Warchi/iStock via Getty Images

Warren Buffett is reported to have said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Kilroy Realty (NYSE:KRC) is not necessarily a wonderful company, but it is better than merely fair, and it is on sale at a wonderful price.

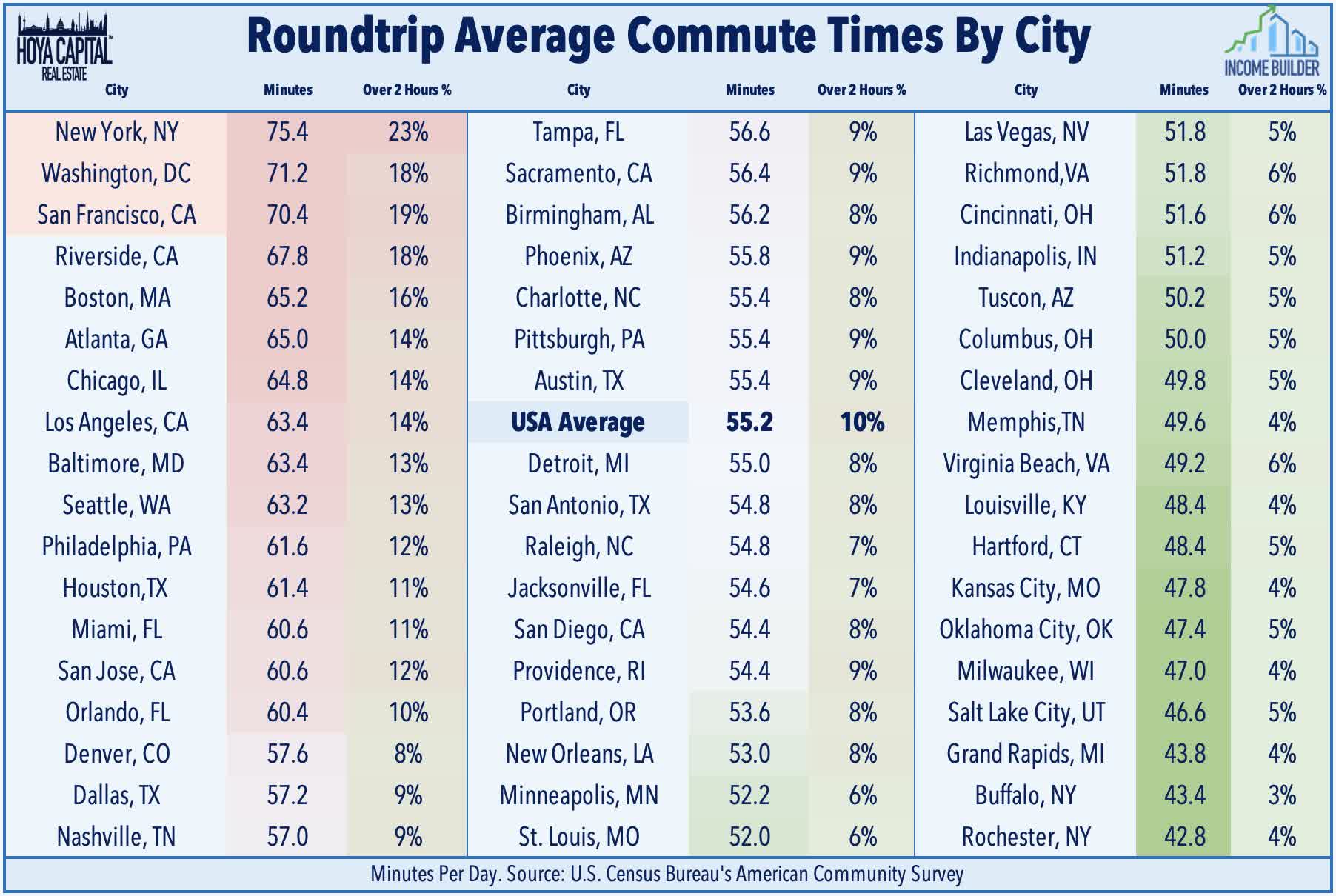

Office REITs have a bad hangover from the COVID pandemic, in the form of the WFH (work from home) trend. Thanks to new technological tools, employees can work much more productively from home, and many of those workers are reluctant to give up that convenience. This is especially true for those who live in areas where commutes are longest. The lack of a commute is far and away the top benefit of working from home, according to WFH Research.

Hoya Capital Income Builder

Thus, demand for office space has weakened, resulting in a supply glut for the foreseeable future. As Hoya Capital forecasts in their recent sector review:

We expect a 15-20% decline in office space per employee by the end of 2030 as many corporate tenants in low-utilization markets significantly reduce their footprint.

The glut of office space has created a flight to quality, benefitting Class A property owners, because companies downsizing their footprint can use their bargaining power to extract concessions and upgrades from landlords.

According to Hoya:

Sunbelt and secondary markets . . . have seen far higher utilization rates throughout the pandemic with Austin, Houston, and Dallas recovering to around 60% while rates are closer to 75% in . . . Raleigh, Charlotte, Atlanta, and Phoenix.

Hoya Capital Income Builder

There are signs that Office REITs may be oversold.

- Office REITs currently trade at an average discount of 29% to NAV (Net Asset Value).

- Guidance hikes outpaced reductions 6 to 1 in Q3.

- Lab space is still in high demand, benefitting REITs with this type of asset.

- Leasing spreads are still positive, at 4.6% on average, which is double their 2021 nadir of 2.3%.

Hoya Capital Income Builder

This article examines growth, balance sheet, dividend, and valuation metrics for an intriguing Office REIT, benefitting from the flight to quality and the robust demand for life sciences office/lab space.

Meet the Company

Kilroy Realty

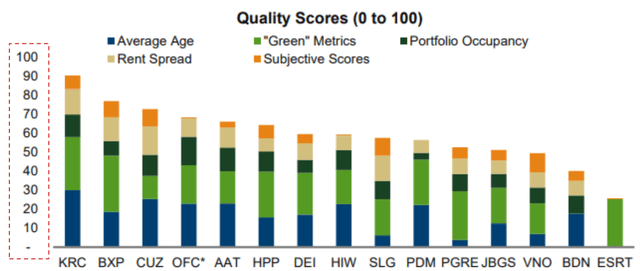

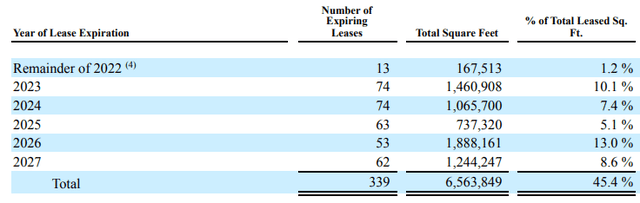

Founded by John B. Kilroy in 1947 and headquartered in Los Angeles, Kilroy Realty became a REIT in 1997. The company owns 120 Class A office properties totaling over 16 msf, enjoying 90.8% occupancy. KRC’s properties earn the highest Green Street Quality Score of all Office REITs, as shown below.

Kilroy September conference presentation

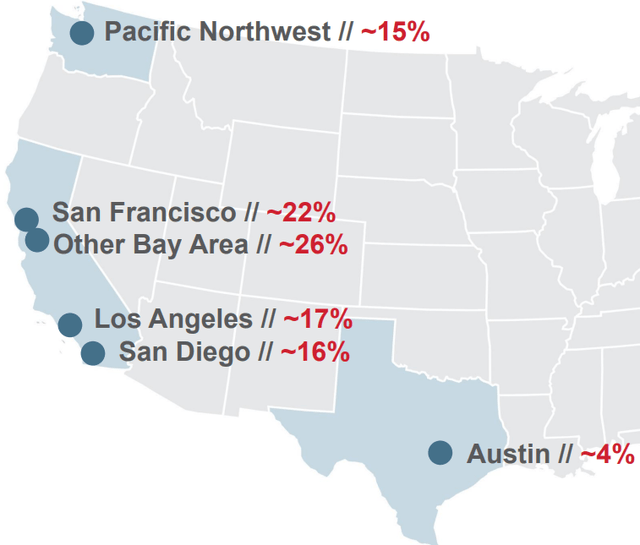

The vast majority of KRC assets are on the West Coast, but the company recently established a toehold in Austin, Texas.

Kilroy September conference presentation

Job postings in West Coast Gateway markets where Kilroy operates are up 19% YoY, providing a tailwind.

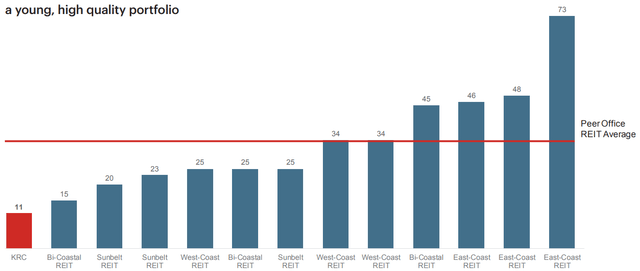

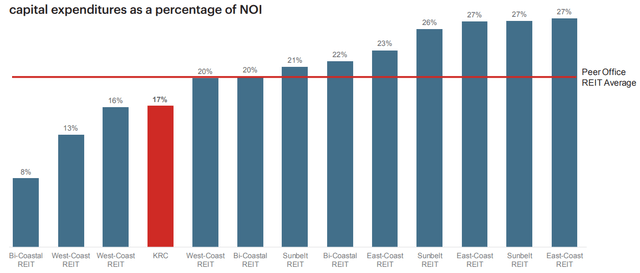

This company aggressively disposes of properties over 12 years old. As a result, the average age of Kilroy office buildings of just 11 years is far below the Office REIT average of 34 years.

As a result, capex is only 17% of NOI, versus the peer REIT average of over 20%, and operating margin stands at a very strong 72%.

Dispositions slightly outpaced acquisitions in 2020 and 2021, but according to the company’s 10-Q for Q3 2022, thus far this year, KRC has completed four development projects, adding a total of 1.11 msf to the portfolio, at a total investment of $615 million. Two of those facilities are already 100% leased. There are still two more projects in the pipeline, one in San Francisco and one in San Diego, totaling 946,000 square feet and an estimated total investment of $1 billion. KRC also has two redevelopment projects in progress, affecting 786,000 square feet and $715 million. Meanwhile, they have disposed of just one property this year, for gross proceeds of $48 million.

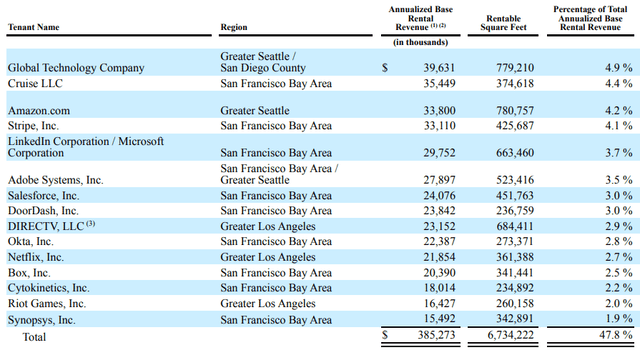

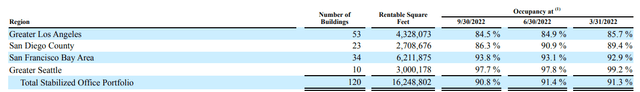

Fully 31% of KRC tenants have investment-grade balance sheets. The tenant base is pretty well diversified. KRC’s top 10 tenants account for 48% of KRC’s total ABR, with the top tenant contributing 4.9%. The weighted average lease term is about 6 years.

Cash leasing spreads on the 59 leases signed thru Q3 2022 (affecting half a million square feet of the portfolio) averaged a healthy 8.0%.

In-place rents are about 12% below market, providing a runway for revenue growth as leases expire. For life science tenants, that figure is closer to 18%.

Lease expirations average about 10% of ABR (annual base rent) per year through 2027.

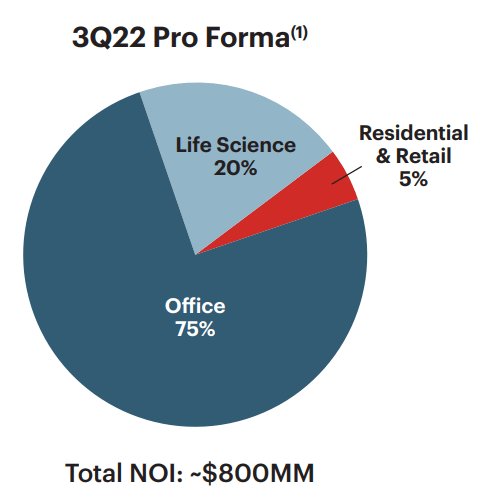

Kilroy derives 75% of its NOI from office properties, 20% from Life Sciences facilities (up from 5% over the past 10 years), and 5% from residential and retail establishments.

Kilroy investor presentation

The robust ongoing demand for Life Sciences office and lab space benefits KRC, which has expanded its investment in these types of facilities by over $850 million in the past 7 years.

Total occupancy for Kilroy’s stabilized office portfolio is 91.3%, with the greatest struggles in the Los Angeles and San Diego markets. By contrast, occupancy for the company’s 10 properties in Greater Seattle is a near-perfect 99.2%.

Quarterly results

Quarterly results for KRC show:

- Revenues of $276 million, up 18.8% YoY.

- Net income of $86.7 million, up 62%, thanks largely to gains from property sales.

- Total share count up just 0.2% YoY.

- Cash from operations through the first 9 months of this year $484 million, up 18.8% YoY.

- NOI of $195 million, up 17.6% YoY.

- NOI thru Q3 of $581 million, up 17.0% YoY.

- Same-store NOI thru Q3 of $468 million, up 4.9% YoY.

- FFO of $140 million, up 20.4% YoY.

CEO and founder John Kilroy said this on the latest conference call:

Our strategy can be summarized via three tenets; best-in-class real estate; disciplined capital allocation; and fortress balance sheet. . . The bifurcation between high quality space and commodity space continues to grow, which bodes well for our young and modern portfolio … Furthermore, throughout 2022, nearly 50% of markets nationally set records for high watermark rents on Premier Class A properties.

Growth metrics

Kilroy is enjoying a banner year, with FROG-like growth in revenue and cash flow, pulling the 3-year averages into double digits.

| Metric | 2019 | 2020 | 2021 | 2022* | 3-year CAGR |

| FFO (millions) | $418 | $433 | $462 | $556 | — |

| FFO Growth % | — | 3.6 | 6.7 | 20.3 | 10.0% |

| FFO per share | $3.91 | $3.71 | $3.89 | $4.65 | — |

| FFO per share growth % | — | (-5.1) | 4.9 | 19.5 | 6.0% |

| TCFO (millions) | $459 | $456 | $516 | $645 | — |

| TCFO Growth % | — | (-0.7) | 13.2 | 25.0 | 12.0% |

*Projected, based on Q3 2022 results

Kilroy also sits in the market cap sweet spot, at $4.6 billion.

Balance sheet metrics

Kilroy’s bond-rated balance sheet sports outstanding liquidity and low Debt/EBITDA, with a solid 36% debt ratio. This company is ready for any weather.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| KRC | 2.15 | 36% | 5.8 | BBB |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

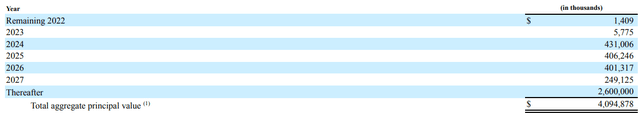

Thru Q3, KRC was holding $250 million in cash equivalents, $1.1 billion available on its revolver, and another $200 million available on its unsecured term loan facility, for a total of $1.55 billion in liquidity, with no maturities until December 2024. Debts total $4.1 billion.

Debt maturities for 2023 are extremely low, amounting to just 1.4% of the company’s $4.1 billion debt, and 63% of the debt is not due until after 2027. The weighted average interest rate is 3.7%.

KRC has 4.9 million shares available for repurchase, but has not announced any plans for a buy-back yet.

Dividend metrics

Over the past 7 years, KRC has increased its dividend by an average of 6.4% per annum, even raising its dividend during the pandemic. The well above-average yield sports an ultra-safe rating of A from Seeking Alpha Premium.

| Company | Div. Yield | 3-yr Div. Growth | Div. Score | Payout | Div. Safety |

| KRC | 5.67% | 4.7% | 6.47 | 50% | A |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

KRC raised its dividend by 3.8% in September, from $0.52 to $0.54.

Valuation metrics

Despite its solid growth figures, KRC sells at just 8.2x FFO ’22 and a 30% discount to NAV. For a company showing such strong recent growth, these prices are amazing.

| Company | Div. Score | Price/FFO ’22 | Premium to NAV |

| KRC | 6.47 | 8.2 | (-30.3)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

What could go wrong?

The company is mostly concerned about risk associated with inflation and interest rates. Continued or increased inflation could adversely affect operating expenses incurred in connection with, among others, the property-related contracted services such as repairs and maintenance, janitorial, utilities, security and insurance, and also general and administrative expenses. Inflation would also raise the cost of development projects, due to increased cost of materials, labor, and services, and consequently lower the cap rates. This in turn is already delaying the start and the completion of new development projects. Rising interest rates would likely decrease the valuation of the company’s assets.

Investors’ bottom line

Kilroy offers an ultra-safe yield that is well above the REIT average, with a solid balance sheet and sturdy growth metrics that stand to gain from the flight to quality and the robust demand for Life Sciences space, all at a sale-rack price. It’s worth a small allocation for the Yield alone, and the growth prospects are surprisingly strong.

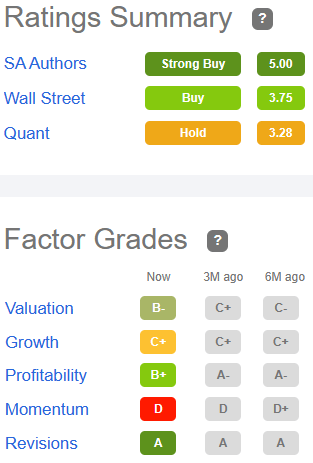

Seeking Alpha Premium

Of the 16 Wall Street analysts who cover KRC, 8 rate the company a Buy or Strong Buy, 7 rate it a Hold, and only 1 advocates selling. The average price target is $50.53, implying 30% upside.

The Street, Ford Equity Research, and TipRanks all rate KRC as Hold or Neutral, as does revisions-sensitive Zacks. But the opinion that matters the most is yours.

Be the first to comment