porcorex

It’s been a few months since I last visited Kite Realty Group (NYSE:KRG), and the stock hasn’t really done much of anything, remaining virtually unchanged since my last piece in last June, and producing a slightly positive 0.8% total return after dividends. This, however, is much better than the -4% return of the S&P 500 (SPY) over the same timeframe.

While KRG isn’t one of the more popular REITs such as Federal Realty Trust (FRT), investing shouldn’t be a popularity contest. Oftentimes, it’s the under the radar ones that are undervalued and have the most potential to deliver stronger returns. This article highlights why KRG remains attractively valued for dividend investors, so let’s get started.

Why KRG?

Kite Realty Group is an Indianapolis based REIT that has 60 years experience in developing, acquiring, and operating retail real estate. It’s been public since 2004, and at present, owns 181 open-air shopping centers and mixed-use assets. Its assets primarily centered around the growing Sun Belt region (67% of annual base rent), and strategic gateway markets (23% of ABR).

Like other high quality shopping center REITs such as Kimco Realty (KIM), KRG has undergone a transformation of sorts in recent years, by transitioning its portfolio towards necessity based centers. This is reflected by the fact that 75% of KRG’s annual base rent now stems from properties with a grocery component, which are more recession and e-commerce resilient.

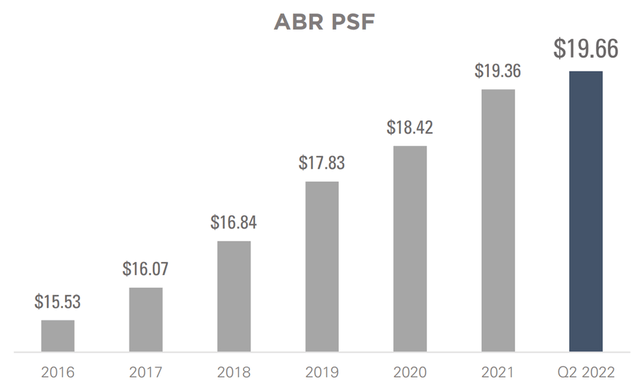

It looks like KRG’s portfolio transformation is bearing fruit. This is reflected by growth in its rent per square foot in every year since 2016. As shown below, KRG’s ABR per square foot now stands at $19.66 in its most recent reported quarter, sitting 1.5% higher than where it was six months earlier.

KRG Rent Per Sq. Ft. (Investor Presentation)

Meanwhile, KRG’s portfolio remains very healthy, with a 96% leased rate on anchor properties, and an 89.3% leased rate on small shops, sitting above the 85% level that I generally consider to be healthy. Importantly, KRG is seeing strong leasing trends, as it saw same property NOI growth of 3.8% YoY during its second quarter. This was driven by 13.2% blended rent growth on new and renewal leases.

Looking forward, I remain optimistic around KRG’s growth prospects, as it has a respectable development pipeline. Moreover, KRG continues to evolve its shopping centers towards mixed use, where consumers both live and shop. These aspects were highlighted by management during its recent conference call:

On the development front, we stabilized two projects this quarter, Shoppes at Quarterfield and One Loudoun Residential. Shoppes at Quarterfield is a 61,000 square foot neighborhood center anchored by Aldi and LA Fitness, which is 100% leased. The One Loudoun Residential project added 378 multifamily units to our exceptional development project in Loudoun County, one of the wealthiest counties in the country.

As a company, we now have a financial interest in over 1,600 multifamily units, and we’re in discussions with joint venture partners to add up to an additional 1,000 units over the next few years. The One Loudoun apartments are approximately 90% leased, which is outperforming our initial expectations on base rent and absorption, which highlights the multiuse demand at One Loudoun.

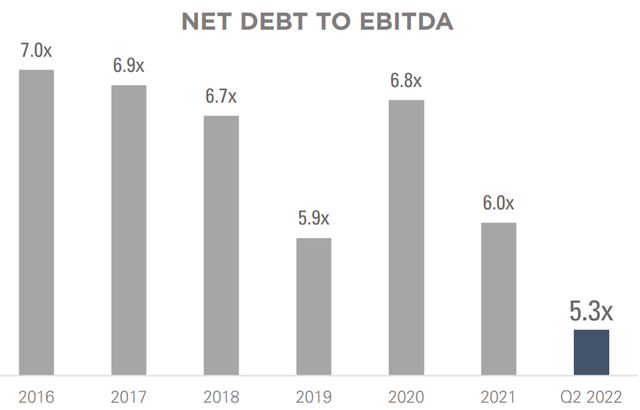

As with all REITs, headwinds to KRG include higher interest rates. However, that’s where balance sheet strength comes into play. KRG has an impressive $1 billion of available liquidity for its size, and carries a net debt to EBITDA ratio of 5.3x. As shown below, the leverage ratio now sits at its lowest level in over 5 years. As such, I see potential for the ratings agencies such as S&P to raise KRG’s credit rating from BBB- should it maintain or drive leverage even lower.

KRG Leverage (Investor Presentation)

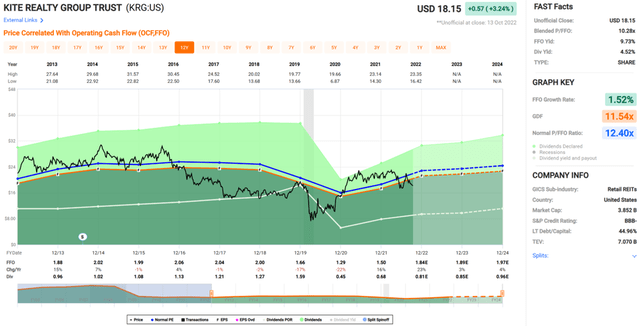

The balance sheet strength also lends support to KRG’s respectable 5% dividend yield, which is very well protected by a 45% payout ratio (based on Q2 FFO per share of $0.49). Lastly, I find KRG to be attractive at the current price of $18.15, with a forward P/FFO of 9.9, sitting well below its normal P/FFO of 12.4 over the past decade. As such, a reversion to the mean combined with a healthy and well-covered dividend yield could result in potential double-digit annual returns for investors over the next couple of years.

Investor Takeaway

Kite Realty has a strong portfolio of necessity based retail, which is more resistant to e-commerce, as well as its impressive development pipeline. Moreover, KRG’s balance sheet strength provides it with significant financial flexibility to continue executing on its growth strategy. These factors, combined with a low valuation, set up investors for potentially strong long-term returns.

Be the first to comment