Juanmonino

Investment Thesis

- The Seeking Alpha Quant Ranking places Kellogg (NYSE:K) 16th (out of 56) within the Packaged Foods and Meats Industry and 59th (out of 188) within the Consumer Staples Sector.

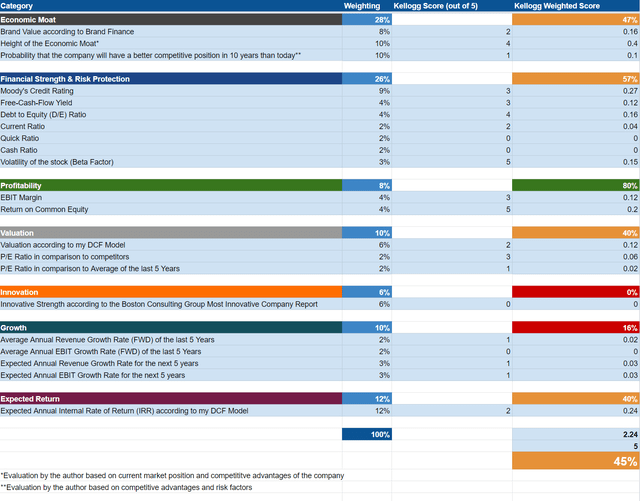

- The HQC Scorecard demonstrates that Kellogg is only moderately attractive in terms of risk and reward: Kellogg receives an overall rating of 45 out of 100 points and only in terms of Profitability is the company rated as very attractive. In the categories of Economic Moat, Financial Strength, Valuation and Expected Return, it is rated as moderately attractive; in terms of Growth, however, the company is rated as very unattractive.

- I rate Kellogg as a hold: the current valuation of the company is not low enough to rate it as a buy. Although Kellogg shows high profitability, its growth rate is not attractive enough at the current valuation.

Kellogg’s Competitive Advantages

In a previous analysis on Kellogg, I took a more detailed look at the competitive advantages of the company:

“Due to the high and relatively stable earnings that Kellogg generates year over year, the company is able to spend a substantial proportion of its earnings on the research and development of new products as well as in the marketing of its existing products. In 2021, Kellogg spent $134 million on research and development and $790 million on advertising. Those spendings make it more difficult for potential competitors to enter into the already highly competitive consumer goods market.”

Furthermore, I mentioned that Kellogg has managed to build a relatively strong brand image:

“Kellogg has managed to build brands and to create a product distribution network during its more than 100 years of history as a company. Furthermore, they have been able to build economies of scale that help the company to stand out against their competitors. With Pringles, Kellogg owns a strong consumer brand that the company acquired from Procter & Gamble (NYSE:PG) back in 2012. With the brands Kellogg’s and Cheez-It, the company has a number of important brands in its product portfolio that consumers have been familiar with for decades.”

Additionally, I explained why I think the Kellogg stock could contribute to the reduction of volatility in your investment portfolio:

“I believe that the competitive advantages listed above will ensure that Kellogg will continue to be able to generate stable profits in the future. Due to the company’s proven ability to generate high profits even in economically challenging times, I assume that Kellogg’s stock will continue to be less volatile than the broader stock market.”

Overview: Kellogg

|

Kellogg |

|

|

Sector |

Consumer Staples |

|

Industry |

Packaged Foods and Meats |

|

Market Cap |

$25.68B |

|

Employees |

31,000 |

|

Revenue [TTM] |

$14.58B |

|

Operating Income |

$1.98B |

|

Revenue 3 Year [CAGR] |

1.92% |

|

Revenue 5 Year [CAGR] |

2.68% |

|

Gross Profit Margin |

30.96% |

|

EBIT Margin |

13.56% |

|

Return on Equity |

35.29% |

|

Free Cash Flow Yield |

5.04% |

|

Dividend Yield [FWD] |

3.13% |

|

Dividend Payout Ratio |

55.24% |

Source: Seeking Alpha

Kellogg’s Valuation

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Kellogg. The method calculates an intrinsic value of $69.60 for the company. The current stock price is $75.59, which results in a downside of 7.90% for Kellogg.

Kellogg’s Revenue Growth [FWD] Rate is 3.15%. I have made more conservative assumptions and for my DCF Model have assumed a Revenue and EBIT Growth Rate of 2% for the company over the next 5 years. Furthermore, I assume a Perpetual Growth Rate of 2%. Due to Kellogg’s low growth perspectives (which is underlined by the D- rating for Growth as according to the Seeking Alpha Factor Grades), I expect the company to grow slightly below the United States’ Average GDP Growth Rate of 3%. I have used its current discount rate [WACC] of 6% and Tax Rate of 24.1%. Furthermore, an EV/EBITDA Multiple of 8.7x was used, which is the company’s latest twelve months EV/EBITDA.

Based on the above, I calculated the following results:

Market Value vs. Intrinsic Value:

|

Market Value |

$75.59 |

|

Upside |

-7.90% |

|

Intrinsic Value |

$69.60 |

Source: The Author

Relative Valuation Models

Kellogg’s P/E [FWD] Ratio

Kellogg’s P/E Ratio is 19.56, which is 17.05% above its average of the last 5 years (16.71), thus providing an additional indicator that the company is currently overvalued.

Kellogg According to the Seeking Alpha Factor Grades

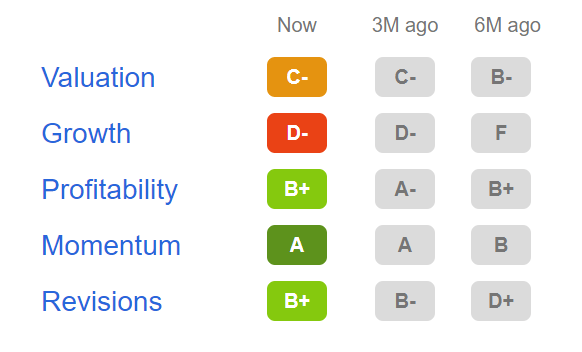

According to Seeking Alpha’s Factor Grades, Kellogg is rated with a C- in terms of Valuation. Regarding Growth, the company gets a D- rating. In terms of Profitability, Kellogg is rated with a B+. For Momentum, it gets an A and for Revisions, a B+.

Source: Seeking Alpha

This rating as according to the Seeking Alpha Factor Grades, strengthens my belief that the company is currently not attractive enough both in terms of Valuation and Growth to receive my buy rating.

Kellogg According to the Seeking Alpha Quant Ranking

The Seeking Alpha Quant Ranking puts Kellogg in 16th position (out of 56) within the Packaged Foods and Meats Industry, and 59th (out of 188) within the Consumer Staples Sector.

Source: Seeking Alpha

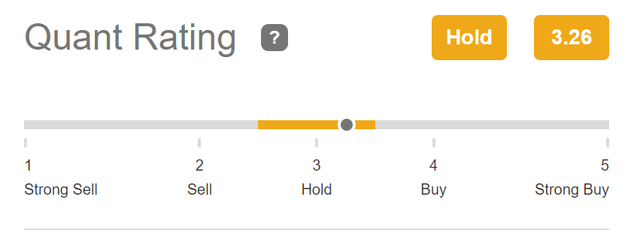

Kellogg According to the Seeking Alpha Quant Rating

According to the Seeking Alpha Quant Rating, Kellogg is rated as a hold, which once again underlines my own hold rating for the company.

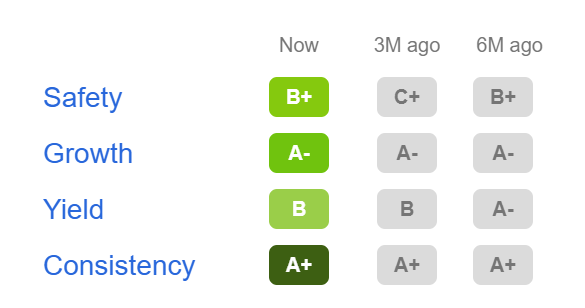

Kellogg According to the Seeking Alpha Dividend Grades

According to the Seeking Alpha Dividend Grades, Kellogg is rated with a B+ in terms of Dividend Safety and an A- in terms of Dividend Growth. For Dividend Yield, the company gets a B and an A+ for Dividend Consistency.

Source: Seeking Alpha

Kellogg’s strong results as according to the Seeking Alpha Dividend Grades, demonstrate that even if the company is not rated as attractive in terms of Valuation and Growth, its stock could still be appealing for dividend income investors seeking to reduce the volatility of their investment portfolio. Kellogg’s 60M Beta of just 0.43 and 24M Beta of 0.28 backs up this theory.

The High-Quality Company [HQC] Scorecard

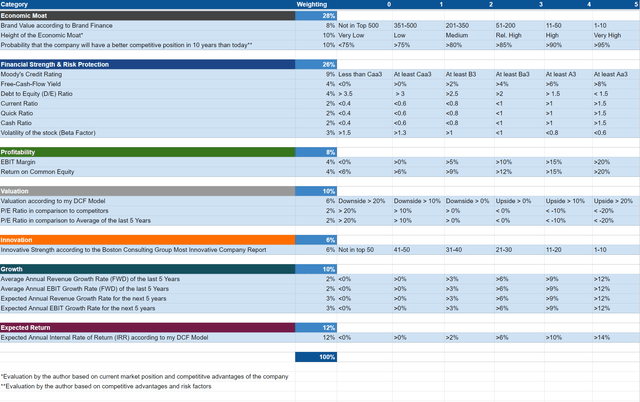

“The HQC Scorecard aims to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here, you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Kellogg According to the HQC Scorecard

According to the HQC Scorecard, Kellogg receives an overall score of 45 out of 100 points. In terms of risk and reward, this means it can be classified as moderately attractive.

The HQC Scorecard indicates that Kellogg is only rated as very attractive in the category of Profitability. In the categories of Economic Moat, Financial Strength, Valuation and Expected Return, the company is rated as moderately attractive. For Innovation and Growth, it has a very unattractive rating.

This moderately attractive overall scoring in terms of risk and reward and the very unattractive rating for Kellogg in terms of Growth (underlined by the results of the Seeking Alpha Factor Grades) strengthen my belief in continuing to rate the company as a hold.

Risk Factors

In my previous analysis on Kellogg, I shared my thoughts on the most significant risk factor concerning an investment in the company:

“I see the strong and intense competition in the consumer goods industry as one of the main risks for Kellogg. The company has strong competition from competitors like PepsiCo (PEP), who are growing faster than Kellogg. At the same time, competitors such as PepsiCo, Nestle (OTCPK:NSRGY) and Danone (OTCQX:DANOY) have been able to establish even stronger brand images than Kellogg. For example, PepsiCo is ranked at 36 on the Forbes list of the most valuable brands in the world. Furthermore, PepsiCo even has some sub brands that are ranked on the list such as Frito Lay. Nestle is ranked at position 54 and Danone at 82. Kellogg, however, does not appear in the ranking of the 100 most valuable brands in the world.”

At the same time, I explained why I think a high inflation environment could also be a problem for Kellogg:

“In times of high inflation like now, companies with the strongest brand images are the most likely to be able to pass on to consumers the increased costs they have in the manufacturing process of their products. That’s why I think that a company like Kellogg, which doesn’t have such a strong brand image in comparison to some of its competitors, could be more likely to suffer from high inflation. Thus, they might not be able to pass the higher prices on to consumers to the extent that PepsiCo can, potentially resulting in lower profitability for the company in the future.”

These risk factors also contribute to the fact that I currently rate Kellogg as a hold.

The Bottom Line

In this analysis I have used different valuation methods that have contributed to my overall conclusion: a hold rating for Kellogg.

The DCF Model shows that Kellogg is currently slightly overvalued by demonstrating a downside of 7.9%. Relative Valuation Models (such as the P/E Ratio) further demonstrate that the company is currently slightly overvalued: with a P/E Ratio of 19.56, which is 17.05% above its average of the last 5 years (16.71).

The results of the Seeking Alpha Factor Grades in terms of Valuation (C- rating) and Growth (D- rating) strengthen my decision to rate Kellogg as a hold. Kellogg’s only moderately attractive rating in terms of risk and reward as according to the HQC Scorecard, once again underlines my own rating. The company’s very unattractive rating in terms of Growth also plays a major role in cementing my opinion.

From my point of view, the Kellogg stock is currently only appealing for dividend income investors seeking a stock that contributes to reducing the volatility of their investment portfolio. Proof of this is Kellogg’s low 60M Beta of just 0.43 and the company’s 24M Beta of only 0.28. For all other investors, I would recommend waiting until the valuation of the stock is lower before investing in the company.

Author’s Note:

Thank you very much for reading! If you have any questions regarding this analysis, feel free to leave a comment below! I‘m happy to discuss your thoughts on Kellogg.

Be the first to comment