imaginima

(Note: This article was in the newsletter on October 30, 2022)

Kinder Morgan (NYSE:KMI) stock has been stuck in a trading range for some time. The reason is that the business has not really grown materially while the company “righted” the balance sheet. The carbon dioxide business prices have been weak for some time. Now, it appears every part of the business is going to do better. That should turn this investment vehicle from a strictly income vehicle to a growth and income vehicle.

Carbon Dioxide Business

This business has been stable at lower profit levels for some time. That may be about to change.

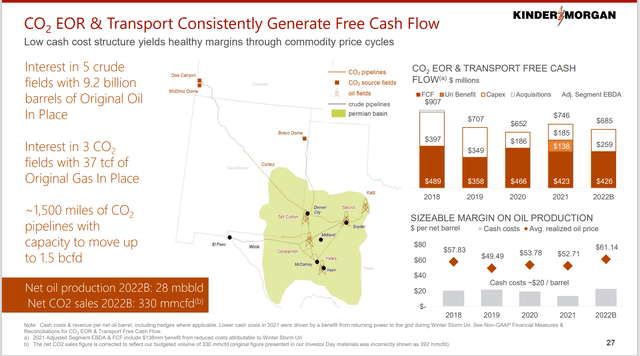

Kinder Morgan Summary Of Carbon Dioxide Business Operations (Kinder Morgan October 2022, Investor Presentation)

The carbon dioxide business (and related projects) has always been profitable. It is just that they have been more profitable in the past. Excluding the effects of winter storm Uri, it appears the business is showing the potential to improve profits for the long term for the first time since really 2015.

The EOR business tends to be higher cost because it occurs after the typical upstream conventional operators have produced the cheaper oil. Therefore, the last five years or so have limited the appeal of this business. The far more robust commodity prices now are encouraging more interest in secondary recovery projects. That is good news for the carbon dioxide business.

The carbon capture business is “right up the alley” of this company because it has a whole lot more carbon dioxide experience than just about anyone else in the midstream industry. Time will tell what management decides to do with that knowledge. But there are clear advantages for this management in the carbon capture business. Investors may want to watch how management navigates this business in the future.

California

California has kind of been a businessman’s “no man’s land” for outsiders in the industry for some time. Kinder Morgan is looking to change that.

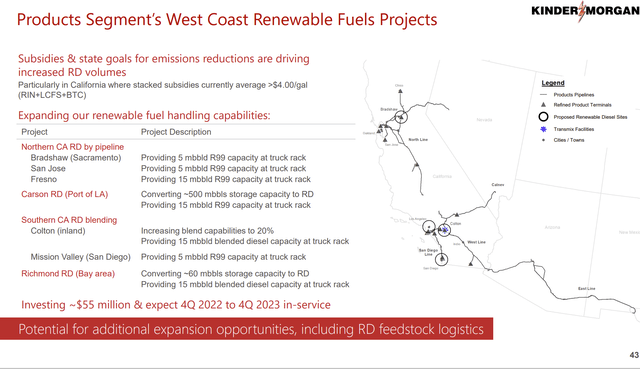

Kinder Morgan Summary Of California Renewable Diesel Projects (Kinder Morgan October 2022, Corporate Presentation)

Kinder Morgan may be the first midstream company in some time to invest in the California market. Entering the market with a popular renewable idea is a good way to establish a foothold in a market that could prove lucrative in the future.

Management noted that they gained some experience with the permitting process and were able to adeptly work around some issues in the process. California is its own world. The experience gained from these two projects could be very valuable down the road as more “green” or “renewable” projects become available.

The two projects that the company committed to will not “make or break” the company. But they will enable management to evaluate the California market for profit potential in the future. The renewables market in California is probably the largest potential market in the country. But navigating California probably takes a lot more agility than does the Texas business. Gaining that agility will put the company ahead of a lot of potential competition.

Natural Gas Business

The natural gas business is projected to need more transportation capacity in the future.

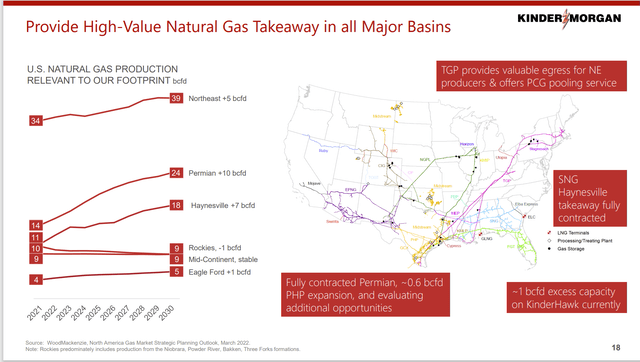

Kinder Morgan Summary Of Key Transportation Future Needs For Natural Gas (Kinder Morgan October 2022, Corporate Presentation)

While much of the focus has been on the Permian (and the Permian does need more capacity), the greatest growth (percentage-wise) will come from the Haynesville area. That basin appears to be poised to surpass other basins to become the new “natural gas king of basins” in terms of production.

Anyone who has followed the industry knows that continuing technology advances have often meant that different basins become low-cost production basins where the most activity occurs. Haynesville has an ideal location for a lot of markets (even export markets) along with low costs. In the distant future, it may surpass the natural gas production levels of the Permian if current trends hold.

Kinder Morgan has had some projects underway. But like many midstream companies, there has not been material growth as the industry has had idle capacity. Now users see the need for more capacity so much of the midstream industry is now talking about brand new pipeline projects to materially add to existing capacity.

Natural Gas Futures

Natural gas has a very bright future despite the emphasis on “green” and “renewable” projects. Therefore, investment in more natural gas transportation capacity makes a lot of sense.

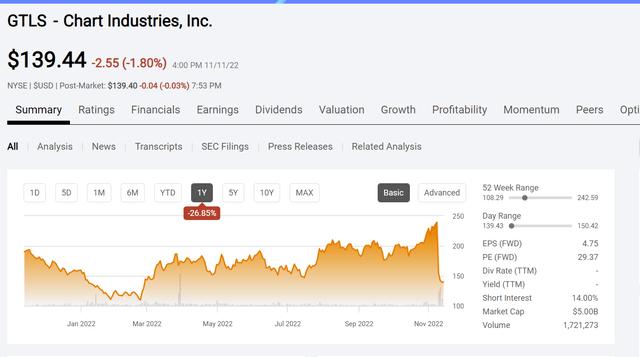

Chart Industries Common Stock Price History And Key Valuation Measures (Seeking Alpha Website November 13, 2022)

Chart Industries (GTLS) is a major supplier of natural gas storage and handling equipment to this and related industries. As you can tell from the stock price chart above, business is absolutely booming. Management expects a nearly 50% profit gain in the next fiscal year. If there were any worries about the future of natural gas, this is the company that would most likely express those fears in the form of lower profits. Instead, the booming business expressed by this supplier to the natural gas industry suggests instead that a lot of pipelines are going to be needed in the future. That is very bullish for Kinder Morgan.

The reason for the recent sizable price drop is that management announced an acquisition that Mr. Market appears to have other ideas about. At issue is the amount of preferred stock and debt that will be ahead of the common. As oil and gas investors well know, this market does not like leverage and the announced deal has plenty of leverage. So even though business is booming as shown by the stock price before the deal was announced, Mr. Market headed for the exits.

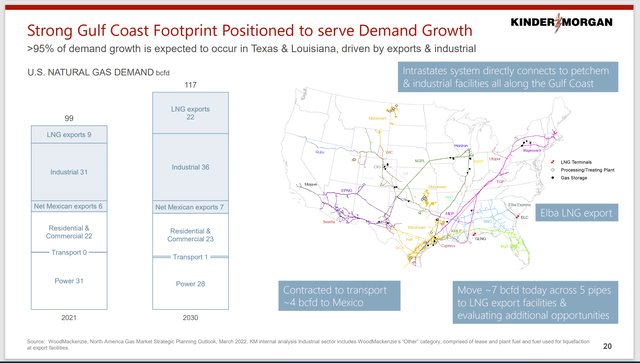

Kinder Morgan Projection Of Natural Gas Demand Breakdown By Sectors (Kinder Morgan October 2022, Investor Presentation)

So, when management projects growth, there are other industries that related also projecting that future growth. Natural gas appears to be in a position to benefit from the green revolution rather than be replaced by the green revolution. That could change in the future. But if it does, it appears the change, if it happens at all, will be in the very distant future.

Kinder Morgan has the experience to provide related services like fractionation as customers demand it. So, management can do more than transport natural gas as the demand arises.

Key Takeaways

For the first time since 2015, Kinder Morgan appears to have all the businesses positioned to take advantage of the future and for the first time in a while, business growth is in the future. The balance sheet leverage is no longer an issue because the business has expanded to the point where idle capacity is no longer an issue. Now, customers are indicating the need for more capacity as production approaches pre-pandemic levels.

Commodity prices appear to be in a position to indicate that production levels throughout the industry will have the profitable future necessary to grow production past the 2019 production levels. This transporter of oil and gas-related products will likely participate in both the growth and the growth of exporting ability.

As the largest company in the midstream industry, Kinder Morgan either participates or connects to all major basins and exporting locations. So, the company can easily participate in growth wherever that growth occurs.

Management has in the past supplemented growth with an occasional acquisition. That is likely to happen in the future. Pandemic issues as well as too much speculative money entering the industry, delayed the recovery from the big price drop in 2015. But that recovery and continued orderly growth now appear to be set to resume.

The geographical diversification as well as the financial strength is really unmatched throughout the midstream industry (in combination). The growth of a large company is slower than is the case for some smaller companies. But the safety of a diversified large company often offsets the risky growth of a smaller company. Investors are likely to finally realize average combined returns (from the dividend and business growth) in the teens from this industry giant as a result.

Be the first to comment