skynesher

Kinsale Capital (NYSE:KNSL) has been the top performing insurance stock over the past 5 years, having increased an astounding 584% since late 2017. During this time Kinsale’s EPS has increased nearly as fast as its share price, growing 43% per year. While the company produced a relatively mediocre ROE of 12% in 2017, today that figure is closer to 26%, which is well above the 8-12% returns typically observed in the commercial insurance sector.

As we sit today, Kinsale is valued at an eye-popping 11x book value and 40x EPS. At today’s valuation, investors are implicitly assuming that the company will continue to generate a return on equity more than double peer average and that Kinsale will grow at a 15%+ rate for several years to come.

While Kinsale may have some competitive advantages which will allow the company to generate outsized returns and growth (for a period), ultimately I think that competitive forces (insurance is a highly competitive industry as I will discuss below) will reduce returns and growth. Should this happen Kinsale shares could fall by 70% (or more). Needless to say, I am avoiding Kinsale stock.

Overview

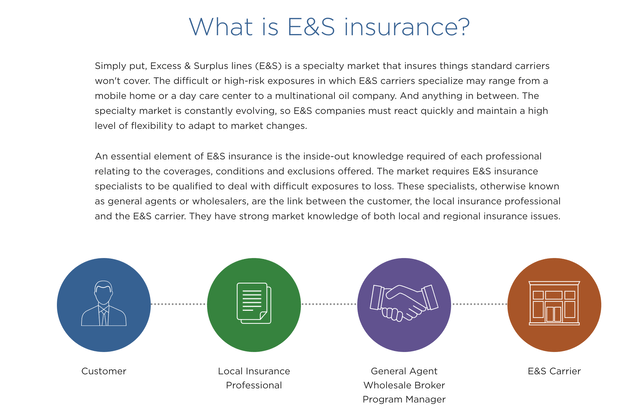

What is Excess & Surplus? (Nationwide)

Founded in 2009, Kinsale is a pure-play provider of Excess & Surplus (E&S) Insurance. E&S is a form of specialty insurance purchased by businesses which have significant risk exposure (high potential losses like in the construction industry) or a poor history (client has a history of reporting frequent losses to insurers in the past). These are risks most insurers look to avoid.

Kinsale Competitive Advantages (Investor Presentation)

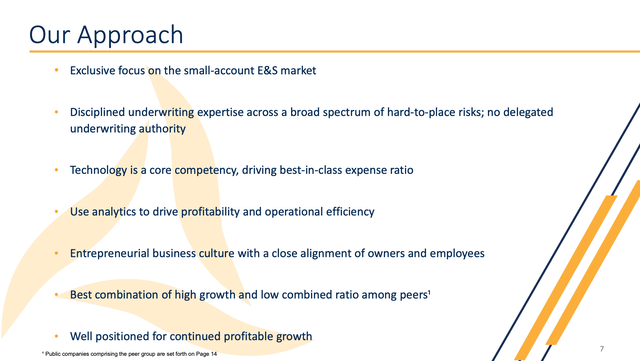

As mentioned in my introduction, Kinsale has been highly successful in insuring E&S risks. For its part, Kinsale believes its success is repeatable through:

- Maintaining disciplined on price (being sure to be paid for each unit of risk assumed). To generate outsize returns, it is absolutely imperative that insurers do not chase market share by being too aggressive on price.

- Avoiding writing policies it doesn’t have a comprehensive understanding of the magnitude and frequency of loss

- Kinsale is focused on relatively small accounts which may be underserved (less competition) which allows the company to avoid having to compromise on price.

- Kinsale believes it has a competitive advantage via technology. Many insurers are much older than Kinsale and are (to varying degrees) beholden to legacy operating systems.

Financial Results

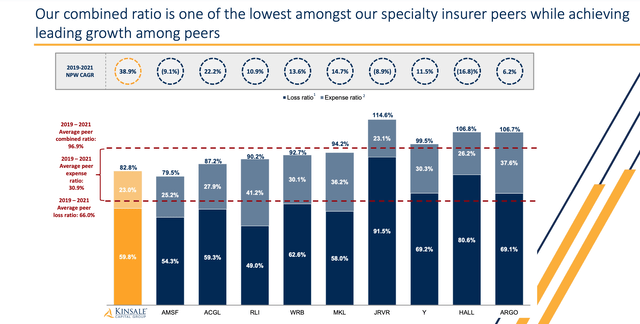

Combined Ratio versus Peers 2019-2021 (Investor Presentation)

As shown above, Kinsale has been highly profitable on an underwriting basis with a combined ratio well below 100%. In non-insurance speak, this means that Kinsale has earned 17c for every dollar of premium written from 2019-2021. As shown below this has occurred during a favorable period in the insurance cycle. This trend has continued into 2022 – through the first 9 months of 2022 Kinsale’s combined ratio has been just 80% despite higher catastrophe losses (hurricane Ian).

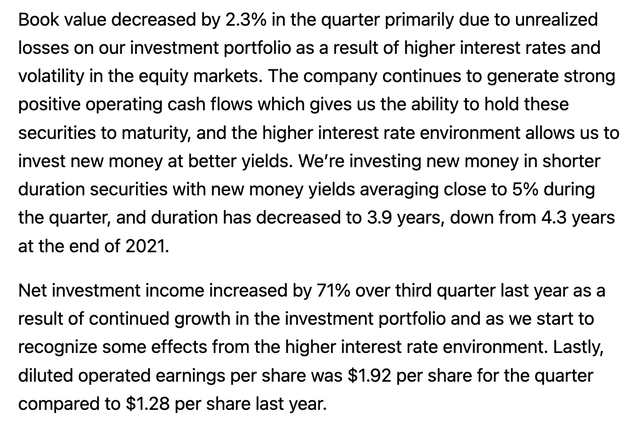

2022 results have also benefited from higher interest rates with 3Q22 interest income up over 70% year-over-year. The company should continue to benefit from higher interest rates as its bond portfolio matures and proceeds are reinvested at better yields.

Commentary on Investment Income (3Q22 conference call transcript from Seeking Alpha)

All-in, solid underwriting and increased investment income have led to a 24% annualized ROE through the first 9 months of 2022.

That sounds great but here is why I’m bearish:

Insurance is a business where no news is good news. While we are currently in what is known as a hard market (strong pricing and high returns on equity), many things can go wrong in the insurance business:

- Long tail – Insurance is one of the few businesses where the cost of goods sold is unknown at the time of sale. In some lines of business (such as personal auto or home) the outcome is clear within 6-12 months. However, E&S is what is known as ‘long-tail insurance’. The cost of goods sold may not be known for 3-5 years (in some cases longer). The sector has long been plagued by provisions for adverse development of losses. While Kinsale has avoided this thus far, it is certainly not immune to this risk.

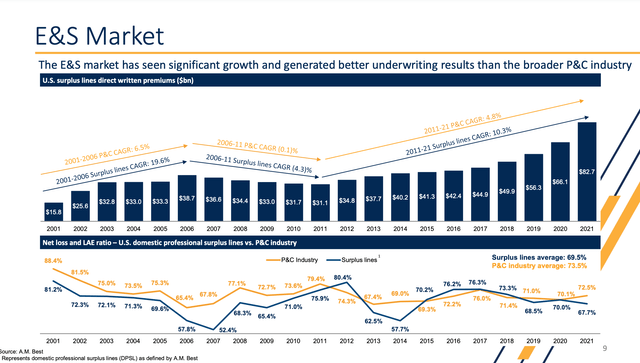

- Cyclical – the insurance business (including E&S) is cyclical with profitability governed by the amount of capital in the industry and underwriter discipline. Excess & Surplus has been in a hard market (strong pricing/high returns) for several years. History shows that over time, high returns lead to more competition, price competition and eventually lower returns. As you can see below, industry revenue and profit suffers dramatically in a soft market (2009-12).

Cyclicality (Investor Presentation)

- Inflation can cause tremendous problems for long-tailed insurance companies. Inflation increases the cost of claims – this can be a big problem in long-tailed business as losses are subject to inflationary forces while premiums cannot be retroactively adjusted upward.

- Competition – there are very few barriers to entry in the insurance industry. Multiline insurers like Markel (MKL) or W. R. Berkely (WRB) can quickly allocate more capital to the E&S business if they see the opportunity for attractive returns (which can reduce the returns for the segment as a whole). Further, commercial insurance is distributed through insurance brokers – an insurer doesn’t need to spend a lot of time and money building a sales force.

- As Kinsale gets larger, it becomes more difficult to grow at high rate (denominator effect).

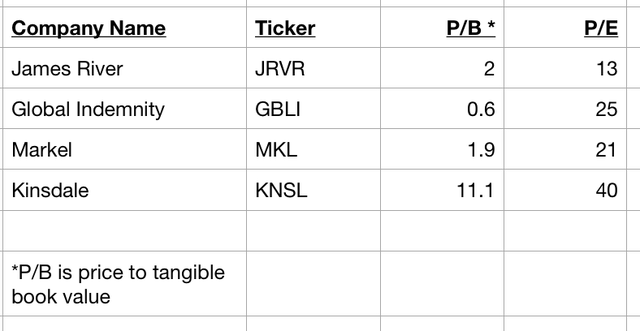

- Valuation – Kinsale is priced for (beyond?) perfection – Insurance companies typically trade for somewhere between 0.7-3.0x book value. As we sit today, commercial insurers with meaningful E&S exposure trade at multiples significantly below Kinsdale:

Comparable Valuations (Company Filings)

Insurance is a cyclical business (and is subject to large losses in any given year) which can create wild fluctuations in annual earnings. As such, I think it makes more sense to look at price to tangible book value. As shown above Kinsdale trades at an extremely high multiple of book value versus its comparable group.

What does 11x book value imply?

As mentioned, I’ve never seen this type of a valuation for an insurance company. That said, Kinsale has traded above 5x book value (and as high as 12.5x earlier this year) since 2018. In all honesty, if we had a conversation then, I probably would have said ‘Don’t buy Kinsale – Kinsale is overvalued’. Of course, I would have done you a terrible disservice as the company has generated fantastic returns for shareholders since that time.

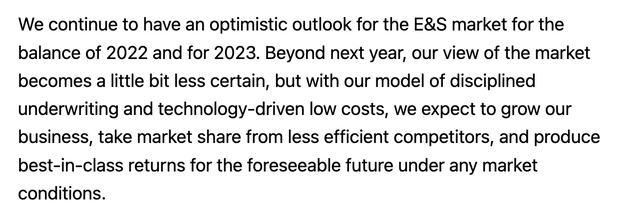

Having said that, as I discussed above, insurance is a competitive, cyclical business that deals in the business of uncertainty. It is not a linear business. Results are inherently unpredictable. While the management believes the industry outlook is favorable for 2023, it acknowledges things are murky looking forward:

Outlook (3Q22 conference call transcript from Seeking Alpha)

To support its current price, Kinsale would have to maintain a 21% ROE and nearly triple its book of business over the next five years. This would result in a 2027 book value of ~$75 (so the company would trade at nearly a 4x price to book in 2027).

In order for shareholders to achieve a 15% annualized return for shareholders (from today’s $290/share price), over the next 5 years Kinsale would have to generate a 31% ROE (so 6-7% better than today) while quadrupling its book of business (and maintain a 5x price to tangible book value in 2027).

This is very unrealistic, not only because of the difficult nature of the insurance business, but because in order to generate low combined ratios Kinsale must be selective in which risks it chooses to accept (has to turn down lots of bad business) which is clearly at odds with quadrupling its book of business.

Conclusion and Price Target

I see significant downside risk to Kinsale’s share price should results falter (due to factors cited above) or if the market simply decides to price it more in-line with other commercial insurance companies.

To determine a price target for Kinsale, I’ve assumed that the company continues to generate a 25% ROE in 2023 and 2024 which results in a 2024 year end book value of $44 per share. From here, I assume that the company earns a sustainable ROE of 16% (sustaining a 16% ROE would still be considered a fantastic performance for an insurance business) and 7% long-term growth rate (again this would be an outlier). Assuming a 10% cost of equity, this suggests a P/B value of 3.0x (which is equal to where the best insurers are trading today) and a 2025 price target of $132. Discounting back to today at 10% results in a current price target of $110 which is 62% below the current target.

Despite the high valuation (and difficult nature of the insurance business), Kinsale has a low short interest (sub 4%) and the cost of borrow is inexpensive (I’m seeing sub 1% here) – as such the company may be an attractive short sale candidate for long/short investors.

Be the first to comment