AndreyPopov/iStock via Getty Images

A Quick Take On Know Labs

Know Labs, Inc. (OTCQB:KNWN) (KNW) has filed to raise $6 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing a non-invasive blood glucose monitoring and related vital signs device in the U.S.

While day traders or other retail investors may be attracted to the extremely low nominal price per share for the IPO and create significant early trading volatility, I’m on Hold for the company’s prospects.

Know Labs Overview

Seattle, Washington-based Know Labs was founded to develop its KnowU and UBand devices for external testing and monitoring of blood glucose levels and potentially other vital signs in humans.

Management is headed by Chief Executive Officer Phillip A. Bosua, who has been with the firm since 2017 and was previously founder and CEO of LIFX, a smart light bulb manufacturer and prior to that was founder and CEO of LimeMouse Apps, a mobile app developer on the iOS platform.

The company is seeking to develop measurement technologies using electromagnetic energy to perform sensing functions (Bio-RFID) for consumers.

Know Labs has booked fair market value investment of $100 million as of March 31, 2022, from investors including Clayton Struve and others.

The firm is still in development for its primary devices which will require U.S. FDA marketing clearance, and the company has undertaken comparison reference testing with existing glucose monitoring products as part of that process.

Know Labs generated revenue in Q1 2022 not from product sales, but from the sale of NFTs, or crypto Non-Fungible Tokens.

Know Labs’ Market & Competition

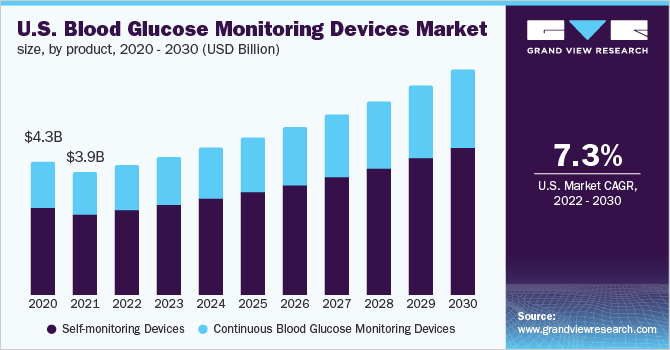

According to a 2022 market research report by Grand View Research, the global market for blood glucose monitoring devices was an estimated $11.7 billion in 2021 and is forecast to reach $21.7 billion by 2030.

This represents a forecast CAGR of 8.0% from 2022 to 2030.

The main drivers for this expected growth are an increasing awareness by consumers for monitoring their blood sugar level and a growing number of patients suffering from diabetes or pre-diabetic conditions.

Also, below is a chart showing the U.S. blood glucose monitoring market history and projected future growth trajectory from 2020 to 2030:

U.S. Blood Glucose Monitoring Devices Market (Grand View Research)

Major competitive or other industry participants include:

-

Abbott Laboratories (ABT)

-

Medtronic plc (MDT)

-

F. Hoffmann-La Roche Ltd.

-

Ascensia Diabetes Care

-

DexCom, Inc. (DXCM)

-

Sanofi (SNY)

-

Novo Nordisk (NVO)

-

Insulet Corporation (PODD)

-

Ypsomed Holding

-

Glysens Incorporated

Know Labs Financial Performance

The company’s recent financial results can be summarized as follows:

-

Topline revenue from unrelated NFT sales

-

Continued operating losses

-

Variable cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended March 31, 2022 |

$ 4,360,087 |

–% |

|

FYE September 30, 2021 |

$ – |

-100.0% |

|

FYE September 30, 2020 |

$ 121,939 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended March 31, 2022 |

$ 1,087,225 |

1982.3% |

|

FYE September 30, 2021 |

$ – |

–% |

|

FYE September 30, 2020 |

$ – |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended March 31, 2022 |

24.94% |

|

|

FYE September 30, 2021 |

0.00% |

|

|

FYE September 30, 2020 |

0.00% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended March 31, 2022 |

$ (3,712,408) |

-85.1% |

|

FYE September 30, 2021 |

$ (10,446,148) |

–% |

|

FYE September 30, 2020 |

$ (6,825,928) |

-5597.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended March 31, 2022 |

$ (11,497,357) |

-263.7% |

|

FYE September 30, 2021 |

$ (25,360,213) |

-581.6% |

|

FYE September 30, 2020 |

$ (13,562,641) |

-311.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended March 31, 2022 |

$ (1,022,019) |

|

|

FYE September 30, 2021 |

$ (6,850,699) |

|

|

FYE September 30, 2020 |

$ (3,913,803) |

|

(Source – SEC)

As of March 31, 2022, Know Labs had $11.2 million in cash and $5.9 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($5.7 million).

Know Labs, Inc. IPO Details

Know Labs intends to raise $6 million in gross proceeds from an IPO uplisting of its common stock, offering 3 million shares at a proposed price of $2.00 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $77.7 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 6.41%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

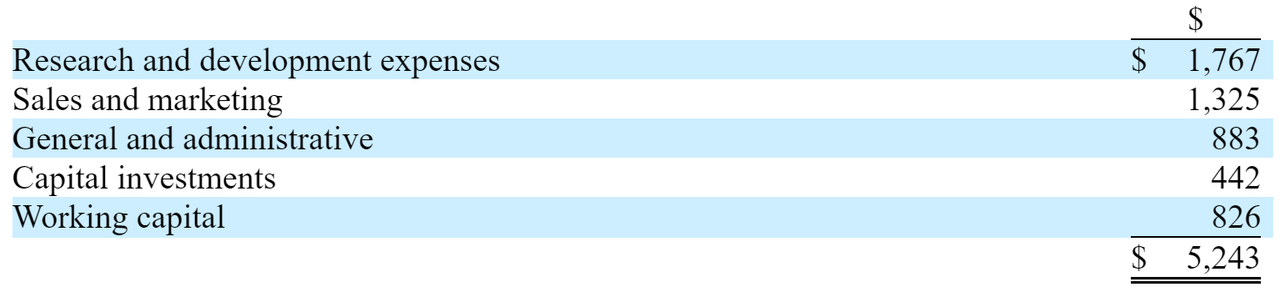

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company is not currently a party to any legal proceeding ‘that is not ordinary routine litigation incidental to our business.’

The sole listed bookrunner of the IPO is Boustead Securities.

Valuation Metrics For Know Labs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$93,653,562 |

|

Enterprise Value |

$77,655,292 |

|

Price / Sales |

21.48 |

|

EV / Revenue |

17.81 |

|

EV / EBITDA |

-5.48 |

|

Earnings Per Share |

-$0.78 |

|

Operating Margin |

-324.73% |

|

Net Margin |

-845.34% |

|

Float To Outstanding Shares Ratio |

6.41% |

|

Proposed IPO Midpoint Price per Share |

$2.00 |

|

Net Free Cash Flow |

-$5,716,879 |

|

Free Cash Flow Yield Per Share |

-6.10% |

|

Debt / EBITDA Multiple |

-0.03 |

|

CapEx Ratio |

-4.24 |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Know Labs’ IPO

KNW is seeking public capital market funding to advance its medical device development plans.

The company’s financials have produced revenue only from unrelated NFT sales, considerable operating losses, and fluctuating cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($5.7 million).

The firm currently plans to pay no dividends and intends to retain any future earnings to reinvest back into the business.

The market opportunity for improved blood glucose monitoring technologies is large and expected to grow as the global population ages and has a higher incidence of diabetic-related conditions.

Boustead Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (6.5%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is that its primary product is still in development stage and its U.S. FDA approval is an unknown.

As for valuation, management is asking investors to pay an Enterprise Value of above $77 million for a company with no approved or commercialized product.

While day traders or other retail investors may be attracted to the extremely low nominal price per share for the IPO and create significant early trading volatility, I’m on Hold for the company’s prospects.

Expected IPO Pricing Date: To be announced.

Be the first to comment