Charday Penn

Maintaining Our Rating

We initiated a “HOLD” rating for Kyndryl Holdings, Inc. (NYSE:KD) on August 17th, citing the company’s unclear path to growth and deteriorating financial picture. We also conducted a potential valuation exercise of what the company may be valued at, if the company were to achieve the long-term margins guidance. However, we found execution risk to be considerable, and, therefore, recommended a “HOLD” based on our last review.

Since the time of our writing, Kyndryl has lost -16.01% compared to the broader market decline of -10.42%. After the recent earnings announcement on November 3rd, we are reiterating our “HOLD” rating, as we continue to see no signs of financial prospects changing and as we see more risks ahead.

Recent Earnings

The recent earnings announcement was generally subpar, with the company reporting and decrease in quarterly revenue on a YoY basis along with another quarter of net loss. Kyndryl reported a net revenue of $4.2 billion for this past quarter, which represents a year-over-year decline of 9%. This decline is substantial given, that the revenue decline on inflation adjusted terms would be even higher than what is reported on a nominal basis.

One piece of good news was that net loss shrank on a year-over-year basis, with a net loss this quarter of -$281 million. This is far below the -$690 million reported in the same quarter last year. Management also discussed the launch of new services, most notably Kyndryl Bridge, Kyndryl Vital, and Kyndryl Consult. More information on these new services can be found here. Nevertheless, it is unclear how these new services will immediately translate to top line growth or margin expansion.

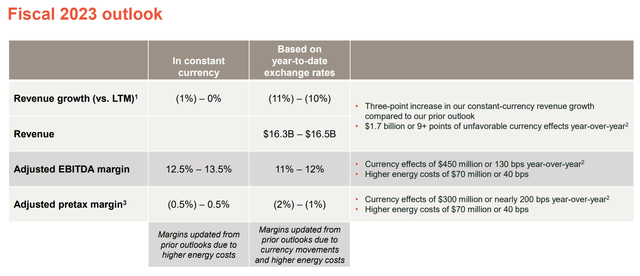

Margin Pressure and Balance Sheet

The biggest takeaway from the recent earnings announcement was the major impact of cost pressures on Kyndryl’s bottom line. The company pointed to higher energy costs and unfavorable currency rates as the major factors impacting the company’s guidance on margins. As a result, compared to the FY 2023 13% – 14% EBITDA margin that was reported in Q1 FY2023 earnings, the company has revised that margin guidance downwards to 11% – 12%, which is a substantial downward revision on quarter-over-quarter basis. The company’s declining top line performance and continued pressure in business margins are not likely to turn around anytime soon. Nevertheless, the balance sheet remains robust, as company reported an available liquidity of $5.0 billion along with cash of $1.9 billion at hand.

New Partnerships

Similar to last quarter, Kyndryl has continued to develop current partnerships and find new ones, which demonstrates management’s execution of becoming a larger cloud player with diversified service offerings. These strategic moves are based on management’s long-term vision of providing an “extensive, integrated IT system” for its partners and clients. While we welcome new partnerships with big corporations as the ones shown below, we would like to wait to see how these partnerships translate to any potential for a re-acceleration of growth.

Final Word

We maintain a “HOLD” rating for Kyndryl Holdings, Inc. based on the company’s recent financial announcement. The overall financial picture is mixed, and as a newly spun-off company, it will take time for Kyndryl management to execute on its long-term plans and vision. However, as of now, we believe that investors should continue to monitor Kyndryl Holdings stock, and see more concrete results of a change in prospects before making a determination on the stock.

Be the first to comment