tupungato

Thesis

Kering (OTCPK:PPRUF) (OTCPK:PPRUY) stock is down about 30% YTD, materially more than most of the major equity indices. The company now trades at very attractive risk/reward levels. Notably, at a x14.7 P/E Kering trades at a 30% discount to LVMH, which is not justified, in my opinion. Based on a residual earnings framework, anchored on analyst EPS consensus, I see about 20% upside for Kering. My target price is $61.73/share.

About Kering

Kering is a global luxury house and fashion conglomerate, ranking as the world’s third biggest luxury group behind LVMH and Richemont. The company designs, manufactures and distributes the entire spectrum of luxury products–with a special focus on fashion and leather goods. Kering owns an exceptional portfolio of luxury brands, including Gucci, Alexander McQueen, Balenciaga, Bottega Veneta and Saint Laurent. From a revenue contribution perspective, Gucci is the company’s most important brand, accounting for approximately 60% of total revenues, followed by Saint Lauren with about 15% and Bottega Veneta with nearly 5%. The rest is made by other houses. From a geographic perspective, Asia is Kering’s the most important end-market with about 35% of sales—as for most luxury sellers. But Europe and the North America Region are also important accounting for 30% and 20% respectively.

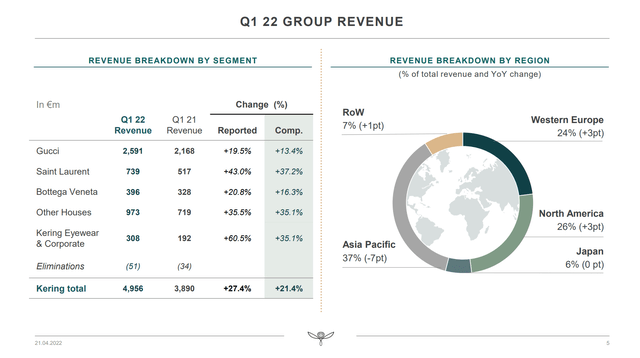

Strong Q1 2022

Kering delivered a very strong Q1 2022 with 27.4% sales growth for the group. On a comparable basis, exclusive of currency tailwinds, revenue grew 13.4%. Gucci underperformed as compared to other segments, growing only 19.5%. The underperformance, however, appears temporary as the brand has significant exposure to China, which suffered from economic headwinds and lockdowns. Most notably, e-commerce sales increased 34% year-over-year and now account for approximately 15% of total retail sales. With regards to geographical revenue breakdown, there were some significant changes as compared to 2021. Asia-Pacific still is the group’s strongest region but now accounts for only 37% of group revenue, which represents a drop of 7 percentage points. North America and Western Europe, each gained 3 percentage points accounting for approximately 26% and 24% of the group’s total revenue.

Fundamentals Indicate Bargain Opportunity

In general, Kering’s financials are strong. In 2021, Kering generated revenues of $20.87 billion and achieved net-income of $3.929 billion (18.8% margin). The company’s balance sheet is strong. As of Q1 2022, Kering recorded cash and cash equivalents of $5.98 billion and total debt of $11.29 billion. Cash from operation was $5.55 billion in 2021. That said, Kering could achieve a net-cash position as early as by 2023—implying more than adequate balance sheet strength to justify shareholder distributions and/or strategic M&A.

Kering is valued very attractively. Kering stock is currently trading at one year forward x16.8 P/E, x8.8 EV/EBITDA and x4.6 P/BVPS. Most notably, all of these multiples are more than 2.2 standard deviations below the company’s 2-year historical trading multiples. For example, if we anchor on P/E and consider a 2-year historical average of x23.5, the stock would have more than 30% upside—if multiples were to mean revert. Moreover, if we assume that Kering and LVMH should trade at the same multiple, Kering currently trades at a 20% discount (LVMH trades at X20.8 P/E vs Kering at x16.7 P/E).

Residual Earnings Valuation

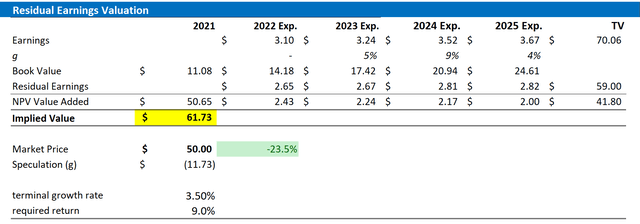

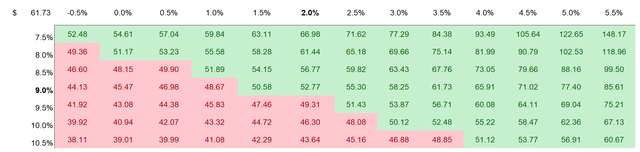

Let us now look at Kering’s valuation in more detail. I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS ’till 2025, a WACC of 9% and a TV growth rate equal to nominal GDP growth (3.5%).

In my opinion, the long-term growth assumption equal to GDP growth might definitely be an underestimation, in my opinion, but I prefer to be conservative. If investors might want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to Kering’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $61.73/share, implying approximately 23% upside potential based on accounting fundamentals.

Analyst Forecast, Author’s Calculation Analyst Forecast, Author’s Calculation

Risks

In my opinion, Kering stock is significantly de-risked at a P/E (FWD) below 20 and the risk/reward looks favorable. However, investors should note the following risks that might cause Kering stock to significantly deviate from my target price: 1) slowing consumer confidence due to inflation outpacing wage growth, rising interest rates and increasing unemployment; 2) Kering’s significant exposure to China, which is especially Covid-19 lockdowns; 3) macroeconomic uncertainty relating to the monetary policy actions of the ECB and actions of the European government against Russia.

Conclusion

In my opinion, Kering is a quality company with a strong portfolio of iconic brands. In addition, I believe stock is undervalued as there are three ways to calculate >20% upside for the stock. First, investors could anchor on a residual earnings valuation based on analyst consensus estimates. Second, investors could consider the 20% premium gap versus LVMH, which is not justified in my opinion. Third, investors could argue that Kering’s valuation multiples will mean revert to the 2-year historical average. Personally, I anchor on a residual earnings valuation and calculate a base-case target price of $61.73/share.

Be the first to comment