designer491

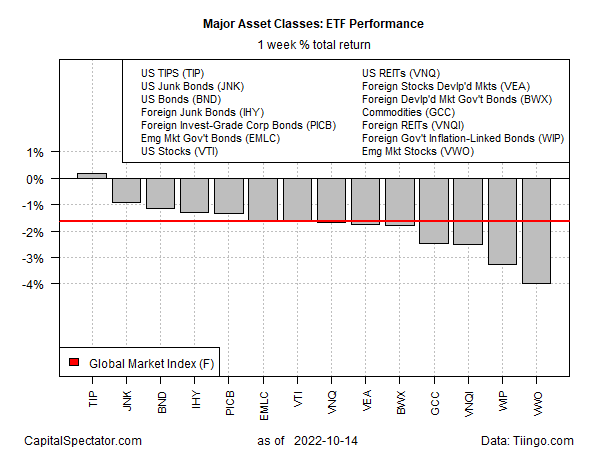

US government bonds offering inflation hedging provided the only positive return for the major asset classes in last week’s trading through Friday, Oct. 14, based on a set of proxy ETFs.

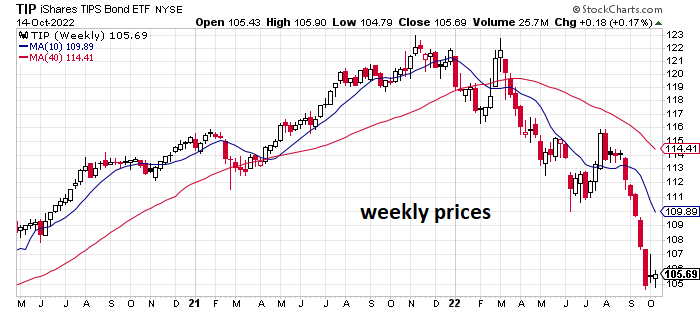

The iShares TIPS Bond ETF (TIP) rose 0.2%, marking the second weekly advance for the fund. Although the fund has lost ground this year, the 13.3% loss is relatively modest vs. the US stock market’s 23.8% haircut so far in 2022. TIP’s year-to-date slide also compares favorably against US bonds overall, based on the 15.8% year-to-date decline for Vanguard Total Bond Market Index Fund (BND).

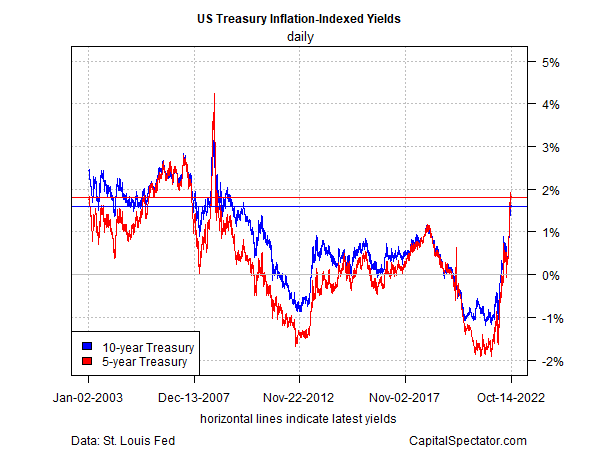

Investors are also eyeing the recent rebound in inflation-adjusted yields offered in this corner of the Treasuries market. After an extended run of negative real yields, the payout rate for a 5-year inflation-indexed Treasury note, for instance, has surged recently and is currently at 1.81%, the highest since 2009. Investors who buy and hold the 5-year TIPS bond will lock in the relatively elevated real yield.

The rest of the major asset classes lost ground last week. The biggest setback: stocks in emerging markets via Vanguard Emerging Markets Stock Index Fund (VWO), which lost a hefty 4.0%. VWO ended the week near its lowest close in 2-1/2 years.

Broad based declines took a bite out of the Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies overall. GMI.F fell 1.6% last week, the fourth weekly loss in the past five.

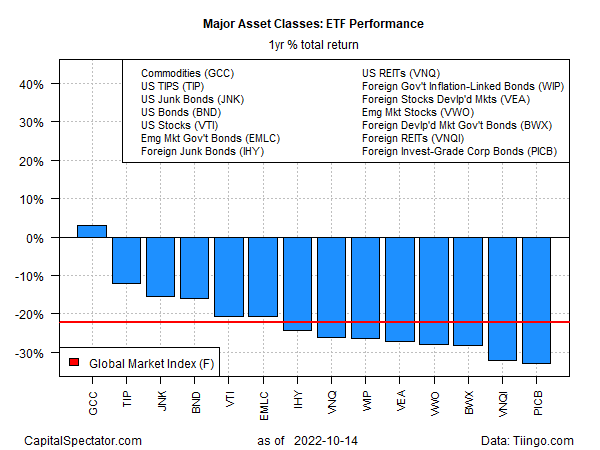

For the one-year change, a broad measure of commodities (GCC) is still the only slice of the major asset classes posting a gain. GCC is up a modest 3.0% over the past year, in sharp contrast with losses for the rest of the field.

GMI.F is down 22.2% for the past year.

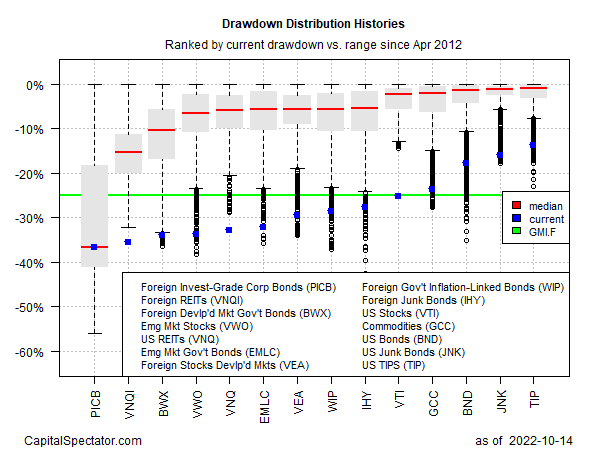

Looking at the major asset classes through a drawdown lens shows that all markets are posting relatively steep declines vs. previous peaks. The softest drawdown at the moment: inflation-indexed Treasuries (TIP), which closed with a 13.7% drawdown. At the other extreme: foreign corporate bonds (PICB) are nursing a roughly 37% slide from the previous peak. GMI.F’s drawdown: -25% (green line in chart below).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment