This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

Kansas City Southern (KSU) recently reported solid first-quarter results helped by strong revenue growth and impressive cost controls. The company’s Q12020 revenues grew by 8% and adjusted expenses declined by 2% resulting in a 29% growth in adjusted operating income and over 100% incremental margins. Its adjusted EPS was $1.96, up 30% over the prior year. The company’s adjusted operating ratio of 59.7 improved 650 basis points over the first quarter of 2019 and is the first sub-60 operating ratio posted by the company in any quarter.

When the company first introduced Precision Scheduled Railroading [PSR] initiative to reduce cost last year, its target was to reach an operating ratio of 60% to 61% by 2021. It then increased its target to a sub 60% operating ratio by 2021 based on FY2019 performance. It appears that the company would have reached this goal in 2020 itself if there wasn’t a macroeconomic shock from COVID-19.

Management hasn’t slowed down because of COVID-19 though. They reiterated their outlook for $61 million in incremental savings in 2020. This outlook is unchanged from the update that they provided in January despite the anticipated negative volume impact of COVID-19 relative to their original plans.

Aggressive cost reduction

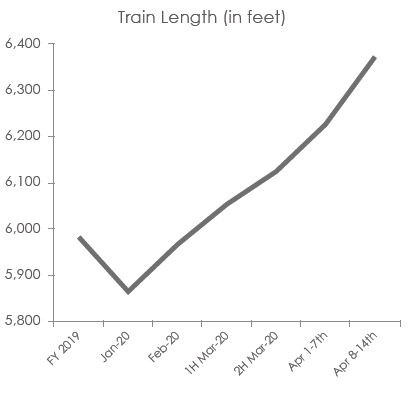

In response to COVID-19 management is aggressively reducing expenses on a real-time basis to offset volume reductions. The following chart shows how quickly the company has reacted to volume deceleration in April due to plant shutdown by reducing daily train starts and increasing train length.

Source: Company Presentation

Reducing one daily train start equates to ~$2 mn in annual savings while increasing train length helps the company reduce cost by moving more goods per train.

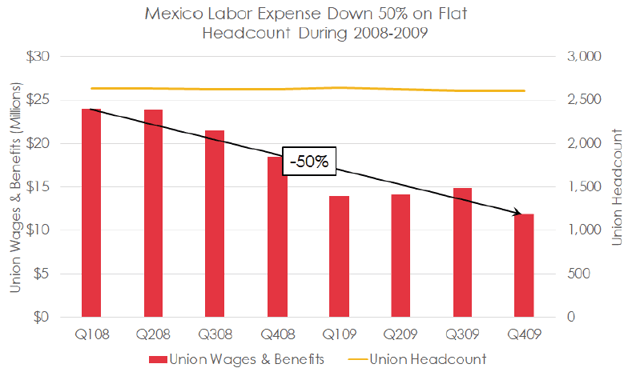

Kansas City Southern also benefits from a highly variable cost structure of its Mexico business. Over 75% of its payments to Mexican workers are variable in nature. This helped the company in the last cycle when it was able to reduce Mexico’s labor expense by half despite flat headcount.

Source: Company Presentation

Retaining the workforce keeps the company well-placed for a recovery in case volumes come back while decreasing payments help reduce operating cost and limit downside.

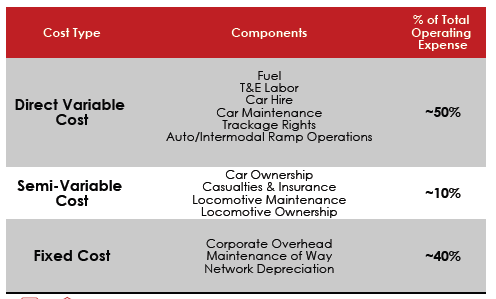

Overall, management believes that ~50% of the company’s total expenses are variable, ~10% semi-variable, and ~40% fixed cost in nature.

Source: Company presentation

Estimates

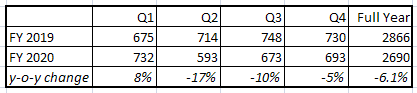

For the first fifteen days of April, management said that it is seeing volumes down ~21%. However, comparisons in the first fifteen days were also impacted by the timing of Good Friday. Last year, Good Friday occurred on April 19th and impacted the second half of April. This year Good Friday fell on April 10th and impacted volumes in the first half of April. So, the trend is more like high teens decline in volume decline if we adjust for Easter timings. Looking forward, I believe with the economy slowly reopening, the decline will moderate in May and June. If we assume April volumes to be down in high teens and May and June Volume down mid-teens, Q2 volume can be down ~17%. For Q3 and Q4, I am assuming 10% and 5% year-over-year declines, respectively.

In a normal environment, railroads are usually able to raise pricing above inflation. However, this is a very different environment and customers are asking the company to be more accommodating in terms of price. So, I am assuming a flattish pricing environment in the current year. So, revenue decrease will be roughly in line with volumes. A 17% revenue decline in Q2, 10% in Q3, and 5% in Q4 give us a 6.1% revenue decline for the full year.

Source: Company filings, GS Analytics estimates

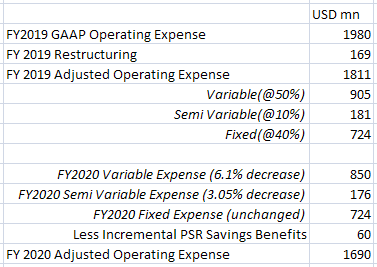

On the operating expense front, as discussed above, approximately 50% of costs are variable, ~10% semi-variable, and ~40% are fixed. If we assume variable cost declining in line with revenues, semi-variable cost declining at half the rate of revenue decline, and fixed cost remain unchanged, the company’s adjusted operating expenses will be approximately $1690 in the current year (see calculations in the table below). In this calculation, I have assumed ~$60 mn incremental benefits from the PSR initiative this year. The company achieved ~$58 mn in annualized cost savings last year and is expected to achieve ~$61 mn in annualized cost savings this year. I have assumed that half of the benefits from $58 mn of cost savings were already realized last year. So, the incremental benefits from last year’s PSR savings will be $29 mn this year. In addition, the company will also see half of the benefit from the planned savings of $61 mn in the current year. This gives the total incremental benefit of $59.5 mn (or approximately $60 mn) from the PSR initiative this year.

Source: Company filings, Management commentary, GS Analytics estimates

Subtracting operating expenses from revenues, we get an FY2020 operating profit estimate of $1 billion for the company. Last quarter the company incurred $34.2 mn in interest costs and earned $2.4 mn in other income/equity in net earnings of affiliates. Annualizing these we have $127.2 mn net impacts from interest and other income. The company also incurred $59.5 mn in foreign exchange losses but I am excluding it from my adjusted EPS calculations. This gives us pretax earnings of $873 mn. Assuming a 28.1% tax rate, we have $628 mn in net income or $6.54 in EPS (using 96 mn share count). This compares to an adjusted net income of $689.9 mn and an EPS of $6.91 per share in FY2019.

My take

While a high single-digit decline in adjusted net income and a mid-single-digit decline in EPS is not something to cheer about, this is much better than what several other companies are experiencing. Further, the company has reduced its capital expenditure guidance to $450 mn for the current fiscal year versus $587 mn last year. So, despite a decrease in net income, it can still increase its free cash flow. Looking beyond the current year, the company’s PSR initiative and structural cost reductions will help it post strong margins and earnings growth as revenue recovery takes hold.

While most of the businesses are facing disruptions due to coronavirus and stock prices have corrected meaningfully across the board, I believe things will improve once the economies begin reopening. I like companies whose businesses have manageable downside risks from the slowdown and can come out stronger on the other side. Kansas City Southern fits this criterion and I believe the stock is a good buy at current levels.

The stock was trading over $175 in mid-February before coronavirus started impacting the U.S. economy. The sell-side consensus EPS estimate for FY2020 was $8.05 at that time giving the company a P/E multiple of 21.74x. Post FY2020, I believe the company can grow its EPS in low to mid-teens for the next few years as it sees benefits from volume recovery and cost savings. I believe the company will be able to regain P/E multiple north of 20x once the recovery starts taking hold. For FY 2021, the current sell-side consensus EPS is $8.06. Applying a 20x P/E multiple, we get one year forward target price of $161.2 or ~22% upside from the current levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment