Leila Melhado/iStock Editorial via Getty Images

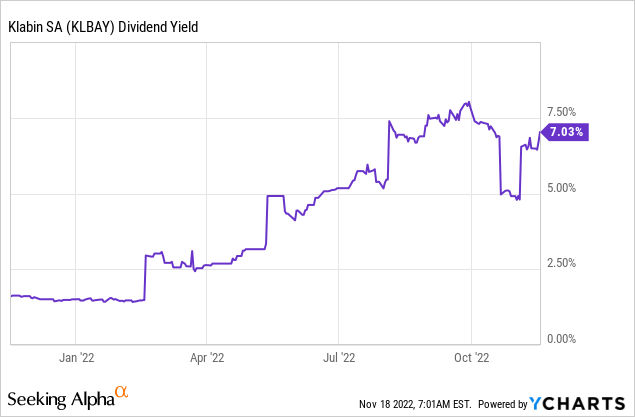

Klabin (OTCPK:KLBAY) has defied bearish calls for a cyclical downturn thus far, most recently delivering record quarterly EBITDA numbers in Q3 on strong volumes and favorable price adjustments. While the company hasn’t been immune from inflationary cost pressures, the ongoing pulp price strength and favorable seasonality for paper products should support a similarly strong Q4. Heading into 2023, the key debate remains around pulp/kraft liner prices and where they ultimately stabilize going into what could be an oversupply situation. Calling a cycle top is beyond anyone’s capabilities, but Klabin’s relative pricing power in paper & packaging, as well as potential benefits from the ramp-up of new paper machines, should support earnings through a downturn. Net, the stock is compelling at a discounted ~6x fwd EV/EBITDA valuation, along with an attractive ~7% yield.

A Stronger for Longer Demand Environment

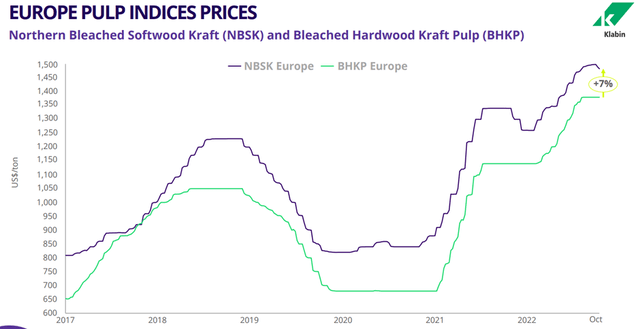

Even in the face of headwinds from macroeconomic conditions globally and the energy crisis in Europe, demand for Klabin’s products has remained strong. Tight supply conditions have helped as well – pulp prices, for instance, have been resilient at elevated levels due to a persistent demand/supply imbalance. At some point, the cycle will inevitably turn, but I suspect a downcycle is further away than many expect. Per Klabin management, the global pulp market will see ~1.2mt of additional volume coming online next year; yet, the ongoing supply disruptions mean most of the new capacity could be absorbed anyway.

Skeptics may point to emerging signs of moderation in softwood pulp prices, with the softwood/hardwood premium normalizing lower recently. Most of the convergence is down to greater supply issues for hardwood pulp, however, rather than easing supply/demand conditions in softwood. Getting supply back online will take time, and new capacity is only set to enter the market in 2023; thus, prices could well stay at elevated levels into the next year as well. Even if supply-side conditions ease alongside subsiding logistical issues over the mid to long term, the positive impact from fiber-to-fiber and fossil-to-fiber substitution initiatives should provide price support.

Klabin

Quarterly Results Defy Peak Cycle Concerns

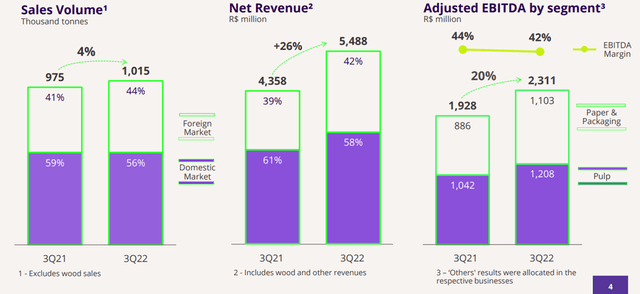

Klabin’s pulp EBITDA growth of +21% QoQ outpaced expectations on better pulp prices (average realized prices were up ~9% QoQ). Paper EBITDA growth was even stronger at +31% QoQ, as improved pricing (+5% QoQ) and volumes (+3% QoQ) were helped by lower operating costs (-4% QoQ). Given most of the company’s products are concentrated on consumer businesses, which have shown more resilience, packaging products should continue to see robust demand in the coming quarters. Beyond the near term, the ramp-up of PM27 (kraft liner machine) and the startup of PM28 (production line for coated board grades) in 2023 should support volume growth for the years to come.

Klabin

The key concern is the ongoing inflationary pressure on pulp costs – thus far, Klabin has seen cash costs in its pulp business increasing ~11% QoQ on higher fuel and chemicals prices (mainly related to caustic soda). In addition, the company is also exposed to higher pricing for third-party wood to supply the initial Puma II cycle (i.e., PM27/28). On the flip side, Klabin has proven its ability to pass on cost inflation via continued price increases. Further, the one-off impact of chemicals and fuels on pulp costs this quarter should normalize over time, providing downside support to margins.

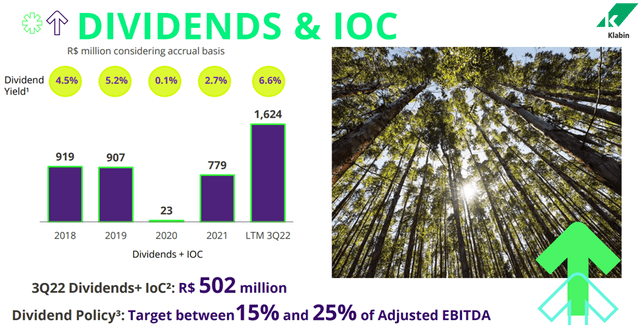

Healthy Balance Sheet to Support the Dividend

Following the strong quarterly results this year, Klabin’s decision to up the capital return to R$502m of interim dividends and interest on capital [IOC] will be well-received by investors. Including the latest dividend payout, this brings total shareholder return to R$1.6bn, implying a healthy ~7% yield. Given the dividend payout stands at a modest 15%-25% of adjusted EBITDA, this yield will likely sustain through the cycles as well.

Klabin

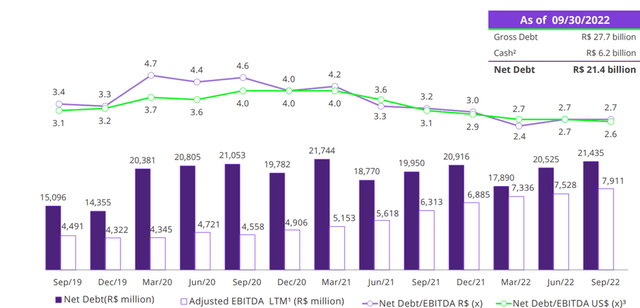

Finally, the balance sheet is well-capitalized – while Klabin was negative FCF in its most recent quarter, driving net debt slightly higher relative to the previous quarter, net leverage remains manageable at 2.7x (or 2.9x including leases). Plus, the liquidity position offers the company ample runway, with R$6.3b in cash and an additional R$2.7bn in revolving credit facilities against termed-out debt maturities until 2026.

Klabin

Defying the Cycle

Klabin’s recurring EBITDA growth of +20% YoY this quarter once again defied expectations of a cyclical slowdown, as higher realized pulp and paper prices boosted profitability. While cost inflation remains high, with cash costs up +11% QoQ, Klabin’s Q4 should continue to outperform on ongoing pulp price strength and better seasonality for its paper products. Plus, the core paper & packaging business has proven its resilience through the cycles and will receive a timely boost from the ramp-up of new paper machines going forward. Yet, the market is discounting a fair bit of pessimism here, with the stock trading at a discounted ~6x EV/EBITDA valuation and offering a ~7% yield.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment