Suwat Rujimethakul/iStock via Getty Images

A Quick Take On Kingsoft Cloud

Kingsoft Cloud Holdings Limited (NASDAQ:KC) went public in early 2020, raising approximately $510 million in gross proceeds from an IPO priced at $17.00 per share.

The firm provides enterprises in Asia with a suite of cloud-based service offerings.

Given the company’s business transition that is still in progress and the need for management to restart growth while meaningfully reducing operating losses, I see no major upside catalyst to the stock.

I’m on Hold for KC in the near term.

Kingsoft Cloud Overview

Hong Kong, China-based Kingsoft was founded to provide enterprises with complementary cloud services as an alternative to their on-premise information technology systems. Kingsoft is a spinoff from Hong Kong-listed Kingsoft Corporation (HK:3888).

Management is headed by Vice Chairman and Chief Executive Officer Mr. Tao Zou, who was CEO of Seasun Holdings and has been responsible for the firm’s entertainment software business since 2004.

The company’s primary offerings include:

-

Compute

-

Networking

-

Storage & CDN

-

Database

-

Data Analysis

-

Security

Kingsoft Cloud’s Market

According to a 2020 market research report by Allied Market Research, the global market for cloud services of all types reached a value of $265 billion in 2019 and is expected to reach $928 billion by 2027.

This represents a forecast 16.4% CAGR from 2020 to 2027.

The main drivers for this expected growth are a large and continued transition by enterprises worldwide from on-premises systems to cloud environments and ongoing innovation in cloud system offerings by service providers.

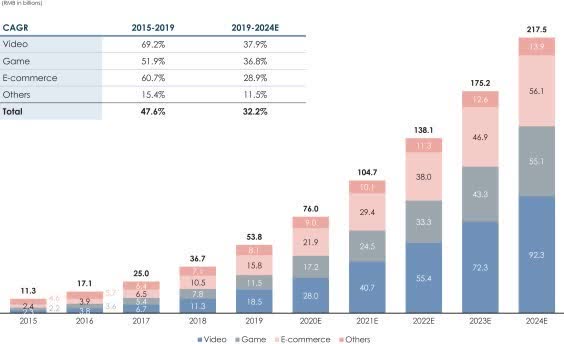

A Frost & Sullivan report commissioned by Kingsoft shows the expected growth of various sectors in China as shown in the chart below:

Frost & Sullivan

Kingsoft Cloud’s Recent Financial Performance

-

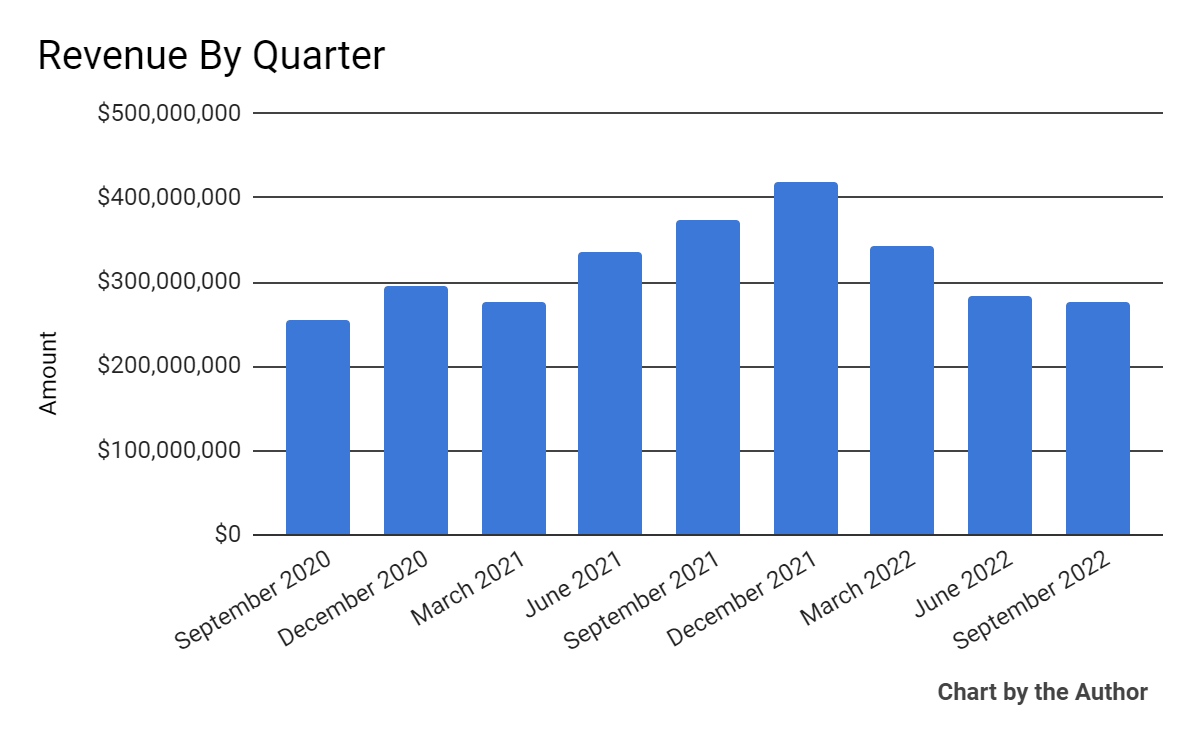

Total revenue by quarter has fallen in recent quarters, as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

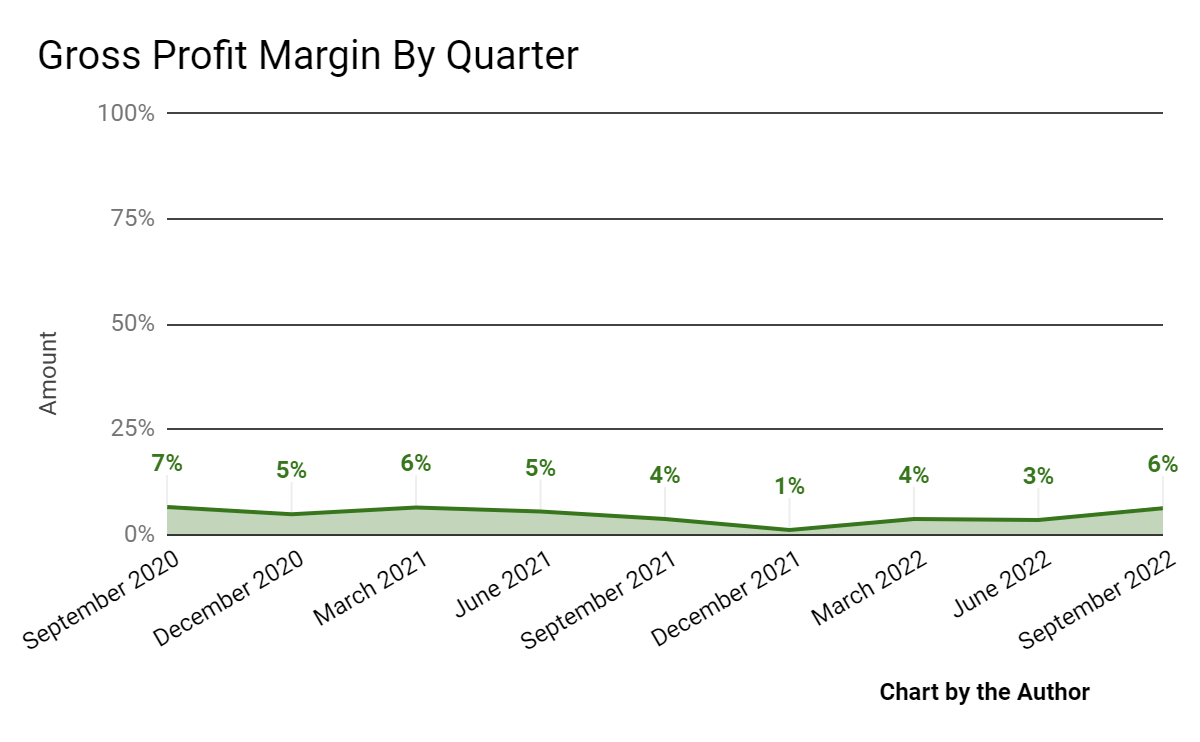

Gross profit margin by quarter has remained very low:

9 Quarter Gross Profit (Seeking Alpha)

-

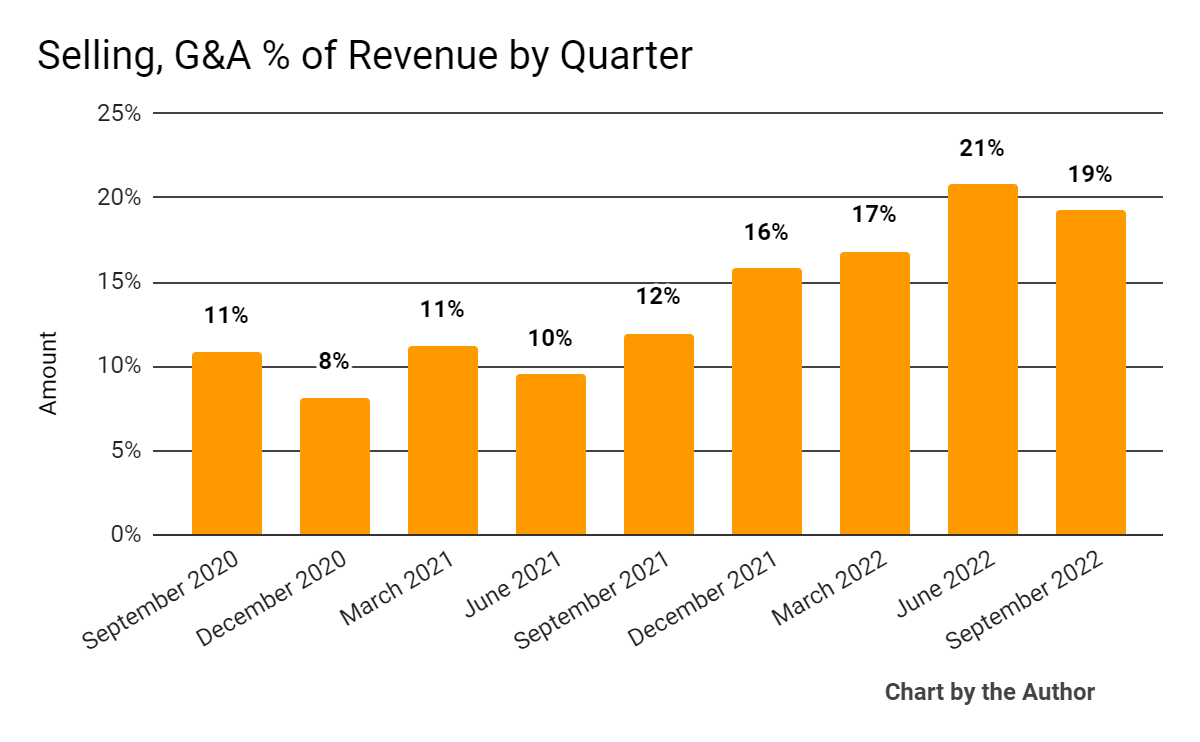

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent periods, a negative signal that indicates decreasing efficiency:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

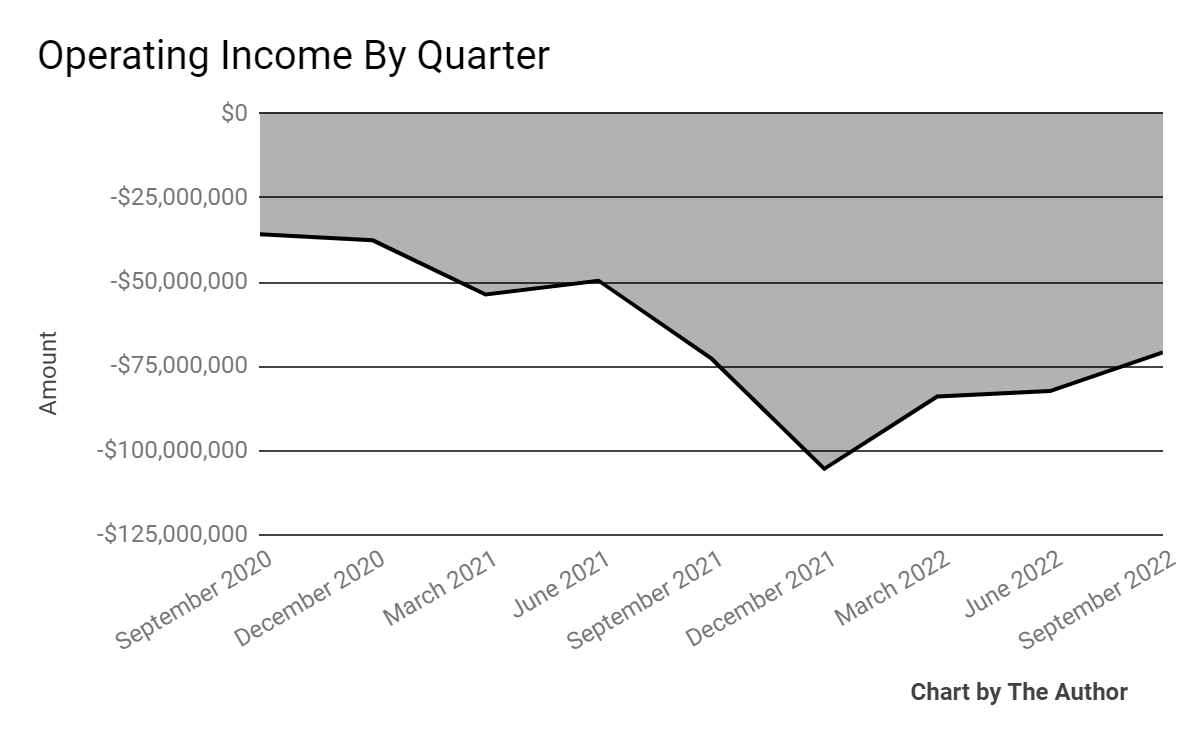

Operating income by quarter has remained substantially negative, as the chart shows here:

9 Quarter Operating Income (Seeking Alpha)

-

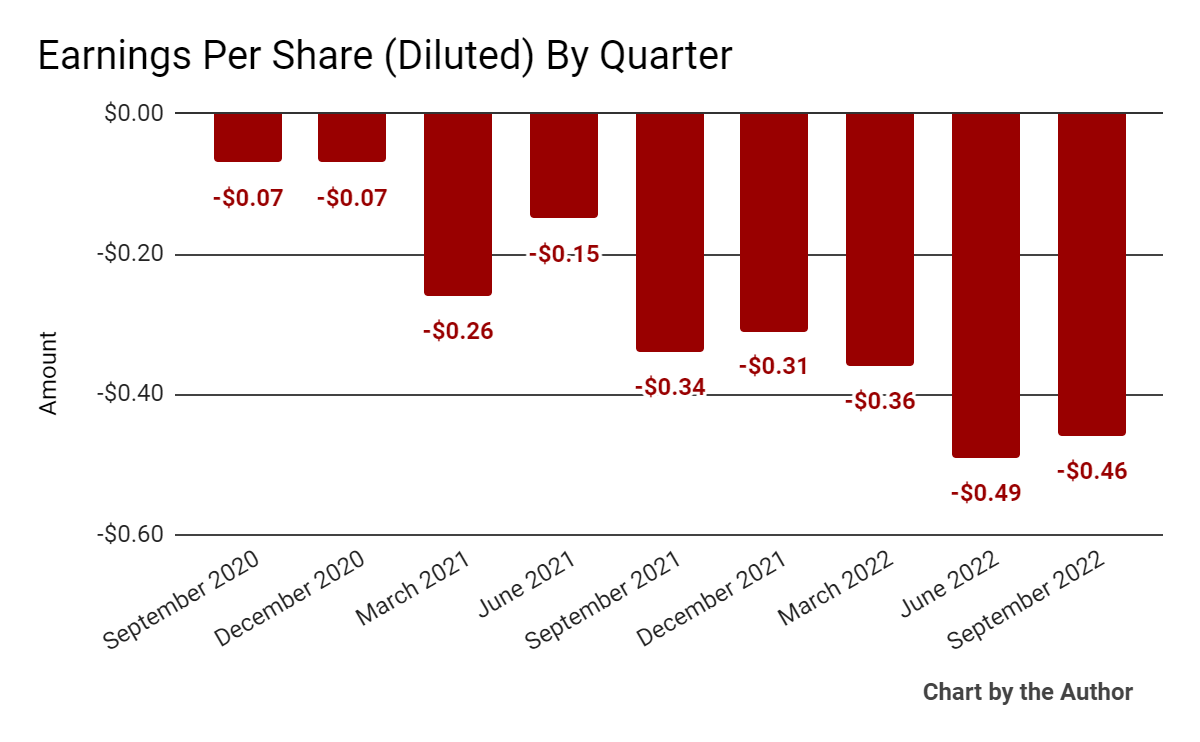

Earnings per share (Diluted) have worsened in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

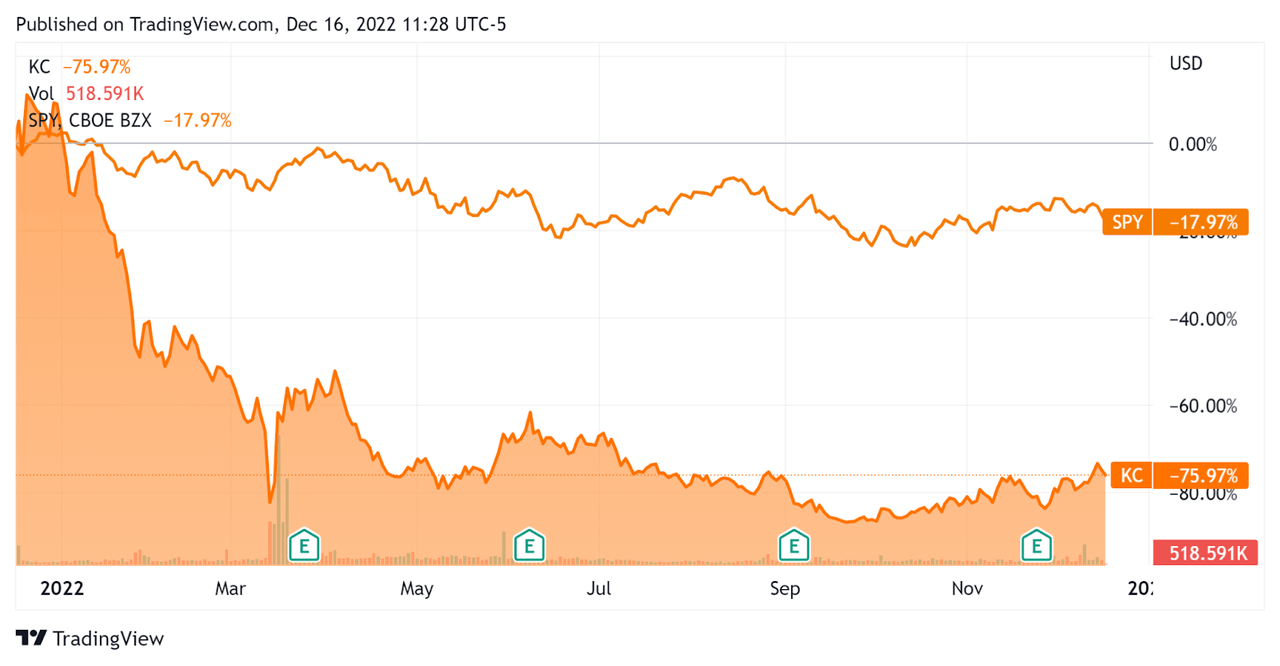

In the past 12 months, Kingsoft Cloud Holdings Limited’s stock price has fallen 76% vs. the U.S. S&P 500 Index’s drop of around 18%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Kingsoft Cloud

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.5 |

|

Revenue Growth Rate |

4.6% |

|

Net Income Margin |

-30.2% |

|

GAAP EBITDA % |

-13.6% |

|

Market Capitalization |

$926,151,100 |

|

Enterprise Value |

$547,758,660 |

|

Operating Cash Flow |

-$20,164,730 |

|

Earnings Per Share (Fully Diluted) |

-$1.62 |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

KC’s most recent GAAP Rule of 40 calculation was negative (9.0%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

4.6% |

|

GAAP EBITDA % |

-13.6% |

|

Total |

-9.0% |

(Source – Seeking Alpha.)

Commentary On Kingsoft Cloud

In its last earnings call (Source – Seeking Alpha), covering the Q3 2022 results, management highlighted the recent review the new CEO has conducted of its strategy, business and financial results.

Leadership is seeking to focus on “a better balance between revenue growth and cost control, to achieve a better balance between revenue growth and profitability.”

As to its financial results, total revenue dropped 20.2% year-over-year, largely due to the ‘scaling down’ of its CDN [Content Delivery Network] business segment.

Management did not disclose any company retention rate metrics. Its Rule of 40 results have been negative, so the firm is in need of serious improvement for this metric indicator.

While gross profit margin has risen, SG&A as a percentage of total revenue has also grown, while operating losses remain substantial and earnings per share heavily negative.

For the balance sheet, the firm ended the quarter with $749 million in cash, equivalents and short-term investments and $214.9 million in borrowings and debt.

Over the trailing twelve months, free cash used was $209.1 million, of which capital expenditures accounted for $188.9 million cash use. Management also awarded $74.1 million in stock-based compensation.

Looking ahead, management guided Q4 revenue to a growth rate of approximately 6.6% at the midpoint of the range.

Notably, the firm filed in July to list its shares on the Hong Kong Stock Exchange, so may be looking to delist from the U.S.

Regarding valuation, the market is valuing KC at an EV/Revenue multiple of only 0.5x, reflecting its growth trajectory and production of substantial operating losses, which have been punished in the current market environment.

Given the firm’s business transition that is still in progress and the need for management to restart growth while meaningfully reducing operating losses, I see no major upside catalyst to Kingsoft Cloud stock.

I’m on Hold for Kingsoft Cloud Holdings Limited in the near term.

Be the first to comment