Morris MacMatzen/Getty Images News

Introduction

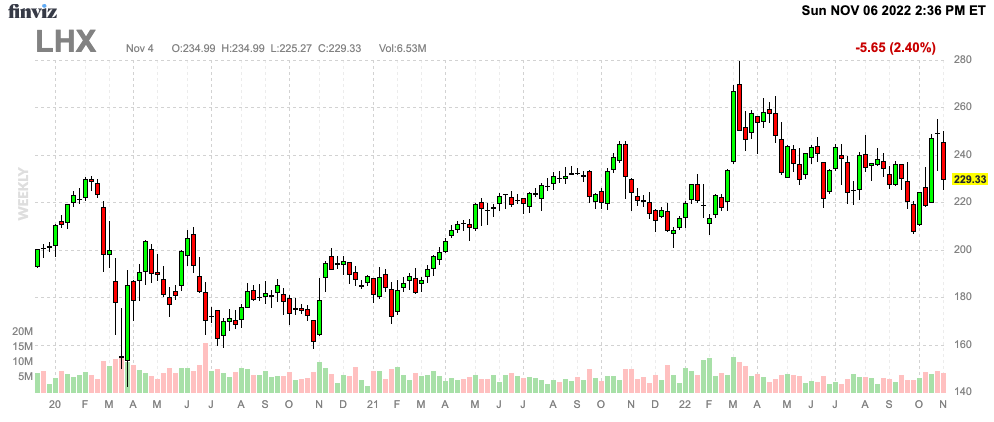

L3Harris Technologies (NYSE:LHX) is one of my favorite dividend growth stocks. However, besides delivering reliable and growing dividends, the company is a great indicator of the defense industry’s health as it is a major supplier and a well-diversified contractor. Year-to-date, the company is up 8%, which beats the S&P 500 by 28 points. More recently, the company benefited from strong earnings from peers like Lockheed Martin (LMT) (as I discussed in this article). However, the stock fell 8% last week as a result of poor earnings. The company’s revenue and earnings came in lower than expected, and management was forced to cut guidance across the board.

However, the defense industry is everything but weak. With supply chains easing and defense demand rising, I continue to believe in LHX’s ability to outperform.

Moreover, even if you don’t care for LHX, you will still learn a lot about the defense demand environment and supply chain developments, which go well beyond this company.

Now, let’s dive into the details!

Disappointing Earnings

I have close to 25% defense exposure in my long-term dividend growth portfolio. That decision is based on the quality to consistently grow dividends, and to outperform the market with the subdued volatility that a lot of these stocks bring to the table. One of the reasons why I was able to buy so much exposure is poor earnings calls in the past 2-3 years – and, obviously, the fact that the pandemic came with opportunities.

If there’s one thing bugging defense companies, it is broken supply chains. After the 2020 reopening, defense companies struggled with shortages in semiconductors, general electronic supplies, higher metal prices, labor shortages, and related problems.

It made turning backlog into finished products very hard, resulting in a consistent stream of negative earnings releases and guidance adjustments.

Nonetheless, LHX has done well, adding 7.6% this year so far and 3.2% over the past 12 months.

FINVIZ

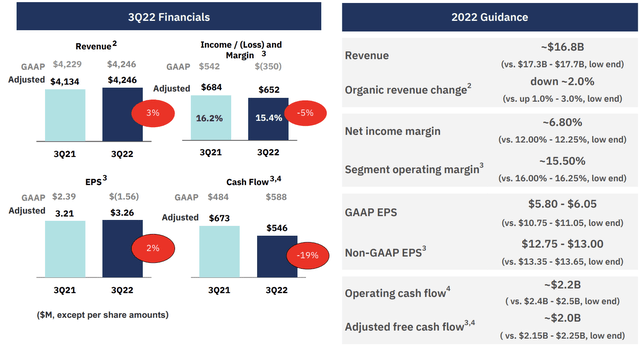

In 3Q22, L3Harris generated $4.25 billion in revenue. That’s $160 million less than expected and 0.5% more than the third quarter of 2021.

The company generated $3.26 in adjusted EPS, a miss of $0.14, and a 2% increase versus 3Q21.

A Great Demand Environment

With that said, the demand environment was quite good. In its investor letter, the company mentioned the increased urgency and focus related to global defense spending. Geopolitical tensions across Asia and the Middle East have been more prominent in recent months, while the conflict in Ukraine entered its ninth month.

As discussed in prior articles (like this one), the company is not dependent on a few large defense projects like Lockheed Martin, which is highly dependent on the F-35 program.

The company has three business segments:

- Integrated Mission Systems

[…] including multi-mission intelligence, surveillance, and reconnaissance (“ISR”) and communication systems; integrated electrical and electronic systems for maritime platforms; and advanced electro-optical and infrared (“EO/IR”) solutions.

[…] including space payloads, sensors, and full-mission solutions; classified intelligence and cyber defense; avionics; and electronic warfare.

[…] including tactical communications; broadband communications; integrated vision solutions; and public safety radios; global communications solutions.

Moreover, this year, it went from four to three business segments, which means the company also still includes commercial aviation products, commercial pilot training equipment, and mission networks for air traffic management. These were formerly part of its Aviation Systems segment.

What this means is that L3Harris is more or less involved in all major programs and a beneficiary of higher spending, in general.

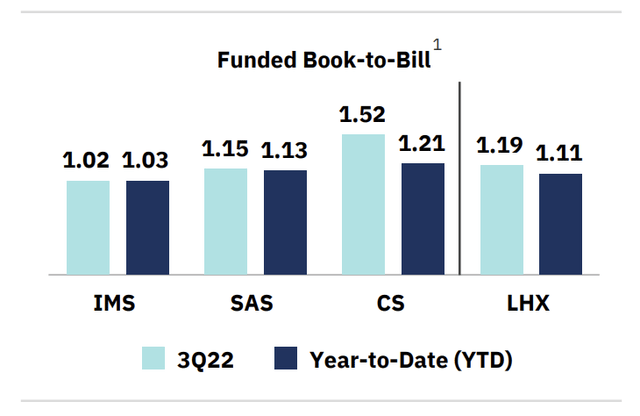

That was indeed the case. In the third quarter, the company had a 1.19 funded book-to-bill ratio, with strength in every segment. No segment has a book-to-bill ratio below 1.00, meaning the order flow is faster than the company’s ability to turn its backlog into finished products.

L3Harris Technologies

Total backlog expanded by 1% in the quarter. It was up 2% adjusted for divestitures, which is a better way to measure backlog.

But wait, there’s more!

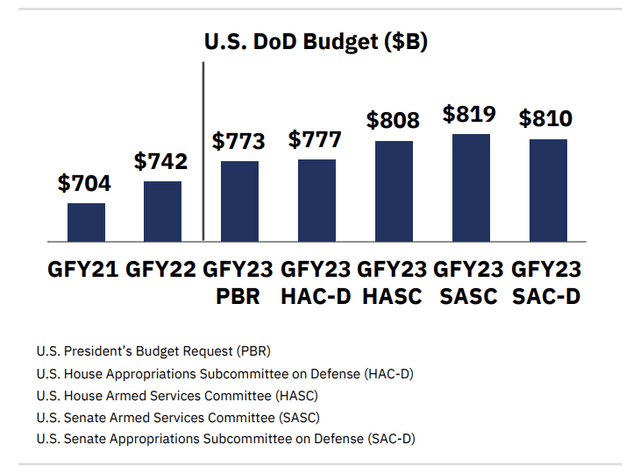

There’s also good news with regard to the US government fiscal year (“GFY”) 2023 Department of Defense (“DoD”) budget.

The Senate Appropriations Subcommittee on Defense supports a $37 billion increase to the President’s budget request of $773 billion. This represents a 9% increase year-on-year.

L3Harris Technologies

As the chart above shows, the budget is now likely to end between $773 and $819 billion, indicating a 4-10% growth range versus GFY22.

According to the company’s investor letter:

These mark-ups, as well as the PBR, highlight support for many L3Harris offerings across domains, including responsive satellites, Intelligence, Surveillance and Reconnaissance (“ISR”) aircraft, tactical communications, networked maritime systems, and classified cyber solutions.

For now, the defense industry continues to operate under the continuing resolution through December 16.

Looking at the bigger picture, it’s not just the US that is boosting defense. Global defense spending is expected to grow. Japan is looking to double defense spending by 2027 as it is stepping up its capabilities in light of Chinese threats to Taiwan.

Thanks to the US, more than $66 billion has been sent to Ukraine as part of defense-related and humanitarian support. L3Harris mentioned that several hundred million dollars worth of funding ended up as new orders for equipment.

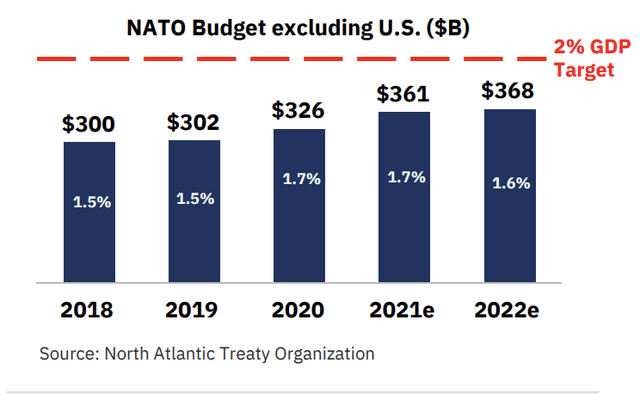

The even bigger news is NATO’s target to boost spending to at least 2% of GDP. This NATO target has been ignored by almost all members, except for the US and a few smaller nations. Now, the alliance is turning 2% into a floor instead of a target (ceiling).

While it remains to be seen if major NATO countries are indeed following these rules, it would mean a tremendous long-term boost in spending. As the overview below shows, 2022 spending is set to be $368 billion (excluding the United States).

Based on simple math, a 2% target would add at least another $92 billion to NATO (ex-US) spending – an increase of roughly 25%.

L3Harris Technologies

LHX will benefit from this because of its diversified portfolio, its role in all major defense programs, and the fact that it gets more than 70% of its international revenues from Europe and APAC countries alone.

Unfortunately, headwinds persist as supply chain issues caused the company to downgrade its guidance. Yet, these issues are slowly fading.

Supply Chains

As the right side of the overview below shows, guidance was ugly. The company downgraded numbers across the board, with organic revenue growth being adjusted from at least 1% growth to 2% contraction.

L3Harris Technologies

While these adjustments are very significant, it’s not a problem that’s unique to L3Harris.

According to the company:

For L3Harris, supply chain disruptions, labor mobility and rising inflation have all had an impact that management is working to address. While the company has made progress in its efforts, impacts to program performance and timing have contributed to the reduced 2022 financial guidance.

Supply chain issues came from shifts in demand, labor shortages, and structural factors. As we already briefly discussed, these issues mainly hit parts of the business dependent on high-tech electronic components, including tactical and public safety radios, night vision goggles, and sensors.

Moreover, supplier disruptions were worse than expected, causing headwinds worth $200 million year-to-date.

L3Harris employs inventory management techniques (smart inventory) and higher engagement with suppliers.

On a long-term basis, the defense giant anticipates that supply chain impacts are limited, giving its own actions, like pricing adjustments and cost controls, and a shorter-cycle portfolio mix. This is expected to offset rising input costs.

Moreover, over the long-term, with a balanced portfolio of fixed-price and cost-reimbursable contracts, along with a relatively short duration of approximately one year, on average, for its backlog, L3Harris is positioned quite well to minimize the inflation impact.

Roughly 25% of contracts are cost reimbursable — 25% are fixed price commercial while 50% are fixed price traditional government. But again, as the company said, product cycles are short, meaning even fixed-price contracts are quickly adapting to higher costs.

Adding to that, macro indicators are telling us that supply chain headwinds are easing.

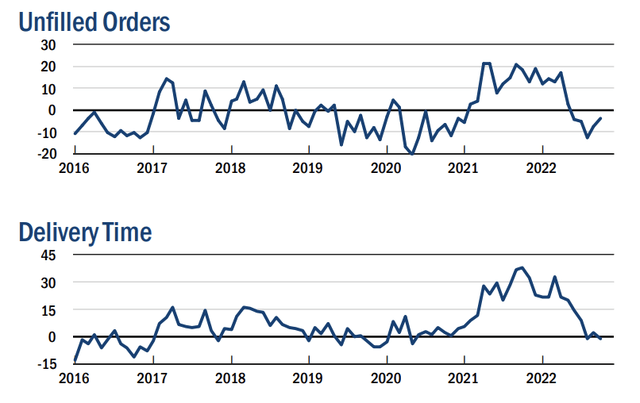

For example, using New York Fed data, delivery times have come down from all-time highs in 2021 to contraction territory. The same goes for unfilled orders, which have been contracting for a while now.

New York Fed

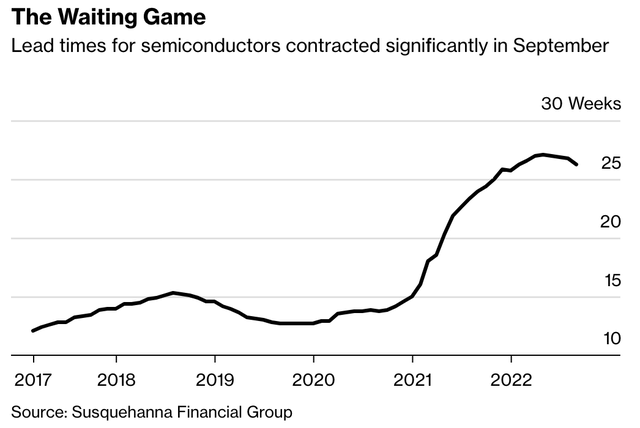

Semiconductor lead times are starting to decline. The gap between when a chip is ordered and when it’s delivered has come down to 26.3 weeks. That’s down from 27 weeks earlier this month.

Bloomberg

Now, onto some cash flow and capital spending numbers.

Capital Allocation

In the third quarter, the company generated $588 million worth of operating cash flow. Adjusted free cash flow was $546 million, a decline of 19% versus the prior year. This is due to higher working capital, and higher R&D-related taxes. Net capital expenditures were $58 million.

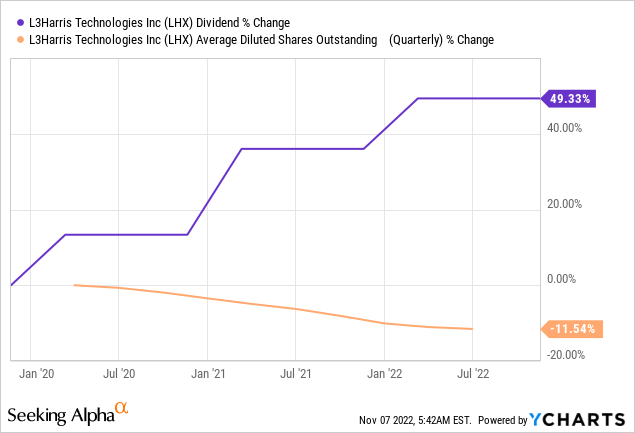

The company used free cash flow to pay $215 million in dividends. On an annualized basis, 2022 dividends are at $4.48 per share. Up from $4.08 per share in 2021 (+9.8%).

The company bought back shares worth $171 million, bringing total buybacks since 2020 to $7 billion. The share count is now down 12% over this period. The current buyback authorization is $4.5 billion.

Moreover, the company announced a definitive agreement to buy Viasat’s (VSAT) TDL product line for approximately $1.96 billion, expanding its capabilities in the field of resilient communications and networking. According to the aforementioned investor letter:

The TDL network, also known as Link 16, is integrated on over 20,000 military aircraft, ground vehicles, surface vessels and operating bases, enabling warfighters to securely share voice and data communications across all domains.

The deal is expected to close in the first half of 2023, allowing the company to compete with Lockheed Martin and Raytheon Technologies (RTX), who both have extended capabilities in the field of communications and networking.

So, what about the valuation?

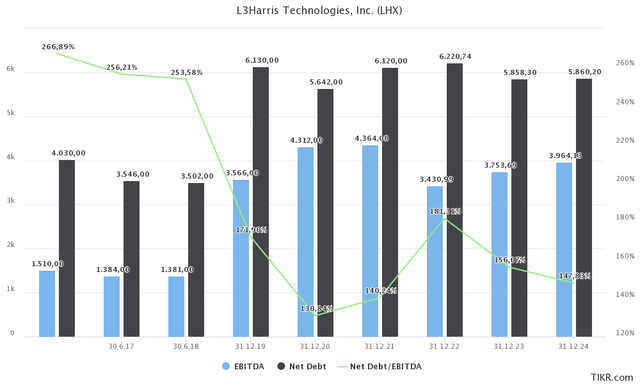

The valuation has increased since my last article. This is a result of a higher stock price and lower EBITDA estimates. The company is now expected to do $3.8 billion in 2023E EBITDA. That’s down from $4.0 billion. Moreover, lower free cash flow is expected to result in a slightly higher 2023E net debt of $5.9 billion. When adding the $43.7 billion market cap, $350 million in pension liabilities, and $100 million in minority interest, we get an enterprise value of $50.1 billion. That’s 13.2x 2023E EBITDA.

TIKR.com

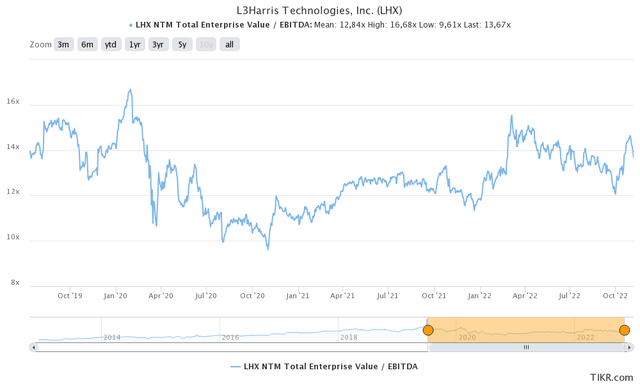

This valuation is not overvalued and I remain bullish. However, if I did not have any LHX exposure, I would wait to buy shares on the next dip.

TIKR.com

Takeaway

Overall, the earnings season for defense companies was good. Supply chain issues were persistent, but slowly fading. Demand was strong, and it’s expected to accelerate as NATO nations – including the US – are stepping things up. In the US, a budget increase of 4% to 10% is likely, with up to 25% growth in NATO (ex-US) nations, given their new priorities.

Overseas, APAC nations are boosting spending as well, given higher tensions in the area.

L3Harris is in a good spot to benefit from this, thanks to its well-diversified and advanced product portfolio. Next year, the company will add new communication and networking capabilities, which will enhance its current portfolio.

While LHX downgraded its outlook, the bull case remains strong. Supply chain issues that caused the downgrades are fading, demand is strong with book-to-bill ratios in all segments above 1.0.

Thanks to its fundamentals, shareholder distributions are set to remain high.

I remain bullish, but I would advise potential buyers to wait for weakness before buying.

(Dis)agree? Let me know in the comments!

Be the first to comment