RichLegg

KB Home (NYSE:KBH) is a tale of two stories in 2022 between record financial results against a weaker outlook for the housing market. The company benefited from the pandemic real estate boom, which has translated into strong earnings, while the poor stock price performance this year reflects a slowdown in new business. Headwinds include mortgage rates and broader macro concerns.

That being said, we see signs that some of the pessimism may be unjustified, considering several other positive dynamics. We’ll note that the climb in home prices supports a strong operating margin that likely has further upside as supply chain disruptions and inflation pressures ease. The robust labor market also provides an underlying level of housing demand, well positioned to absorb the construction backlog. A scenario where macro conditions improve going forward could set KBH up as a compelling turnaround pick for 2023.

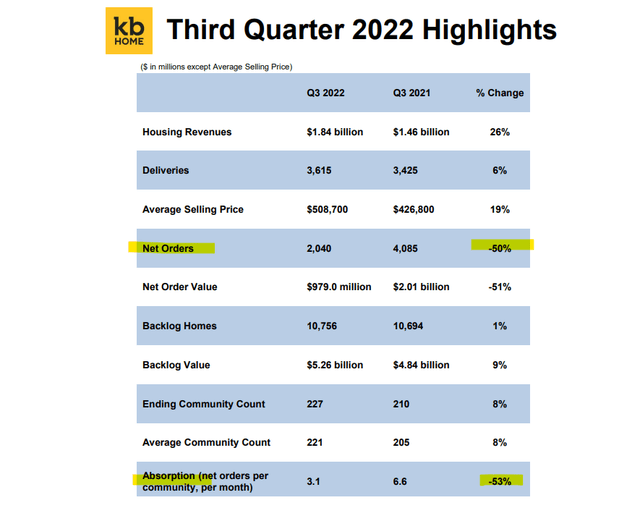

KBH Key Metrics

The company last reported its fiscal Q3 earnings in late September, headlined by housing revenues at $1.8 billion, up 26% year over year. The drivers included a 19% increase in the average selling price of its homes built to $509k, with deliveries reaching 3,615 units from 3,425 in Q3 2021.

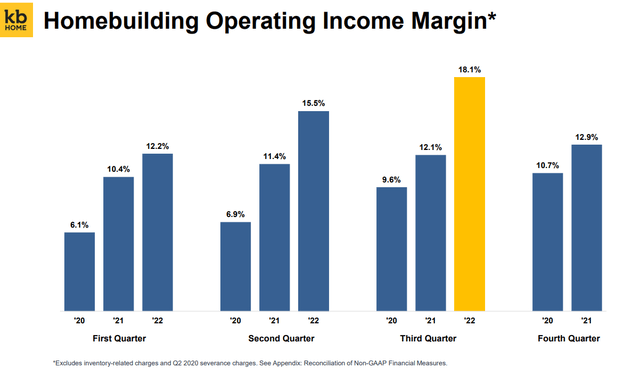

Those operating trends drove EPS to $2.86, up 79% y/y. This figure captured both the top-line strength as well as the gross margin increased by 520bps to 26.7%, driven by the higher home prices and the supply and demand conditions when the orders were initially placed going back to 2020 and 2021.

There was also an effort at improving efficiency, evidenced by SG&A as a percentage of revenue, which declined to 8.9% compared to an average above 10% in recent years. The understanding is that some of this earnings momentum will continue over the next few quarters.

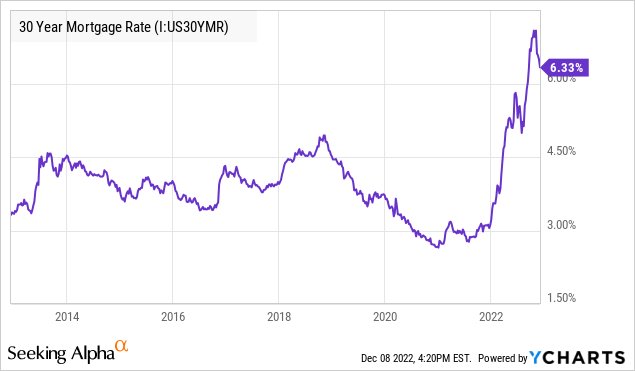

On the other hand, the more concerning trend is the pace of net orders which declined by 50% to 2,040 units compared to 4,085 in Q3 2021. Here, the issue considers the economic environment that follows current U.S. housing market indicators like falling pending and new home sales, largely correlated to mortgage rates reaching a decade high. The factor is also seen in the lower absorption rate at 3.1 compared to 6.6 last year, indicative of weaker demand.

One of the themes during the conference call was to maintain a sense of resiliency despite the more somber market headlines. On this point, cancellations at 9% which is tracked internally were still below historical levels. Sequentially, the trend in net orders and the absorption rate is also expected to stabilize, recognizing that the 2021 reference point was exceptionally strong.

For Q4, with results expected to be released in early January, the company is guiding for revenues around a midpoint estimate of $2.0 billion, a 22% y/y increase. A targeted operating margin at 16.7% implies continued earnings growth leading to more difficult comps by Q1 2023. Finally, we can mention that the balance sheet is strong, ending the quarter with $195 million in cash against $2.0 billion in financial debt. The debt-to-capital ratio is also lower compared to 2019.

What’s Next For KBH?

There’s no bullish case for KBH without taking a more optimistic view of the economy, with room for conditions in housing to at least stabilize from current levels. Any scenario looking for a deepening recession defined by a wave of higher unemployment or persistently stubborn inflation would open the door for a real “collapse” of the housing market akin to the experience during the great financial crisis of 2008. The case we make is that we’re not there yet, and any of those doom and gloom calls are far from certain.

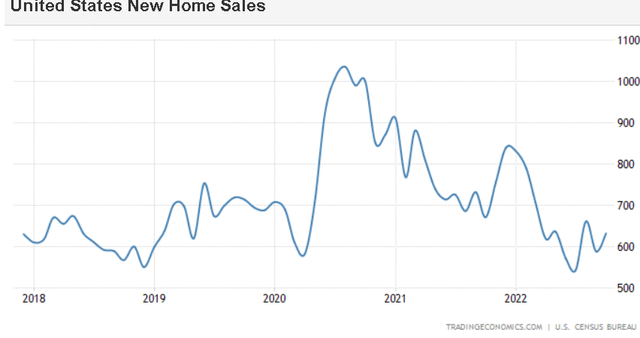

The first point here just looks at the national trend in new home sales, last reported at 632k units for October, which was an uptick from levels in prior months. While the headline figure is down more than 40% from the 2020 pandemic peak above one million, 600k is still around the average from the year before the pandemic. Again, there’s been a sharp correction but the data needs to be placed in context.

One of the surprising trends this year has been the strength of the labor market, with the monthly payroll data beating estimates over the last several months. In our view, the workforce housing demand helps to balance the issues related to affordability and the impact of high-interest rates.

On this point, we’re entering 2023 with a real possibility that long-term rates have peaked, which can be observed through a recent dip in the 30-year mortgage rates last quoted as an average at 6.33% compared to a cycle peak of 7%. This call would depend on a confirmation that inflation is trending lower, opening the door for them to slow the pace of its hawkish rate hikes.

As it relates to the housing sector and KB Home, a stabilization in rates could provide confidence for more positive consumer sentiment as a catalyst for home-buying activity. The impact here would also be positive for the company’s financing activities and land inventory investments. Lower inflation would be positive for earnings through lower construction input costs.

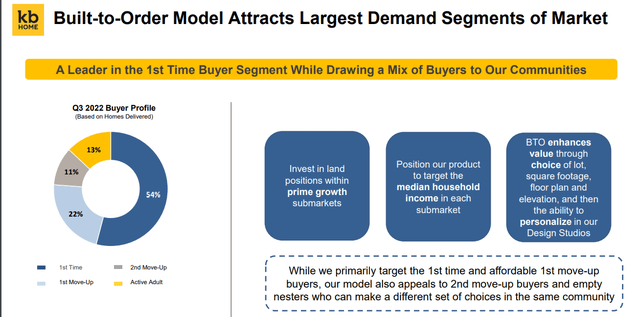

What we like about KBH is its leadership position in the segment of residential first-time buyers, with a coast-to-coast diversification. The company’s build-to-order model adds value to the home-buying process that appeals to many potential customers. Beyond the near-term uncertainties, structural market trends like the underlying housing shortage and tight supply conditions support a positive long-term outlook.

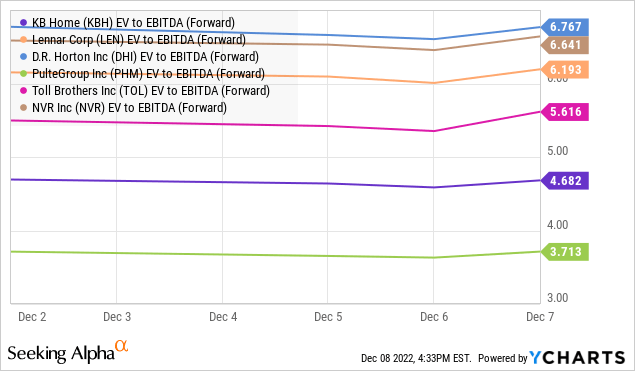

In terms of valuation, KBH trading at a 4.7x EV to forward EBITDA multiple trades at a discount to many of the other sector names like D.R. Horton, Inc. (DHI) 6.8x, NVR, Inc. (NVR) 6.6x, Lennar Corp. (LEN) at 6.2x, and Toll Brothers, Inc. (TOL) on the luxury side at 5.6x. We see room for this spread to converge higher as part of the bullish case for the stock.

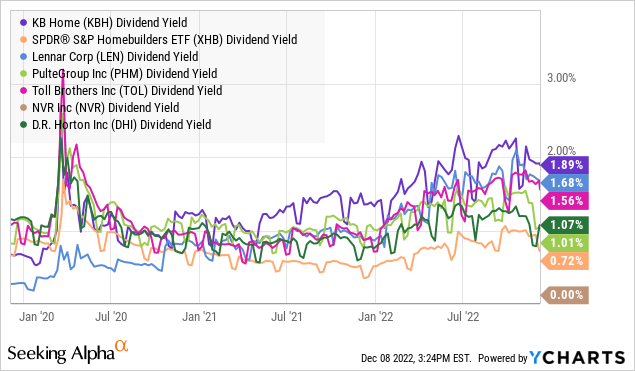

Separately, it’s also interesting that KBH offers a marginally higher dividend yield of 1.9%, compared to a group average closer to 1.25%. KBH appears cheap by this metric, considering shares have historically yielded lower, with a historical average under 1% over the past decade.

KBH Stock Price Forecast

Taking a look at the stock chart, KBH is more than 40% from its 2021 high, suggesting a large part in the turn of events compared to what was likely exuberance during the pandemic has already been priced in. With a reset of valuation, we see room to take a bullish view on KBH with a combination of value and some optimism on the economy. Still, the baseline is to expect continued volatility in the stock.

The good news is that shares appear to have formed a bottom, consolidating around the current $30 level over the last several months, including a rally since the earnings report in September. A potential breakout higher here above ~$32 would represent a technical buy signal, placing the bulls back in control with positive momentum.

We mentioned the risk that the economy simply sputters and deteriorates from here. A move below in the stock under ~$25 would signal a more concerning outlook. Monitoring points over the next few quarters include housing market indicators and trends in the company’s backlog and net orders.

Be the first to comment