Hello my names is james,I’m photographer./iStock via Getty Images

Summary

For the last 2 years, inflation has been a key theme of my investment strategy. Looking forward, Komatsu (OTCPK:KMTUY) (OTCPK:KMTUF) is one of my favorite picks for inflation beneficiaries for multiple reasons.

- Komatsu benefits directly from the inflationary effects of rising commodity prices and rising labor costs.

- Komatsu’s low valuation and inclusion in the Japanese stock market provide defense against hawkish US monetary policy in response to inflation.

- Diverging responses to rising inflation by Japanese vs. Global central banks could weaken the Yen, providing an additional tailwind for Komatsu by increasing its attractiveness to foreign customers.

I outline this thesis in further detail below.

Introduction

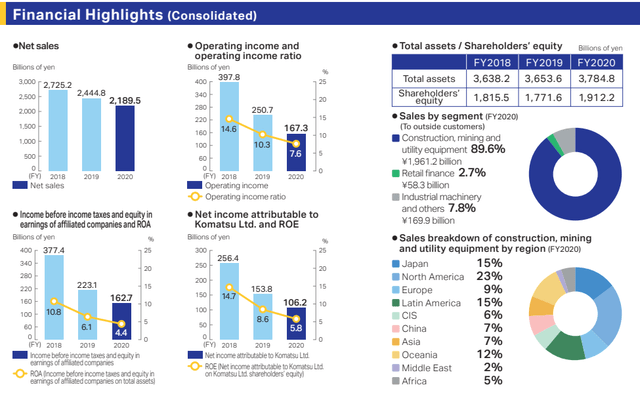

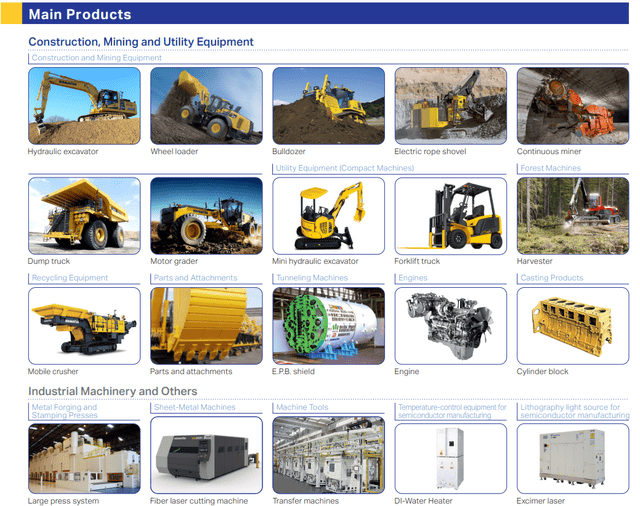

Komatsu is a $22B market cap Japanese heavy industrial equipment company with strong exposure to the global construction and mining industry. In FY2020, 90% of Komatsu’s sales were in the Construction, Mining, and Utility Equipment industry. Summary charts from Komatsu’s corporate profile presentation including more detailed numbers and the geographic exposure breakdown are shown below.

Financial & Product Highlights from Komatsu Corporate Profile Presentation

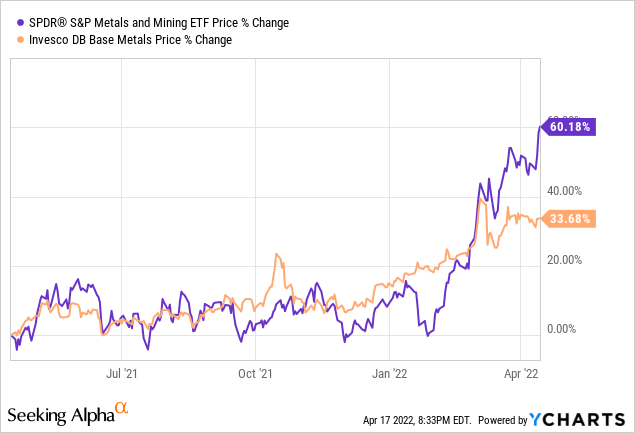

Rising Metals Prices Will Increase Demand For Mining Equipment

Over the last year, metals prices have increased significantly. Rising commodity costs are characteristic of an inflationary environment. In this particular situation, metals are primed for a sustained price rise due to an underinvestment in mining capacity. This has many analysts calling for the start of a new supercycle in metals and mining. Metals prices have already started rising. The Invesco DB Base Metals ETF (DBB) is up 33.7% in the last year. This has led to more capital flowing into the mining industry with the SPDR S&P Metals and Mining ETF (XME) up 60% in the last year. Price trends for both are shown in the figure below, with significant price action beginning around January 2022 with further acceleration in February/March following the Russia invasion of Ukraine.

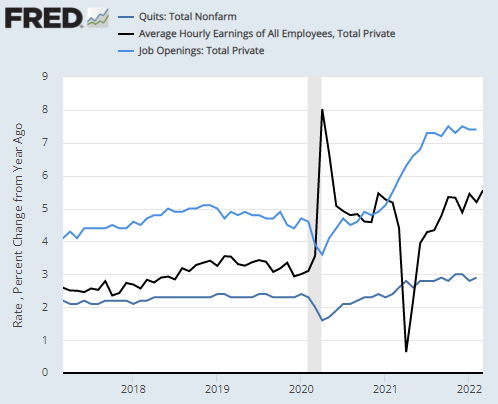

Rising Labor Costs Will Increase Demand For Autonomous Equipment

The pandemic-era fiscal stimulus created a very tight labor market associated with record highs in the recent history of labor metrics such as Total Private Job Openings and Total Nonfarm Quits. Consequently, labor costs are beginning to rise at high rates: the Average Hourly Earnings of All Employees, Total Private is increasing at a rate of over 5% per year. Since labor is a key input into most goods and services, this is an important driver of overall inflation.

FRED

Komatsu is well-known for its autonomous mining equipment. Komatsu advertises that automation can yield cost savings of up to 15%, increased production while promoting zero harm, consistent operation, and optimized dispatching and real-time decision making. The technology is quite impressive; interested readers can view Komatsu Autonomous Equipment Videos on YouTube. This technology has earned Komatsu a 4.3% weighting in Cathie Wood’s ARK Automation ETF (ARKQ).

Global Government Investment In Clean Energy And Resource Independence Will Increase Demand

A confluence of macro conditions has set the stage for sustained global investment in natural resources. First, near-zero interest rates and exhaustion of quantitative easing capability in developed economies will require fiscal stimulus to manage economic downturns in the future. Investments in green energy are a natural target for fiscal stimulus, which will ultimately increase demand for materials such as copper in order to support green energy infrastructure. Bridgewater Associates has written about the likelihood of green energy fiscal stimulus extensively. Second, this is being amplified by geo-political tensions that are increasing calls for energy independence by developed countries. Not only will energy independence require investment in green energy infrastructure, but will also likely come with the desire to develop the capacity to produce the required upstream materials. We are seeing this play out now in the US with Biden taking action to boost strategic mineral supplies. The global energy transition and de-globalization trends are both key components of future inflation.

Low Valuation Provides Buffer Against Increasing Interest Rates

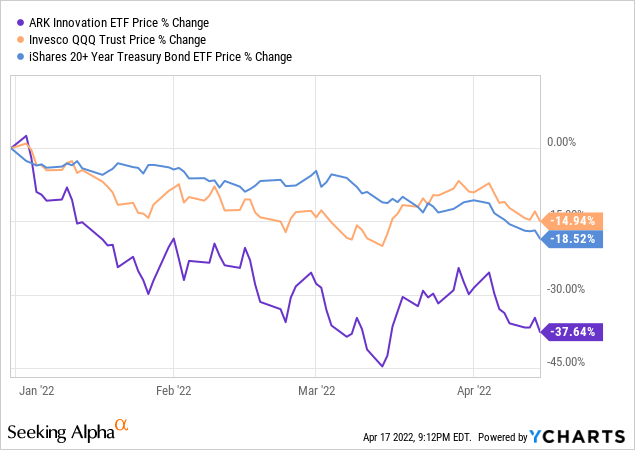

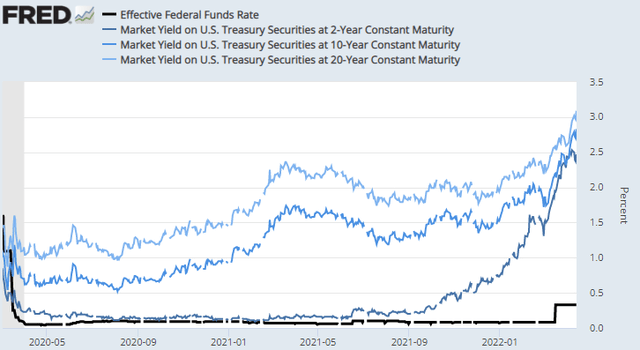

One consequence of rising inflation is the need for global central banks to respond by withdrawing liquidity. This will be accomplished by raising interest rates, both on the short end through interest rate policy and on the long end through quantitative tightening. The result of this tightening is that the risk-free rate will increase. For example, the 10yr US Treasury rate is currently around 2.7% up significantly from a low of 0.5% in 2020.

These rising interest rates effectively reduced the present value of all financial assets, particularly assets with long duration such as high PE growth stocks and long duration bonds. The chart below shows the impact on unprofitable growth stocks represented by the ARK Innovation ETF (ARKK), technology stocks represented by the Invesco QQQ ETF (QQQ), and long duration treasuries represented by the iShares 20+ Year Treasury Bond ETF (TLT).

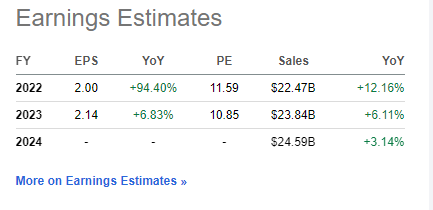

Komatsu by comparison is profitable with a 2022 PE of 11.59 and a 2023 PE of 10.85. On an earnings yield basis, this is a 9% yield which provides a comfortable spread above rapidly rising treasury rates.

Seeking Alpha

Japanese Stock Market Less Sensitive To Withdrawing Liquidity

As a final note, Komatsu is a Japanese stock which gives it some extra defensive characteristics against the hawkish US fed policy in response to rising inflation. First, the Japanese stock market is generally considered to be less sensitive to US liquidity vs. the US stock market. Consequently, the Japanese stock market should also be expected to be less sensitive to receding US liquidity. The US stock market by comparison has benefitted from increased US liquidity partly because US liquidity tends to flow into US markets and partly because US stock market is weighted more toward long-duration technology stocks whose valuations benefit from low interest rates.

Additionally, rising US interest rates should also be expected to strengthen the US dollar. At the same time, Japanese monetary policy is still relatively dovish resulting in a weakening of the Yen relative to the US Dollar, which has been displayed through some recent extreme downward moves in the Yen. A weaker Yen should be expected to increase foreign demand for Komatsu products, which will become less expensive vs. foreign competitors. This could provide an additional tailwind to Komatsu resulting from US / European central bank responses to rising inflation.

Be the first to comment