Author’s Notice: This is a shorter version of a fundamental article published on iREIT on Alpha on March 30th, 2022.

Ramil Nasibulin/iStock via Getty Images

Dear readers,

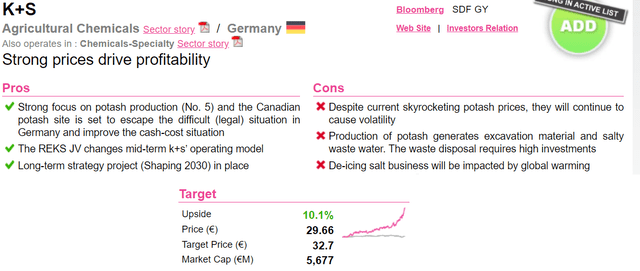

In this article, we’ll take a look at The K+S (OTCQX:KPLUY) (OTCQX:KPLUF) company, which once stood for the Kali Und Salz GMBH. The company is headquartered close to where I grew up, in the German town of Kassel, and this company is Europe’s leading supplier of potash used in fertilizers (Source: IG). The company also has a few other upsides that we’re going to be taking a look at throughout this piece.

This company is a 133-year old giant in the industry – and we’ll look at what upside it can bring for investors at this time.

Looking At K+S

At its heart, K+S is a chemical company founded in 1889. The company has, throughout its history, been a major player in potash as well as a player in salts. That’s also where the company is today. The company merged with the legacy potash division of the BASF (OTCQX:BASFY) subsidiary Wintershall back in the ’70s.

The company has a market capitalization of almost €6B, and is the largest European potash supplier. It’s also the world’s largest producer of salt, following the M&A with Morton Salt back in 2021, a deal valued at around $3.2B.

The company is a fully integrated producer of rock salt and potash. It covers the entire value chain, starting with exploration and ending with S&M for the various applications for their products. In addition, the company owns mining rights for over 1 billion tonnes of potash in Germany alone, with another 1.5B tonnes of crude salt. Its international reserves are also measured in the billions of tonnes, with Canada a large resource.

K+S acquired Canadian Potash One for €300M after the financial crisis, and this brought with it large amounts of exploration licenses with the potential to add around 3B tonnes of potash. The company is also involved in Australia, with mining rights/reserves from local investors in order to set up various projects related to solar. In short, K+S is short neither mining rights, resources or reserves.

As long as the world continues to need potash and salt, K+S will continue to mine and sell its product.

On a global scale, K+S is the fourth-largest behind Canpotex (Nutrien/Mosaic), the Belarus BPC, a former soviet-era potash producer, though it’s unclear what the current macro does of that, and the Russian Uralkali (Source: AlphaValue). What you will find when you look at the public comps is an excessive amount of companies in Eastern Europe, many in Russia/Belarus, all of which are potentially currently under some sort of sanction.

This is one of the reasons you will see K+S grow as much as the company has over the past few months.

K+S has gone through a few changes over the past few years, and 2020 was a brutal year for the company. Not only because of COVID-19, but because K+S offloaded its American businesses, and had to absorb fairly large P&L because of this. However, the resulting balance sheet and corporate structure is an extremely tidy-looking piece of fundamental, and with net debt reductions of €2B and an investment-grade credit rating, K+S looks pretty damn good from a foundational point of view.

As of right now, the company does not have an IG credit rating – it’s rated at B+ from S&P global due to the recent years of M&As. However, the net debt/EBITDA on an adjusted basis should be no higher than around 2X for the 2021 fiscal, making this company somewhat underrated to my mind. The company is also not in any type of liquidity crunch and has secured credit/liquidity of almost a €1B if needed. The gross debt is now almost halved compared to 2020.

K+S is a very “German” company, in that 60% of the company’s shareholders are German, and around 20% in the US. 55% of the company’s share ownership is from institutional investors.

K+S runs two divisions in its business – and these are neither geographical nor product-based, but end-product based. Agriculture comes in at 46% of sales, and Industry comes in with 3 sub-segments. Agriculture holds the global production of potassium chloride and the fertilizer specialties business. Industrial activities see sales of chlorine alkali processes and isocyanates, as well as food processing sales and sales to Animal nutrition (such as feed/lick stones).

The company also has a partnership in Waste Management through REKS, a JV between K+S and Remodis REMEX. The latter is a family-owned recycler that works with the treatment of mineral waste and backfill/landfill management. The JV is an extension/waste management organization working with underground reutilization (backfilling with less contaminated substances), underground disposal (permanent withdrawal of highly contaminated substances) and building materials recycling. The aim here is obviously K+S access to disposal materials to refill the mined caverns that K+S generates in its core operations. Environmentally friendly waste management is an ever-increasing demand area. The JV allowed K+S to realize a book gain, while generating a cash inflow of €90M pre-tax, and was part of the 2020/2021 plan to reduce debt and add value.

K+S core operations are heavily mining-focused, generating waste products such as water, and having a strong correlation to weather. Low water levels result in reduced productivity/mining because it prevents K+S from discharging saline wastewaters into bodies of water. German inland shipping is also impacted by water levels, and this forces K+S to look for more expensive shipping options – a very important factor to consider today given the state of logistics.

At its heart, K+S is a very strong, inherently solid company with timeless operations and products. Salts and Potash aren’t going anywhere. In fact, with the situation in the east, the markets for potash from Belarus and Russia have become extremely difficult. This is also why we’ll see the company bouncing like a rubber ball – as we’ll look at in valuation. It seems doubtful that these issues wind down in the very near future, giving this company an upside.

When it comes to what sort of flows dictate this company’s performance, you’re looking at the average selling prices of things like Potash and Salt. Its vertical integration gives K+S a unique pricing power and hedging potential, and its logistical proximity to appealing German waterways makes at least the theoretical logistics fairly easy during times of normal water levels. The prices for fertilizers for the past year have skyrocketed – and as such, the same thing is true for the company’s sales as well as the company’s share price.

Going forward, K+S expects significant improvements in EBITDA and sales, offsetting the cost inflation and logistical issues around the world. The company recently and very significantly expanded its storage and basin capacity, meaning it can, if needed, wait for things to improve on the cost side before selling if necessary.

K+S has several upsides, in the form of new structural clarity after the disposals, new JV’s that are set to improve the company’s operating model, and a long-term 2030E target strategy that’s paving the way for growth and stability.

Let’s look at some of the issues with K+S.

K+S – The risks/Issues

Fertilizer prices and everything having to do with agriculture is an extremely volatile place to be in. I should know, I’ve invested in the area for years. It’s up and down, and the best time to “get in” is when the area is being crushed on the market. That really isn’t the case at this time.

Despite the current pricing trends in potash, there’s continued potential for volatility here, as I don’t see anything that would negate this company’s inherent product pricing volatility.

While the products/services the company provides are essential to living (they allow the growing of food), they’re also not as hassle-free as you might expect. I’ve been in three different mines in two countries – and the operations are neither clean, easy nor cheap. The company requires significant investments in mining capacity, not only tools & machines but automation. Then there’s the issue of waste product disposal, primarily water. All of these areas require high amounts of investments, and these investments do not go away just because sales prices drop.

As someone who lives in cold climates, I can also tell you that road salt doesn’t just work – it’s a necessity (though in massively cold climes, such as the ones I’ve had in some of my consulting contracts, they use gravel/snow chains instead of salt). However, road salt usage is impacted by the green arguments. Salt contaminates groundwater, kills wildlife, and is considered an environmental pollutant with climate impact. Not only that, the use of salt will of course go down as warmer climates come further north. Much of Sweden, for instance, the southern parts in particular, no longer need road salting to any major degree.

Those are some of the risks to K+S.

K+S Valuation

Valuation for K+S has become extremely complicated for the past few months. The company has excellent foundations to go into a market that’s characterized by rising potash prices but at the same time, a massively rising valuation for the company wreaking havoc with the comparables. I use DCF, NAV, and public comps as well as other analyst comparisons to reach a consensus and try to understand how K+S is viewed by the market today.

This is not a complex exercise to K+S.

Expecting the company to grow at these current levels in the longer term is not something that’s going to happen. While K+S might capture sales market shares from its eastern counterparts, I cap sales growth at 3.5-4% with a 1.5-2% EBITDA growth rate in outlying periods with a steady CapEx/sales ratio over the coming years. At a WACC of around 7.7% with a cost of debt below 5%, the company, at a normalized long-term growth rate of 1.5-2.5% gives us a target price range of €16.8-€21.5/share. All of these prices are significantly below the current valuation, which was completely expected. The reason K+S trades at massive multiples today isn’t that people believe this growth rate is indicative for the long term, but rather the current situation in fertilizers. That makes DCF perhaps a less ideal method for looking at the company currently. I believe it crucial though, to highlight just how disconnected K+S has become from “standard” growth metrics. You can also see by other analyst targets how little these analysts consider the long-term growth rate to matter here.

Things look a lot better in peers. K+S has always been a cheap business in terms of its multiples, owing to the recent few years of weakness. Its peers include Yara International (OTCPK:YARIY), Wacker (OTC:WKCMF), Symrise (OTCPK:SYIEY), and to some extent, BASF. Compared to these chemical companies and this group of comps, the company is actually significantly undervalued even with a discount of 10-15%, which I would apply across the board due to the company’s low fundamentals. At an average peer P/E of 17-18X, and EV/EBITDA of 9X, this company is undervalued. Only the low yield, below 2%, currently speak against it from a public comp perspective.

The company, given its reporting structure, is simple to value at NAV level. All you need to decide on is what multiple to use. I use a range of 9-10X EV/EBITDA, which net of debt and commitments comes to a current NAV/share of between €23-€26.6 – closer to the company’s current share price, but not exactly at the €30/share level the company is now currently close to trading at.

Company valuation upsides are related to either book multiples, EV/EBITDA or P/E comps, or applying a high, comparative multiple to the NAV valuation. All of these are completely valid approaches given the geopolitical and global backdrop we’re entering. A company like K+S could very well see its fortunes rise to such a level, given the exclusion of eastern players, that a 12-13X EV/EBTIDA multiple could become less than ridiculous for the company. If this was the case, there could be a significantly higher upside to the company.

Indeed, many analysts, including AlphaValue, see an upside for K+S even at this price because of this. However, there’s also a significant amount of uncertainty to this. A lot of the potash demand comes from China, and the dictatorship hasn’t yet decided on how exactly it will handle Russian sanctions. It’s likely that China could continue to buy from Uralkali and similar sanctioned businesses, likely at lower prices than from K+S.

Alpha Value K+S Targets (Alpha Value)

S&P Global takes a similar view to K+S here, though the targets do still massively lag the updated macro. At a range of €12.5/share to €33/share on the high end, the analysts do validate the equity analysts price target, but it comes down to an average of around €22.5 (Source: TIKR, S&P global). The €12.5 price target is an analyst who hasn’t yet updated his assumptions for the current conflict, and the €33/share is the positive assumption that fertilizers will be at high prices for the foreseeable future.

I do agree with the latter part of that assumption – though I discount it somewhat more and come to a €30/share long-term PT for K+S, taking into full account the company’s expected operational improvements until 2030.

The threat of actual hunger in Europe is of course driving pricing higher here. There’s also the concern of ammonia feedstock availability given Russia’s position in the urea value chain – but the overall picture for the future is still positive.

Wrapping up

K+S has just instituted a new dividend policy, to a floor of at least €0.15/share per year, plus a discretionary premium based on annual performance. This turns, finally, this lackluster payor into a reliable dividend company. The company also confirmed FY22 guidance, expecting upwards of €800M in adjusted free cash flow, paving the way for a positive 2022.

It’s my stance that K+S is not going back to the cheaply valued company it was years ago, but that a mix of the global macro and fundamental shifts in the supply situation will drive a higher-valued company for the next 5-10 years. Its market position and market share virtually ensure K+S European dominance in potash with the Russian/Belarus competition being excluded. This is based on the assumption that even if the war stops/normalizes, normalized relationships between Russia and Europe have become impossible under the current Soviet-2.0 leadership.

The native ticker for K+S is SDF, a German ticker from the XETRA. The ADR for K+S is KPLUY, a 0.5X ADR. Due to the thinly-traded nature of this ADR, I would recommend that investors frequent a broker that allows native trading.

My position in K+S is unfortunately small next to my massive stake in peers like Yara international, which I’ve owned profitably for years. However, the fundamental stance I want to take in this article is that fertilizer/agri companies are an area you want to be invested in.

People underestimate the importance and potential of fundamental/foundational company stocks and investments. Food, utilities, living, and the like. They are some of the things I invest most of my money into.

At its heart, I believe K+S deserves a €30/share long-term PT. That makes the company a “slight buy” here, and a business I want to highlight in the current environment.

Be the first to comment