onurdongel/iStock via Getty Images

Introduction

The midstream industry saw a wave of consolidation throughout recent years, such as Altus Midstream, who merged with EagleClaw Midstream to create Kinetik Holdings Inc. (NASDAQ:KNTK). Whilst the recent sell-off that pushed their share price down around 20% in merely weeks may seem like an opportune time to scoop up a bargain, disappointingly their shares are cheap for a good reason, which sees me skipping this high 8%+ dividend yield.

Executive Summary & Ratings

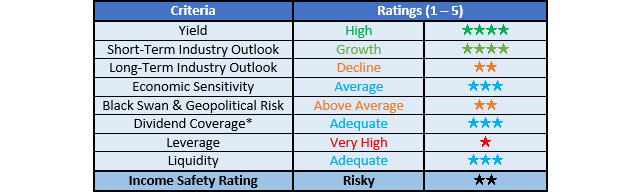

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who wish to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

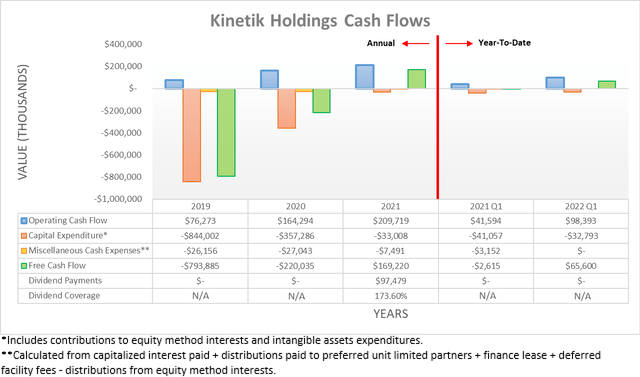

Following their merger, unsurprisingly their cash flow performance increased significantly year-on-year, with operating cash flow of $98.4m during the first quarter of 2022. This more than doubled versus their previous result of $41.6m during the first quarter of 2021. When looking ahead, this appears poised to accelerate throughout the last nine months of 2022 as they continue to integrate the two companies.

When looking at their guidance for 2022, the company sees an adjusted EBITDA of $790m at the midpoint, as per slide twenty-four of their May 2022 investor presentation. Throughout the first quarter of 2022, adjusted EBITDA was $140.8m. Thus, given their operating cash flow of $98.4m that only saw an immaterial working capital movement, their cash conversion was circa 70%. If this continues during the remainder of 2022, this means their adjusted EBITDA guidance should translate into operating cash flow of circa $550m for 2022. Thus, given their guidance for capital expenditure of $137.5m at the midpoint, it sees estimated free cash flow at approximately $410m.

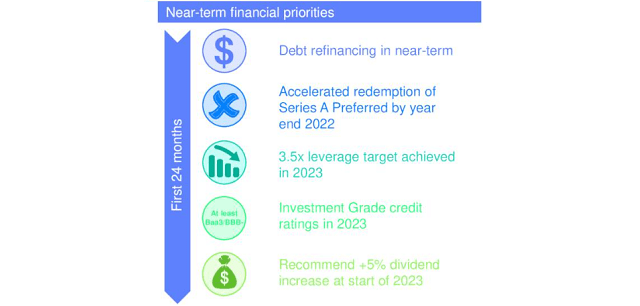

Since this estimation saw approximately $450m of operating cash flow during the remaining nine months of 2022, which equals $150m per quarter, it means that on a rolling basis going forward their operating cash flow could be upwards of $600m per annum. Once subtracting their same capital expenditure guidance for 2022, this sees estimated free cash flow of approximately $460m per annum on a rolling basis going forwards to execute their capital allocation strategy, as the slide included below displays.

Kinetik Holdings May 2022 Investor Presentation

Whilst debt refinancing could help reduce their interest expense, this era of higher interest rates may leave this less effective and thus, in my eyes, it should not be counted upon. Meanwhile, they also plan to redeem their preferred shares by the end of 2022, which saw $6.9m in dividend payments during the first quarter, thereby annualizing to $27.6m per annum. Seeing this cash outflow removed will help, but more so remains merely cleaning up their capital structure, because with operating cash flow of circa $600m per annum, the savings are relatively minor. When it comes to their strategy of deleveraging and increasing their dividends by 5% in 2023, these two topics are intermixed and hinge significantly upon their dividend reinvestment program, as per the quotes included below:

“The Reinvestment Agreement obligates each Reinvestment Holder to reinvest in shares of Class A Common Stock at least 20% of all distributions on Common Units or dividends on shares of Class A Common Stock held by such Reinvestment Holder…”

-Kinetik Holdings Q1 2022 10-Q.

Unlike virtually all of their midstream peers, when they declare a dividend a sizeable portion is not paid via cash, with their “reinvestment holders” instead receiving anywhere from 20% to 100% paid via new shares. These reinvestment holders are their largest shareholders that collectively own the vast majority of the company, such as Apache (APA), Blackstone and I Squared Capital, who have elected to reinvest the entirety of their dividends in new shares during 2022, as per the quotes included below:

“On February 22, 2022, the Audit Committee and subsequently the Board approved that for the calendar year 2022, 100% of all distributions or dividends received by the Reinvestment Holders would be reinvested in newly issued Class A shares.”

“On April 20, 2022, the Company’s Board of Directors (the “Board”) declared a cash dividend of $1.50 per share on the Company’s Class A Common Stock, which will be payable to stockholders on May 17, 2022. The Company, through its ownership of the general partner of the Partnership, also declared a distribution of $1.50 per Common Unit from the Partnership to the holders of Common Units. “

“The Company anticipates 7.8 million of the Class A and Class C shares will receive a cash dividend with the balance receiving additional Class A shares under the Reinvestment Agreement…”

-Kinetik Holdings Q1 2022 10-Q (previously linked).

Since this pre-dated their two-for-one share split, they had 18,986,460 Class A shares and a further 47,260,000 Class C shares. This made for a total outstanding share count of 66,246,460 and thus, since only a mere 7,800,000 received their dividends via cash, it leaves 58,446,460 that would have received new shares for a total value of $87.7m. At the time of payment, May 17th 2022, their pre-split share price was trading around $80, and thus indicates that circa 1.1 million new shares were issued. This amounts to a 1.65% dilution that annualizes to a material circa 6.50%, before considering the effects of compounding.

Whilst their future share price will influence dilution, their current post-split share price of $34 or $68 pre-split is considerably lower, which stands to make future dilution even worse, unless their share price rallies. It should also be remembered that each time their reinvestment holders receive a dividend via new shares, it entitles them to receive even more dividends the next time, thereby compounding the dilution to those retail shareholders who opt for cash. When these variables are combined, it would not be surprising to see their outstanding share count diluted by around 10% by the end of 2022.

After seeing this dilution, their outstanding share count should have increased to circa 73 million on a pre-split basis or circa 146 million on a post-split basis, thereby meaning that their post-split quarterly dividends of $0.75 per share will cost circa $438m to fund with cash during 2023, even if they ceased their dividend reinvestment program. If they also pursue their planned 5% dividend increase, this increases to circa $460m and thus would likely consume essentially the entirety of their previously estimated annual free cash flow, thereby only seeing adequate coverage, assuming that their yet-to-be known capital expenditure is similar to 2022. Even if either their capital expenditure is reduced or their operating cash flow increases during 2023 versus my estimation for 2022, this would likely leave minimal scope for future growth nor deleveraging without the continued use of their dividend reinvestment plan.

Whether their largest shareholders continue reinvesting the entirety of their dividends in new shares in the future remains to be seen, although at minimum, they are obligated to reinvest at least 20% until the end of the first quarter of 2024. When combined with their already thin outlook for coverage coming into 2023, this could see their outstanding share count grow too high and thus make it impossible to sustainably fund their dividends via cash once their dividend reinvestment program ceases, unless their share price rallies for a prolonged length of time to minimize the compounding effect of their dividend reinvestment program.

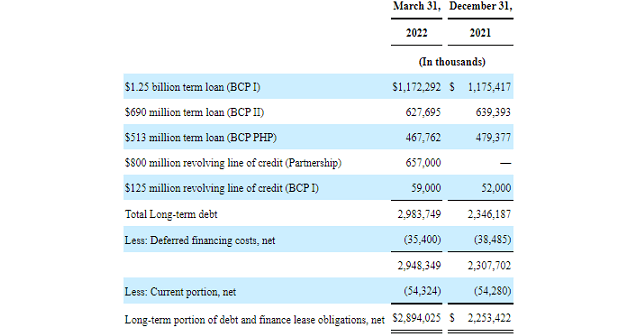

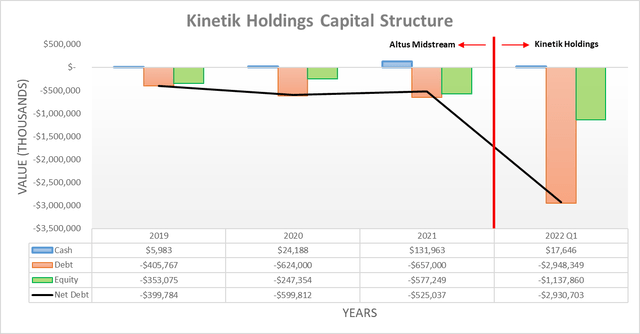

Quite possibly the most stark difference following their merger sits within their capital structure that saw their net debt expand many-fold higher to $2.931b at the end of the first quarter of 2022, versus its now seemingly minor result of only $525m at the end of 2021 in the final days of trading as Altus Midstream. When looking ahead, their net debt appears unlikely to change materially during the remainder of 2022, as they focus on redeeming their preferred shares, which currently carry a balance sheet value of $460.8m and thus comparable to their estimated annual free cash flow.

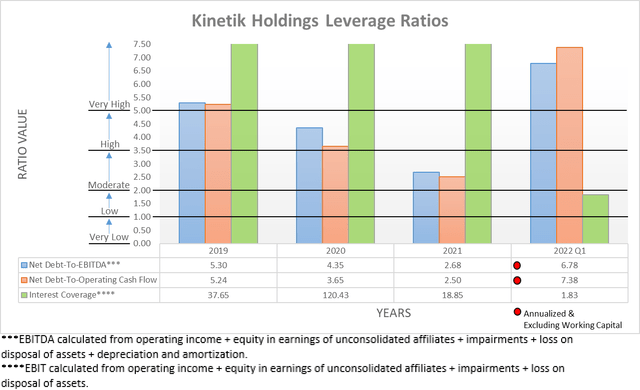

When turning to their leverage, it clearly ended the first quarter of 2022 within the very high territory given their net debt-to-EBITDA of 6.78 and net debt-to-operating cash flow of 7.38 are both well above the applicable threshold of 5.01. Even after accounting for the expected acceleration in their financial performance during the last nine months of 2022, their estimated operating cash flow of $550m for 2022 would see a net debt-to-operating cash flow of 5.32 on their current net debt, thereby still above the threshold for the very high territory.

Whether management reaches their leverage target of 3.50 during 2023 remains to be seen, as per their previously displayed capital allocation strategy, although the outlook is not positive with a problematic paradox for dividend investors. If they opt to wind down their dividend reinvestment program to reduce their worryingly large dilution, it means less cash to address their leverage in 2023 but on the other hand, if they continue paying the majority of their dividends via new shares during 2023, it helps deleverage but would further hurt their already thin dividend coverage, likely making them impossible to sustainably fund via cash.

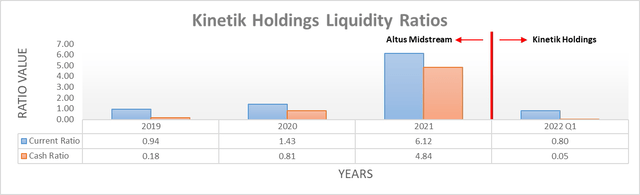

Thankfully their liquidity is not nearly as complicated as the rest of their outlook with a current ratio of 0.80 and cash ratio of 0.05 both appearing adequate. Meanwhile, they still retain a further $209m of availability under their two credit facilities, as the table included below displays. When reading through their associated notes, their closest maturity is not until 2023 when their BCP I $1.25b term loan and associated credit facility fall due.

Kinetik Holdings Q1 2022 10-Q

Conclusion

Even though finding an investment that carries a sustainable high double-digit dividend yield would be desirable, sadly, their shares are cheap for a good reason, with their largest shareholders receiving their dividends via new shares, thereby diluting those who opt for cash. Since this risks leaving their dividends impossible to fund via cash after the next two years, it sees me skipping this high 8%+ yield, and thus I believe that only a hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Kinetik Holdings’ SEC filings, all calculated figures were performed by the author.

Be the first to comment