FotografiaBasica

Earnings of Lake Shore Bancorp, Inc. (NASDAQ:LSBK) will likely stay flattish this year and then grow at a healthy rate next year. Moderate loan growth and margin expansion will likely sustain earnings through the end of 2023. I’m expecting Lake Shore Bancorp to report earnings of $1.02 per share for 2022 and $1.17 per share for 2023. The year-end target price suggests a high upside from the current market price. Further, Lake Shore Bancorp is offering an attractive dividend yield. Based on the total expected return, I’m adopting a buy rating on Lake Shore Bancorp.

New York’s Economy to Sustain Loan Growth

Lake Shore Bancorp’s loan book grew by 5.8% during the first half of the year (11.6% annualized) which is quite good from a historical perspective. I’m expecting loan growth rate to be lower in the second half of the year compared to both the first half of 2022 and previous years. This is because interest rates are currently at the highest level since 2008. High borrowing costs are bound to dampen credit demand.

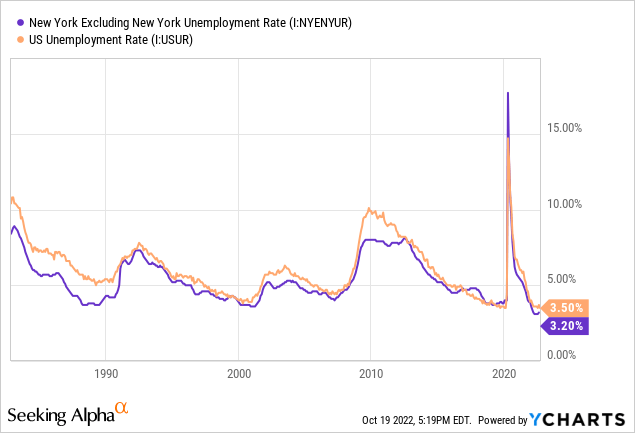

However, strength in other economic factors can keep loan growth at a satisfactory level. Lake Shore Bancorp operates in the Chautauqua and Erie counties of Western New York. Excluding New York City, the state’s economy is currently in very good shape. The unemployment rate is near record lows and below the national average, as shown below.

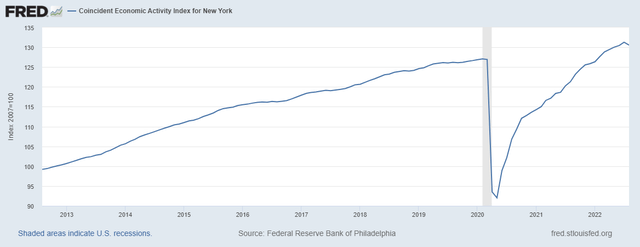

Further, the economic activity is recovering at a good pace compared to the past, as shown below.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 1.25% every quarter till the end of 2023. This is at the lower end of the historical growth rate trend.

Securities, Adjustable-Rate Deposits to Restrict Margin Expansion

Lake Shore Bancorp’s deposit cost is quite rate sensitive because of the large balance of deposits with adjustable rates. These deposits, namely interest-bearing demand, NOW, money market, and savings accounts made up 56% of total deposits during the second quarter of 2022, according to details given in the 10-Q Filing.

The large balance of debt securities will further hold back margin expansion as most securities are based on fixed rates. Securities made up 12% of total earning assets at the end of June 2022.

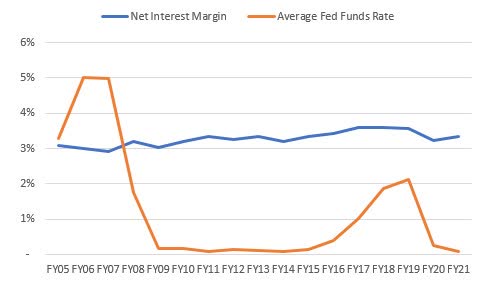

Historically, Lake Shore Bancorp’s margin has been only slightly correlated with interest rates, as shown below.

SEC Filings, The Federal Reserve Bank of St. Louis

Considering these factors, I’m expecting the margin to grow by 30 basis points in the second half of 2022 and 10 basis points in 2023.

Earnings Likely to be Flattish this Year Before Surging Next Year

The anticipated loan growth and margin expansion will support earnings through the end of 2023. On the other hand, an inflation-driven surge in salary and other non-interest expenses will drag earnings. Meanwhile, I’m expecting the provision expense to make up around 0.14% of total loans (annualized) in every quarter till the end of 2023, which is the same as the as the average from 2017 to 2019.

Overall, I’m expecting Lake Shore Bancorp to report earnings of $1.02 per share for 2022, down by just 3% year-over-year. For 2023, I’m expecting earnings to grow by 15% to $1.17 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 18 | 19 | 20 | 22 | 24 | 28 | ||||

| Provision for loan losses | 0 | 1 | 2 | 1 | 1 | 1 | ||||

| Non-interest income | 2 | 2 | 3 | 3 | 3 | 3 | ||||

| Non-interest expense | 15 | 16 | 16 | 17 | 19 | 21 | ||||

| Net income – Common Sh. | 4 | 4 | 5 | 6 | 6 | 7 | ||||

| EPS – Diluted ($) | 0.66 | 0.68 | 0.77 | 1.05 | 1.02 | 1.17 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Future Equity Book Value Erosion to Hurt Market Valuation

Lake Shore Bancorp’s equity book value has dropped by 8% during the first half of the year mostly because of the accumulation of unrealized losses on the available-for-sale (“AFS”) securities portfolio. As interest rates surged, the market value of fixed-rate AFS securities plunged, leading to unrealized losses. These losses reduced the equity book value after bypassing the income statement.

Further equity book value attrition is likely because of the 150 basis points hike in fed funds rate during the third quarter and the expectation of further rate hikes through 2023. Overall, I’m expecting the equity book value to drop by 6% in the second half of 2022 due to the mark-to-market losses. The drop in equity book value will hurt Lake Shore Bancorp’s market value, as discussed below.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 392 | 471 | 524 | 517 | 561 | 590 |

| Growth of Net Loans | 7.5% | 20.0% | 11.3% | (1.3)% | 8.5% | 5.1% |

| Other Earning Assets | 110 | 96 | 116 | 120 | 98 | 101 |

| Deposits | 432 | 483 | 560 | 593 | 593 | 623 |

| Borrowings and Sub-Debt | 25 | 35 | 30 | 22 | 25 | 26 |

| Common equity | 80 | 83 | 86 | 88 | 77 | 79 |

| Tangible BVPS ($) | 13.1 | 13.8 | 14.4 | 15.0 | 13.0 | 13.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

High Dividend Payout Appears Secure

Lake Shore Bancorp is offering a high dividend yield of 5.5% at the current quarterly dividend level of point $0.18 per share. This dividend payout appears secure because of the following two factors.

- The earnings estimate for 2023 and the current dividend payout suggest a payout ratio of 62%. Although this payout ratio is high, Lake Shore Bancorp has borne even higher payout ratios in the past. In 2019, the payout ratio stood at 71%. Further, the payout ratio was as high as 88% in the first quarter of 2022. The last five-year average payout ratio stands at 61%.

- Lake Shore Bancorp is well capitalized as it had a community bank leverage ratio of 12.02% at the end of June 2022, as opposed to the minimum regulatory requirement of 9.0%. This means there is no pressure on Lake Shore Bancorp from regulatory requirements to reduce the dividend and thereby increase retained earnings. In my opinion, the attrition of equity book value discussed above is not a cause of concern because the attrition is temporary and not too large.

Adopting a Buy Rating

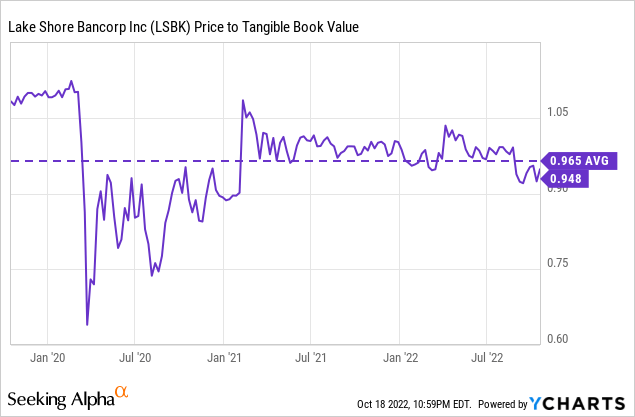

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Lake Shore Bancorp. The stock has traded at an average P/TB ratio of 0.97 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $13.0 gives a target price of $12.5 for the end of 2022. This price target implies a 3.4% downside from the October 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.77x | 0.87x | 0.97x | 1.07x | 1.17x |

| TBVPS – Dec 2022 ($) | 13.0 | 13.0 | 13.0 | 13.0 | 13.0 |

| Target Price ($) | 9.9 | 11.2 | 12.5 | 13.8 | 15.1 |

| Market Price ($) | 13.0 | 13.0 | 13.0 | 13.0 | 13.0 |

| Upside/(Downside) | (23.4)% | (13.4)% | (3.4)% | 6.6% | 16.6% |

| Source: Author’s Estimates |

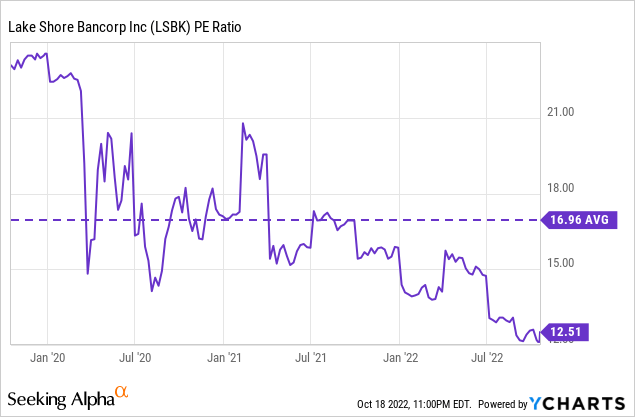

The stock has traded at an average P/E ratio of around 17.0x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $1.02 gives a target price of $17.2 for the end of 2022. This price target implies a 32.8% upside from the October 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 15.0x | 16.0x | 17.0x | 18.0x | 19.0x |

| EPS 2022 ($) | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 |

| Target Price ($) | 15.2 | 16.2 | 17.2 | 18.3 | 19.3 |

| Market Price ($) | 13.0 | 13.0 | 13.0 | 13.0 | 13.0 |

| Upside/(Downside) | 17.1% | 25.0% | 32.8% | 40.6% | 48.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $14.9, which implies a 14.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 20.3%. Hence, I’m adopting a buy rating on Lake Shore Bancorp.

Be the first to comment