Bill Chizek/iStock Editorial via Getty Images

Investment Thesis

We have updated our view on Kirin (OTCPK:KNBWY), following their announcement of a medium-term plan in February 2022, highlighting opportunities for growth and improving profitability. However, recent circumstances have taken over this positive scenario, with inflationary cost pressures and a rapidly depreciated yen forcing down margins. With downside risk for consensus earnings estimates, we rate the shares as a sell.

Quick Primer

Kirin Holdings is a Japanese brewery, non-alcoholic beverage, and pharmaceutical company. The key businesses are Kirin Brewery (with the largest domestic share in the beer-substitute drinks market), Kirin Beverage (the fourth-largest domestic soft drinks maker), and Lion (Australia’s second-largest beer company). Exposure to pharmaceuticals comes from the 53.8% stake in Kyowa Kirin (OTCPK:KYKOF) with its key drug Crysvita for hypophosphatemia treatment. Other notable assets in the group include a 100% stake in Four Roses Distillery, a 48.6% stake in San Miguel Brewery in the Philippines, and a 32.8% stake in Japanese cosmetics and dietary supplements company FANCL (4921 JP). Peers include Asahi Group (OTCPK:ASBRF) and Suntory Beverage & Food (OTCPK:STBFY).

In June 2022, Kirin announced that it had agreed to sell its 51% stake in Myanmar Brewery to its local joint venture partner, following the decision to withdraw made back in February 2022.

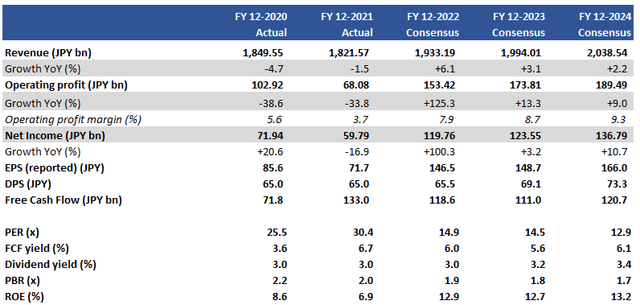

Key Financials With Consensus Estimates

Key financials with consensus estimates (Company, Refinitiv)

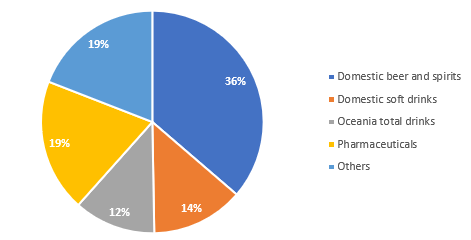

FY12/2021 Sales Split By Segment

FY12/2021 sales split by segment (Company)

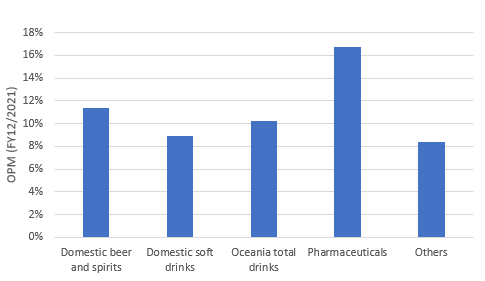

FY12/2021 OP Margin By Segment

FY12/2021 OP margin by segment (Company)

Our Objectives

Kirin’s shares have risen 18% YTD, bucking the trend of global equity markets. Since our initial note published in May 2021, notable developments have been a new medium-term plan (announced in February 2022) and a price hike for certain domestic PET bottled and canned drinks from October 2022. We were previously sellers based on risks over new domestic beer pricing laws that would negatively impact demand for Kirin’s beer-substitute drinks. In this piece, we want to update our view and assess the potential impact of these developments. We will take each one in turn.

Sensible Measures Over The Medium Term

New medium-term plans allow a company to set out its vision for the next 3 years. Kirin’s current plan for FY2022-2024 is not without its issues, but overall, we believe it addresses three key areas that should result in increasing corporate value as well as increasing shareholder returns.

Firstly, Kirin will continue to divest non-core assets and plow any excess capital back into growth businesses or to shareholders. The Myanmar exit was inevitable due to the change in political status, but with approximately 150 consolidated subsidiaries in the group, there is scope to streamline. The next material transaction appears to be an exit from the China beverage business. The core theme is to focus on Kirin’s core businesses where it is most competitive, as well as investing in promising future growth drivers.

Secondly, the company has identified areas of growth. Although currently sub-scale, one product is an immune health ingredient called ‘LC-Plasma’ which is aimed at producing functional food and drink with positive health effects. Functional products can be sold at a premium (like Yakult drink made by Yakult Honsha (OTCPK:YKLTF)), and are very popular in Japan and South East Asia. Kirin is developing its own products (incorporated into green tea, for example) and partnering with external brands. Another is craft beer in the brewery business, which has been primarily driven by M&A (the acquisition of New Belgium in 2019, and Indian brewer Bira 91 in 2021) under the Australia Lion beer operation. Although a competitive market and full of small and independent brewers, it continues to experience much stronger volume growth versus the overall beer market in the US (8% growth versus 1% in 2021) which is Kirin’s core target geographic market. Both these measures should enable the company to drive some topline growth, although functional food and drink will potentially take longer than 2-3 years to become material.

The third area is profitability improvement via cost reductions and price hikes. Although this is a perennial issue for most manufacturing businesses, the company has identified JPY30 billion/USD222 million worth of cuts, focused on supply chain management and standard SG&A cuts. Price hikes are centered on overseas operations at Lion. If management is able to conduct profitability improvements to this level, it will be material.

Unfortunately, global inflationary pressures have changed significantly since the medium-term plan was announced. In May 2022, Kirin announced price hikes for its domestic beverage business, highlighting cost pressures – its domestic peers have done the same. We will look at this next.

Inflation Derailing Plans

From October 2022, Kirin will raise prices for its beverages for the domestic market to the tune of 6% to 25%. Although the company stresses that some products will not be affected, flagship products such as ‘Gogo-no-Kocha’ (afternoon tea), ‘Nama-cha’ (green tea), and Kirin Lemon (soda drink) will see increases.

The cause of this action is multifold. The rapidly depreciated yen has inevitably increased raw material costs, containers, packaging, energy and logistics. Cost pressures must be so acute for Kirin to announce this, and inevitably this throws a spanner in the works for its medium-term plans. Cost reductions will be much harder to execute, and in ‘retreat’ mode any major divestment activities we expect will slow down.

In the short term, the company did not revise down guidance for FY3/2023, but with profitability inevitably under pressure, we expect a downward revision once interim results are announced on 8th August 2022. We believe price hikes in the domestic market will be negatively received, as Japanese consumers tend to be price sensitive. Consequently, any price hike from October 2022 will be accompanied by volume declines. Conversely, we watch for some preemptive demand pushing up volumes prior to the price hike.

Valuation

On consensus estimates, the shares are trading on PER FY12/2023 14.5x with a free cash flow yield of 5.6%. These valuations are not demanding and would be attractive for a relatively defensive business under benign environmental conditions. However, given the rapidly rising cost pressures that Kirin (and other food and beverage manufacturers) have limited options to mitigate, we believe consensus earnings are too optimistic.

Risks

Upside risk comes from a rapidly strengthening yen, decreasing cost pressures as input and operating costs begin to normalize.

Kirin’s efforts to develop functional food and beverage is a major success, and exposure to craft beer markets overseas begin to yield high returns.

Downside risk comes from cost pressures decreasing profitability much harder than market expectations. This could have a negative knock-on effect on dividend growth.

Efforts to divest non-core businesses will be halted, and potential bid prices become highly discounted as it becomes a buyer’s market.

Conclusion

In our view, Kirin presented a credible medium-term plan earlier in 2022. Under normalized business conditions, there was scope for better capital allocation, growth, and improving profitability. However, there are limits to what the business can proactively achieve in the face of current inflationary cost pressures, and the domestic price hike announcement highlights its gravity. Although this risk is well understood by the market, we believe consensus forecasts are too optimistic and with earnings downside risk, we rate the shares as a sell.

Be the first to comment