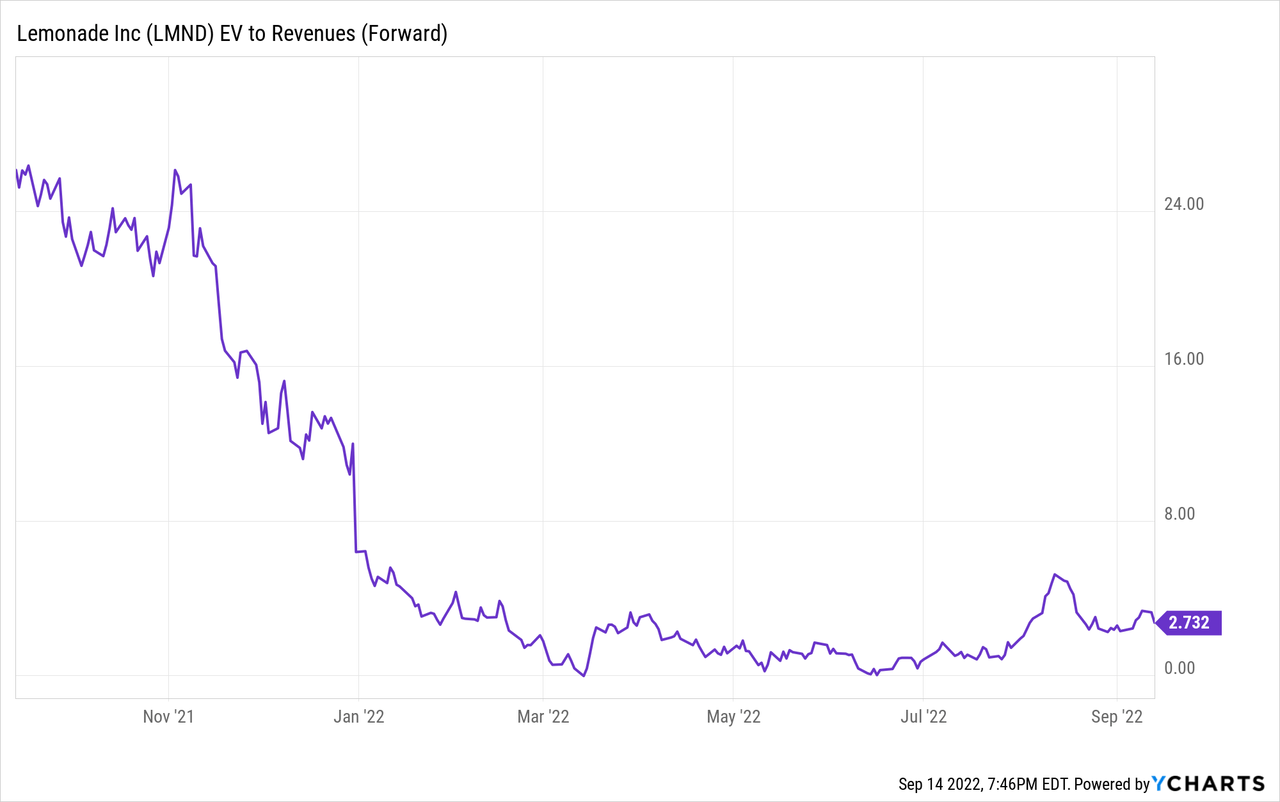

To no surprise, the company’ stock has been under pressure this year with valuation pulling back from over 25x forward revenue down to under 3x forward revenue. And even at the current level, valuation does not appear overly attractive.

Yes, revenue growth remains healthy and the company has done a great job of expanding into other areas of insurance, providing significant cross-sell opportunities. However, even when looking at a Rule of 40 score, LMND scores in the negative because of their adjusted EBITDA losses over 100%.

The company has a current market cap of $1.65 billion and with just over $1 billion of cash/investments, the company’s enterprise value is around $600 million.

With consensus expecting FY23 revenue around $375 million, this pushes valuation to under 2x FY23 revenue, which at face value appears pretty attractive.

But as we potentially enter a recessionary environment and macro slowdown, revenue growth may naturally slowdown. In addition, investors have continued to place more focus on company’s profitability metrics and trajectory. Even though management laid out their longer-term ambitions, it may take several years to reach breakeven point.

For now, I continue to remain on the sidelines as I believe the company remains a show-me story. With LMND expecting to host an analyst day in November, investors may find some updates around longer-term expectations, which could be the next catalyst for the stock.

Be the first to comment