robertprzybysz/iStock via Getty Images

Just over two months ago, I wrote on Kura Sushi, noting that valuation remained an issue from an investment standpoint and that rallies above $55.00 would present an opportunity to book some profits. This turned out to be a terrible call, with the stock blasting through the $55.00 level with ease after a fiscal Q3 earnings report that can be described as nothing less than phenomenal. The significant breakout has improved the technical picture, and the margin performance has reinforced the justification for rapidly growing new units, given the impressive unit economics. Based on the strong year-to-date results, I see the stock as a solid buy-the-dip candidate.

Kura Sushi Restaurant (Company Website)

Q3 Results

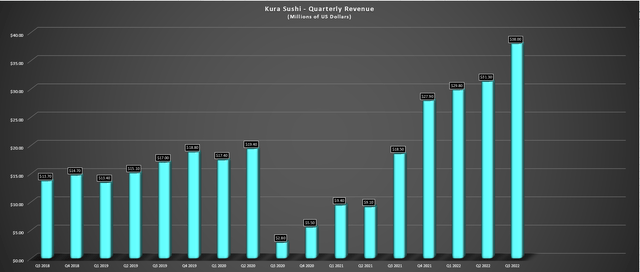

Kura Sushi released its fiscal Q3 results in July, reporting record revenue of $38.0 million, a 105% increase from the year-ago period. This was driven by strong comp sales and industry-leading unit growth, with comp sales up 65% year-over-year and six new restaurant openings (37 vs. 31 at the end of the period). These results were even more impressive given that the industry struggled immensely in calendar year Q2, with consumers pulling back from dining out due to rising gas prices, higher mortgage costs, and higher grocery prices.

Kura Sushi – Quarterly Revenue (Company Filings, Author’s Chart)

Kura Sushi (“Kura”) noted in its prepared remarks that it opened one new restaurant in the period, has opened five year-to-date and is now planning to open 8 for the year. This would represent 25% growth year-over-year from its 32 restaurants open as of August 2021, and importantly, its guest reception is exceeding expectations at its new openings. From a productivity standpoint, the company has done a great job, completing its robot server rollout ahead of schedule. The initiative is expected to reduce the workload of its front-of-house staff and could boost retention, with front-of-house staff being less overwhelmed during busy periods than other dine-in brands.

Kura Sushi Server (RobotLAB Group)

While the earlier-than-planned rollout and exceptional sales performance were commendable, the margin performance in the quarter really stood out. In a period when the industry has been reporting rising food & beverage and labor costs despite menu price increases, Kura saw a 560 basis point decline in labor costs and a 200 basis point decline in food/beverage costs year-over-year. This resulted in a significant increase in restaurant-level operating margins, which came in at 22.5% in Q3 2022, a massive jump from 5.8% in Q3 2021 and (-) 3.8% year-to-date.

This impressive margin performance was helped by menu price increases, sales leverage, and less food spoilage, offset by industry-wide inflationary pressures. The result was that Kura’s adjusted EBITDA improved to $3.2 million from (-) $2.6 million, and restaurant-level operating profit soared to $8.5 million, up from $1.1 million last year. Given the company’s industry-leading unit growth, this should lead to a record year for Kura by a wide margin, with annual EBITDA expected to come in at ~$7.5 million, improving to $13.0 million next year based on current estimates.

Industry Trends & Recent Developments

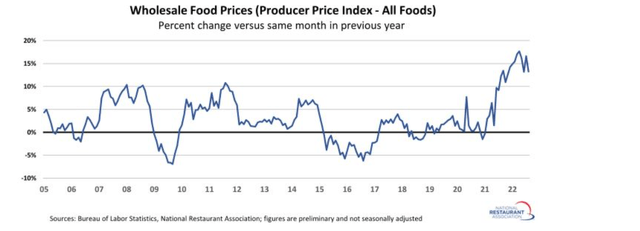

If we look at the industry, Q2 was rough, to say the least, with consumers pulling back from a spending standpoint, evidenced by declining traffic in May, June, and July. While this impacted nearly all brands, Kura Sushi noted that it’s been benefiting from a higher average check due to both menu pricing and more plates per visit, and its sales leverage has helped mitigate cost pressure. The good news is that if Kura has already seen margin gains in a highly inflationary environment and the theme appears to be that commodity prices are stabilizing and peaking in some cases, the company should see further gains in FY2023.

Wholesale Food Prices (National Restaurant Association, BLS)

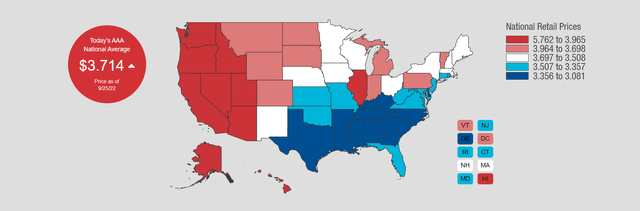

Meanwhile, from a traffic standpoint, the lower gas prices ($3.80/gallon vs. $5.00/gallon) could help the industry a little from a sentiment standpoint, with this being one less thing in consumer’s faces they have to worry about that’s impacting their discretionary budget. Although this is partially offset by higher mortgage costs and grocery costs continuing to climb, this is some relief and a small win at a time when consumers need one. So far, we appear to be seeing signs of a turnaround in industry-wide traffic, with August traffic down just 1.9%, a healthy improvement from July comp traffic of (-) 5.1%.

National Gas Prices (AAA Gas Prices)

Unfortunately, California was the worst-performing region for two consecutive months (July and August), but it’s not clear yet whether this will dramatically impact Kura’s sales in fiscal Q4. Currently, Kura has nearly half of its footprint in California. Still, due to higher income guests on average and its strong value proposition, it’s been mostly immune from the traffic pullback we’ve seen for more casual diners to date.

Valuation & Technical Picture

Based on ~9.8 million shares and a share price of $65.00, Kura trades at a market cap of ~$637 million and an enterprise value of ~$630 million. Historically, the stock has traded at 3.7x sales and currently trades at ~4.5x FY2022 sales based on FY2022 estimates of $141 million. Usually, I would discount the historical multiple, given that we’ve seen meaningful multiple compression in growth stocks due to higher rates, and the industry itself continues to struggle with staffing and inflationary pressures. However, Kura Sushi has been a clear exception, and I think a premium multiple is justified for this small-cap growth story.

Based on what I believe to be a fair multiple of 4.0x sales and FY2023 revenue estimates of $185 million, I see a fair value for the stock of ~$750 million, or $76.50 per share. This is well above my previous fair value estimate of $55.70, entirely due to the company’s incredible margin performance, which should justify maintaining a ~20% unit growth rate. The exceptional margin performance and relatively inflation-resistant model also contribute to the higher multiple, given that investors are hard-pressed to find any concepts with similar or higher margins vs. FY2019 levels. Hence, I see an 18% upside from current levels.

Kura Sushi – EV/Sales Multiple (TIKR)

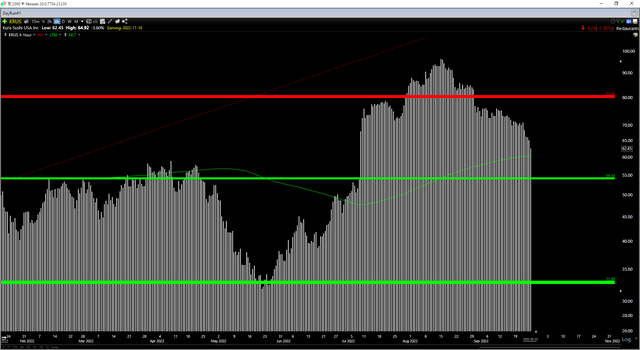

We’ve also seen a major change from a technical standpoint, with KRUS blasting through previous resistance at $54.00, with this previous resistance level now becoming new support. This has positively impacted the technical picture from a reward/risk standpoint. Given the phenomenal performance, I would not be surprised if the $50.00-54.00 level was the new floor for the stock, assuming the S&P-500’s bear market correction magnitude is contained to 30% or less (22% currently). However, with KRUS only slightly below the middle of its support/resistance range ($54.10-80.45), I don’t see a low-risk buying opportunity just yet.

Summary

Kura Sushi had a phenomenal quarter in fiscal Q3 and is set to end the year with record sales, record EBITDA (above 2019 levels), and very strong margins. This is a very clear divergence from the industry, which might be putting up record sales due to ~20% menu pricing, but is struggling on balance from a profitability standpoint among operators, with examples being Shake Shack (SHAK), Carrols (TAST), and BJ’s Restaurants (BJRI). Given this impressive performance combined with industry-leading unit growth, I see KRUS as a solid buy-the-dip candidate. That said, the lower-risk buy point is closer to support at $54.50, where I would get more interested in the stock.

Be the first to comment