According to Women’s Wear Daily, the sale of Victoria’s Secret by L Brands (LB) could be in jeopardy:

Parent company L Brands’s deal to sell a 55-percent stake of the Victoria’s Secret lingerie and beauty divisions, along with the Pink business, to private equity firm Sycamore Partners was expected to close in 2020’s second quarter. But as the economy slows to a near standstill amid the coronavirus pandemic, retail and fashion brands have been some of the hardest-hit sectors.

In its annual report filed with the Securities and Exchange Commission Monday, the company offered a list of risks to its business, including that the deal might not close or that the company might not obtain the necessary regulatory approvals.

“[There are] difficulties arising from the business uncertainties and contractual restrictions while the VS transaction is pending,” the company said.

L Brands confirmed the sale of a majority stake in Victoria’s Secret in late February. Sycamore’s price implied an enterprise value of $1.1 billion, which equated to less than 2x EBITDA. A lot has changed since then. The negative effects of the coronavirus has led to social distancing, which has hurt the economy. President Trump recently extended social distancing guidelines through the month of April. With millions of Americans isolated at home, retail sales could fall sharply. That does not bode well for L Brands and Victoria’s Secret.

Will Coronavirus Trigger An MAE?

Most merger agreements include a material adverse effect (“MAE”) clause which allows the buyer to terminate the transaction in case of a material adverse effect to the business. An MAE can be interpreted broadly, including but not limited to, a loss of a large client or the expiry of a patent or trademark deemed important to the business. Per the transaction agreement between L Brands and Sycamore, an MAE is defined as:

“Material Adverse Effect” means any state of facts, circumstance, condition, event, change, development, occurrence, result or effect (i) that would prevent, materially delay or materially impede the performance by Parent of its obligations under this Agreement or Parent’s consummation of the transactions contemplated by this Agreement; or (ii) that has a material adverse effect on the financial condition, business, assets, or results of operations of the Business.

Due to the spread of the coronavirus, in mid-March L Brands temporarily closed all Bath & Body Works (“BBW”), Victoria’s Secret PINK stores in the U.S. and Canada. The company is extending the closures beyond the initial March 29 date. The action will likely hurt Victoria’s Secret sales through physical locations. That puts more pressure on sales through the digital platform to make up the difference.

Chatter suggests L Brands may have suspended its Victoria’s Secret e-commerce site to focus on producing soap and hand sanitizers. This could potentially hurt sales for Victoria’s Secret online. I highly doubt Sycamore had this in mind when it acquired Victoria’s Secret. Knock-on effects of the coronavirus – store closings, falling sales and earnings will likely reduce the value of Sycamore’s investment. If sales and earnings for the brand fall precipitously, then a case could be made that an MAE has occurred to the financial condition, business and assets of Victoria’s Secret.

Retailers like Victoria’s Secret still have to pay rent even if their stores are closing. Certain retailers may seek concessions from landlords until business returns to normal. Others may attempt to invoke force majeure clauses that could potentially suspend rent payments for a certain period:

Many retailers will have what is known as business interruption insurance, real estate experts said. But, typically, a pandemic caused by a virus is not covered by that. Instead, it is more for fires and natural disasters.

The next step that many retailers are taking is figuring out if force majeure, or “Act of God,” clauses justify tenants’ suspension of performance of their duties under their leases — primarily operating stores and paying rent, Marmins explained.

The answer to this, he said, will depend on the specific contract language, local law and the “causal connection between the pandemic and the particular tenant’s inability to meet its lease obligations.”

If claims of force majeure could help retailers avoid rent payments, then Sycamore could potentially use a similar argument to (1) back out of the deal for Victoria’s Secret or (2) re-negotiate the terms.

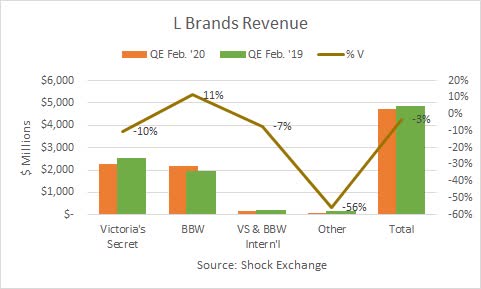

Victoria’s Secret faced challenges prior to the sale. In the most recent quarter revenue for Victoria’s secret was $2.3 billion, down 10% Y/Y. It reported an adjusted operating income of -$543 million, an $844 million decline versus the prior year period. Adjusted operating income for L Brands was $82 million, down 90% Y/Y.

The temporary store closings will likely add to woes at Victoria’s Secret. The additional headwinds come as Victoria’s Secret faces $2.5 billion in lease liabilities. The lease liabilities could amplify the pain at Victoria’s Secret and eat into Sycamore’s investment. Sycamore could face lease payments amid declining cash flow, and a need to pony up more capital to help turnaround an already flagging brand.

The temporary store closings will likely add to woes at Victoria’s Secret. The additional headwinds come as Victoria’s Secret faces $2.5 billion in lease liabilities. The lease liabilities could amplify the pain at Victoria’s Secret and eat into Sycamore’s investment. Sycamore could face lease payments amid declining cash flow, and a need to pony up more capital to help turnaround an already flagging brand.

What’s Next For L Brands

L Brands recently drew $950 million from its revolving credit facility to shore up liquidity amid the pandemic. This would bring its debt load to about $6.5 billion, equating to 3.5x last 12 months (“LTM”) EBITDA. Its debt-to-EBITDA was about 3.0x at the end of the February quarter. Moody’s downgraded L Brands to Ba3 from Ba2, partly due to lack of diversity of its earnings stream after the Victoria’s Secret sale. BBW’s performance has been solid. In the most recent quarter, it grew revenue by double digits and adjusted operating income in the high single-digit percentage range. Sales of soap and hand sanitizers amid the coronavirus could provide an additional boost next quarter.

However, the additional debt and overhang from Victoria’s Secret are a concern. L Brands has 45% exposure to Victoria’s Secret regardless of whether the sale to Sycamore closes. If the deal does not close, then falling operating income and $2.5 billion in leases related to the brand could continue to drag down the company.

Conclusion

I believe there is a risk Sycamore could attempt to back out of its acquisition of Victoria’s Secret or attempt to re-negotiate the terms. LB is down over 60% Y/Y and could fall further. Sell LB.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year – a 33% discount.

Disclosure: I am/we are short LB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment