Sergei Dubrovskii

This article is not about KNOT Offshore Partners’ (NYSE:KNOP) overview of its business model but rather for someone who has followed the MLP for some time. Looking for the business model I kindly refer to some of the other articles written about it.

KNOP faces a lot of challenges in the next year and potentially beyond. The cut of the distribution is priced already – but one question is by how much and is the cut sustainable? Implied the current share price is a cut of ~41%%. I believe this level is not sustainable as KNOP faces rev decline, refinancing risks and deteriorating fundamentals. Based on these issues the distribution cut might be higher compared to the implied market pricing.

Certainly, there is upside in the longer term with the fleet of under development in Brazil. In the short-term KNOP only faces upside risk to the contracting of vessels in FY 23e and a successful refinancing and/ or lower operating expenses. It is also possible that the sponsor is helping out in some form, but this will be at the expense of unit holders. I would sell units and look for yield somewhere else. Maybe there will be a time to take KNOP as a reliable income provider in the future, however, I believe this will not be before H2 23e.

The article will look at historical yields, implied pricing for current unit valuation, revenue decline and debt refinancing. Please let me know about your opinion in the comment section – critical comments (based on factual evidence) are always welcome.

Historical Yield

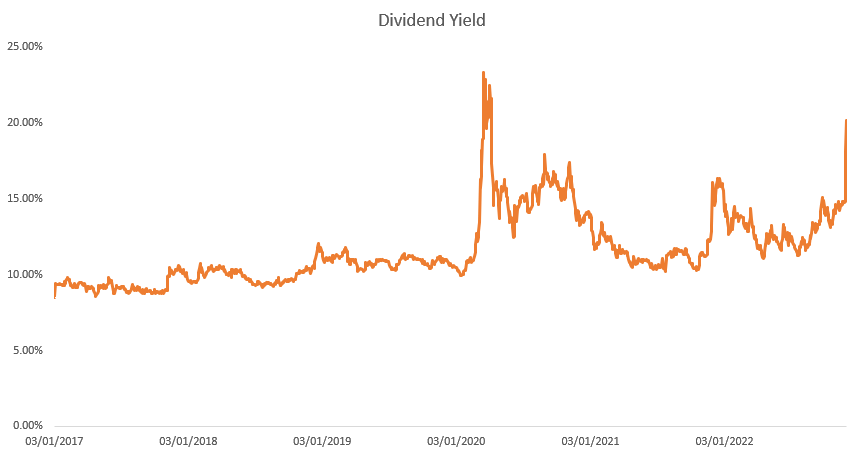

Since 2017, KNOP was valued at 11.2% on pay-out yield and during 9M 22 the average implied yield was at 13%. Spot yield is at ~23% at USD 9.25 common unit price, obviously already implying a cut in distribution. The following chart shows the historical yield over time since 2017 until today.

Historical distribution yield (KNOP figures, own calculations)

On average the yearly range of yield was between 9.3% and 14.4%. KNP had the highest yield during 2020 with 23.3% at USD 8.92.

Implied market pricing

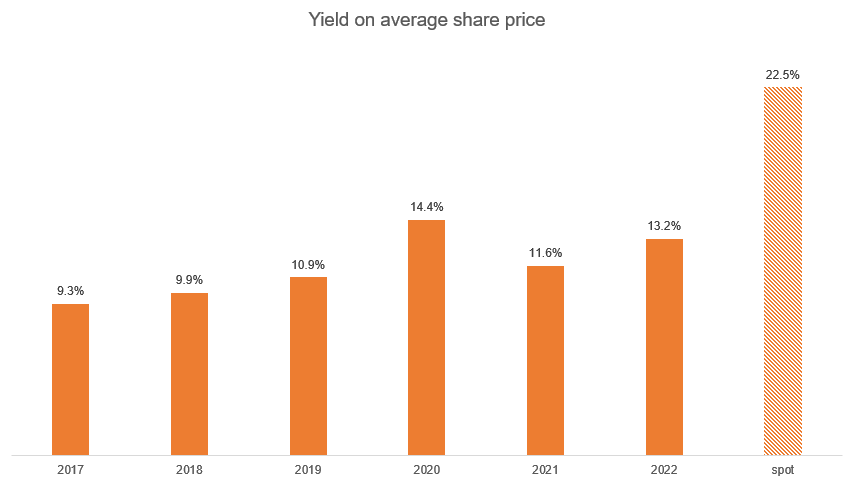

Taking the current spot yield of ~23% and plugging out the yield with the 9M 22 average, the cut should be ~41%. This implies a distribution of USD 1.22 per share. Sustainable cut? I don’t think so looking at future revenues at risk (or operating expenses and financing cost).

Average distribution yield (KNOP figures, own calculations)

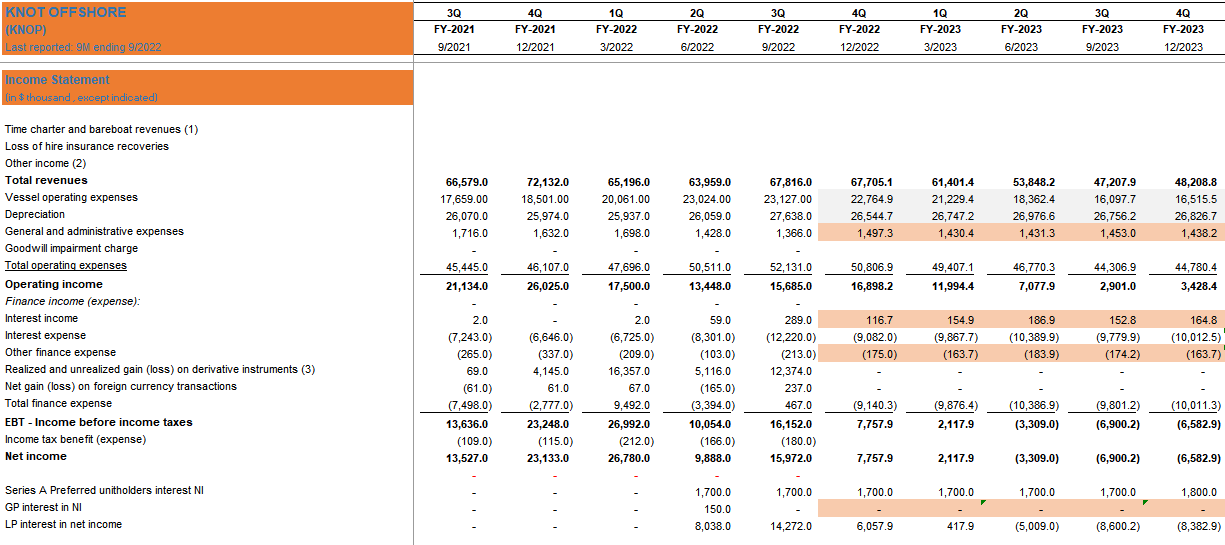

Coverage ratio

In regard to coverage of the distribution, the historical level has been at 1.4x on average since 2017. However, I do not believe KNOP mgmt. Intends a similar level post cut of the distribution as there could be some upside if tankers are contracted attractively. In my view, the coverage should be around 120% of distributable cash flow. With .64x coverage over 9M 22, and a targeted coverage of 1.2x the distribution post cut could get to USD 29m, or .83 per share. This would imply a cut of ~50% and is certainly sustainable. However, I also believe this is the lower end of a potential future distribution and would imply yield of 8% and is below past averages. Furthermore, with lower duration of contracts, an older fleet as well as near term refinancing needs, the required yield should be above this level, implying further downside to the units compared to current prices. Taking the average yield of 9M 22, the units could have downside to USD 6.3, or another ~32%.

Revenues going forward

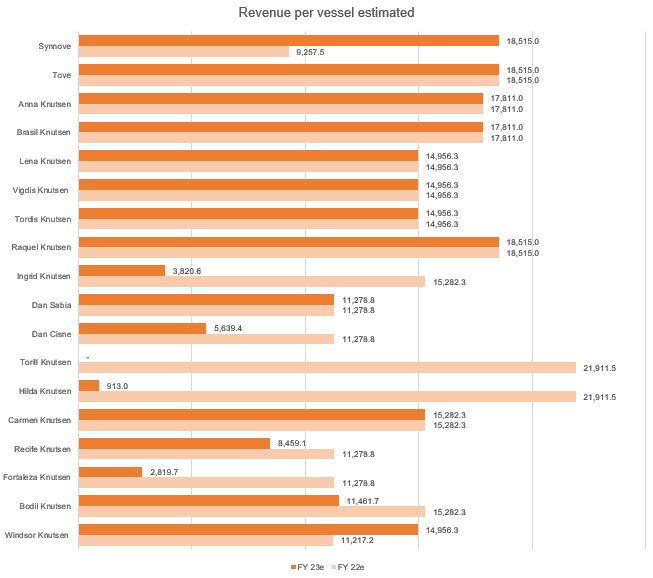

Taking into account charter contracts expiring in Q4 22e and more importantly in FY 23e, KNOP faces a very challenging year ahead. A rough calculation of those missing revenues could amount to USD 62m, or top line in the next year to come in at USD 211m.

This decline stems mainly from the following vessels:

Estimated revenue per vessel (KNOP figures, own estimates)

All those assumptions are based on the presentation of contract expirations in their Q3 22 earnings call presentation.

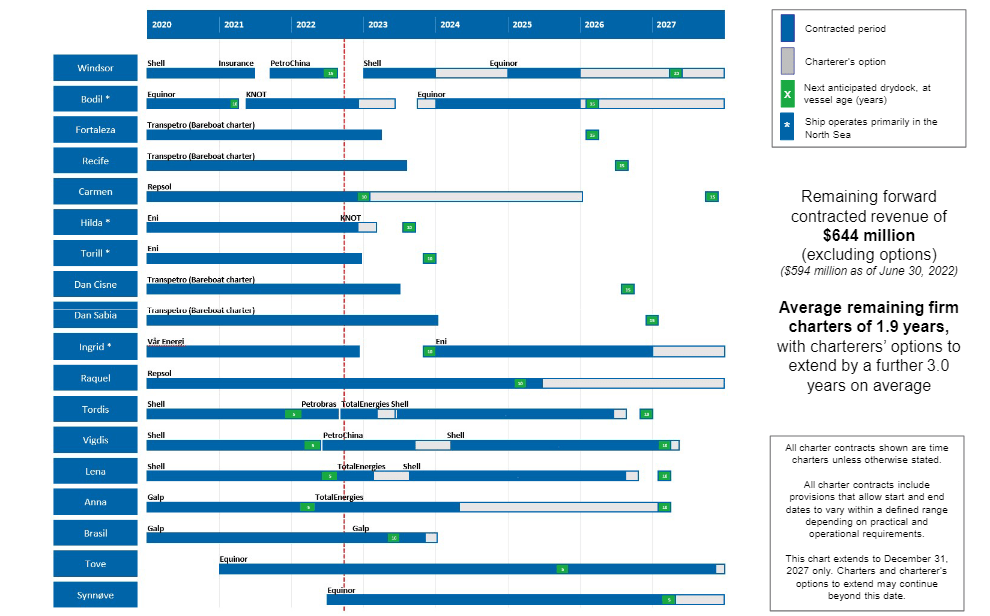

KNOP contract maturities (KNOP Q3 22 presentation)

While this is certainly an extreme scenario, considering potential (and costly) alternatives such as employing the vessels within the conventional tanker market, it shows the high risk of a cut that is substantially lower than market participants pricing right now. Assuming all of the above contracts are not renewed, the operating expense stay at an elevated level and financing cost stay at the average of the previous 9M 22, then KNOP has not much left to distribute.

KNOP income statement estimates (KNOP financials and own estimates)

KNOP income statement estimates (KNOP income statement and own estimates)

Considering a stable margin for operating expenses (that is not very likely as even ships moored face operating expenses), the basis for distributions could even be smaller.

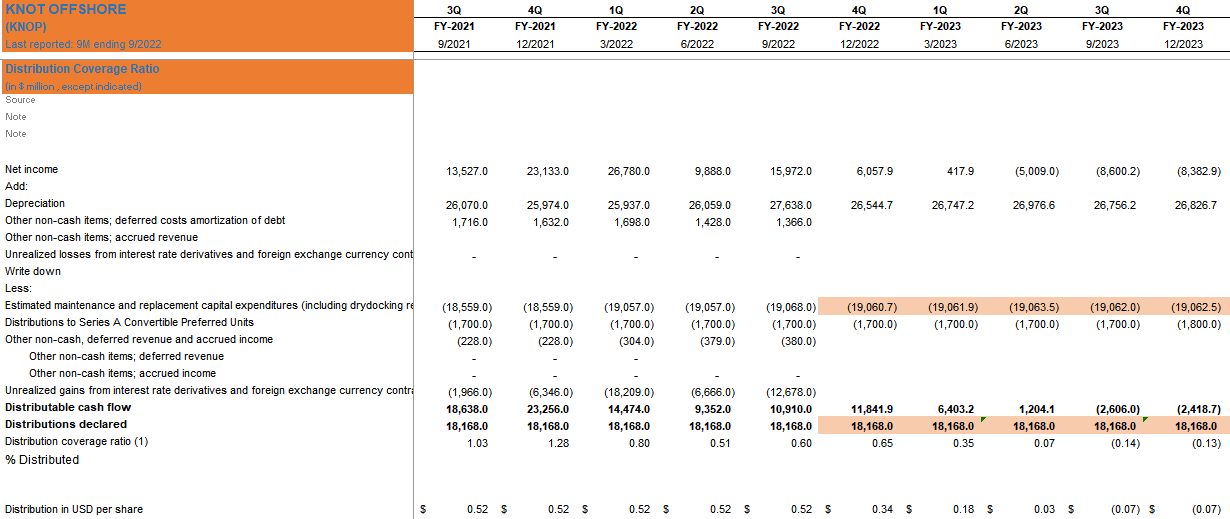

Another risk that increases delay of new contracting is the high share of expiring contracts in the North Sea. All four vessels operating in the North Sea will have to renew during FY 23e, however, the North Sea currently faces a challenging environment as management has mentioned in the conference call Q3 22 and in the press release of the figures. With my estimates there are some USD 58m, or ~94% of expiring contracts located in the North Sea.

Rev. at risk per geography (Own estimates)

The press release stated the following:

In contrast, the delayed resumption of activity in the North Sea, and in particular in the Norwegian sector, continues to dampen shuttle tanker demand and charter rates where 4 of our 18 vessels typically operate. We believe this situation could persist in 2023 with demand for shuttle tankers remaining below the levels of available tonnage. Over several quarters, we expect the market to rebalance as we see our customers moving forward with offshore projects that were postponed or delayed, as countries increasingly prioritize oil production due to high oil prices and energy security concerns and as some older vessels also naturally exit the shuttle tanker market.

In the meantime, for any North Sea vessels that are unable to secure a suitable third party time charter contract conducting offshore loading activities, the Partnership will look to employ such vessels in the conventional tanker market if appropriate opportunities can be found, based on market rates, and taking into consideration potential exposure to significant offhire time between voyages, and fuel and repositioning costs associated with this type of employment. However, if we are unable to employ our North Sea vessels in the near term at acceptable rates, either on third party charters or in the conventional tanker market, we are likely to experience a material adverse effect on our distributable cash flow, in particular given the scheduled vessel drydocks due in 2023.

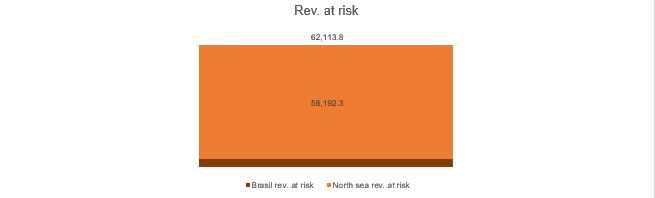

More issues due to debt

KNOP faces refinancing risk in the next year.

As of last reporting KNP has ~1.07bn in debt of which ~33% is maturing over the next year (sale & leaseback pmts. + period pmts. + balloon repayment).

Debt maturities (KNOP financials)

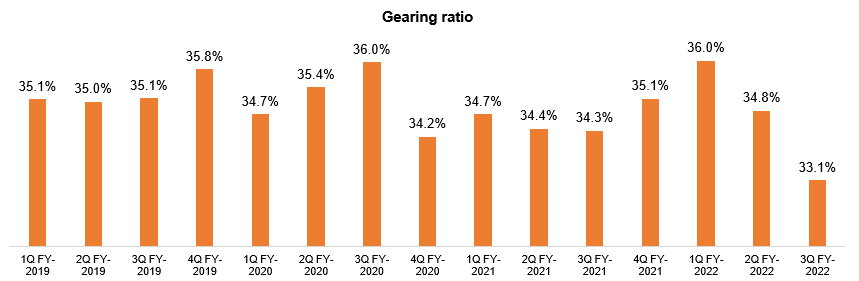

The largest item is the balloon payment of the multi-vessel facility of the tankers Windsor, Bodil, Fortaleza, Recife, Carmen, Ingrid and a smaller one for the Dan Cisne and Dan Sabia. Total balloon pmt is 266m. However, timing is not that great as KNOP has the lowest gearing ratio over the past three years with 33%. If KNOP has to pay a higher margin on its debt, this puts further pressure on cash flows going forward. So the overall refinancing risk for the debt is high in the next year.

Gearing ratio (KNOP financials and own calculations)

In regard to cost of debt, KNOP pays on its fixed debt of 458m an average of 190bps and receives 3M/6M Libor. However, on the amount of 363m KNOP pays a variable interest rate. Taking the latest financing of the Synnøve Facility, KNOP pays 1 year LIBOR + a margin of 171 bps. 1-year LIBOR is indicated at 543bps this week with just 38 bps at the beginning of the year. This exemplifies the pressure on cash flows or implied yields on the tankers. Also, the interest rate swaps will expire in 3.2 years. This might be in the distant future, but there is a cost that once discounted should decrease present values.

Deteriorating fundamentals

Duration of contracts

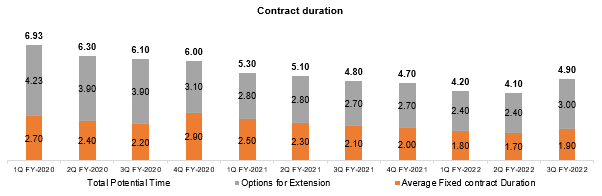

The duration of the contracts has decreased over the past quarters. From a high of 2.7 years fixed contracted maturity and 6.9 years including options to 1.9 years and 4.9 years in total. This only increased due to the new drop down.

Contract (KNOP financials)

Margins under pressure

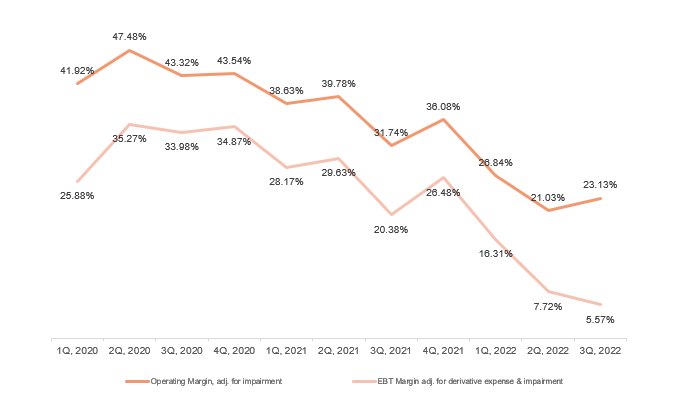

Margin are under pressure since FY 2020 when operating margin was at 42%, declining to just 23% in Q3 22. One of the reasons for increased operating cost is the higher bunker cost for ships on their way to drydocking. This was USD 1.6m in Q1 22 – this might fade in coming quarters, but certainly not bringing margins to FY 20 levels of on average 44%.

EBT margin decline on the other hand is driven by increased financing cost as LIBOR rates have strongly increased. Over the 9M 22 financing cost increased by USD 5.6m to USD 27.2m. I do not want to disappoint optimists, but in Q4 22e interest cost will further increase – LIBOR was on average at 490 bps in Q4 22 versus just 208 bps in Q3 22.

Operating and EBT margin (KNOP financials)

Conclusion & upside levers

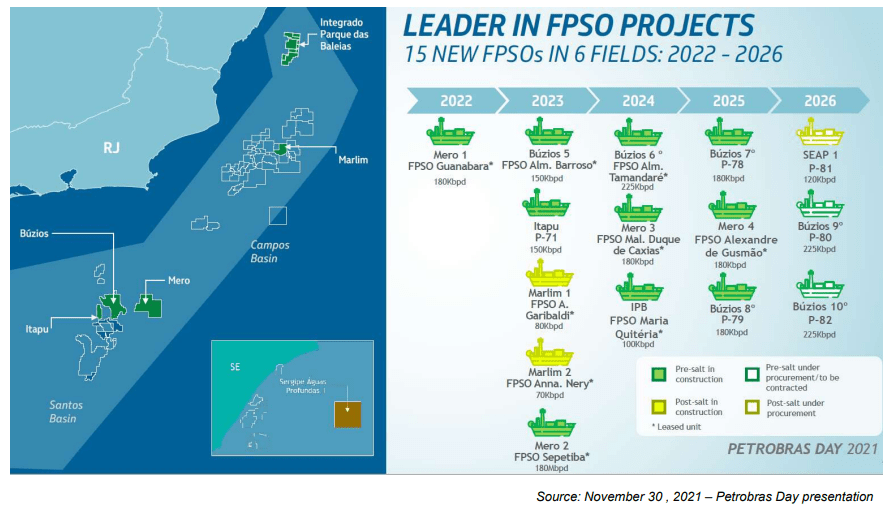

In the short term, I do not really see any upside levers. However, in the longer run the Brazil Pre-salt fields offer great potential for sustained demand for shuttle tankers.

In the press release KNOP mentioned the following:

High oil production seen in Brazil has continued in the third quarter and we expect that this will continue into the foreseeable future as additional low-cost production capacity comes online during 2023 and beyond. As such, we believe that demand for shuttle tankers in Brazil, where 14 of our vessels typically operate, will also strengthen in 2023 and continue into the mid and long term, aided by a multi-year pipeline of investment in new FPSOs and related production infrastructure, as well as the lack of new shuttle tanker tonnage available to enter the Brazilian market before 2025.

Pre-salt investment pipeline (KNOP and Petrobras)

However, in the meantime it is important for KNOP to renew the North Sea contracts at favourable terms. Maybe during H2 23 there will be good news on that side that could help the distribution to recover and unit prices with it. Based on current information, however, KNOP is more likely to disappoint at that front. Until then I will be patient.

Be the first to comment