blackdovfx/E+ via Getty Images

Introduction

As a dividend growth investor, I am always looking for new opportunities to increase my dividend income. Sometimes I add to existing positions in my dividend growth portfolio, while other times, I am starting new positions in my portfolio. The current volatility in the market, and the S&P 500 in a bear market, leave room for some more opportunities.

In this article, I will look at Lam Research (NASDAQ:LRCX), a leading company in the IT sector. This is a segment that has suffered from a significant price decline over the past several months. A year ago, I believed that the shares were a BUY, and since then they have plummeted. In this article, I will revisit the company from the perspective of a dividend growth investor.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits. The company sells its products and services to the semiconductors industry in the United States, China, Europe, Japan, Korea, Southeast Asia, Taiwan, and internationally.

Wikipedia

Fundamentals

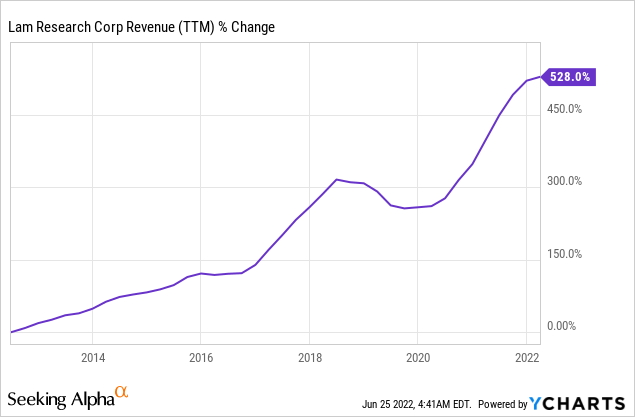

The revenues have increased by more than 500% in the last decade. Lam Research enjoyed significant growth due to the higher demand for semiconductors. Most of this growth was achieved organically, and as the demand continues to surge, there will be a significant tailwind for sales growth. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lam Research to keep growing sales at an annual rate of ~10% in the medium term.

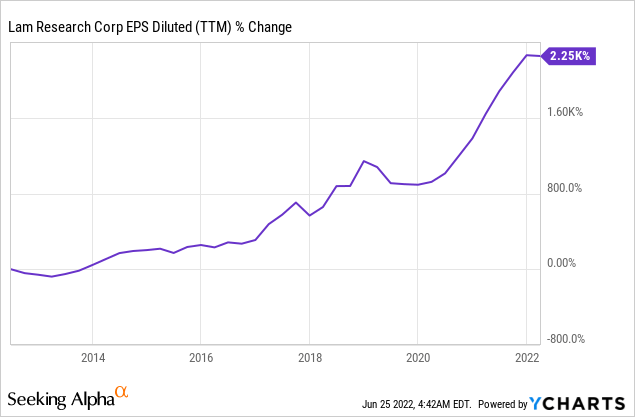

The EPS (earnings per share) has grown at an even faster pace than the revenues. EPS multiplied by more than 20 times in the last decade and it was fueled by a combination of sales growth, significant buybacks, and above all, improved margins as operating margins improved from 9% to 31%. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lam Research to keep growing sales at an annual rate of ~13% in the medium term.

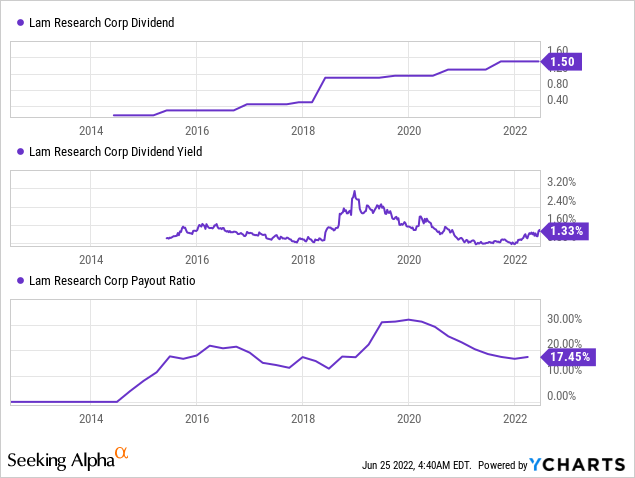

The company doesn’t have a very long track record of dividend increases. However, the current streak looks promising. The company initiated the dividend seven years ago and raised it every year since. The current yield is 1.33% and it is extremely safe with a payout ratio below 20%. In addition to that, investors should expect another double-digit dividend increase in the upcoming dividend paid declared in August and paid in October.

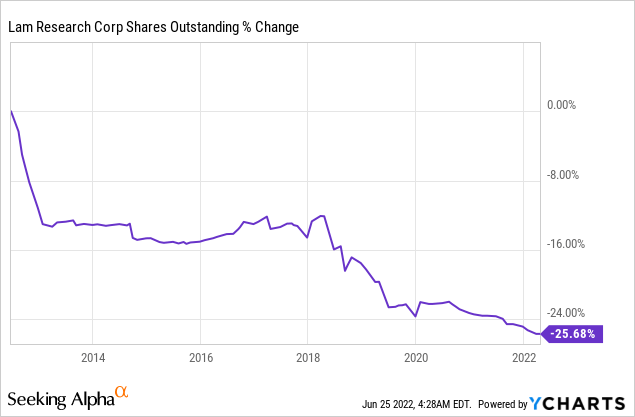

In addition to dividends, Lam Research has been returning capital to shareholders in the form of buybacks. Over the last decade, Lam Research has bought back over 25% of its shares outstanding. Buybacks are a good sign when the company is growing as they support EPS growth. At the current valuation, the new buybacks plan worth $5B will be extremely effective, and support EPS and dividend growth.

Valuation

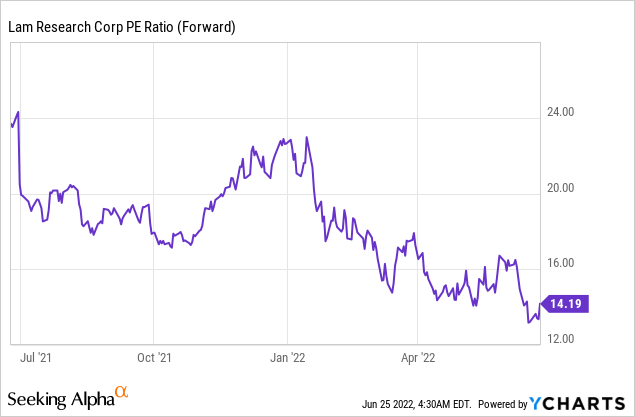

The current P/E (price to earnings) when using the current forecast for 2022 is 14. It seems like an attractive valuation, as this is the lowest valuation we have seen over the last twelve months. A year ago shares were trading for more than 24 times earnings, as interest rates were low and the forecast was for fast EPS growth.

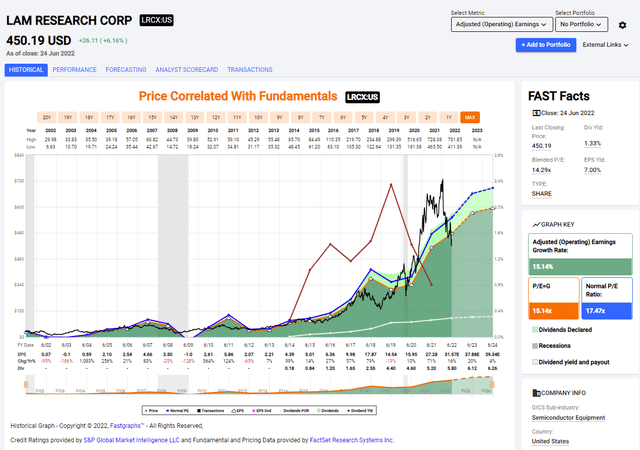

The graph below from Fastgraphs.com show even better how Lam Research is attractively valued. The company is trading for 14 times earnings when historically it has traded for 17.5 times earnings. In addition, the company still shows an impressive growth rate that is in line with the historical growth rate of 15% annually. Therefore, I believe that shares are attractively valued.

Fastgraphs

To conclude Lam Research is a great company. It has extremely solid fundamentals as the top and bottom lines grow. It also has an increasing dividend and buybacks that are fueled by EPS growth. This great package comes at what I believe to be an attractive valuation with a P/E ratio of less than 15.

Opportunities

There is still an extremely high demand for semiconductors. The basic thesis hasn’t changed. We consume more electronics, every device has more computing power and capabilities, thus the demand keeps increasing. Lam Research is a leading supplier and it will keep capitalizing on that demand in the medium and long term.

Moreover, the company, as one of the leaders in its segment, has tier-1 clients such as Micron (MU), Intel (INTC), and Samsung (OTC:SSNLF). These are all stable leading companies that can deal with any short-term challenge, thus the long-term demand seems secured from the clients’ perspective. Owning leading tech capabilities and having relationships with leading semiconductors companies when the market is shifting toward tech is promising.

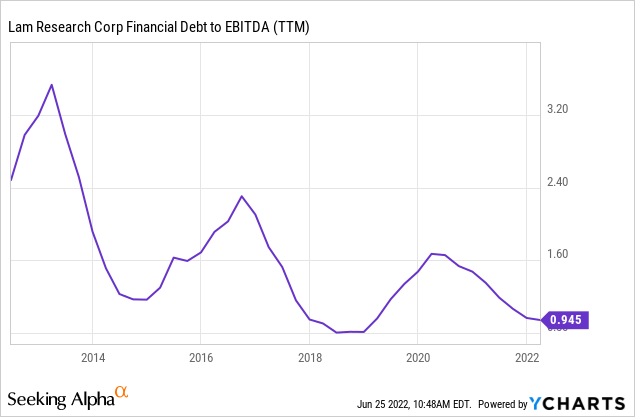

Another opportunity for Lam Research is the low debt levels. The low debt level will be beneficial in two ways. First, it will allow the company to avoid the risks of a higher interest rate. Second, it will allow the company to use its flexible balance sheet in order to acquire smaller peers or struggling startups that can improve the value proposition in the long term.

Risks

The first risk for the stock price, especially in the short to medium term, is the risk of a recession. It becomes quite clear that there is a significant chance that we will see the economy slowing down and even contracting. If the environment deteriorates, and the economy suffers from a severe recession, we will see a substantial decline in demand.

In the short term, there is the risk of supply chain challenges across the globe. The company also has its own supplier that cannot always deliver the orders in full. Therefore, the company has to acquire supplemental materials for a higher price. It hurts the company’s gross margins and makes it harder to grow. The supply chain challenges also impact semiconductor companies that in their turn may order less from Lam Research and its peers.

There’s a decent amount of incremental costs that we’re incurring right now and just managing the supply chain. Buying expensive components to get them because we need them, that’s the most important thing. I’ve got people, like I described, this task force all over the place, traveling all over the place, doing incremental work, that’ll go away at some point.

(Doug Bettinger – EVP & CFO, Bank of America 2022 Global Technology Conference)

Another strain on the delicate supply chain is the lockdowns in China. The supply chains are already weak and fragile, and companies struggle to maintain a healthy flow of materials. The lockdowns in China hurt Lam’s suppliers, clients, and end-users of the electronic devices. Therefore, additional lockdowns will have even more short-term impact.

Conclusions

Lam Research is a leading company in the semiconductors segment of the IT sector. The company is working with the leading semiconductor companies delivering them high-end equipment. The company has great fundamentals with increasing sales, EPS dividends, and buybacks. These fundamentals come for an attractive valuation.

When it comes to risks and opportunities, the company has great growth opportunities in the long term and the medium term. The risks are mainly concentrated around the short and medium term. Thus, investors have a great long-term outlook for the company. I believe that the company is a long-term BUY despite the volatility.

Be the first to comment