Gwengoat/iStock via Getty Images

So far, 2022 has been a terrible year for growth investors, continuing the trend started in 2021. High flying, high multiple names have fallen from grace and has been pummeled from the onslaught of higher rate expectations, inflation and the war in Ukraine.

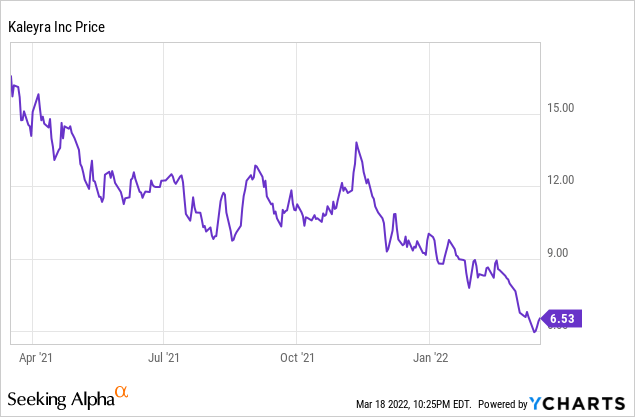

Then there is little old Kaleyra (NYSE:KLR), down a whopping 58% over the last year, despite being one of the cheapest growth company’s in the market today. In this article, I would like to explore potential arguments as to why this is and the potential path forward.

Overview

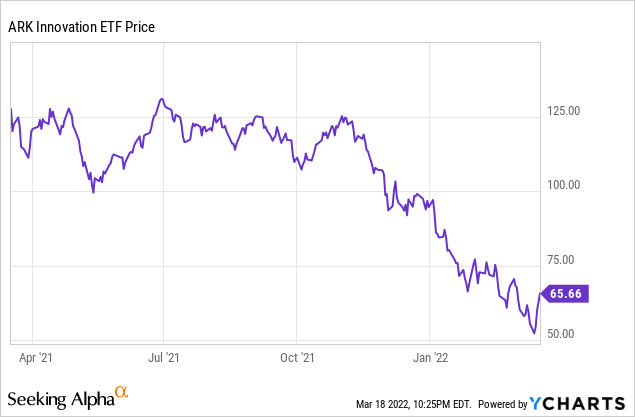

It is no secret that high multiple growth names have been simply eviscerated over the last year given rampant inflation and the expected fed rate hikes looming on the horizon, along with the recent geopolitical developments in Ukraine. A good barometer of these high multiple names has been Cathy Woods ARK Innovation fund (ARKK).

Are you confused as to why I am invoking Cathy Wood when discussing Kaleyra? The answer is that the chart for Kaleyra for some reason closely resembles the ARK Innovation fund, only unfortunately it is slightly worse.

It certainly seems that Kaleyra has been lumped in by the market as a high growth, high multiple stock, despite the unfortunate reality that Kaleyra is priced roughly 30% cheaper than even struggling AT&T (T) on a S/EV basis.

The similarities between ARK Innovation and Kaleyra are few, I see one positive and one negative. The positive similarity with ARK is the high growth that Kaleyra is putting together. Between year end 2020 and the 2022 projected revenues, the company is expected to grow from $147 million in revenue all the way to $401 million, or 272% revenue growth over a 2 year period.

The negative similarity here is the fact that Kaleyra is not yet GAAP profitable. While this fact is legitimate and is of some concern, the valuations placed in the ARK names compared to Kaleyra are simply in another galaxy.

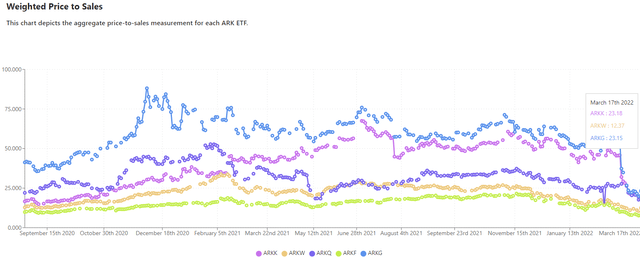

ARK Innovation, as of March 17th, 2022 is estimated to carry a price to sales multiple of 23.18. Kaleyra in comparison sports a 0.89 price to sales ratio, making the difference between the two a ridiculous 2,604%. To put this another way and into proper perspective, if Kaleyra was currently priced the same as the average ARK holding, by my calculations it would be trading today at $161.23.

Given the massive disconnect in valuations, I want to go through a few of the arguments I have seen as to why Kaleyra is so cheap.

GAAP Profitability

It seems likely to me that a major reason the company is becoming intertwined with ARK is due to the lack of consistent profitability, however the company has shown tremendous progress on this front over the last year, in large part thanks to the accretive mGage acquisition.

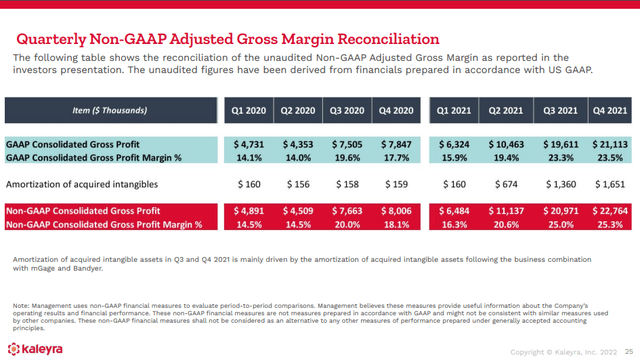

As you can see from the above slide, the company has made year over year progress regarding both GAAP and non-GAAP margins every quarter of 2021 and this trend look set to continue given the increased focus on higher margin services such as voice, RCS and video along with further penetration of the high margin US market.

Now, I am certainly not claiming that Kaleyra will be GAAP profitable in the very near future, so I imagine this point will continue to be used as a bludgeon against the company, however, I do believe that the company is likely to continue to make progress on this front and consistent non-GAAP profitability does appear to be a reasonable expectation considering they are non-GAAP and EBITDA profitable currently.

Stock Based Compensation

One key reason that the company is not GAAP profitable and may not be in the near future is the stock based compensation expense they award. The company during the last 12 months has issued $25.6 million in stock based compensation, with the last two quarters, representing the period after the mGage acquisition showing $14.2 million.

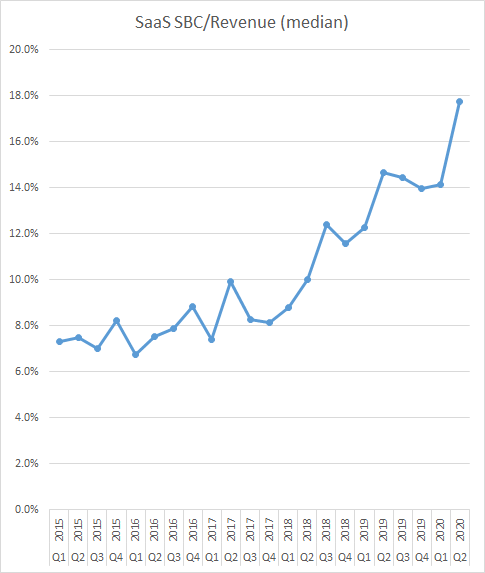

Lately, I have noticed a substantial increase in the negative attitude of investors towards stock based compensation with Kaleyra, so I thought I should dig into this further. If we assume that the SBC expense will be roughly $28.4 million per year going forward for 2022, this equates to roughly 7.1% of expected revenue at Kaleyra.

To put this into further perspective, this compares to over 22.5% of revenues at Twilio (TWLO), 22% of revenue at Ring Central (RNG) and 13.6% of revenue at 8×8, Inc. (EGHT). In fact, from what I can find, only Bandwidth (BAND) has a lower SBC expense among competitors than Kaleyra at only 2.9% of revenues, which frankly is quite impressive for Bandwidth.

In looking at numbers among high growth peers, it appears that among SaaS companies, the average SBC/Revenue was around 18% as of Q2 2020, which in my opinion is egregiously high.

Behind the balance sheet

While I am not a fan of egregious stock based compensation, unfortunately I believe it is likely here to stay as software engineers and talented, skilled workers will continue to demand to be paid at a premium in the current market. Kaleyra’s SBC expense frankly is higher than I would like, however, by comparison with its peers, it is certainly at a much more reasonable level.

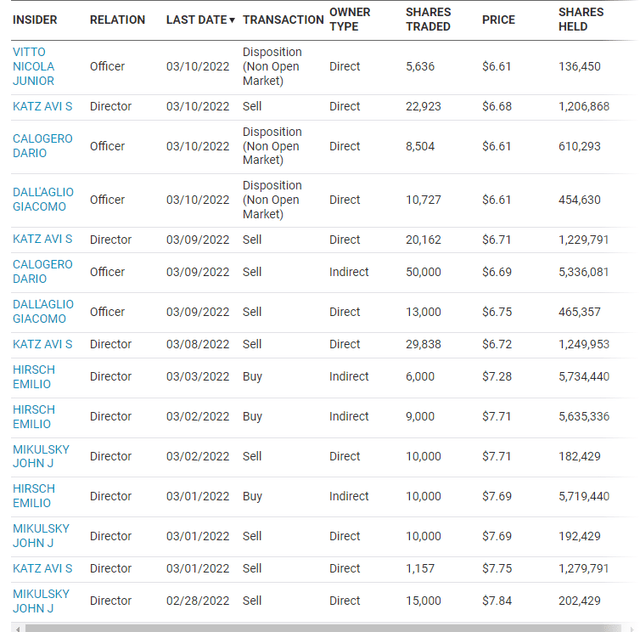

In addition to the SBC expense, many have become concerned due to the perceived increase of insiders selling at Kaleyra recently. In my opinion, this appears to be a generated concern to justify selling. Below is a list of recent transactions.

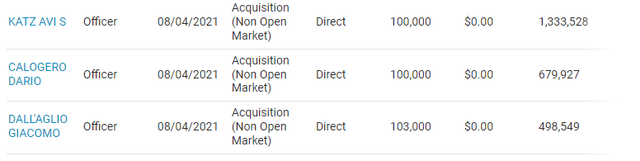

Looking at this list, at first glance it certainly does look scary that directors, the CEO and the CFO are all selling with the notable exception of Emilio Hirsch. Yet when you dig just one page back on the NASDAQ site, what you see is that nearly all of these sellers had options vest and exercised for roughly the amount of shares that were sold with CEO Dario Calogero receiving 100,000 shares and CFO Giacomo Dallaglio receiving 103,000 in August of 2021.

To be clear, I have not audited line by line each transaction, however this type of selling occurs at nearly every company and I see no transactions that scream out “danger”.

I do believe that insiders on the whole, have been net sellers of the shares and while it may annoy me that insiders have not been aggressively buying at these levels, insiders already own roughly 30% of the float and are highly aligned to shareholder success.

Ukraine / Russia Disruptions

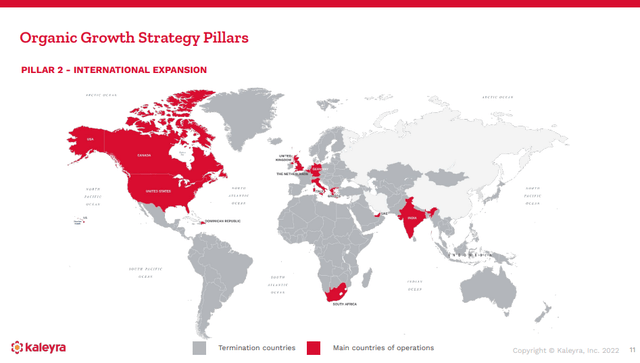

Another theory circulating among keyboard warriors is that somehow Kaleyra is exposed to the Russian sanctions and to the Ukrainian market. This one is rather simple to shut down, Kaleyra, from what I can see, is not exposed in any meaningful way to either market.

This is not to say that economic spillover and commodity inflation resulting from this war into the wider European economy would not negatively affect performance, I am sure that it will to an extent, however using this as a pretext for assigning a 0.89 sales to revenue valuation to Kaleyra is a bit of a stretch.

Bottom Line

Kaleyra remains absolutely dirt cheap and on a S/EV basis is the cheapest it has ever been, all while the company is enjoying the highest margin profile and growth rates of its public existence. The disconnect between the price of the shares and the business in my opinion is extreme and unjustified.

Now, I do not possess magical powers to see the future and the company may well not be successful in its efforts and end up as a footnote in history, however the risk-reward presented by Kaleyra at the current price in my opinion is truly asymmetric.

The company is quite far along with the integration of mGage and is projected to generate $401 million in revenue during 2022 and continues to expand the margin profile. They are non-GAAP and EBITDA profitable with long term revenues estimated to grow at 25%+.

Execution and continued progress on both margins and GAAP profitability are imperative to improve market sentiment around the company and I plan to continue to hold my oversized position with the theory that if progress continues towards these goals, eventually the company will garner a reasonable valuation, leading to outsized returns from current levels.

Thank you for reading and I look forward to your comments below. Good luck to all!

Be the first to comment