photoschmidt

Investment Thesis

Lam Research Corporation (NASDAQ:LRCX) continues to report a robust pipeline, given the impressive YoY growth of 97.2% in its deferred revenues, from $1.11 in FY2021 to $2.19B in FY2022. Furthermore, it is essential to note that the management has already managed Mr. Market’s expectations on the ban during its previous earnings call. Thereby, improving its chances for success on 19 October, given the lower estimates and reduced anticipation. We shall see.

The recent demand destruction in the PC and mid-tier smartphone markets may have consequently led to lower capital expenditures ahead. However, we expect these headwinds to be temporary and sufficiently alleviated once the macroeconomics improves by mid-2023.

LRCX’s Investment in Foundry Logic Is Paying Off

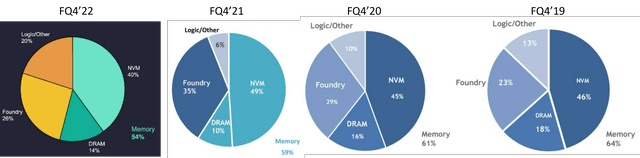

Furthermore, LRCX’s fundamental demand remains robust, given its strategic investment in the leading-edge foundry/ logic segment. LRCX reported growth in the Foundry and Logic/Others segments, accounting for 29.8% and $2.82B of its FY2019 revenues, which grew impressively to 35.7% and $5.93B by FY2022. Furthermore, its DRAM segment remains intact moving forward, since it is unlikely to be affected by the US government ban. Therefore, investors should not be overly worried.

LRCX’s Management Continues To Impress

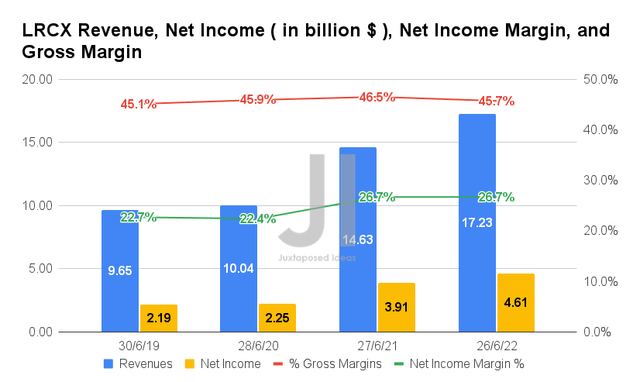

In FY2022, LRCX reported revenues of $17.23B and gross margins of 45.7%, representing YoY growth of 17.7% and minimal moderation of -0.8 percentage points YoY, respectively. In contrast, the company continues to report improved profitability, with net incomes of $4.61B and net income margins of 26.7% in the latest fiscal year. It represents a remarkable increase of 17.9% and in-line YoY, respectively, despite the rising inflation.

It is most evident by now, that the COVID-19 pandemic has been kind to LRCX indeed, given the impressive 3Y revenue CAGR of 21.32% and net income CAGR of 28.16%, compared to pre-pandemic levels of 17.96% and 33.84%, respectively.

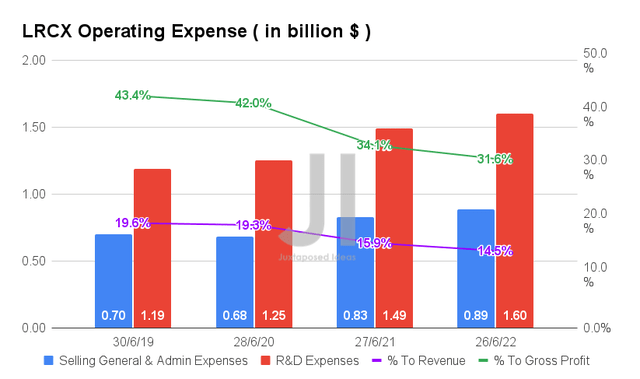

LRCX has also proved highly competent in its cost management, with operating expenses of $2.49B in FY2022, representing a minimal increase of 7.3% YoY. Therefore, contributing to its improved cost ratio to its growing sales to 14.5% of its revenues and 31.6% of its gross profits by the latest fiscal year, representing continued moderation of -5.1 and -11.8 percentage points, respectively, from FY2019 levels. Thereby, triggering LRCX’s improved profitability, as the company continues to invest strategically in its R&D efforts ahead.

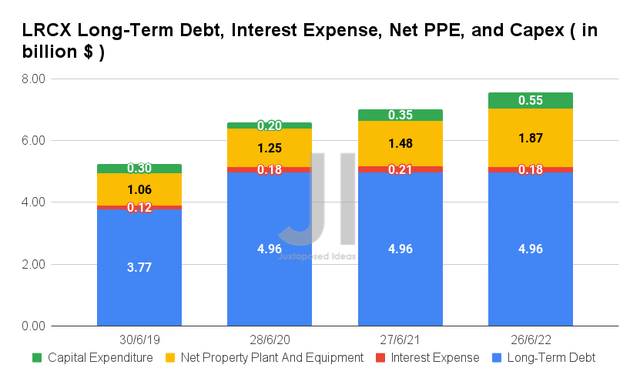

LRCX has been reporting elevated long-term debts of $4.96B and interest expenses of $0.18B in the past three years, indicating an increase of 31.5% and 50% from FY2019 levels, respectively. However, investors have nothing to worry about, since only $0.5B will be maturing by 2025, with $3.75B due beyond 2027. Thereby, freeing up the company’s liquidity for the next two years.

In the meantime, LRCX has been consistently growing its capabilities with a capital expenditure of $0.55B and net PPE assets of $1.87B in FY2022, representing an increase of 57.1% and 26.3% YoY, respectively. These would prove to be top and bottom lines accretive, especially aided the Chips Act injecting $52.7B into the semiconductor industry with another 25% tax credit for chipmaking companies within the US.

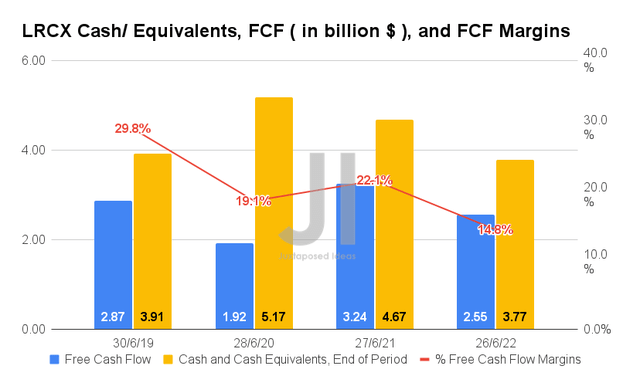

Therefore, it is not surprising that LRCX reported a lower Free Cash Flow (FCF) generation of $2.55B and an FCF margin of 14.8% in FY2022, representing a decrease of -21.2% and -7.3 percentage points YoY, respectively. Nonetheless, its cash and equivalents of $3.77B remain relatively robust during the worsening macroeconomics moving forward.

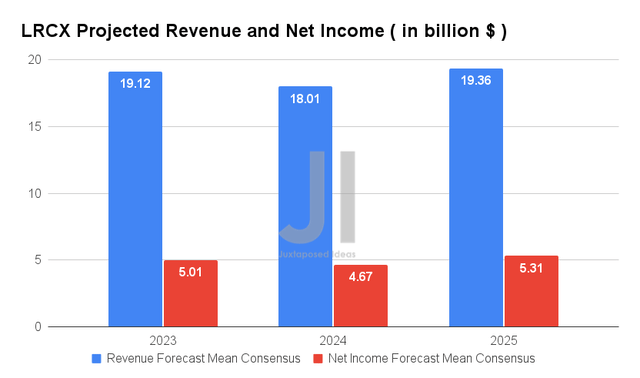

Over the next three years, LRCX is expected to report an adj. revenue and an adj. net income growth at a CAGR of 12.30% and 15.91%, respectively, between FY2019 and FY2025. Analysts are also confident about its improved profitability, given the notable improvements in its net income margins from 22.7% in FY2019, 26.7% in FY2022, and finally settling at a stellar 27.4% by FY2025.

For FY2023, LRCX is expected to report revenues of $19.12B and net incomes of $5.01B, representing an impressive YoY increase of 11.03% and 8.9%, respectively, despite the tougher YoY comparison. For FQ1’23, analysts are projecting revenues of $4.93B and EPS of $9.56, indicating impressive YoY growth of 14.47% and 14.41%, respectively. Given how LRCX has been mostly smashing consensus estimates for the past seven consecutive quarters, we expect similarly excellent results ahead. Thereby, potentially triggering a short-term rally then.

So, Is LRCX Stock A Buy, Sell, or Hold?

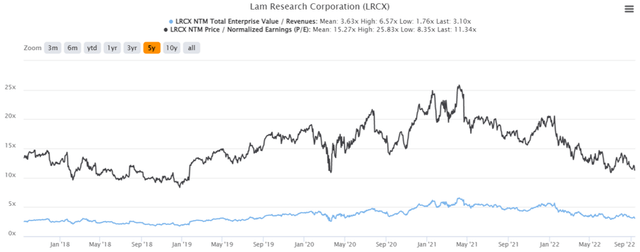

LRCX 5Y EV/Revenue and P/E Valuations

LRCX is currently trading at an EV/NTM Revenue of 3.10x and NTM P/E of 11.34x, relatively in line with its 5Y EV/Revenue mean of 3.63x, though lower than its 5Y P/E mean of 15.27x. The stock is also trading at $421.76, down -42.3% from its 52 weeks high of $731.85, though at a premium of 12.2% from its 52 weeks low of $375.87. Otherwise, consensus estimates remain bullish about LRCX’s prospects, given their price target of $569.11 and a 34.94% upside from current prices.

LRCX 5Y Stock Price

LRCX Dividend Payout & Yield

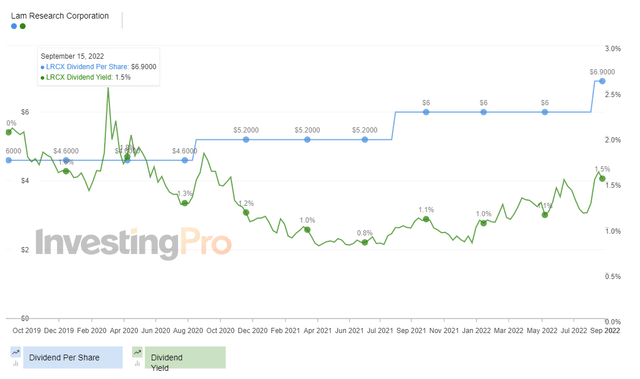

Long-term LRCX investors would have been happy with the recent dividend hikes as well, with a $6.45 payout for 2022, assuming another $1.725 for Q4. Though its dividend yield of 1.52% is noticeably lower than other industries, it is better than its peers, such as KLA Corporation (NASDAQ:KLAC) at 1.35% and Applied Materials (NASDAQ:AMAT) at 1.12% at the moment.

Combined with $3.86B share repurchases exercised in FY2022, it is evident that LRCX has returned much value to its investors, given the -3.6% YoY decrease in its diluted shares outstanding to 138.31M by FQ4’22. This is remarkable, due to the YoY increase in its Stock-Based Compensation by 17.6% to $259.06M at the same time.

However, with the increased US restriction on technology export to China, we may expect to see the stock continue see-sawing ahead, despite the management’s lower estimates for FQ1’23 in its previous earnings call. This is because the country accounts for 31% of the company’s revenues in FQ4’22. Naturally, this is higher than UBS analyst Timothy Arcuri’s lower estimates of a 10% sales impact moving forward, attributed to LRCX’s long-term relationship with multiple Chinese semiconductor companies.

In addition, LRCX may decline moderately over the next two quarters as Mr. Market bears the brunt of the Fed’s aggressive rate hikes through 2023, since the August CPI of 8.3% remains elevated compared to pre-pandemic levels of 2%. As a result, we encourage conservative investors to wait for a deeper retracement and, most importantly, clearer guidance from the management in its upcoming earnings call before adding LRCX.

Nonetheless, those with higher risk tolerance and long-term trajectory may want to nibble at current levels, given the relatively attractive risk/reward ratio and its near-bottom stock valuations.

Be the first to comment