ayagiz/iStock via Getty Images

This week’s Fed meeting will be crucial, with charts of many important markets at pivotal technical levels.

The leading narrative in the market has been that interest rates are set to steadily rise going forward, with global central banks trying to combat rising inflationary pressures.

However, price action on the charts does not support this leading narrative. As the majority of the markets have bought into the “higher interest rates” story in the news and media, this means there is a potentially huge profitable opportunity coming up.

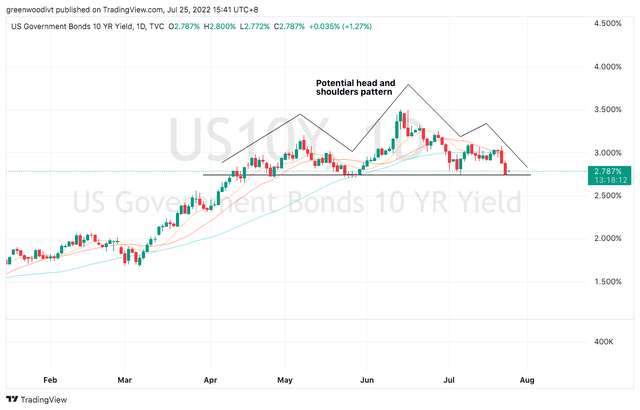

For one, the US 10Y treasury yield has been tracing out a bearish distribution pattern (head and shoulders). This is potentially a topping pattern, and will be completed if price breaks below the pivotal neckline level (around 2.75%). In the formation of the right shoulder, price has quickly lurched towards the neckline, which hints at an increase in downward pressure.

Daily Chart: US 10Y Treasury Yield

This development is divergent from the leading narrative out there. If interest rates are set to rise going forward, the 10Y yield should not be behaving this way.

The market is a forward-looking mechanism, and hence we cannot trade based on what is happening now. As such, price action is key in determining divergences in the market.

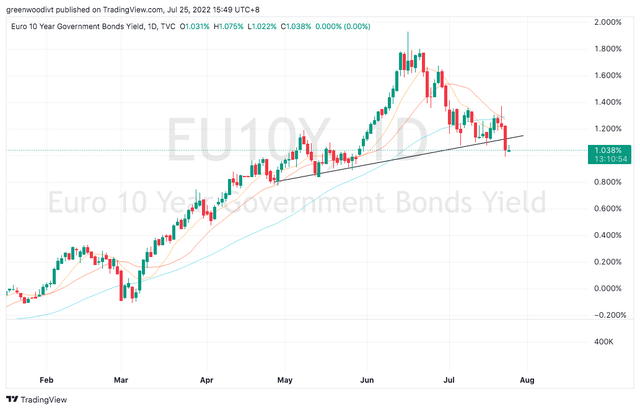

Such divergent price action is not only seen in the US 10Y yield, but also in bond yields in Europe. Last week, the European Central Bank surprised the market by increasing interest rates by 50bps instead of 25bps, which was the consensus. Theoretically, bond yields in Europe should have shot up higher.

However, the Euro 10Y government bond yield actually broke below important support levels, as you may see from the daily chart below.

Daily Chart: Euro 10Y Government Bond Yield

The market is of the understanding that central banks are forced to raise interest rates to combat inflationary pressures. However, there are technical signs that inflation may not be as high as we fear.

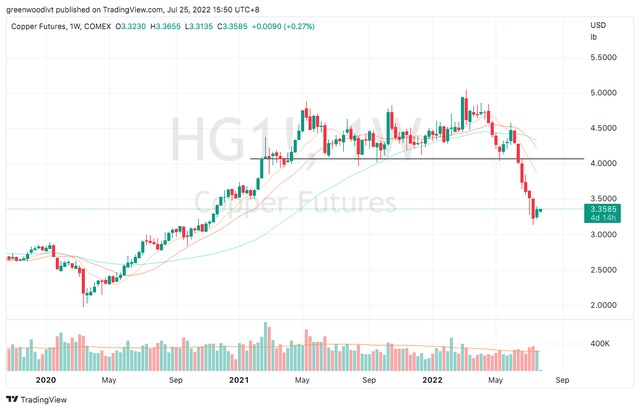

Below is the weekly chart of copper prices, which share a very strong positive correlation with bond yields. Higher copper prices tend to portend higher interest rates, and vice versa.

In the chart, you may observe the same distribution pattern in copper prices as bond yields. The only difference is that copper has already broken below the key level, and look at the magnitude of the drop since then.

Weekly Chart: Copper

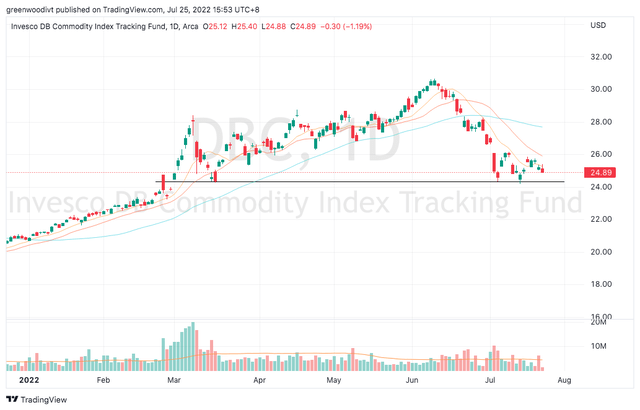

Looking at commodities as a whole, the Invesco DB Commodity Index (DBC), which tracks a diversified portfolio of spot commodity prices, is fast approaching key support levels. DBC is potentially building a large distributive pattern too, with price now contained by downward sloping moving averages on the daily chart.

Daily Chart: Invesco DB Commodity Index

If we really get lower yields in the market, what are some of the big beneficiaries? Without a doubt, growth stocks and cryptos.

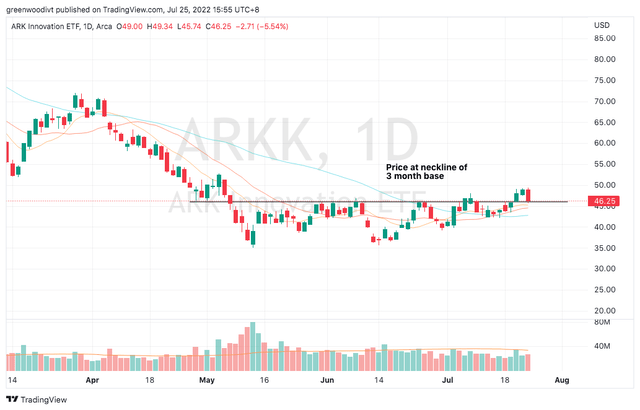

The ARK Innovation ETF (ARKK) has been building a base for 3 months running, and has peeked above the neckline. Price is now retesting this breakout zone, and I think we will get a firm directional move after the Fed meeting.

Daily Chart: ARK Innovation ETF

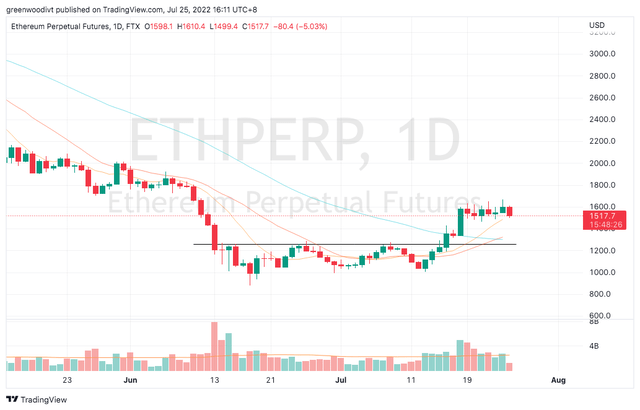

In addition, a number of altcoins in the crypto space broke out from bases last week, which supports the bullish price action that we are seeing in the growth space as a whole. Ethereum is a proxy for altcoins, and it has broken out higher from a 1-month base, and is now trading in a tight range as we approach the Fed meeting.

Daily Chart: Ethereum

Is this the bottom for growth? No one will know for sure. But the technical developments across many key markets point towards a tradable bottom at the very least for growth sectors.

Be the first to comment