Bill Pugliano

Many analysts are expecting an economic downturn in 2023. Inflation is high. The Federal Reserve has increased interest rates to 3.75% to 4% in an attempt to curb inflation to bring it in line with the desired benchmark annual inflation rate of 2%. This is the highest interest rates have been since 2008, and interest rates for debt like mortgages have increased rapidly.

There is fear that the current environment could lead to a recession next year, despite very low unemployment figures. If a recession hits, equities in the consumer staple space should perform higher than many others. Consumer staple companies provide products that people continue to buy in all economic conditions. People who receive unemployment insurance and EBT payments through SNAP still need to eat, so popular foods are not as likely to see big drops in their sales.

A food company that should continue to produce sales and profits in a recession is Kellogg Company (NYSE:K). Additionally, the company should have pricing power in a recessionary environment because of brand name identification.

Kellogg Overview

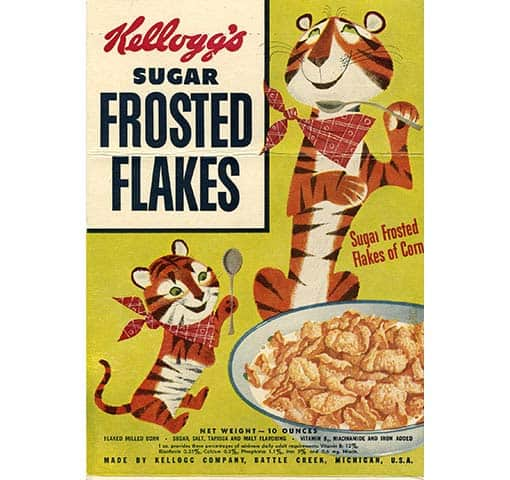

One producer of popular breakfast and snack foods is Kellogg. This company has been in business since 1894, when W.K. Kellogg first created the corn flake. Today, the company sells more than just Corn Flakes (or Corn Flakes with sugar, known as Frosted Flakes…They’re Grrrreat!). Several years ago, the company bought out Pringles, and it also produces Cheez-Its, among other popular snacks. Additionally, those who love Eggo Waffles for breakfast contribute to Kellogg’s bottom line. People have purchased these breakfast foods and snacks for decades, and they will likely continue to do so well into the future.

Kellogg’s Frosted Flakes from 1952 (Kellogg)

Over the past 10 years, Kellogg has had flat revenue. It has decreased ever-so-slightly from $14.197 billion to $14.181 billion between 2012 and 2021. The estimated revenue for 2022 is pretty much flat, as well. Although the revenue is slightly down over ten years, it’s actually increased from a December 2017 low of $12.854 billion.

While the company’s revenue is down, net income has increased over the same period. There was an anomaly in 2013, when net income was $1.8 billion. Outside of this outlier, the number has come in over $1 billion for four of the last five years, hitting a high of $1.495 billion in the last annual report. This followed three straight years in which net income peaked at $700 million. Therefore, the net income is trending in the right direction.

Many income-focused investors purchase K for its dividend. The current estimated forward yield is 3.29%, which is well above the overall yield for the S&P 500 (SPY). As of 11/22, the yield is 3.24% based upon a closing price of $72.03. The payout ratio is only 56.55%, which indicates that the dividend should be safe in the near term.

Dividend growth investors will likely appreciate the fact that Kellogg has increased its dividend for 17 straight years. However, the growth has been slow in recent years. The most recent increase (from $0.58 per share per quarter to $0.59), was a 1.3% increase. The past five years have seen an average increase of only 2.24%. This has been a very slow incline. In other words, K has been a boring stock. Share prices are actually down about $14 from the all-time high – that was set in 2016.

However, when comparing K to the market as a whole, the company has actually performed quite well. It’s up 11.36% YTD, while the SPY is down 16.29%.

This goes back to the initial analysis that consumer staples tend to perform relatively well in recessions and down markets. The company’s share price over the past ten years has been boring. Dividends – boring. Dividend growth – boring. Why would investors look at K now?

Considering K: It’s About to Get Less Boring

Boring can actually be beautiful when investing in stocks. Many people have made a killing by investing in companies like Kellogg or Coca-Cola (KO) over the long run. Growing dividends can provide quite a bit of income over a period of decades. However, the dividend is not the only thing that makes Kellogg interesting at this point.

The company is planning to break up, spinning off two branches next year. The “Global Snacking Co.” provides most of the company’s revenue–about $11.4 billion in global net sales. The traditional cereal company will focus on North America, and it involves about 20% ($2.4 billion) of the company’s sales. The third company will be a plant-based food operation that will house the MorningStar Farms brand and other options that will likely provide the biggest opportunity for growth in the long run. The company believes that the latter will offer “a significant opportunity to capitalize on strong long-term category prospects by investing further in North America penetration and future international expansion.”

If the company’s expectations for the plant-based company play out, this could pay off well for investors. With marketing expertise likely carrying over, the spinoff company could see growth in a market that’s increasingly interested in sustainability. Additionally, plant-based foods seem to be increasing in popularity, growing by 27% in 2020 alone, so this could provide a big driver of growth into the future. Finally, a smaller company can take more initiative that can drive growth that exceeds the growth of a large company like the current iteration of K.

Those who purchase shares of Kellogg today would have shares in not one, but three companies after the spinoff of the Cereal Co. and the Plant Co. in 2023. The specific names are not spelled out yet, but Kellogg has promised to “maintain a strong aggregate dividend and return-on-capital profile across the three businesses.” It’s likely that purchasing all three companies after the spinoffs will require more capital than purchasing shares of K today.

Therefore, those who want an opportunity to get shares in three companies with one purchase might want to purchase Kellogg before the spinoff. Spinoffs frequently unlock value and provide higher growth. It’s not a given, but it’s a decent possibility.

Be the first to comment