blackdovfx

By Cristopher Anguiano

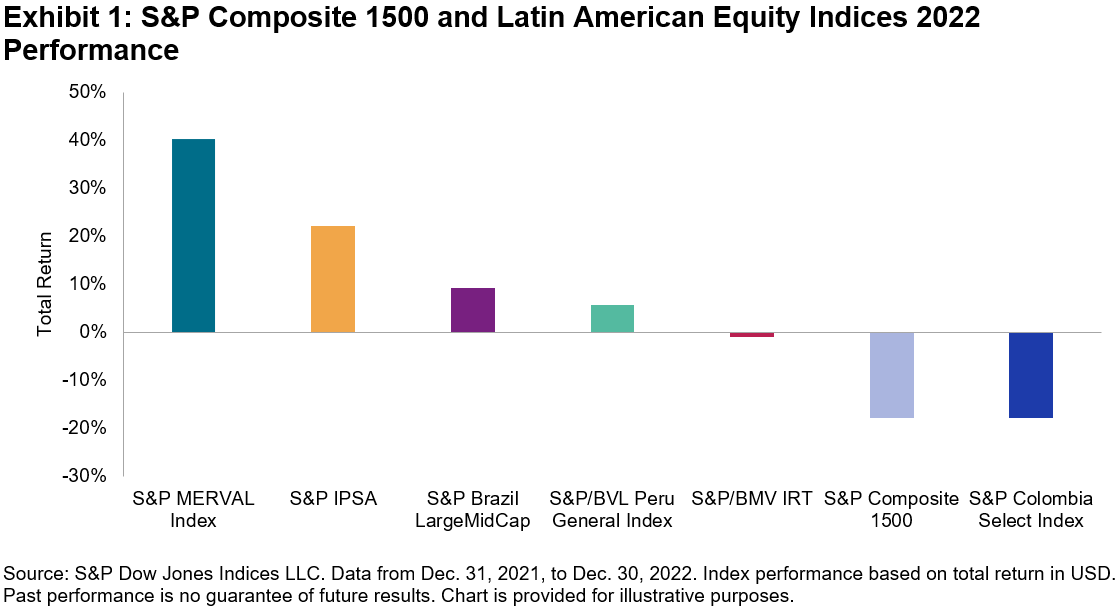

2022 was a challenging year for equity markets, as central banks around the world hiked interest rates in response to surging inflation. U.S. equities were affected by the souring sentiment, with the S&P Composite 1500® down 17.8% in 2022. More broadly, all 25 countries in the S&P Global Developed BMI declined in U.S. dollar terms since the end of 2021, while 15 out of 24 S&P Emerging BMI countries declined by the same measure. However, Latin American equities had a stronger year than most regional markets: Exhibit 1 shows that equity markets in Argentina, Chile, Brazil, and Peru increased in U.S. dollar terms last year.

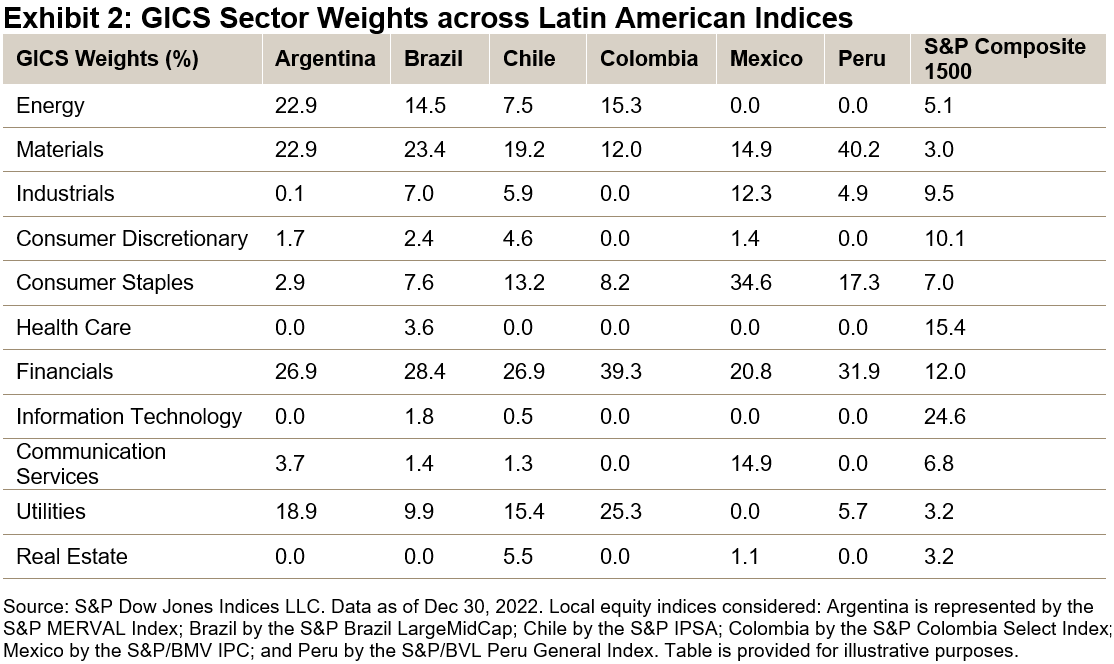

Sector exposures were a key reason for performance differences in 2022. Exhibit 2 shows that many Latin American countries benefitted from having more (less) exposure to out- (under-) performing GICS® sectors compared to the S&P 1500™. Indeed, Latin American countries typically had greater weight in Energy, Financials, Materials and Consumer Staples, and less exposure to Information Technology and Consumer Discretionary.

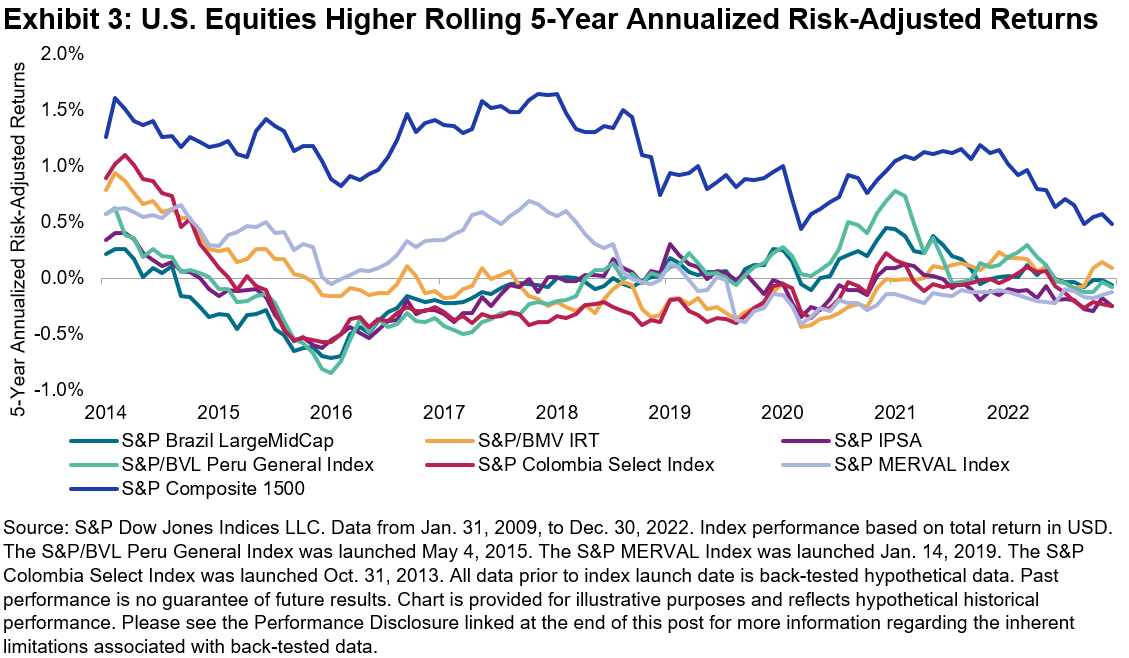

Although the out performance of domestic equity markets may be well received by investors across Latin America, some may wish to take a longer-term perspective. Over long-term horizons, the S&P Composite 1500 showed higher returns and lower risk compared to the country-specific indices. Exhibit 3 shows the rolling five-year risk-adjusted returns, where U.S. equities posted a higher return per unit of risk.

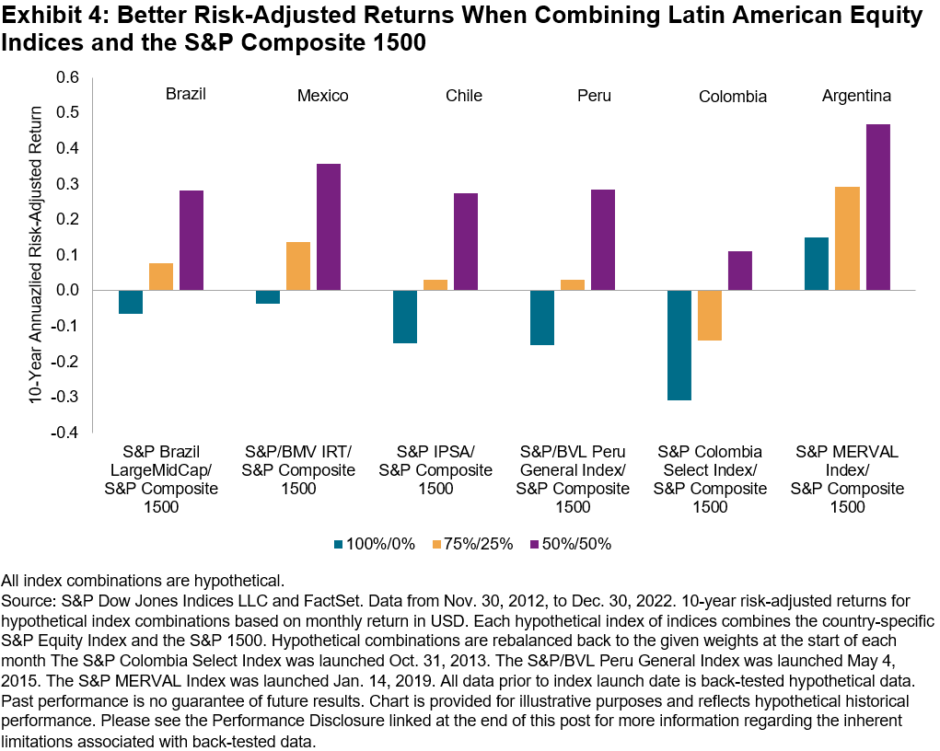

Combined with the less-than-perfect correlation between the performance of the S&P Composite 1500 and various countries in Latin America, it is unsurprising that Exhibit 4 shows that adding a U.S. equity allocation to a domestic equity allocation could have improved risk-adjusted returns, historically.

As a result, Latin American equity indices outperformed in 2022, as they benefitted from having less exposure to sectors that were most affected by higher interest rates. However, U.S. equities may still be relevant to investors in Latin America. Combining U.S. equity exposures with a domestic equity allocation could have improved risk-adjusted returns, historically, and the U.S. market’s distinct sector exposures could help mitigate domestic sector biases.

| Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit www.spdji.com. For full terms of use and disclosures, please visit www.spdji.com/terms-of-use. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment