aprott/iStock via Getty Images

Kohl’s (NYSE:KSS) has been in negotiations for a potential buyout for what seems like years now, but the department store retailer still doesn’t have a deal in place. Considering the current economic environment, shareholders shouldn’t actually want a deal based on the rumored prices of the last remaining offer after other potential bidders have backed out. My investment thesis remains ultra-Bullish on the stock for upside from either a buyout at much higher prices or via executing on the business plan.

Lowball Offer

Prior to the recent weakness in the retail sector with consumer sentiment plunging to record lows similar to the 1980 recession, Kohl’s had multiple bids in the upper $60 range. Those offers appeared far too low for a department store with tons of valuable real estate and a strong earnings stream.

After Kohl’s cut earnings expectations by ~$0.60 along with the Q1’22 earnings report, only one bidder has emerged as still working on a deal. The big question is whether shareholders should actually want a deal at these prices.

The Franchise Group (FRG) is apparently still working on a deal for $60, or the equivalent of $7.6 billion. The small retailer only has a market value of $1.4 billion, so pulling off such a deal appears increasingly difficult in this difficult economic environment.

Apparently, Apollo Global Management (APO) plans to offer the firm a $2 billion loan to help complete the deal. On June 6, Kohl’s Board of Directors apparently entered into an exclusive negotiation with the Franchise Group, but again, the company shouldn’t waste time on such a lowball deal.

Too Much Value

Only at the beginning of the year, a lot of details emerged on Kohl’s having real estate in the valuation range of $7+ billion. The company shouldn’t be in any hurry to unload the stock without a premium valuation considering the real estate holdings.

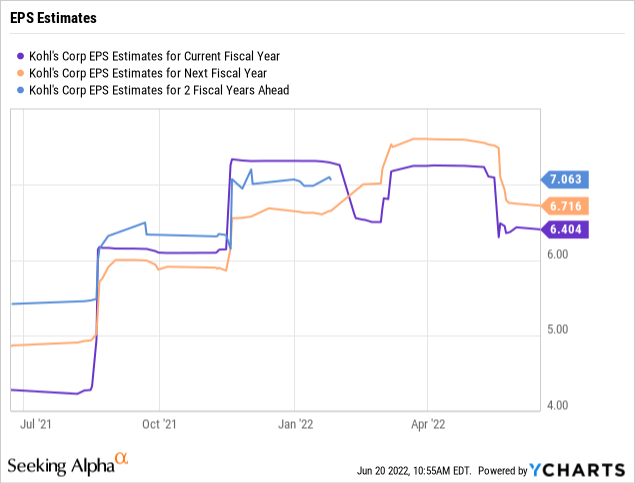

Back in May, Kohl’s cut the EPS targets for the year to $6.45 to $6.85 per share. The news came after Target (TGT) had slashed targets, but fellow department store Macy’s (M) beat estimates.

One key differentiator with Macy’s is the latter relies heavily on tourists at key New York City and San Francisco, amongst others, locations for sales. Those numbers were crushed starting in 2019 and are now returning. Macy’s has a natural reopen boost not prevalent in most retailers while also focusing on the luxury goods sector not as impacted by the current inflation issue hampering lower-income consumers.

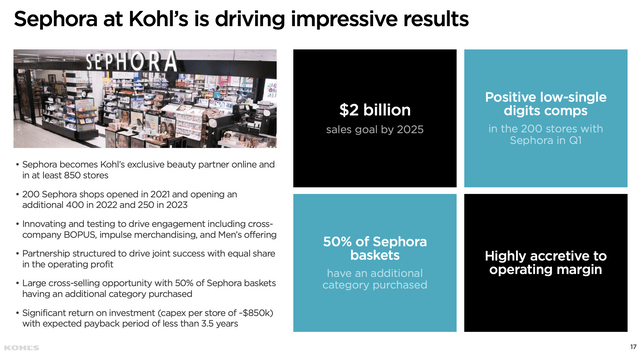

Analysts generally forecast Kohl’s to grow earnings after this period in 2022 of normalization. Remember, the department store retailer is only now implementing the strategy with Sephora for the store within a store. The forecast is to open 400 Sephora locations this year and another 250 next year.

These Sephora locations are expected to generate $2 billion in sales by 2025, and the company only opened new ones this year starting in April. The vast majority of the benefit hasn’t even accrued to the business yet.

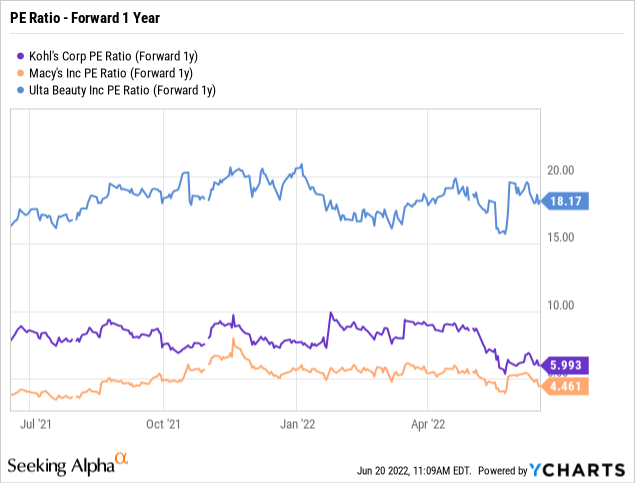

The problem facing Kohl’s is that department store stocks aren’t valued very highly in the recent market. Investors are still fearful Amazon (AMZN) and other online retailers are going to take market share while Kohl’s did an exceptional job of finally altering this reality during Covid shutdowns. The company was able to thrive with online ordering due to pick up and returns in the store or curbside.

The addition of Sephora could be a game-changer considering how much the market values Ulta Beauty (ULTA) in relation to a Macy’s. Every dollar of earnings from Ulta is worth 4x in comparison to Macy’s.

Why the board would want to dump the business with the valuable real estate, the strong profit machine and the plans to open more Sephora stores isn’t logical. Now isn’t the time to take a lowball offer and spend even a second considering the proposal.

Takeaway

The key investor takeaway is that shareholders have 50% upside from closing a deal with Franchise Group at $60. In addition, the business probably has further upside from executing on the business plan and repurchasing $1 billion worth of stock this year in what would amount to 20% of the outstanding shares.

Ultimately, investors should win either way with the stock only at $40.

Be the first to comment