guvendemir/iStock via Getty Images

Editor’s Note: This article is meant to introduce Equanimity Investing’s Marketplace service, Equanimity Research

I’m excited to launch Equanimity Research, a new Seeking Alpha Marketplace Service. The service is to first and foremost help you preserve your existing capital. Secondly, you should want to steadily build your investment portfolio in a manner that best suits you: Whether that’s sustainable income, growth, or both.

Subscribers should choose the Equanimity Research service if they want actionable ideas based on fundamental analysis backed by a sensible valuation approach. If you want stock ideas that fall into the categories of value, GARP, and income, then be prepared to have them served to you on a silver platter. Stocks covered will primarily be businesses that have shown a strong history of operating performance and/or have a strong likelihood of delivering shareholder value over the long term.

My motivation for launching this service is to generate stock ideas for continuous compounding that can be leveraged by subscribers and myself. My goal is to show you compelling moderate-high dividend yielding and double-digit total return opportunities.

My hope is that investors of all kinds, whether you’re just starting out all the way to seasoned veterans, will find value in my research. In a nutshell, subscribers will receive regular stock ideas and updates, two model portfolios, a regularly updated watch list, direct access to me, live chat sessions, and more. Effectively, you’ll have access to my ideas, research methods, and other frameworks to help you become a better investor and grow your wealth.

Risk Management In A Tough Environment

Everyone is aware of the headlines with spiraling inflation eroding your purchase power, but making the right investments can help you sustainably beat inflation with strong real returns. Next, did you know that global debt has amassed beyond a record $303 trillion? Well, that debt overhang creates a lot of uncertainty and risk for equity investors. You need to make sure the companies you’re invested in have good business models and controlled risks. Economic superpowers, the fraying of globalization, and supply chain disruptions also are impacting companies domestically and internationally. On top of all that, central banks being synchronized with monetary tightening has created more concerns about a looming economic downturn.

So how does an investor manage all of these risks? Like any period in history, it requires careful asset allocation and security selection. The key is to always be investing for steady wealth accumulation and having enough cash liquidity to take advantage of volatility and market drawdowns. In other words, investors should be able to have a portfolio that allows them to succeed regardless of the direction of the overall market.

With that, it’s important to identify growing businesses with durable competitive advantages, clean balance sheets, and acceptable valuations, so you can build sustainable income and long-term growth. My goal is to identify such ideas so you make the decision to invest alongside me.

What Do You Receive From Equanimity Research Marketplace Service?

The Equanimity Research service will provide subscribers with the following offerings:

- Access to all articles, including Marketplace research in advance of Premium publications.

- Exclusive Marketplace Content with analytical research.

- My two model portfolios: Dividend and total return, including all buy, hold, and sale transactions plus other critical information.

- A regularly updated watch list.

- Direct access to Equanimity Investing during weekdays during most after-market hours and evenings.

- Access to an active live chat room and Q&A sessions.

- Other useful investment tips and tricks.

Most articles will regularly be posted with either new investment ideas or updates on a weekly or bi-weekly basis in the Marketplace in advance of being released as premium articles. Marketplace and premium articles will either cover stocks that I’m currently invested in or be more research-focused with the potential for future investment.

Exclusive Marketplace Content will provide more detailed analysis and reasoning behind existing positions and new ideas, why each stock is worth owning, and relevant business progression. These updates will include any changes in the two portfolios, the watch list, transaction notices, and other relevant information.

The dividend and total return model portfolios will summarize my best stock ideas, most recent articles, position-sizing, valuation estimates, dividend sustainability, and other important information as a snapshot guide. Recall that regardless of which portfolio, I only buy companies to theoretically have timeless ownership in the business. In practice, I’m always buying and holding stocks, and will rarely sell positions.

The Dividend Portfolio

The dividend stock portfolio will be long-only investments that only contain companies with durable competitive advantages, high-quality cash flows, strong balance sheets, and dividend safety. These companies fall into two different buckets: 1) Low-moderate dividend yields with dividend growth potential, and 2) moderate-high dividend yields with dividend stability. The ultimate goal of this portfolio is to generate sustainable income that runs above the broader market and other high-yield ETFs and mutual funds that are available.

The Total Return Portfolio

The total return stock portfolio will also be long-only investments that contain companies with favorable risk-adjusted returns. These companies can be dividend or non-dividend stocks that will possess durable competitive advantages, high-quality cash flows, and strong balance sheets. These companies will either fall into the compounder, growth at a reasonable price, or value categories. Some companies may be of somewhat lower quality, but for the sake of gaining access to opportunities that are cheaper than high-quality options. In either case, the goal is to identify opportunities with significant dislocations in valuation, either due to the business demonstrating fundamental improvements, unjustified sell-offs, or both.

Other Important Features

The investment portfolios will never utilize margin leverage, short-selling, or securities and/or investment products that have leverage as those strategies are inherently riskier. My goal is to achieve steady capital accumulation while limiting downside risk at all costs.

All buy, hold, and sales transactions and other critical information will be made available in the two model portfolios as well as with trading alert articles only provided to Marketplace subscribers. Just like asset allocation and security selection, proper timing of the purchase is equally important as those can make or break the risk/reward profile.

The regularly updated watch list will contain stocks that are currently being researched, are planned to be purchased in the future, or could be imminently purchased. The watch list will give subscribers a visible funnel of any new ideas coming down the pipeline.

Subscribers will receive direct access to me, Equanimity Investing, so you can send over any questions, comments, or concerns about the service. Some topics might include requesting information about the portfolios, stock ideas, recent developments, transactions, or otherwise. To do so, simply send me an inbox message in the top right-hand corner “Send Message” and I’ll look to give you a response within two business days.

The active live chat room is an open community between all Equanimity Research subscribers with the goal of forming constructive dialogue. Once again, these discussions can include anything from stock updates, new ideas, transactions, portfolio weightings, etc. My belief is that we can all help make each other better investors and build wealth more effectively together.

Investment tips and tricks can be discussed on an ad hoc basis or in live chat sessions. With my extensive tenure as a research professional and cumulative investment experience, there are certain ways investors can gain an edge in the market to help produce alpha and avoid costly pitfalls.

A Few Recent Winners

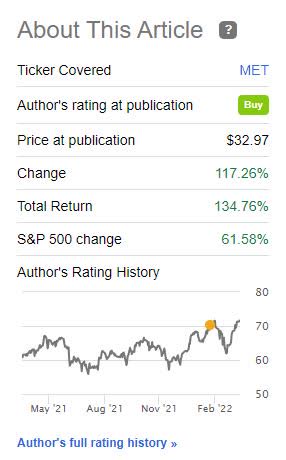

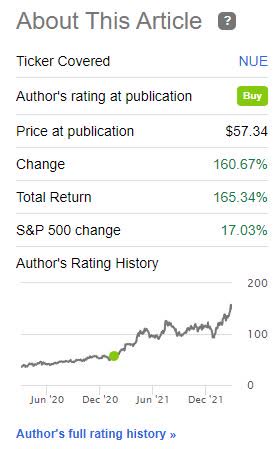

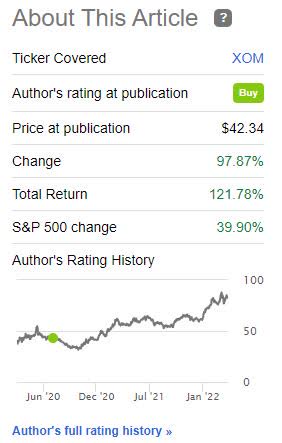

Stock ideas that fit into our fundamental Marketplace criteria of being a growing business with durable competitive advantages have delivered excellent absolute returns and relative to the broader market. A handful of recent stock picks included the purchases of MetLife (MET), CVS Health Corporation (CVS), Nucor Corporation (NUE), Exxon Mobil (XOM), among others, that have posted double-digit annualized returns and materially outperformed the S&P 500.

MetLife Return Performance (Author) CVS Return Performance (Author) NUE Return Performance (Author) XOM Return Performance (Author)

Please note that not all of my historical premium articles fall into the investment criteria required for the service’s dividend and total return portfolios, i.e. some irrelevant stocks carry hold and sell designations. Moreover, not every long stock position has outperformed the broader market, and of course, more recent buy ideas posted in 2021 and 2022 are still in the early innings. Nonetheless, several of my stock picks are beginning to outperform the S&P 500 here in 2022 and are already posting solid returns.

Should You Subscribe To Equanimity Research?

Equanimity Research is meant for many types of investors that are either looking to actively or somewhat passively manage their portfolios. Investment ideas are routinely listed but the objective is to own these stock positions for extended periods of time, ideally 5 to 10 years or longer. Equanimity Research also is meant for medium to long-term investors seeking sustainable income and/or growth in their portfolios. I’m indifferent to company size, so ideas will range from underfollowed microcaps all the way to mega-caps. I leave no sector or industry untouched and aim to identify strong businesses that are undervalued that can generate above-average market returns. I also will search for any market dislocations caused by overdone selloffs in a particular stock, group of stocks, or industry. Such overreactions due to temporary headwinds can be great opportunities to generate significant alpha.

Readers should take note that I actively seek to avoid companies that are speculative in nature. I will never invest in “penny stocks,” companies with no real business model, broken business models, pre-revenue companies, companies vulnerable to bankruptcy, sanctioned companies, and/or value traps. Additionally, I avoid any companies that might have management with misaligned interests, excessive executive or share-based compensation, high executive turnover, potential frauds, serial cash burners, serial equity diluters, exposure to toxic financing, poor capital allocation, unable to generate returns above their cost of capital, accounting concerns, or any other shenanigans. Identifying such red flags and excluding such companies is part of my fundamental research process and helps guide portfolio construction.

Getting Started Today

I have been writing for Seeking Alpha since 2013 and have fully enjoyed my experience working with the SA editorial team, discussing ideas with my readers, commenters, having 1-on-1 conversations, networking, and having gathered more than 2,700 followers to date. With the Equanimity Research Marketplace service, I want to provide even more compelling research and actionable ideas for subscribers to achieve strong risk-adjusted returns.

With that, consider joining Equanimity Research today to start building your wealth and income safely. As a general sweetener, I wanted to make the Equanimity Research Marketplace service affordable for all investors.

As a starting incentive for the first 10 annual subscribers only, I’m offering a 62% discount at a cost of $250/annually, or an effective price of ~$21/monthly! Hurry and grab this discount before other subscribers do!

After the initial 10 subscribers have signed on, the standard price will increase to $55 per month, or $350 for an annual subscription, which equates to a 47% discount on the monthly rate. Service prices will remain unchanged for those who subscribe early. Prices for later subscribers, i.e. in 2023 and beyond, will likely see a higher pricing structure to adjust for inflation so locking in your subscription now will save you money in the long run.

If you want to learn more about the service to see if it’s worth it to you, please try my two-week FREE trial. This trial will allow you to gain access to the service and all of the offerings available. There are absolutely no obligations or commitments attached to this trial whatsoever.

If you have any questions about the service, please send me an inbox message through Seeking Alpha or leave a note in the comment section below. I’ll answer all of your questions in a timely manner to the best of my ability.

Thank you for your time and I look forward to your comments, inbox messages, and seeing subscribers in the chatroom!

Equanimity Investing is a research professional by trade with an extensive background in data analytics, deep research, financial modeling, and more. Other knowledge encompasses corporate debt markets, credit analysis, capital structures, accounting, applied economics, monetary policy, and related topics to asset allocation and security analysis. Having more than a decade of investment experience has helped me become more disciplined, humble, and a shrewd risk manager. I often focus on minimizing the downside and the upside will often take care of itself. If you would like to learn more about my research and investment approach, feel free to send me a note and I’d be more than happy to chat with you.

– Equanimity Research

If you’re reading this via Seeking Alpha’s mobile app, to try this service right now go to seekingalpha.com and enter “Equanimity Research” in the site search to visit my Marketplace Service checkout page.

Be the first to comment