Sundry Photography

Investment Thesis

Keysight Technologies (NYSE:KEYS) is a leader in the field of testing and measurement.

The company provides vendor-agnostic solutions that are flexible enough to span across multiple markets, platforms and workflow tasks. This greatly accelerates the time-to-market for its customers’ products and services.

In spite of its heavy investments in R&D, KEYS is still observed to have maintained very favorable bottom line margins with respect to its competitors.

The company’s pivot to the 5G segment is likely to benefit greatly from this industry’s long-term tailwind.

To achieve even higher profitability, the company is increasingly transforming its products and services to be delivered through a subscription model. This transformation is likely to succeed since this is a proven forward-looking business model that has benefited other companies.

The company is currently undervalued which presents a great long-term investment opportunity.

Company Overview

Even before companies roll out their communications products and services like 5G communications, IoT, gigabit-to-the-home broadband equipment, and other cloud services, there is a need to go through a thorough testing phase to ensure the high quality of these products and services. If done correctly and effectively, companies achieve a timely TTM (Time to Market), that brings with it the benefits of first-mover advantages like increased market shares and revenue. As a leader in the field of testing and measurement, this is the main value proposition that KEYS provides for its customers.

From the presentation given by the company during its ‘Investor Day 2020‘, we understand that KEYS is in the business of helping customers bring deliver “first to market, software-centric solutions” that fit industry standards and specifications.

From the company’s latest quarterly and annual reports, we can observe two reportable operating segments representing the main business segments of the company.

- Communications Solutions Group – This provides testing solutions for the segments of “Wireless and Wired Communication”, “Network Applications and Security” and “Aerospace, Defense, and Government”.

- Electronic Industrial Solutions Group – This provides testing solutions for the segments of “Next Generation Automotive and Energy”, “IoT”, Consumer, Education, and Medical Electronics, Semiconductor Design, and Manufacturing.

Vendor Agnostic Solutions with DENT Open Source Technology

DENT is a network operating system (NOS) based on Linux open source technology. Leveraging on the DENT technology allows KEYS to benefit by providing solutions in a vendor-agnostic way. This means KEYS is able to design solutions from “the widest range of hardware selection”. This flexibility greatly simplified the process to keep up to date with the customers’ changing needs.

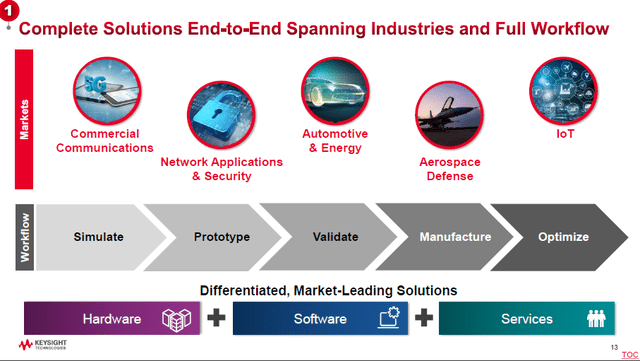

As mentioned in the deck of ‘Investors Day 2020’, the company provides a very broad range of communications testing solutions that span across:

- Multiple platforms of hardware, software, and services

- Multiple markets from ‘commercial’ communications to ‘government related’ aerospace defense.

- Multiple tasks in a testing workflow that includes initial stages of simulations to final stages of optimizations.

Company’s Solutions (Investors Day 2020)

This comprehensive portfolio of agnostic, end-to-end, complete testing solutions allows customers to greatly accelerate the time to market for their new products, giving the company a very strong competitive advantage in the market.

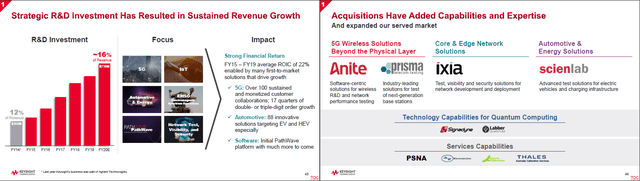

Growth By R&D Investment and Acquisitions

The company is one of the key players in the field of communications testing. This is attributed to its heavy investment in R&D to achieve organic growth. Astute acquisitions of strategic players in the field of wireless communications, network, and automotive further contributes to its inorganic growth.

R&D Investment and Acquisitions (Investors Day 2020)

This combination of organic and inorganic growth provides KEYS with a very broad portfolio of testing solutions compared to other alternatives in the market.

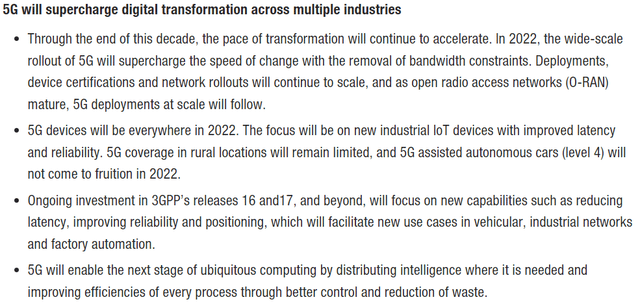

Pivot to 5G testing

KEYS ‘predicts’ that its pivot to 5G testing is expected to bring the company’s profitability to greater heights:

Technology Predictions from an Electronic Design and Test Thinktank (Company Website)

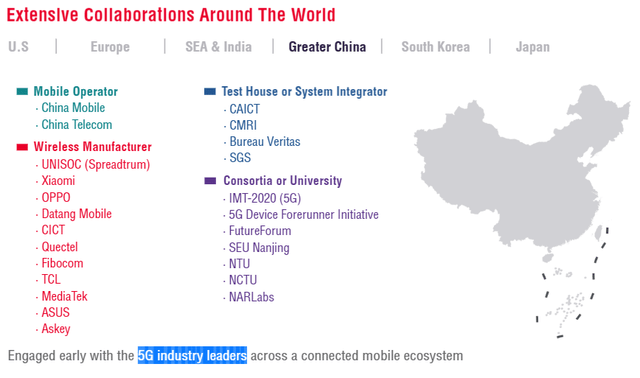

In fact, the company is already a seasoned global player in this field:

5G Solutions (Company Solutions)

According to Grand View Research, the global 5G testing equipment market size is expected to grow at a CAGR of 8.8% from 2020 to 2027 and KEYS is already one of the key players.

As an existing key player in 5G testing, the company’s pivot to the 5G testing market in terms of increased R&D investment is expected to benefit greatly from this global tailwind.

Strategic Shift to Subscription Business Model

Generally, a subscription business model is superior to that of providing customers with “perpetual access” to a company’s software services. According to McKinsey:

Not only can the subscription model drive greater average spend, launch a virtuous cycle of using data to better serve consumer needs, and inspire loyalty, it provides value to consumers who appreciate the convenience, novelty, and curated experiences.

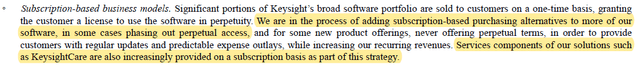

According to the company’s latest annual report, KEYS is progressively transitioning its business to such a superior subscription model:

Benefits of Subscription Model (McKinsey Website)

We have reasons to believe the company will benefit greatly from this transition in the same way that the subscription model has benefited other companies.

Financial Comparison With Competitors

These are the companies that compete with KEYS, as inferred from the company’s annual report:

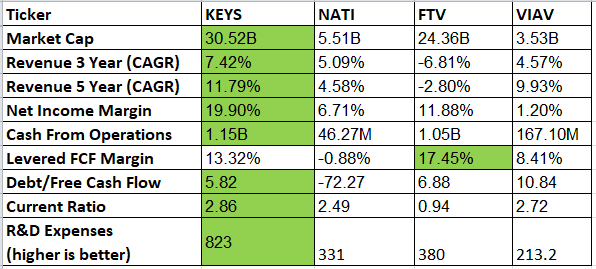

We extracted some key financial data from Seeking Alpha for comparison.

Key Financial Figures (Seeking Alpha)

We can observe that:

- KEYS is the largest player in the comparison list with respect to market capitalization.

- In a long-term multi-year period of 3 to 5 years, KEYS is able to grow its top-line revenue faster than all the other players in the comparison list.

- It is superior in most of its bottom line items of Net income and operating cash flow. In the comparison list, only KEYS and FTV has an FCF margin of double-digit.

- Comparing the company’s debt with respect to its cash flow, KEYS has the lowest debt profile.

- With the highest current ratio, the company has the most assets with respect to liabilities in the comparison list.

- We discussed earlier that continued R&D expense provides KEYS with a competitive advantage. From the comparison list, we can observe that it is way higher than all other players in the comparison list.

Growth companies with a high level of expense usually need to sacrifice bottom line margins. For KEYS, this is not the case. Not only is it able to splurge on high R&D investments to gain and maintain its competitive advantage, but it is also able to do so while maintaining remarkably profitable bottom line margins with respect to its competitors.

Valuation

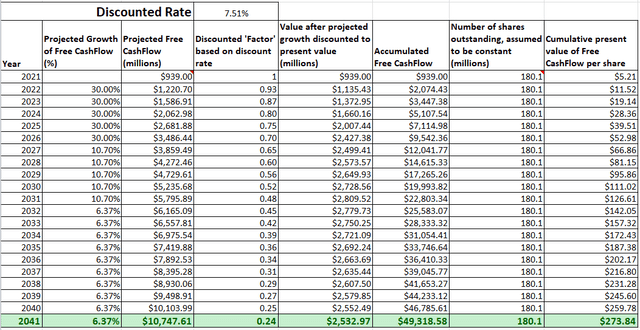

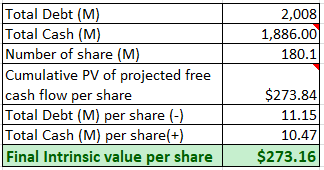

We will calculate the intrinsic value of the company using the Discounted Free Cashflow model over a 20-year timeframe with the following assumptions and values:

- The last reported ‘Total Common Shares Outstanding‘ is 180.1M.

- The last reported ‘Total Cash & ST Investments’ is 1,886.0M.

- The last reported ‘Total Debt’ is 2,008M.

- The latest Free Cash Flow during the TTM period is 939M.

- The discount rate is estimated to be 7.51%, taken from the WACC value.

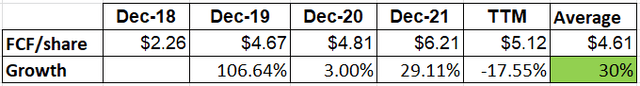

- The company has been growing its FCF/share at about 30% per year for the last 5 years. We will assume that it can maintain this growth for at least the next 5 years.

Author’s calculation of FCF Growth (Seeking Alpha)

- The growth for the subsequent 5 years is assumed to be10.7%, which is the average growth of the S&P 500 since it was introduced in 1957.

- For the last 10 years, the company is assumed to grow at the ‘mean value’ of the U.S. GDP growth rate of 6.37%.

Intrinsic Value by Discounted Free Cashflow (Author’s Calculation)

Based on the above inputs, the present value (“PV”) of projected Free Cash Flow per share for KEYS is $273.84.

Intrinsic Value by Discounted Free Cashflow (Author’s Calculation)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is about $273.16.

At the current price of 169.6, KEYS’s share price is currently undervalued and selling at a discount of -37.91% (169.6/273.16-1).

Conclusion

Even as an established key player in the “Communication Test and Measurement (CT&M) Market”, KEYS is not sitting on its laurels but investing heavily in organic growth and strategic acquisitions to expand its lead in the CT&M market.

Such investments were observed to have paid off convincingly as reflected in its superior bottom line margins with respect to competitors. This is achieved in spite of its heavier investments in R&D compared to other competitors.

The pivot to 5G testing is expected to allow the company to ride on the tailwind brought about by the growth and adoption of the 5G infrastructure.

The company’s transition to a subscription business model is expected to push the company’s profitability to greater heights just as it has done for other companies.

The stock is currently undervalued which presents a great long-term investment opportunity.

Be the first to comment