ricochet64

Dear Readers/Followers,

In this article, we’re going to be taking a closer look at KONE (OTCPK:KNYJF), a Finnish giant in the segment of elevators, escalators, and similar areas. This company represents, at heart, an attractive investment with a potentially solid upside – because its products and services are fairly resilient to the macro and ups and downs, overall. It’s also internationally diversified and with a broad exposure. I’ve made a fairly good 80% RoR with the company historically, but decided to sell when some margin pressures and issues started materializing more clearly years ago.

Since that time, I’ve held only watchlist coverage of the company.

Today, I’m re-initializing my coverage on the company.

What is KONE?

KONE is a Finnish play on indoor mobility, access, and similar adjacencies – things usually considered self-explanatory when building or designing structures. The company designs, researches and builds systems that transport people short distances or allow/disallow people access.

This is a fairly attractive play on macro trends. 68% of the world’s population is expected to live in Urban areas in 2050, which is an increase of 2.2B, and therefore a massive market opportunity. Trends like the pandemic can induce massive spikes and volatility for a business like KONE, which saw customer use of elevators plummet, but now recover to normalized levels.

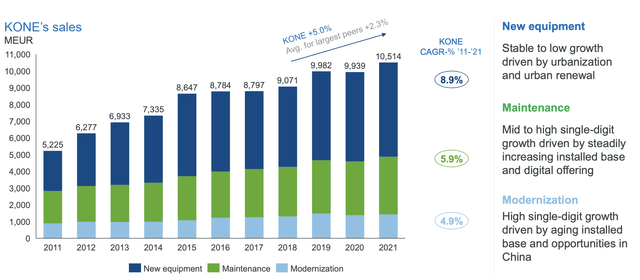

KONE not only sells the systems – but they also maintain them. The combination of these two sectors, where sales are more volatile and maintenance/service is more dependable, is what forms the basic thesis on this company.

This is also what forms some of the basic challenges of the company. Historically, the company has had little control over margin challenges, and those are what are declining – and have been declining for years, without the company having the necessary market dominance or position to raise prices to offset these.

We can see this when looking at adjusted EBIT. While EBIT, or pre-tax earnings, are mostly growing with the exception of a slump in 2017-2018 (when I last sold the company) – the issue is that in 10 years, company margins have dropped from 14% on an adjusted EBIT level to 8% in 1Q22. That’s a fairly steep drop.

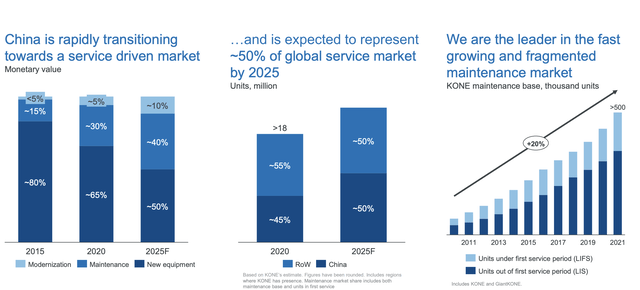

The company is combating these with dynamic pricing and different contract structures as well as internal efficiencies – but my main issue with the company was historical that it wasn’t in a great position to drive these changes to the customer side. There was also the overreliance on China as a growth market, which puts them not only in competition with local Chinese brands but at the exposure of a well-known, volatile market. While the trends in China are solid on a high level…

…there are underlying trends here that are best viewed or expressed in looking at the way the company’s profit margins are developing – which has been in one direction for the past decade or so.

Don’t get me wrong. This company has a very attractive set of fundamentals. It has a strong Asian market position #1 in China and #2 in APAC, and its innovation history is second to absolutely no company in the industry. It’s adopted the model of predictive maintenance, and I use KONE elevators, escalators, and products every day here. The company is at the forefront of access innovation and has 31 products with best-in-class energy efficiency in accordance with ISO 25745. Like many Finnish companies, it’s at heart a well-working organization.

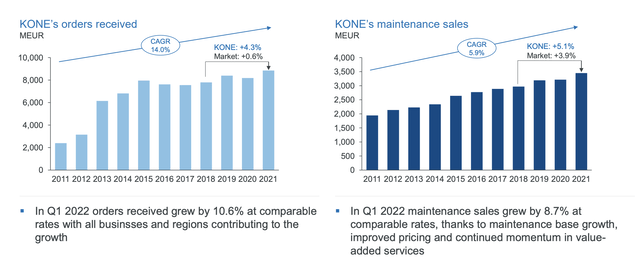

Sales show no real issue here, and KONE outperforms peers by more than 2x, with a very attractive overall mix that’s going the “right way”.

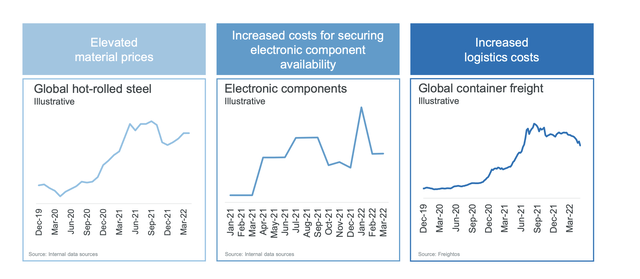

However, at the same time, the company is perhaps one of the most-impacted businesses I have the pleasure of covering. Since 2020, the costs for KONE have shot up, and it’s been all KONE has been able to do to not completely lose what margins it has.

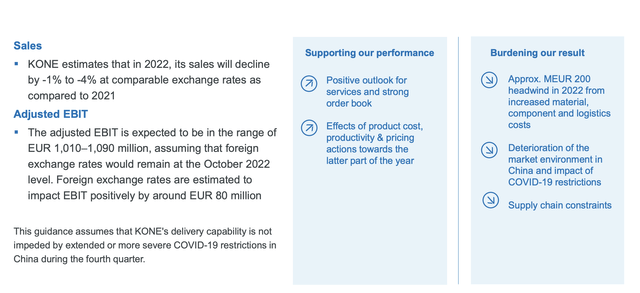

The fact that the primary driver of positive guidance (though lower than 2021) is positive FX shows you how “bad” things are. The company is recoding €200M worth of impacts from labor, materials, and logistical costs. KONE is battling back with pricing, renegotiating product costs through different sourcing, and improving productivity. All of those are good things, but we’re not talking about a company that was working “badly” before – meaning if they start cutting costs at the wrong corner, they may end up hurting their reputation and actual product quality – a definite undesirable, as far as things go here.

Net debt has been increasing and is now at almost €2.2B. The company, aside from pricing, is also battling using innovation and attractive M&A’s. KONE is M&A-heavy and since 2015 has acquired almost 200 businesses, mostly of them very small with a total M&A CapEx of below €40M on the average year.

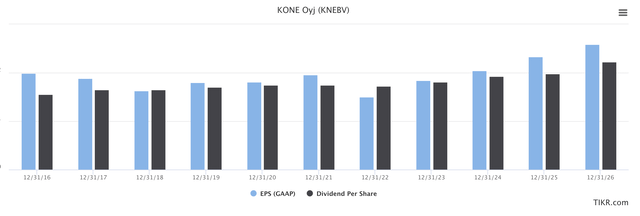

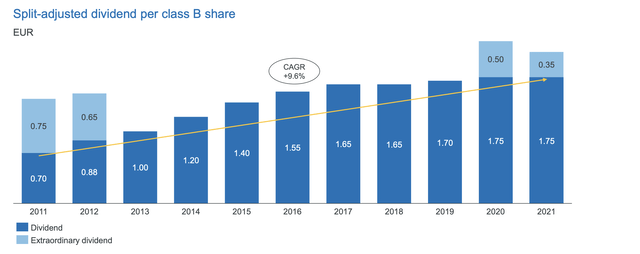

One of the positives is the dividend. That one is stable as a rock, despite the ups and downs.

And that dividend, as things stand today, is over 4%. Attractive in its own right, for sure. The company does not have any credit ratings, but this is due to the cost of the agencies. KONE has available revolvers of €850M and its service-oriented business structure ensures that it’s far from any sort of cash or credit crunch. I view the company as IG-equivalent, even if it doesn’t have IG.

The latest quarterly results continue to highlight the issues the company is facing. Orders received are down for 3Q22, even if the order book is filled and sales are up. However, adjusted EBIT continues to decline, even if margins are up from single-digit to bare double-digit levels at 10.2%.

Services are the saving grace for the business. The company is reporting penetration of up to 20% in connected services, which has reduced entrapment by 40% and identified faults proactively at a growth of 65%. Again, innovation and product quality have never been the problem for KONE, and it sees strong trends to continue this.

KONE’s main battlefield is improving its financial performances. Here are some ways in which it seeks to do this.

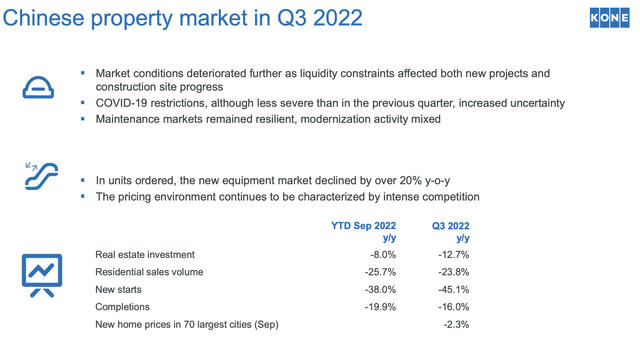

Every KONE market is down except non-China APAC. China especially, the company’s growth engine, has stalled due to ongoing COVID measures, and this is proving more and more of a problem for the company. Not just due to COVID-19, but due to the state of the property market, which as I see it, in a state of free-fall.

Now, because KONE positioned itself so firmly with China, they are now reaping the whirlwind of what they sowed a few years back. Orders are down, but at least the margins of new projects are up slightly – even if a lot of the offsetting numbers here are not due to any qualitative increase, but a significant positive FX of nearly €185M.

The margin for YTD 2022, looking beyond 3Q22, is still at 8.9%, only slightly improved overall, and I doubt the company will manage double digits for the full fiscal here. Operational cash flows are taking hits as well, and is only half of what it was at the same time last year. It’s not enough to impair or hinder the dividend, but the trend is not good, because it’s not just COVID-19.

Some of these issues are structural/fundamental. This is affecting the company outlook, as it stands today, and what we expect from KONE going forward.

Slowing order book rotation and the risk of continued China issues are the short-term issues – but Wage inflation, inflation over all, and geopolitical tensions are the more long-term ones.

This calls into question what we should pay for KONE as a business and as an investment. Because at a high level, the appeal of the company is not in question. But any valuation needs to take into consideration the state we’re currently in.

KONE’s Valuation

I don’t view KONE’s Valuation as all that attractive here, and I didn’t view it as convincing when it was below €45 either. Even at those levels, which are a perceived low, the company traded, at trough, at a 16x normalized P/E. The level at over €50/share is over 27x P/E, which is a massive premium. This is especially true for a company that’s essentially facing margin compression.

The main thing I want to see before investing in KONE is an indication for when things may normalize. This is not something that we have a very high visibility towards at this time.

Current EPS estimates call for the company’s FY22 to be the worst year, after which the company will recover and rise to significant EPS levels going forward, with dividends rising on par with these trends. You’ll note that GAAP EPS on a forecasted basis currently does not cover the dividend, and we’re rising to a 90%+ payout ratio on a forward basis.

Kone Forecasts (TIKR.com/S&P Global)

The main issue is really that I don’t agree with or view these forecasts as being realistic. Investing in KONE, I would more heavily impair the forecasts and use DCF valuations that result in an implied share price going no higher than €42/share, moderating the growth rate to below 3.5% and assuming that the cost increases we’re currently seeing aren’t likely to go away very quickly. Combine this with frankly worrying China weakness, and the company’s overexposure to the Asian geography does no one any favors.

Many other contributors are bullish on KONE. I am not.

I see the company heading into even more of a margin crunch while facing a declining property sector in its core segment, China. While I don’t see any fundamental worries for the company’s cash flows, I do not see a positive thesis that would call for an investment at this price.

Most analysts agree with me. Out of 24 following the native share, only 6 are at “BUY” with an average PT of €46.78. Over 14 are at “HOLD” or Underperform valuations, with one of the analysts calling the company a sell here.

Based strictly on multiples, DCF, and book values, the company is trading at premiums we haven’t seen in some time, while at the same time facing some fairly serious issues, for which we have no real answers beyond boilerplate for addressing. Ironically, KONE in its current state gives me more worries than do high-exposure chemical businesses like BASF (OTCQX:BASFY) or Yara (OTCPK:YARIY).

I believe investors should be extremely careful l investing here because you might be locking in capital at excessively positive assumption ranges.

I would give KONE no more than 15x P/E normalized – that comes to around €42/share, and that’s as high as I’ll go. Even at that valuation, we have alternatives with great upside – which KONE does currently not have, as I see it.

Here is my thesis for KONE.

Thesis

- KONE is a great, fundamental business in access and transportation technology. It’s a market-leading innovator with a great portfolio and a market-leading penetration across the world. However, investments have left it overexposed to a fragile Chinese property market and geography, which combined with current macro trends in inflation, wages and pricing, are wreaking havoc with margins in a most unappealing manner.

- I won’t touch KONE at above €42/share. I don’t view the upside as attractive enough at this time.

- Based on this, my stance is currently “HOLD”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment