SolStock

Introduction

Shares of Keurig Dr Pepper (NASDAQ:KDP) look strong +1.5% YTD despite monetary tightening. The company continues to pass on price increases to the end consumer and increase sales. In my personal opinion, a period of economic uncertainty allows leading companies to increase market share, because leaders can use economies of scale and leverage. In addition, the company continues to effectively control costs to maintain operating profitability.

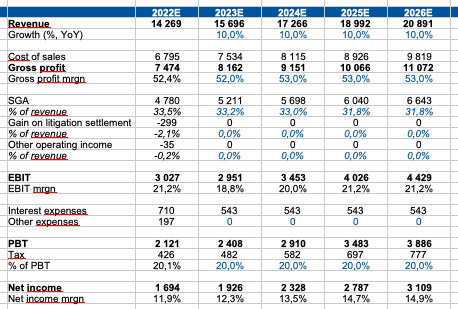

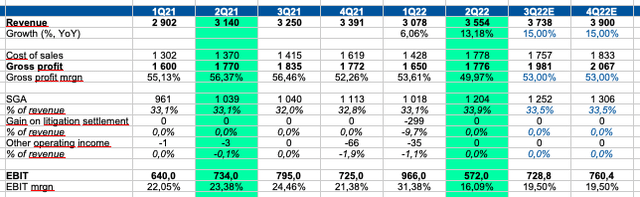

Projections

Gross margin: I expect a modest recovery in the gross margin in the coming quarters on the back of rising prices for the company’s main products, slowing inflation in the main categories of raw materials, and lower incremental costs that we saw in 2Q 2022. Next, I set a near-stable gross margin that will reach 53% by 2026.

SGA: I believe we will see a slight reduction in SGA spending (% of revenue) in the coming quarters. Next, I predict a slight reduction in SGA spending (% of revenue) from 33.5% in 2022 to 31.8% in 2026 in my DCF model.

Revenue growth: based on historical data, management statements and current inflation forecasts, I believe that the company will continue to show double-digit growth in the following periods. First, it is easier for the leading companies in the market to use economies of scale and shift inflation onto the end consumer. In addition, I believe that the company will continue to show growth in volume terms due to new products and geographies.

Quarterly projections:

Yearly projections:

Personal calculations

Valuation

To value a company, I prefer to use the DCF model and calculate multiples because:

1) The company has a long history of reporting so I can research past periods and make assumptions based on historical data

2) The company’s business is stable, so it’s easier to make assumptions about future growth rates

3) Based on historical data, macro data and management forecasts, I can make assumptions about cost growth and profitability

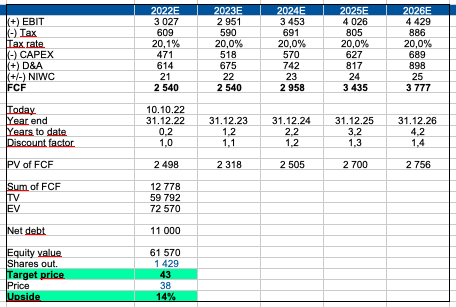

For evaluation, I use the following inputs:

WACC: 7.7%

Terminal growth rate: 3%

Personal calculations

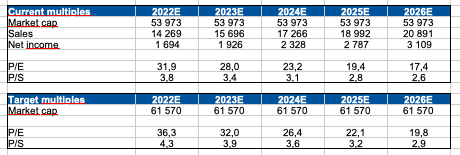

Multiples

Personal calculations

Drivers

Macro: decrease in inflation and recovery in consumer confidence will support consumer spending and support the company’s revenue in the coming periods.

Growth: the growth in traffic and average check, as well as the successful opening of new stores, can have a positive impact on the company’s revenue growth rate too.

Margin: effective cost control can help a business maintain operating margins.

Risks

Macro: continued tightening of monetary policy, lower consumer confidence and lower real incomes could have a negative impact on revenue growth due to lower consumer spending in the discretionary segment.

Margin: rising prices for raw materials, commodities, energy and transportation may lead to a decrease in the operating profitability of the business

COVID: the return of the COVID pandemic could have a negative impact on operations because new restrictions could disrupt supply chains

Conclusion

Despite the fact that the company is facing rising costs and declining operating margins, in my personal opinion, now is not a bad time to go long. First, the rise in prices for basic commodities has stabilized. Secondly, the company is one of the market leaders, and it is easier for the leader to use economies of scale and leverage to maintain profitability against the backdrop of smaller players. In addition, the company’s business is stable and predictable, which is especially important for investors in the face of pressure on consumer spending in other sectors. Thus, according to my DCF model, the company is trading below the fair level of $43 (upside potential 14%).

Be the first to comment