Daniel Wright/iStock Editorial via Getty Images

Investment Rationale

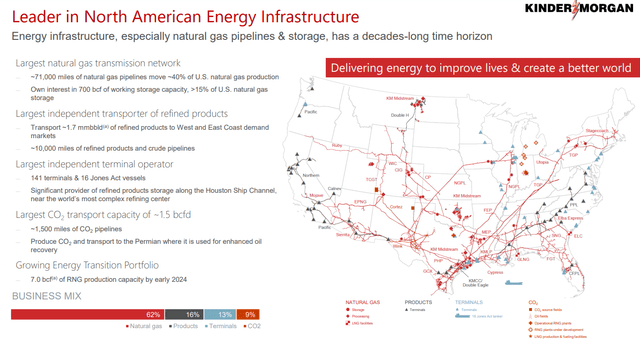

Kinder Morgan (NYSE:KMI) is a leading player in the U.S. energy infrastructure market and has great opportunities yet to be captured in the LNG space. The demand for new energy facilities along the Gulf Coast is the main driver for the company’s growth. Robust expansion of its current extensive energy pipeline is expected to help the company generate more cash flows, fueling growing returns to shareholders in the form of dividends.

About the Company

Kinder Morgan operates around 83,000 miles of pipelines and 141 terminals in North America. The company’s pipelines transport natural gas, gasoline, crude oil, carbon dioxide, and more. The terminals store and handle renewable fuels, petroleum products, chemicals, vegetable oils, and other products.

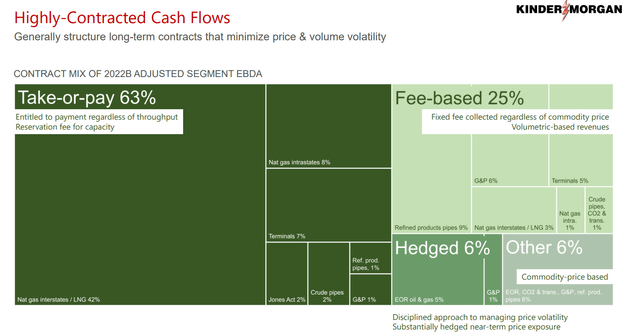

The majority of Kinder Morgan’s business is fee-based. Hence, demand plays a bigger role than commodity prices. Midstream oil & gas businesses don’t suffer as much during a crash in oil & gas prices, as they contract their assets through long-term and fixed-fee contracts which give steady cash flows irrespective of the market cycle. Likewise, these businesses don’t outperform much in an upward cycle as their potential is also capped by long-term contracts.

Robust Cash Flow Generation

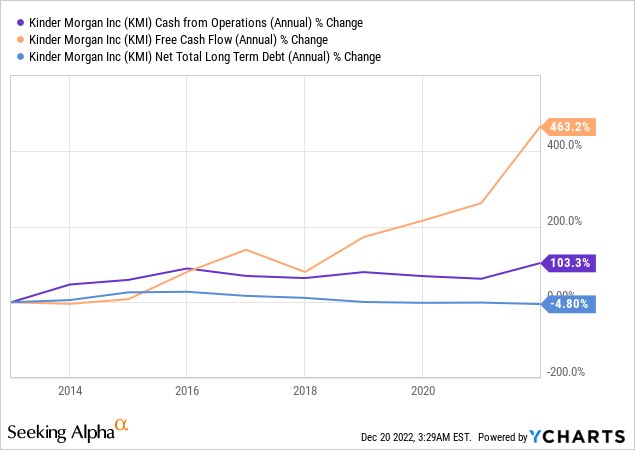

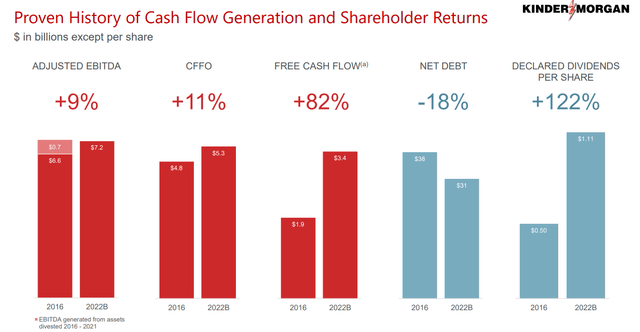

From 2016 to 2022, Kinder Morgan has generated healthy cash flows. The following image throws light upon the EBITDA, CFFO, Free Cash Flow, and Net Debt changes over five years.

The positive growth in both operating cash flows as well as free cash flow has continued for 10 years, as seen in the below chart.

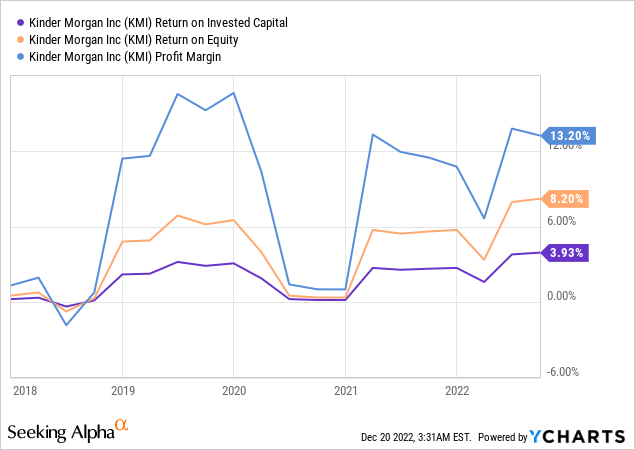

The net profit margin, as well as the return on equity and return on invested capital ratios for Kinder Morgan were substantially hit by the 2020 pandemic. Currently, they are on an upward trajectory. Revival in the company’s operations is gradually expected to improve the ratios over the coming years.

Rewarding shareholders handsomely

In the third quarter of 2022, Kinder Morgan reported a distributable cash flow of $1,122 million, decently above the $1,013 million recorded in the third quarter of 2021. Adjusted Earnings reported were $575 million for the quarter as compared to $505 million in the third quarter of 2021. The company generated earnings per share of $0.25, up 14%, and DCF per share of $0.49, 10.76% up on a YoY basis. In Q4, through October 20, 2022, Kinder Morgan has repurchased about 2 million of its shares for $34 million. On a YTD basis, the company has repurchased around 21.7 million shares.

Kinder Morgan’s third-quarter performance included positive growth in revenue numbers compared to 2021 from all segments, except the product pipelines segment. Natural Gas pipelines performance was boosted by continued strong demand for transport and storage services. Terminals segment earnings increases were driven by gains in the bulk business due to continued strength in both handling rates and volumes for export coal and petroleum coke. The CO2 segment earnings improved on account of higher realized crude, natural gas liquids, and CO2 prices. The contributions from the Products Pipelines contracted due to a decline in commodity prices that impacted inventory values on the company’s transmix and crude and condensate assets.

After slashing the dividend in 2016 due to high debt, Kinder Morgan has been consistently offering growing dividend to its shareholders. The company’s DCF per share stands at $0.49 whereas its dividend per share is $0.278 which indicates that dividend is covered 1.76 times by DCF.

Focus on Renewable Energy

Along with reporting strong performance for the third quarter of 2022, Kinder Morgan is also focusing on adding renewable energy gas assets through acquisition. In August 2022, the company acquired North American Natural Resources and related companies for $135 million. This addition includes landfill-to-gas power facilities which are going to be converted by Kinder Morgan to renewable natural gas by 2024. Earlier this year, Kinder Morgan had announced a $355 million acquisition of Mas CanAm which included purchasing landfill assets comprising an RNG facility in Texas and medium-Btu RNG facilities in Texas and Louisiana.

In the third quarter, Kinder Morgan also sold off a 25.5% stake in its Elba LNG terminals to an undisclosed buyer for $565 million.

Growing Demand for LNG in the U.S.

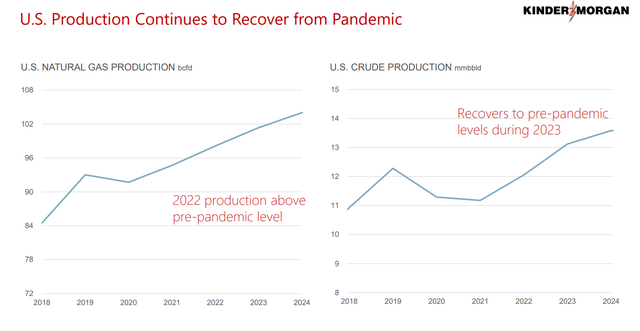

Demand for LNG is expected to rise as summer heat is rising and winter temperatures have been falling in recent years. Besides, the United States is limiting the use of coal plants to emphasize more on cleaner energy. Due to the Russia-Ukraine war, Europe is likely to turn towards the U.S. for its demand for LNG, which will boost U.S. exports. Countries in Asia like China, India, and South Korea are reducing coal consumption and are expected to incline towards more LNG consumption through this decade. The following image shows the recovering production of natural gas and crude in the U.S., as well as expected production in 2023 and 2024.

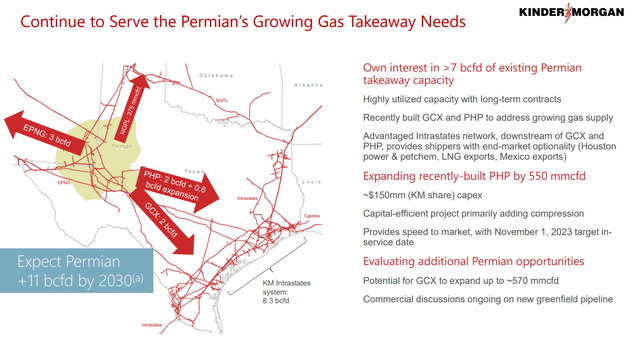

Kinder Morgan owns a major portion of the natural gas pipeline infrastructure in Texas and Louisiana. Most of its demand throughput is located there. The growth in end users as well as the LNG export facilities are likely to fuel rising demand in that region in the coming years. The company currently moves about 50% of the gas consumed by the LNG facilities. This indicates that the company will continue to invest in expanding its infrastructure to cater to the increasing demand.

The company also has several projects aiding the growing LNG demand. Kinder Morgan has approved a 550 million cubic feet per day expansion of its Permian Highway Pipeline to improve the movement of natural gas from the Permian Basin to the Gulf Coast. The company is also working with other LNG developers to build pipelines connecting interstate systems to their export facilities.

Reasonable Valuation

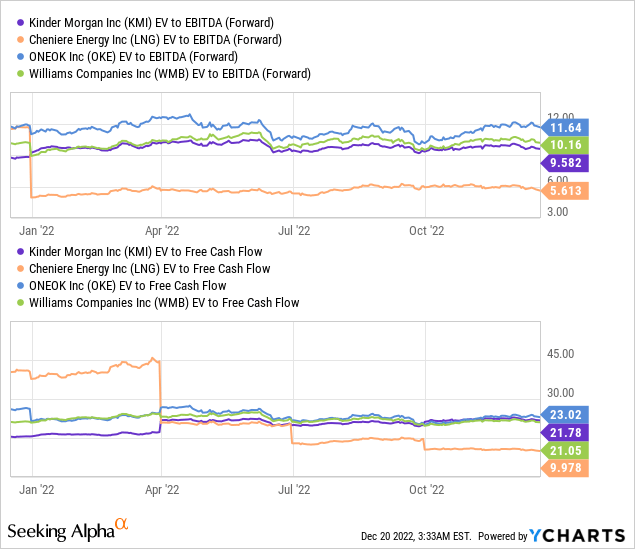

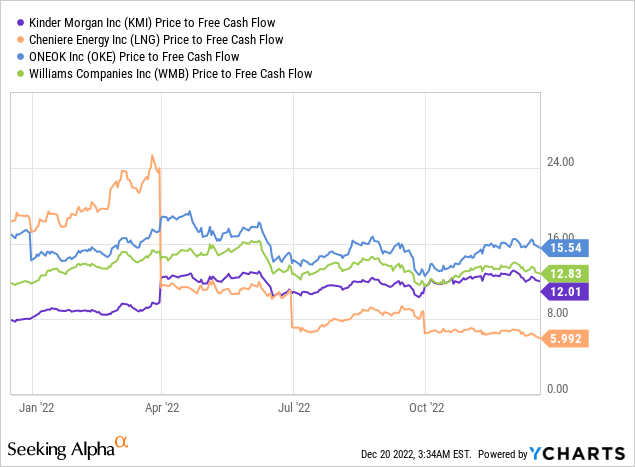

According to Price to Free Cash Flows, forward EV to EBITDA, and EV to Free Cash Flow ratios, Kinder Morgan is trading at a reasonable valuation as compared to its peer companies as seen in the below charts.

The higher enterprise value multiples are a result of some major acquisitions executed by Kinder Morgan in 2022 to expand its footprint in the LNG market.

Seeking Alpha’s proprietary Quant Ratings rate Kinder Morgan as “hold.” The stock is rated low on growth but high on profitability factor.

Risks

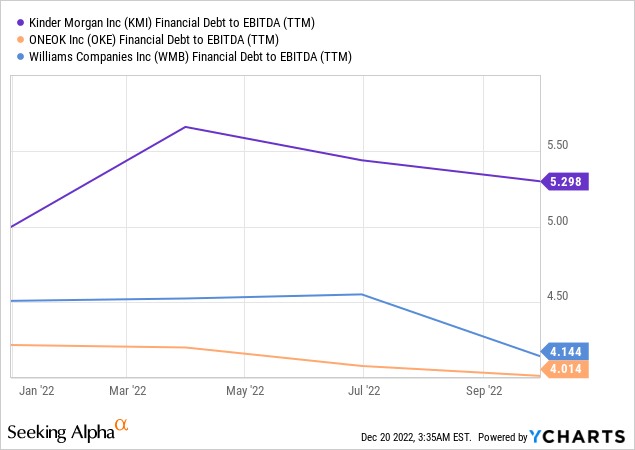

On a TTM basis, Kinder Morgan’s Financial debt to EBITDA ratio is more than 5. Even though the ratio has been decreasing over the past three years, it is slightly higher as compared to its peer companies as seen in the below chart.

I think a debt to EBITDA ratio below 4 is considered to be reasonable. Kinder Morgan has a Financial Debt to EBITDA ratio of 5.3 which is slightly higher. If the company’s expansion plans and cash flow generation continue well, the debt can be a manageable risk, otherwise, the risk of permanent loss of capital might be increased by this debt.

Conclusion

Overall, Kinder Morgan is less risky from the perspective of exposure to a risk of a crash in oil prices as compared to the upstream and downstream companies. A key advantage is the company’s long-term fixed-price contracts. The company’s dividend coverage is strong and it is returning value to its shareholders through stock repurchases and dividend growth. Kinder Morgan’s healthy balance sheet, robust cash flow generation, improved earnings per share, focus on efficient capital allocation, steps taken towards utilizing the LNG opportunities, decent performance in equity markets, and a reasonable valuation make it attractive for dividend investors.

Be the first to comment