ipopba/iStock via Getty Images

On October 11 the Connect 2022 Conference kicks off, and Meta will showcase its “Project Cambria Quest Pro,” a headset which should show significant advancements in eye tracking and face tracking. The event will also reacquaint investors with the metaverse, a subsector of tech that was thoroughly hyped in 2021 only to be thoroughly annihilated in 2022.

Most money-losing metaverse stocks are down for a reason, but one “baby thrown out with the bathwater” that looks mispriced is Kopin (NASDAQ:KOPN), a micro display component provider.

In February 2021 the stock peaked at $11.82. The liquidity-driven Robinhood bids were speculative and short-lived, and the price fell steadily to arrive at its current price of $1.02.

The stock is starting to look washed out. The company has a $98 million market cap, despite having $18.5 million in cash, $34 million in working capital, an enterprise value of $81.46M, and no debt.

With a strong backlog in defense orders, an extensive IP portfolio, and the growing potential of an AR revolution, the company has a few things to recommend it here at this price. In fact, it might be the perfect contrarian play: a metaverse meme stock in 2021, now left for dead a full 91% below its high, but possibly bottoming with near-term catalysts.

Kopin is certainly not a fly-by-night. It has been in business since 1985. It is the sole supplier of the helmet micro displays for the F-35 Joint Strike Fighter Program (which will be in production until at least 2030). However, the past few quarters have been disappointing. Three things that have rightfully concerned investors –the high R+D spending, the dip in industrial/enterprise revenues last quarter, and enduring supply chain issues –must be recognized.

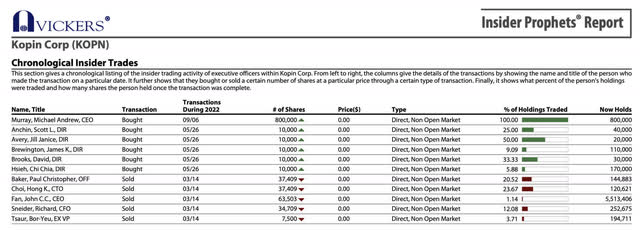

As suppliers will be soon revealed for the next-gen VR headsets, we expect a bounce in Kopin’s share price in October. Insiders have been net buyers since May.

Insider Buying and Selling, 2022 (Vickers)

However, the premise for any new investment in KOPN now depends on whether the dip in profits (despite the jump in military-related revenues) can be credibly assigned to factors that are now mitigating. It revolves around three issues:

- New defense orders are coming in strong this year. How durable is this? Will it ramp up and remain a strong buffer during an impending recession?

- Will the cash burn stop? The recent sharp increase in R+D expenditures has hurt profitability. Is that now mitigating, and will that money now bear fruit?

- The falloff in enterprise revenues over the past two quarters shocked KOPN’s new investors. If this post-pandemic hangover is about to end, can we honestly expect to see a new phase of secular demand or will an incoming recession pummel enterprise revenues further?

Defense Spending: How Durable?

Kopin’s defense orders have ticked up recently, with 87% year-over-year product revenue growth in 2Q. Last December Kopin booked a $19.8 million order for its eyepiece sub-assembly, described as a critical component in the US Army’s “Family of Weapon Sight-Individual” (FWS-I) thermal sight systems. In May, they got a $4.8 million order related to F-35 helmets as well as a follow-on development order for armored vehicle imaging systems. In the late summer they announced a new $3.8 million production order for high-brightness color displays used in helicopter helmets. And on September 29, KOPN disclosed a new $3 million first production order for a new weapon sight.

72% of Kopin’s revenues come from defense customers like Lockheed Martin (LMT), General Dynamics (GD), and Collins. It makes the displays, optics, and imaging units used –respectively– in pilot helmets, infrared gun sights and artillery targeting systems.

Kopin Defense offerings (Kopin website)

Whereas East Asia had been the region of escalating arms race for about a decade, Europe is starting to see that bid as well. The Russian attack pushed Finland and Sweden into NATO and has sent the EU into a massive re-think about defense spending. Earlier this summer EU officials met with member nation delegates to craft ground rules for a €500 million (U.S. $523 million) fund meant to promote quick purchases of military equipment.

By aiding Kiev in the Russo-Ukrainian War, Europeans are now depleting their weaponry reserves and they are already running low, starting the process of rebuilding. Most of that is ammunition and howitzer artillery, but Leonardo DRS, a key Kopin defense customer, recently declared they are seeing high demand for their IWS product, an infrared sight that can be clipped to a gun to let a soldier see in the dark or through smoke via thermal sensing. This is precisely the kind of high-tech add-on to an old gun that can make a novice Ukrainian citizen soldier a much more effective fighter, so I imagine they are being sent East in great numbers.

Clearly, defense spending is likely to increase through 2025 to 2030 in both Asia and Europe, as Russia and China push hard on the Pax Americana status quo. The situation is starting to feel like 1935, when Mussolini disregarded the League of Nations with its attack upon Ethiopia and Western Europe had to sober up to the thought of a new period of geopolitical conflict.

In June, NATO announced it plans to increase the size of its rapid reaction force from 40,000 to 300,000 troops. This increase is staggering. Forces would be based in their home countries but deploy further east, where the alliance would stockpile equipment and ammunition. On September 28, France added $3 billion to its defense spending, double their typical increase.

One analyst expects the global micro display market to grow from $712 million in 2020 to $3.6 billion by 2025 a CAGR of 38.4%. Others put the 2025 number at $3.4 billion. Both of these are old estimates that do not include the defense spending increases of 2022.

In addition, a new CEO, Michael Murray, was just appointed on September 6. Replacing long-time CEO and visionary founder Dr. John C. Fan, Murray comes from Ultra Electronics Group, a British defense firm, with years of working with defense ministries and governments (preceded by 11 years at Analog Devices). This new CEO could help drive European sales.

Kopin is something of a patent trove. It has an extensive IP portfolio in the micro-display space. Thirty years ago, it was DARPA funding aimed at giving soldiers in the field some computing access that allowed Kopin to develop the first tiny solid-state micro-display, leapfrogging the use of larger CRT monitors. It has 200+ patents related to wearables.

Five years ago, Goertek, the maker of the Oculus Quest 2 and PlayStation VR2, and a Qualcomm XR partner – took a 10% equity stake in Kopin (7.6 million shares at $3.25 per share); it didn’t sell even when Kopin shares were at $13.50 early last year.

Risks: A Scorching Cash Burn Rate And The Big Bulge In R+D. Will We See A Turnaround In 2023?

Despite its storied product history, Kopin has been a serious money-loser for shareholders. Though publicly traded since 1993, Kopin remains micro-cap and a niche component provider in a steadily competitive industry. The shares have remained stagnant, fluctuating on average between $3 to $6 for 30 years, with shares only spiking to $45 during the Dotcom bubble and $11.82 in 2021. Widespread adoption of AR and VR never took off, despite moments of anticipation, and the company survives through defense orders.

Early last year, on March 8, 2021, Kopin inked a $50 million ATM offering agreement with Stifel, Nicolaus & Company. This dilution took advantage of its high price at the time but hurt shareholders. Since then, the cash burn has been shockingly steep. Total cash & ST investments went from $30.8 million to $18.6 million, going from 53% to 33% of asset/liabilities, and suggesting a cash burn rate of just over $1 million a month. This looks ugly. Though revenues are up 20% year over year, the firm’s operating income is down 39.50% over the same time frame (June 201 to June 2022). Operating income went from a $2 million loss in June 2021 to a series of deeper losses –$3.6 to $6.1 to $5.5 — in the past three quarters. Analyst estimates for a EBITDA at -$2.9 million were surpassed last quarter with a loss of $5.2 million, 79% worse than expected! Year over year, earnings from continuing operation is -46.72%. This is a falling knife.

Though defense revenues are rising, and R+D spending and operating loss have softened a bit in the last quarter, the big question is whether KOPN’s expenses can drop fast enough in the coming two quarters to avoid another ATM. There is an argument to be made that the adj. negative EBITDA may have bottomed in the first quarter of 2022 at -6.1 million. One analyst expects a negative EBITDA of $3.8 million next quarter, despite revenues rising to $12.05 million next quarter (3Q) and a $3.34 million loss despite $12.50 million in the following 4Q. Will the R+D costs ameliorate to see a sharp snapback in profitability in the coming quarters? However unlikely, it is possible. The new CEO just started on September 7. It is common for companies to drop “everything but the kitchen sink” into the quarters prior to a new CEO, so that he/she can build confidence with the market. The past two quarters may be the case here, but we can’t be sure. That is what makes this stock so contrarian.

Of course, every company has to reinvent itself from time to time. This might explain the enormous increase in R+D over the past two years, as KOPN fights off recent challenges by competitors. The question is whether a wider enterprise or consumer adoption is about to kick in to make these investments more than a survival play (See the following section for more on this).

Most broadly, the VR industry is moving away from glass-based OLEDs to micro displays based on OLED-on-silicon and from Fresnel glass lenses to Pancake optics. In June 2021, Kopin announced that has produced the world’s first ultrahigh-brightness (> 35,000 nits), high-dynamic-range (HDR), green Organic Light Emitting Diode (OLED) microdisplay on silicon, designed for high-performance AR applications. This takes OLED to the luminance levels of current LCD displays used in high-brightness AR applications.

F-35 pilots had complained that Kopin’s LCD displays were often difficult to use when landing on aircraft carriers at night (day was okay), while earlier versions of OLED display lacked the luminance and caused eye fatigue. Kopin seems to have successfully met the challenge on this front.

The transition from Fresnel lenses and Pancakes is also under way. The main difference between the two lenses is the way in which they direct light. The Fresnel lense –named after the famous French engineer (hence the capital F)– works the same way as those 19th century lighthouses the man designed: by directing and concentrating an existing light source to a fixed point. The process requires a significant space between the display and the lens itself, and this bulks up the headset, adding weight. This explains most VR headsets of the past and present –from VPL to Oculus, etc.

The Pancake, on the other hand, works by folding many lenses together into a curve, bouncing the light within the glass or plastic. This eliminates the distance needed between the wearer’s eyes and the display. It results in a thinner and lighter headset. While the Pancake is less optically efficient than a Fresnel design, it has distinct advantages, especially as developers adopt dual stack OLED displays to boost brightness.

The Pancake technology itself is at least two decades old. The scientific community used Pancake optics years before the first Pancake VR headset prototype by eMagin (EMAN), a direct competitor, in 2015. Two years later, Kopin field its own iteration –the Elf.

In January 2022, Kopin announced its new “P80” Pancake. This P80 version is a major advance and believed to be the first all-plastic Pancake lense in the world. Prior versions of a plastic pancake –from either Kopin or its competitors– required at least one circular glass lens to avoid creating image defects due to the birefringence of plastic materials, essentially the “double refraction” in any transparent, molecularly ordered material.

The P80 does that without a glass inset, making it lighter and arguably cheaper to manufacture. It is said to provide a very sharp, 77° field-of-view (FOV) image with very long (23 mm) eye relief and large (12 mm-diameter) eye box – critical parameters for the AR/VR experience. It provides for longer wear times and less eye fatigue.

As it is lighter and perhaps cheaper to make, the all-plastic design could become the standard. Kopin has applied for three patents on the design, manufacturing processes and system utilization of all-plastic Pancake optics and expects additional filings to follow.

“This major breakthrough represents a foundational milestone for the emerging VR markets,” said Dr. John C.C. Fan, the CEO at the time. “After thorough review of the available optics designs, we believe all-plastic Pancake optics are the best for VR applications that require a very large field of view, excellent image performance, and a super compact size.”

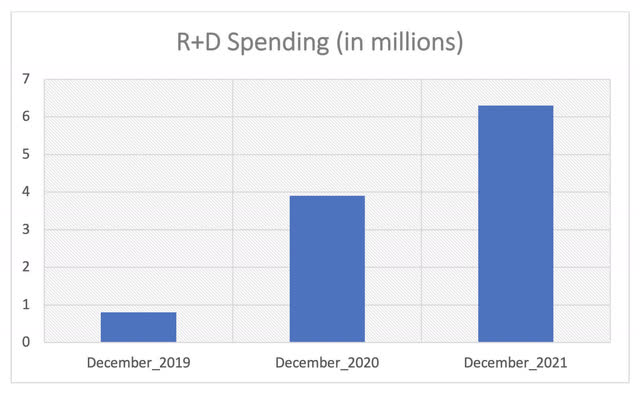

These patent efforts might explain the high R+D spending over the past 3 years, jumping from $800,000 to 3.9 million to $6.3 million, from Dec. 2019 to Dec. 2021.

R+D Spending from 2019 to 2021 (Author)

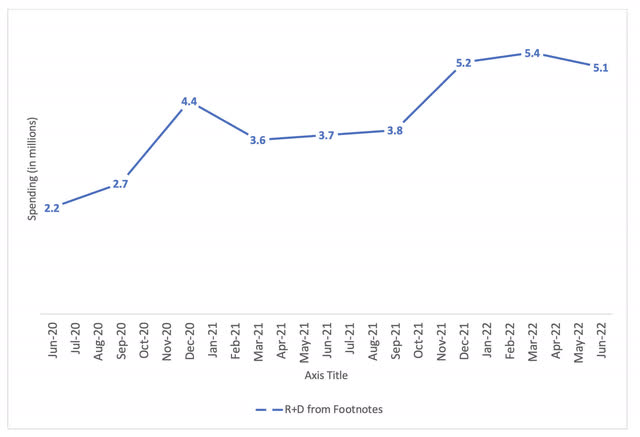

Looking at “R+D Spending, in the footnotes” you also see a clear escalation:

R+D Spending, in the footnotes (Author)

It appears that Kopin is now back at the cutting-edge of display and optics, arguably pulling ahead of competitors, after falling behind eMagin in the 2015 to 2017 period.

This was essential from a survival standpoint, but will the expenditures now mitigate? I think they might, as ultra-high brightness OLED and the P80 were the big push. The all-plastic Pancake enables thinner and lower weight solutions consumers have been asking for. And their Display-on-Chip approach might position Kopin as the ascendent force in display architecture.

Whereas companies like Sony prefer a larger (>2.0”) OLED display on a glass substrate or a silicon-based display with a separate display driver IC that they flip-chip bond to the microOLED, Kopin’s has a different approach. The silicon backplane for their 1.3” microOLED display includes display drivers in the backplane with the OLED layers on top. By adding the drivers, MIPI interface and 10-bit HDR color management in the silicon backplane, their Display-on-Chip approach wins out in terms of cost and performance. By putting a lot of functionality in the backplane, it eliminates both the bonding step and a separate chip. It also allows for more programmability in the way the display can be used. Key manufacturers in this VR supply chain will likely follow this architecture for their headsets.

Kopin is well positioned for demand, with state-of-the-art components and a manufacturing capacity that exceeds most of its direct competitors. We could even see profitability next year if, with a respite in R+D spending, defense order deliveries pick up with a cessation of supply chain issues.

The recent fall-off in enterprise revenues was galling, however, even if the quarter is a cyclical trough. Can we expect new demand from enterprise? Or will an incoming recession pummel enterprise revenue further?

A Resurgence In Enterprise Headsets?

The falloff in enterprise revenues over the past two quarters disappointed KOPN’s new investors. This probably has to do with the transition from the HMT-1 to the Navigator 500 in RealWear’s product line. If this post-pandemic hangover is about to end, and we can honestly expect to see a new phase of secular demand in AR, I think RealWear’s widening adoption in remote auto and industrial servicing might be the trigger.

The global AR enterprise market is projected to grow to over $461 Billion by 2030 according to Market Research Future, but that might be materially affected by a prolonged recession. And of course, there is the risk that the headset revolution will stall out like it did in 1995 and 2013. What is different this time? 5G. No feedback stutter, cloud-based augmentation, a new threshold in resolution, and hands-free direction via excellent voice activation could coalesce to be the game changer. Qualcomm’s Snapdragon XR2 is an 8k VR system and the first one to be 5G enabled.

Though Panasonic and Google have been a customers, one of the most promising trends for Kopin might be from a new crop of ruggedized industrial AR headsets from Moziware and RealWear.

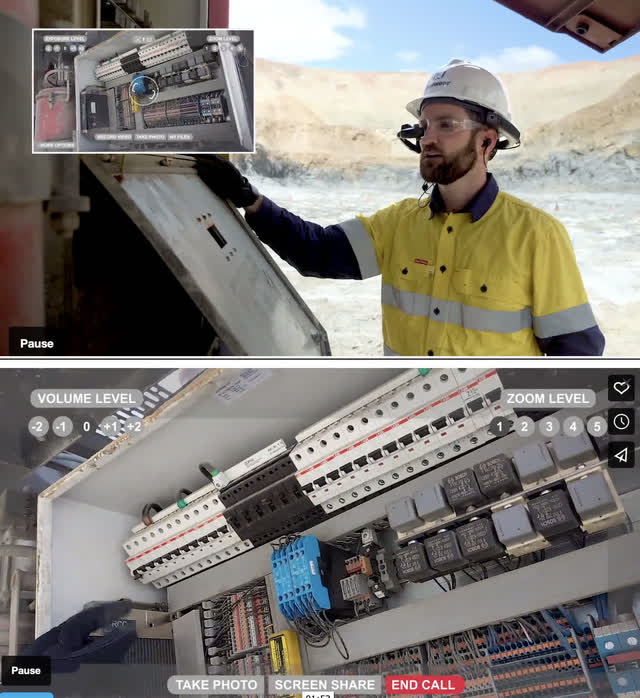

These are not AR glasses per se, but rather a voice-activated camera and below-view displays that allow an on-site service rep to pull up manuals via voice and to interact with the off-site experts. The home office can see the problem real-time via the camera, and expertise, instruction manuals, can be pulled up via the display.

RealWear HMT-1 (Realwear website)

RealWear is a private company. It has experienced great demand for its HMT-1 wearable for remote servicing and after-sales maintenance. It essentially brings expertise to the edge — allowing work to be done in the field with home office mentors watching and prepping field novices. The auto industry is seeing big cost savings in terms of remote servicing and maintenance. RealWear has seen big industrial orders from Ford, Orkel (a European machinery maker), and Mercedes. Germany is now using them to help in remote inspections of nuclear power plants. They are even partnering with Autodesk to bring its drawings and BIM cloud to the HMT-1, which will move their use to construction.

RealWear’s Navigator 500 (RealWear website)

More importantly, in June, RealWear released its new Navigator 500, which will surpass the HMT-1 on camera res, lightness, and its Android 11 operating system. Most intriguingly, its camera stream offers cloud-based labeling. This is a very impressive feature. The camera footage of the headset can be sent to the cloud, where a computer vision system can label in real-time the various objects the operator has in front of her and send this overlay back to her in the display. The augmentation occurs not in the headset, but rather in the cloud. The field operator could then see the step-by-step instructions about the relevant operations to enact. RealWear’s Navigator 500 with this RealWear Cloud feature makes AR different this time.

The Upcoming Catalysts

Kopin releases 3Q 2022 earnings on November 1. Analysts are estimating a .06 EPS loss, but last year, they surprised to the upside in their 3Q 2021 and beat estimates. There could be a repeat, particularly after a very disappointing “everything but the kitchen sink” 2Q (which may have been a gift for the new CEO).

Defense orders will probably be up, R+D costs down, and we might even see the Navigator 500 uptick its industrial orders. Kopin’s management are cautiously optimistic that the supply chain bottlenecks are ameliorating. But I could imagine the issue will persist into 2023.

The good news is that Kopin is now where the proverbial puck is going. The HTC Vive Flow and EM3 Ether will use the Pancake technology. Meta has also confirmed its Project Cambria headset will use Pancake lenses. The Cambria –also called the Quest Pro—is rumored to be released on October 11 and cost between $799 and $1200. Significantly the Cambria will add two new sensor technologies –specifically eye tracking and even face tracking—which could enhance VR adaption by greatly improving the experience.

Eye-tracking is a big deal innovation for the industry. It heightens rendering speed, perceptual depth, and immersive realism. It does this in three ways:

- Foveated rendering — allowing a VR headset to only render, in full resolution, where the user is looking– requires eye tracking and can reduce graphical processing per frame.

- Varifocal display: Overcomes the blurry foregrounds of the present fixed lens systems and allow close-up objects to remain sharp and keep their detail. It also relieves some of the eye strain VR can cause over long sessions.

- Expressive transposition: Eye-tracking and face tracking means that your expressions will be real-time rendered on the face of your avatar, dramatically enhancing the sociability quotient of VR.

This Cambria release could be a catalyst for the VR industry, and possibly a vindicating moment for Mark Zuckerberg himself.

Another possible spark for mass AR adoption: Apple’s glasses –slated for release in late 2023– which just might be hip enough to leap beyond the curse of Google Glass. No word if Kopin will be a supplier.

Conclusion

At this point –with negative EBIDTA and ugly margins– Kopin remains a very speculative trade. But down 91%, it looks washed out in price (if it avoids a new ATM). The recent bulge in R+D spending has positioned the company well. With a new CEO, we should see improvement in the coming quarters and (more broadly) maybe even a secular change in fortunes with the growing defense orders, the new Navigator 500, and improvements on the consumer side.

[1] Meta Announces 2022 Connect Conference, a Key Showcase of its Evolving Metaverse Vision

[2] Kopin Receives $19.8 Million Order

[3] Nations huddle to clarify access rules for $523 million buy-European fund

[4] French 2023 defense budget adds $3 billion to fund ‘war economy’

[5] What’s the Best Display Architecture for VR?

[6] Realwear Navigator 500 Hands-On: Great smartglasses for enterprise

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment