blackdovfx

Introduction

As a dividend growth investor, I constantly seek additional income-producing opportunities. Dividend growth stocks are stocks of companies that increase their dividend consistently over time. Sometimes I add to the stocks I own, mainly when they are attractively valued. On other occasions, I start new positions to diversify myself further.

In 2021, I analyzed KLA Corporation (NASDAQ:KLAC), and I found it to be an attractive company poised to enjoy the semiconductor shortage. Since then, the company has outperformed the S&P 500 significantly. In this article, I will revisit KLA Corporation following its earnings report for Q2, where the company presented its 2026 strategy.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

KLA Corporation designs and manufactures process control and yield management solutions for the semiconductor and related nanoelectronics industries worldwide. The company offers chip and wafer manufacturing products, including defect inspection and review systems, metrology solutions, in situ process monitoring products, computational lithography software, and data analytics systems for chip manufacturers to manage yield throughout the semiconductor fabrication process.

Fundamentals

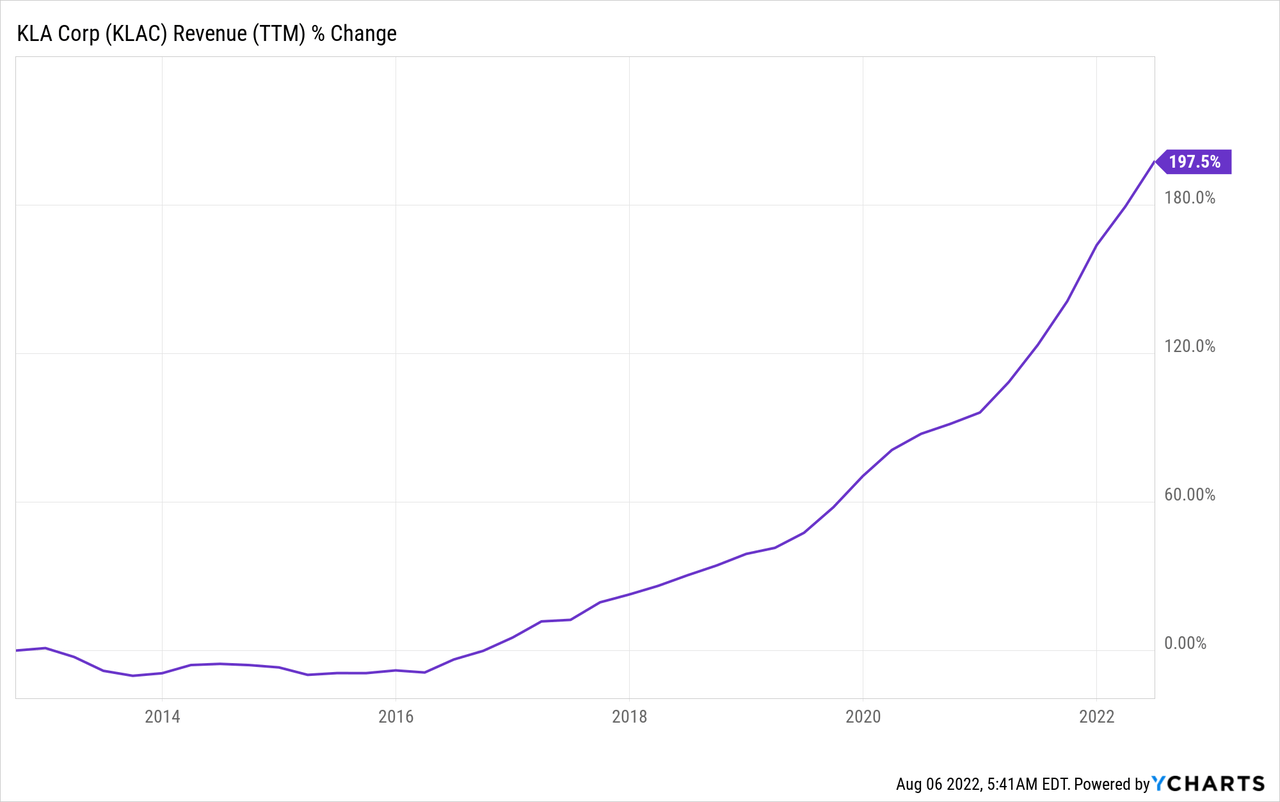

Sales of KLA Corporation have almost tripled over the last decade. The company is capitalizing on the growing need for semiconductors and the fast development of newer semiconductor tech, which requires more advanced machines to produce. KLA Corporation combines organic growth with acquisitions like the acquisition of Orbotech in 2018 for $3.4B. In the future, analysts’ consensus, as seen on Seeking Alpha, expects KLA Corporation to keep growing sales at an annual rate of ~5% in the medium term.

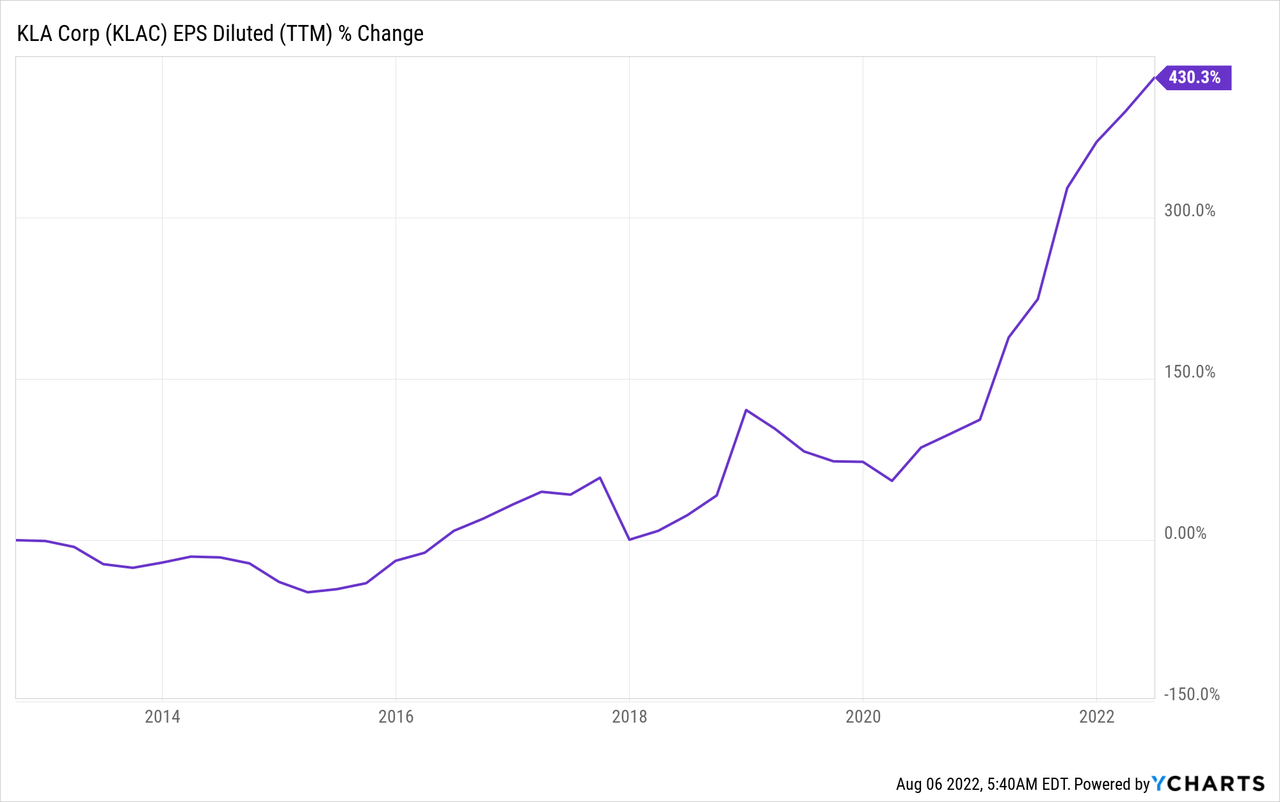

The EPS (earnings per share) has grown faster over the last decade. The EPS is more than five times higher than it was ten years ago. EPS increased due to significant sales growth, higher margins that allowed the company to produce more with fewer expenses, and significant buyback activity during the decade. In the future, analysts’ consensus, as seen on Seeking Alpha, expects KLA Corporation to keep growing EPS at an annual rate of ~7% in the medium term.

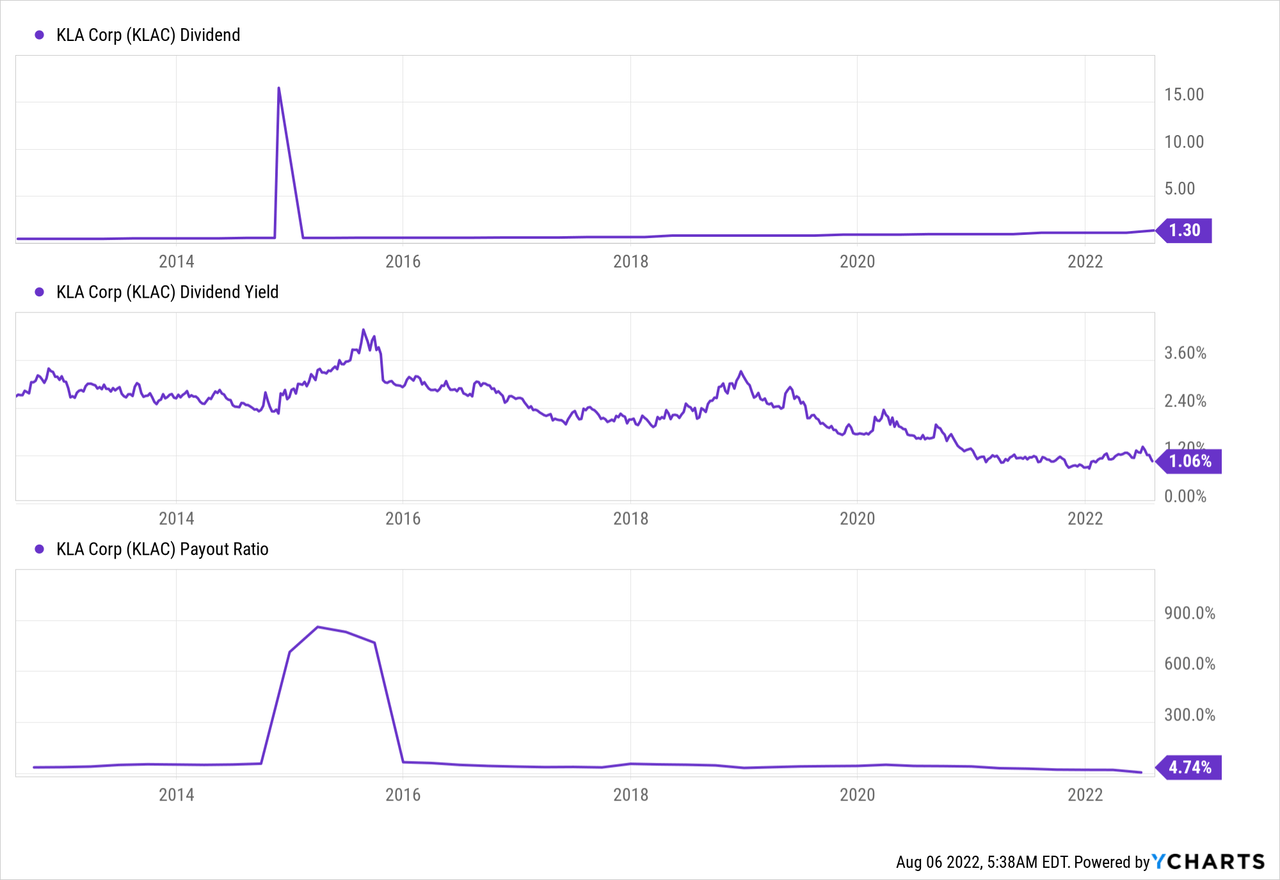

KLA Corporation initiated its dividend 17 years ago and hasn’t reduced it since it started. Moreover, the company has been increasing the annual payment for more than 12 years. The payout ratio using non-GAAP EPS stands at 20%, higher than the GAAP payout ratio but still highly safe. The dividend yield is low at 1.06% but has room to grow. Last week’s latest increase was an impressive 24%, pushing the yield to 1.3%. It emphasizes how fast the yield on cost can grow here.

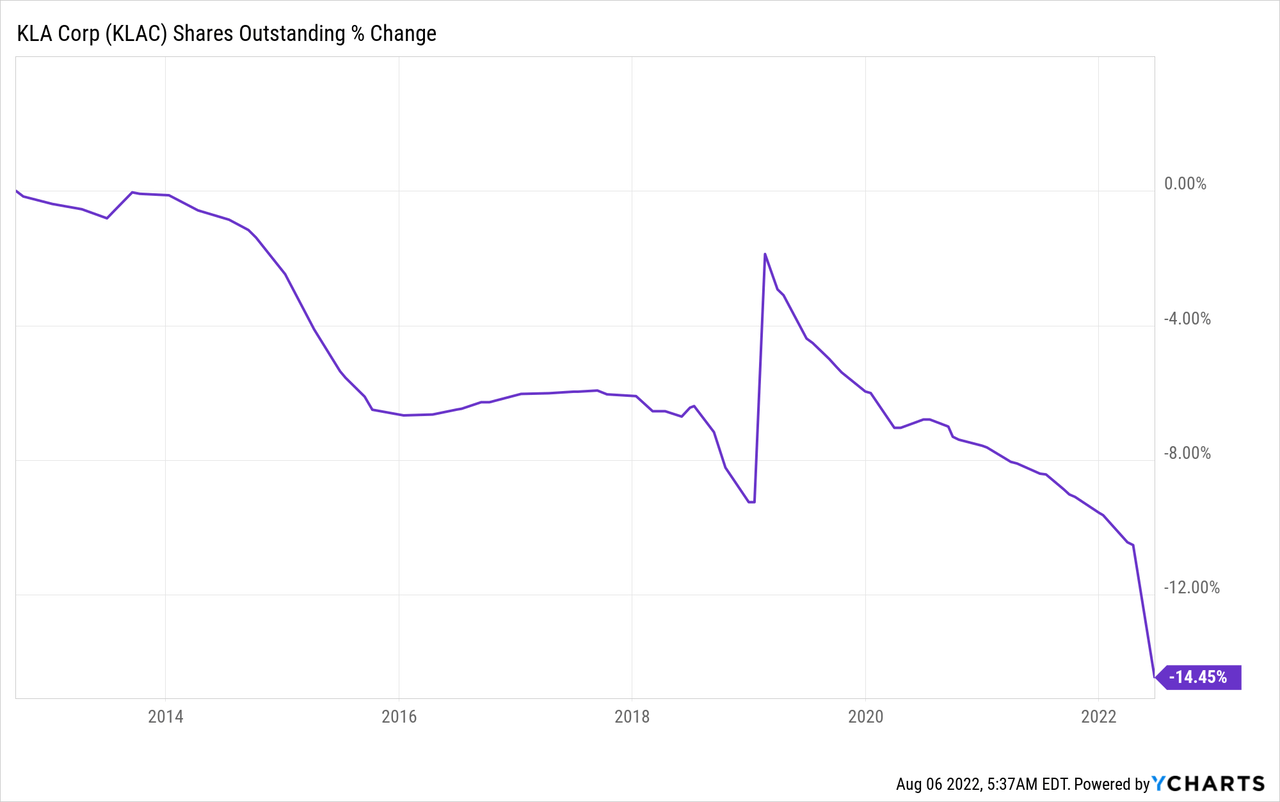

The company is also returning capital to shareholders via buybacks. Buybacks are a way for companies to supplement their EPS growth. The company bought back almost 15% of its shares over the last decade. It is even more impressive considering that the company pays employees with stocks and uses its stock for acquisitions. Despite these two challenges, it achieved a meaningful decrease in shares.

Valuation

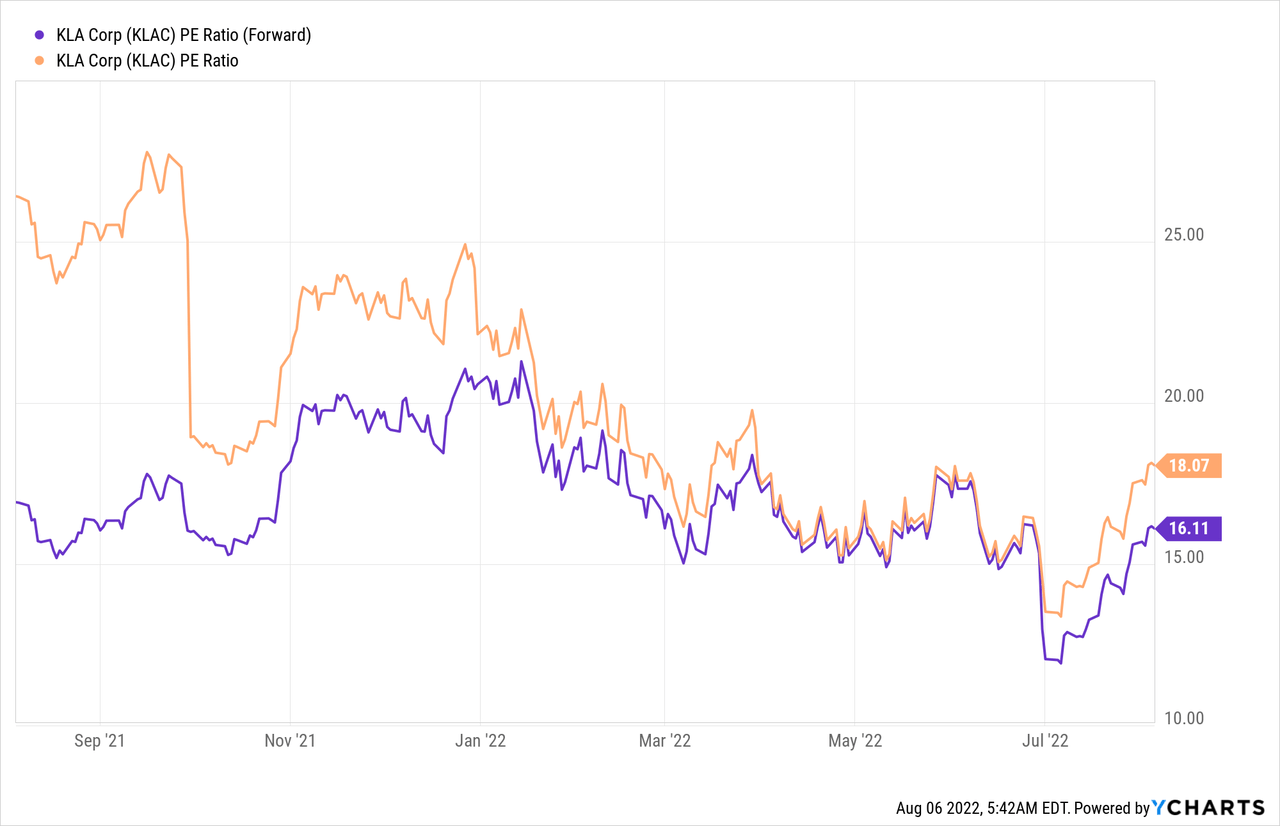

The P/E (price to earnings) ratio of KLA Corporation is in line with the average P/E of the last year. KLA Corporation trades for a P/E ratio of 18 using the actual EPS of the fiscal year ending in June. It is selling for a P/E ratio of 16 when using the forecasted P/E for the coming twelve months. The current valuation seems fair for a company that is expected to show healthy growth.

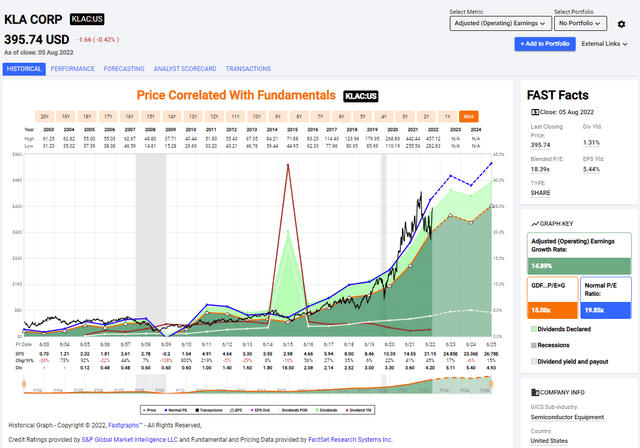

The graph below from FAST Graphs shows that the company is fairly valued. Over the last two decades, the company’s average P/E ratio was almost 20. The current P/E ratio is 20% lower. However, in these twenty years, the EPS also grew faster. Therefore, I believe a slightly lower P/E ratio makes sense, and KLA is valued fairly at 16 times forward earnings.

To conclude, KLA Corporation is a reliable solid company. The company’s fundamentals are stable. It enjoyed significant EPS and sales growth and used the excess cash flow to reward shareholders with dividends and buybacks. This great package comes at what I believe to be a fair valuation as the company is trading for a lower-than-average valuation, even if growth slows down a bit.

Opportunities

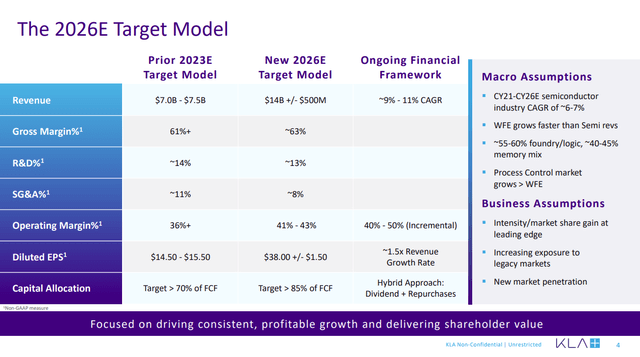

The company’s ambitious strategic plan is the most significant growth plan. The company aims to improve on every metric. Moreover, it released a plan for 2026, believing it can reach challenging goals. It raises the bar significantly higher than the analysts covering its forecast. The company seeks for double digits annual sales growth and EPS growth of 15%-16% annually. If the company manages to achieve it, it is exceptionally attractively valued.

The company’s history of solid execution makes this plan even more impressive and achievable. The slide below shows the current model next to the prior one. The company has executed much better than it modeled, achieving more than $10B in revenues and EPS higher than $21. Therefore, I believe the company’s management team can execute nicely to achieve its goals, especially when its macro assumptions are conservative.

The company also will keep capitalizing on the higher demand for semiconductors. We see that more connected smart devices require chips, and they now need more semiconductors for every unit. The shortage in chips will eventually disappear, but until then, KLA corporation will capitalize on it. It will also benefit from the CHIPS Act promoting American production as an American company. The macro trends in the short and medium term are highly favorable.

Risks

China, Taiwan, and Korea are the three most important markets where KLA Corporation is active. They account for 70% of the sales, with China being the largest market with 29% of sales. The tension between Taiwan and China, and by proxy, between China and the United States may hurt the company’s future growth. CHIPS Act may promote shifting production to the U.S, but it is still a risk as this area is crucial for the business.

Another risk is the competition. The semiconductors market is growing fast, but KLA Corporation plans to grow faster than the market. It means it intends to reach new markets where it is less active or gain market share from its current competitors. Its competitors like, Lam Research (LRCX) and ASML Holding (ASML) are both competent companies with solid growth prospects. The competition will be more complex as the shortage in chips relieved.

Another risk for the company’s growth is a recession. The economy suffers from negative growth, with little effect on employment and consumer spending. However, if the macroeconomy deteriorates, semiconductor demand will be less. People will buy fewer computers, phones, cars, and so on. Therefore, the current plan requires solid economic fundamentals, which are out of the company’s hands.

Conclusions

KLA Corporation is an excellent company on its way to becoming a promising dividend growth company. The company enjoys significant growth in its top and bottom line. It translates the growth into dividends and buybacks to satisfy its shareholders. Moreover, the company has several growth opportunities as the economy needs more semiconductors and production capacity.

There are risks to the investment thesis. Most of them rely on macroeconomics, whether it’s China or a recession in the United States. However, the company is fairly valued at the current P/E. If it achieves its goals, as seen in its strategic plan, the company is a BUY with a high potential for market outperformance.

Be the first to comment