onurdongel

On Wednesday, October 19, 2022, midstream giant Kinder Morgan, Inc. (NYSE:KMI) announced its third quarter 2022 earnings results. The company’s stock has certainly been on something of a wild ride for the past two years, as it fell victim to the crash in everything energy-related back in 2020, but has since rebounded. The market appears to have been quite disappointed with these latest results, though, as the stock plummeted in after-hours trading alongside the earnings announcement.

This is likely because Kinder Morgan posted an earnings miss, although it did beat analysts’ revenue estimates and showed substantial year-over-year growth. This stock decline was without a doubt an overreaction, though, as the actual earnings report was quite solid as we will see over the course of this article. In some ways, the market’s reaction may be handing a gift to investors as it pushed Kinder Morgan’s dividend up to 6.17%, which makes this longtime favorite of income investors even more appealing than it was prior to the announcement.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Kinder Morgan’s third-quarter 2022 earnings results:

- Kinder Morgan brought in total revenues of $5.177 billion in the third quarter of 2022. This represents a 35.38% increase over the $3.824 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $931 million during the reporting period. This represents a respectable 10.31% increase over the $844 million that the company reported in the year-ago period.

- Kinder Morgan transported an average of 38,637 billion BTU of natural gas per day in the most recent quarter. This represents a slight improvement over the 38,527 billion BTU of natural gas per day that the company averaged in the equivalent quarter of last year.

- The company reported a distributable cash flow of $1.122 billion in the current quarter. This compares quite favorably to the $1.013 billion that the company reported last year.

- Kinder Morgan reported a net income of $576 million in the third quarter of 2022. This represents a substantial 16.36% increase over the $495 million that the company reported in the third quarter of 2021.

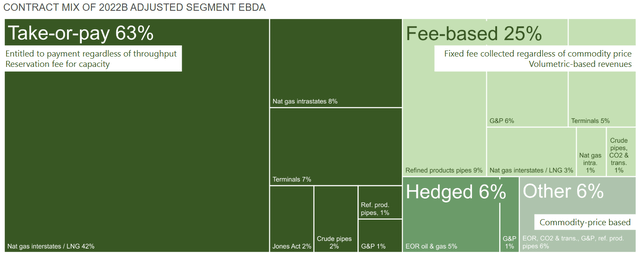

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that Kinder Morgan achieved substantial year-over-year revenue growth. One of the reasons for this is that Kinder Morgan saw higher volumes of natural gas running through several of its pipelines. This boosted revenue because of the company’s business model. In short, Kinder Morgan enters into long-term contracts with its customers under which the customers compensate the company for the volume of resources that they send through Kinder Morgan’s pipelines. This business model provides Kinder Morgan with a great deal of insulation against fluctuations in energy prices. During the third quarter, fully 87% of the company’s cash flow came from these contracts:

This is one of the reasons why Kinder Morgan’s cash flow was not affected very much by the decline in energy prices that occurred following the enactment of the COVID-19 lockdowns in 2020. Unfortunately, it also stops the company from benefiting much when oil and natural gas prices skyrocket, as they did over the past year. This is why we do not see the sort of profit or cash flow growth that we might expect given the size of the energy price surge.

Despite seeing volume growth on some of its natural gas pipelines, we do see that overall the company’s volumes were just barely up relative to the prior-year quarter. One of the biggest reasons for this was the Freeport LNG terminal outage that came about as the result of the fire back in June. On June 8, 2022, the Freeport liquefied natural gas export terminal located on Quintana Island in Texas suffered a leak in its pipe racks, which ultimately led to an explosion and a fire. As a result, deliveries of natural gas to the facility were halted until the plant is repaired. Kinder Morgan is one of the companies that supply natural gas to this facility, so it was affected by this delivery suspension.

Fortunately, its cash flow was not affected very much because the contracts include minimum volume commitments. Basically, Freeport LNG still has to pay Kinder Morgan even if there is no natural gas flowing through the pipelines to the liquefaction plant. This stipulation in the contracts is a nice hedge that provides Kinder Morgan with a great deal of protection against events that are completely out of its control. As investors, we should certainly appreciate this because of the stability that it provides to the company’s cash flow and ultimately the dividend.

As is the case with most of the large midstream firms, Kinder Morgan transports products other than natural gas. Unfortunately for the company, these segments of its business did not perform nearly as well. In particular, it notes that refined product volumes were down about 2% while crude and condensate volumes were down 5% year-over-year. When we divide the refined products into individual products, it paints an even grimmer picture. This is because gasoline volumes were down 3% and diesel volumes were down 5% compared to last year (this was offset by a strong increase in jet fuel volumes).

This could be indicative of an issue with the broader economy. This is because the volumes of refined products are based entirely on end-user demand and not based on volumes that are specified by contracts. Thus, it appears that consumer demand for both gasoline and diesel fuel is lower than in the year-ago quarter, which could be a sign of an economic slowdown. It is also not exactly surprising when we consider that the budgets of many households are being squeezed by rising food and energy prices and the gross domestic product has declined for two consecutive quarters. Unfortunately, this has a very real impact on Kinder Morgan’s cash flows, which are based on volumes just like its natural gas cash flows are. The company was able to offset the weakness here from strength elsewhere in its business, however.

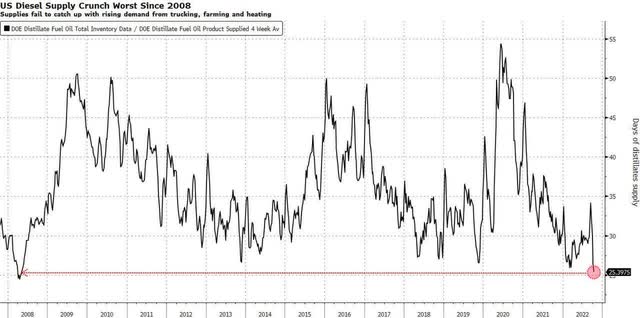

It is possible that we will see an increase in diesel fuel volumes at some point in the near future. This is because the United States is facing a shortage of fuel in the near future. According to the Energy Information Administration, the United States only has 25 days’ worth of diesel fuel supply in storage. This is the lowest level since 2008, right before the last recession hit:

Diesel fuel is critically important for running much of the nation’s transportation infrastructure, such as trucks and trains. We can therefore assume that at some point in the very near future, shipping firms will attempt to boost their stockpiles of diesel fuel. This should cause the volume of diesel fuel moving through Kinder Morgan’s pipelines to increase and thus result in cash flow growth from that business unit. It is, admittedly, uncertain when this will happen though.

In my last article on Kinder Morgan, I pointed out that the company has a number of growth projects currently under development. The company made some progress on these during the third quarter. Perhaps the most important of these is an expansion project for the Permian Highway Pipeline, which is a 490-mile natural gas pipeline running from the Waha Hub (in the Permian Basin) to Katy, Texas. The pipeline entered service in early 2021 and is capable of carrying approximately 2.5 billion cubic feet of natural gas per day. Due to the rapidly growing domestic and global demand for natural gas, this has proven to not be nearly enough capacity so Kinder Morgan is now working to expand the pipeline’s capacity by 550 million cubic feet of natural gas per day. This will bring the pipeline to a total capacity of 3.05 billion cubic feet of natural gas per day when the project is completed, which is expected to be in November of 2023. Kinder Morgan has already secured contracts from its customers for the use of this additional capacity so we should begin to see the impact of the higher volumes as the company enters 2024.

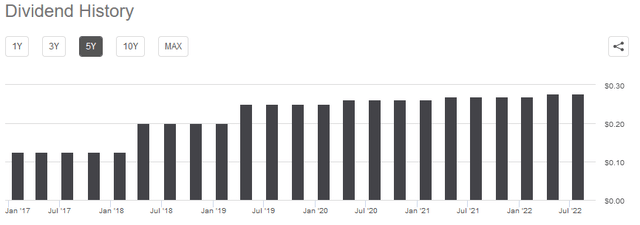

Kinder Morgan has long been an incredibly popular company among income-focused investors due to its high yield and history of growing its dividend over time. As we can see here, the company was one of the few midstream companies that did not reduce its dividend back in 2020 and it has generally been increasing it annually since 2018:

As of the time of writing, Kinder Morgan yields 6.17%, which is substantially higher than the 1.68% yield of the S&P 500 index (SPY). As is always the case though, it is critical that we analyze the company’s ability to pay the dividend. After all, we do not want it to suddenly reverse course and cut the dividend since that would both reduce our incomes and almost certainly cause the company’s stock price to decline. The usual way that we analyze the company’s ability to pay its dividend is by looking at its distributable cash flow, which is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the firm’s ordinary operations and is available to be paid out to the common shareholders. As mentioned in the highlights, Kinder Morgan had a distributable cash flow of $1.122 billion in the third quarter of 2022. This works out to $0.49 per share but the company only declared a dividend of $0.2775 per share.

Thus, the company has a distribution coverage ratio of 1.77x, which is acceptable. Analysts usually consider anything over 1.20x to be sustainable. However, I am more conservative and like to see this ratio over 1.30x in order to add a margin of safety to the position. As we can clearly see, Kinder Morgan easily meets both of these requirements. Therefore, we can conclude that the dividend is likely fairly safe and we should not have to worry too much about a potential cut.

In conclusion, Kinder Morgan’s results generally showed the stability and slow but steady growth that we have come to expect from this company. We see particular strength in the company’s natural gas pipeline unit, which is not surprising considering that natural gas demand has been growing very aggressively over the past year or two as both utilities and the emerging liquefied natural gas industry are requiring more and more to conduct their own business operations. We do unfortunately see some early signs of a recession with the fall in both gasoline and diesel demand but hopefully, that will reverse itself soon. In fact, the fall in diesel demand will soon have to correct or the country could face a very serious infrastructure crisis. Overall, Kinder Morgan remains a very decent way to earn a 6.17% dividend yield.

Be the first to comment