US Dollar Fundamental Forecast: Bullish

- US Dollar supported by hawkish Federal Reserve policy expectations

- Core PCE data is in focus with all eyes on where US inflation is going

- Fed Chair pick a source of near-term USD volatility, but unlikely to last

The US Dollar may remain on the offense in the week ahead as markets turn to important economic event risk from the United States. Inflation has been a hot topic in the country, with headline price growth at its most aggressive since the early 1990s using year-over-year timeframes. Now, the Federal Reserve’s preferred gauge of inflation, core PCE, is in focus.

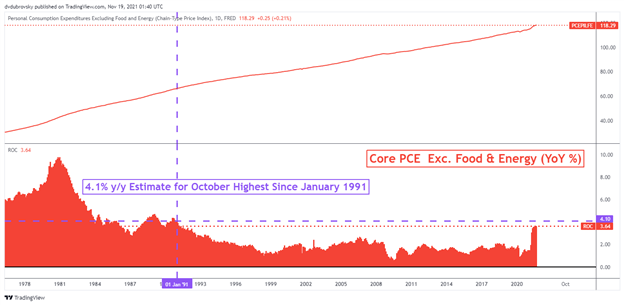

It is expected to cross the wires at 4.1% y/y in October, up from 3.6% prior. That would be the fastest pace since January 1991 – see chart below. Ongoing elevated price readings above the central bank’s target would likely continue to keep Fed policymakers on their toes. Still, the broader argument from the central bank remains that the recent bout of inflation is ‘transitory’.

US Core PCE Data Since 1978 – (Y/Y)

The Citi Economic Surprise Index tracking the US has been pushing higher into positive territory, with the gauge now near the June peak. This suggests that economists are broadly underestimating the health and vigor of the economy. That may open the door to higher-than-expected data surprises, and not just from PCE data. Data on durable goods orders and new home sales as well as the University of Michigan consumer confidence indicator and minutes from this month’s FOMC meeting are also due.

Check out the DailyFX Economic Calendar for more information about US data in the week ahead!

Looking at the chart below, the US Dollar’s advance since June has been associated with increasingly hawkish Federal Reserve monetary policy expectations. Two rate hikes by the end of 2022 are fully priced in. Meanwhile, the 2-year Treasury yield sits at around March 2020 levels. Further rosy economic surprises may reinforce these estimates, lifting the US Dollar.

A near-term source for USD volatility may come from President Joe Biden’s expected nomination of the next Federal Reserve Chair. While Jerome Powell may keep his role, expectations for Lael Brainard’s nomination have been rising. The markets seem to have determined this to be a more dovish pick. Her nomination could then send front-end yields lower and longer-term rates higher. This may boost stocks at the expense of the US Dollar.

Biden’s pick is expected to cross the wires before the Thanksgiving holiday on November 25th. The reaction is likely to be short-term however. The next chair will continue to face the ever-increasing uncertainty around where inflation is going, regardless of who is picked. That may in turn keep the bullish argument for the US Dollar broadly intact.

US Dollar Vs. 2022 Fed Rate Hike Bets and 10-Year Bond Yield Spreads

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment