Galeanu Mihai/iStock via Getty Images

I’m not anti-social. I’m just not social.”― Woody Allen

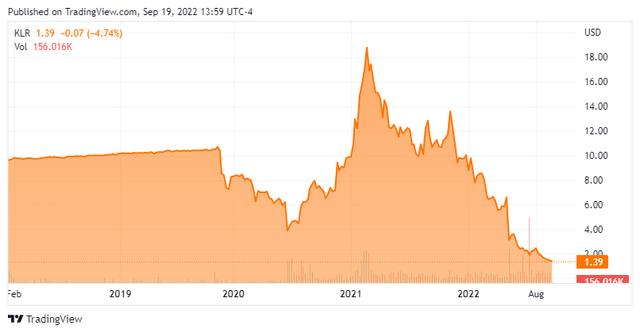

We take our first look at Kaleyra, Inc. (NYSE:KLR) in today’s feature article. The company came public in June of 2020 at $4.50 a share. The shares quickly quadrupled but have been in a downward spiral ever since and are now firmly in Busted IPO territory. So, Is KLR a falling knife or now in oversold status? An analysis follows below.

Company Overview:

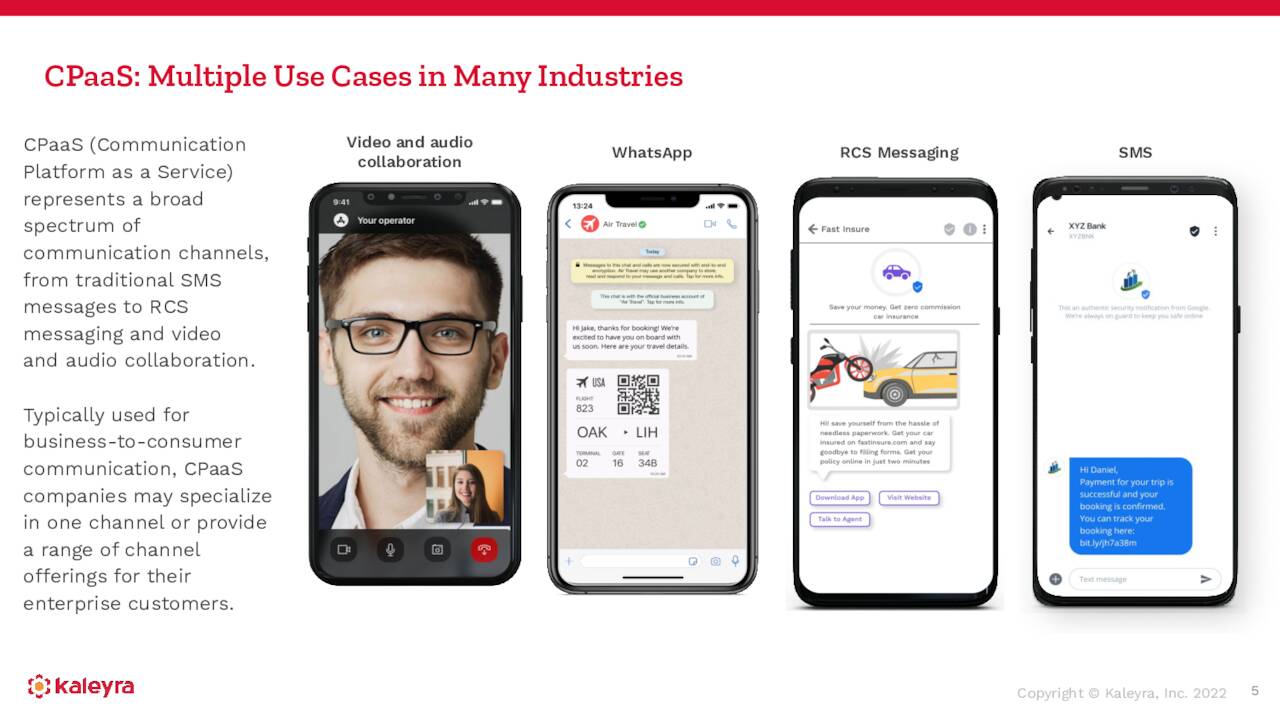

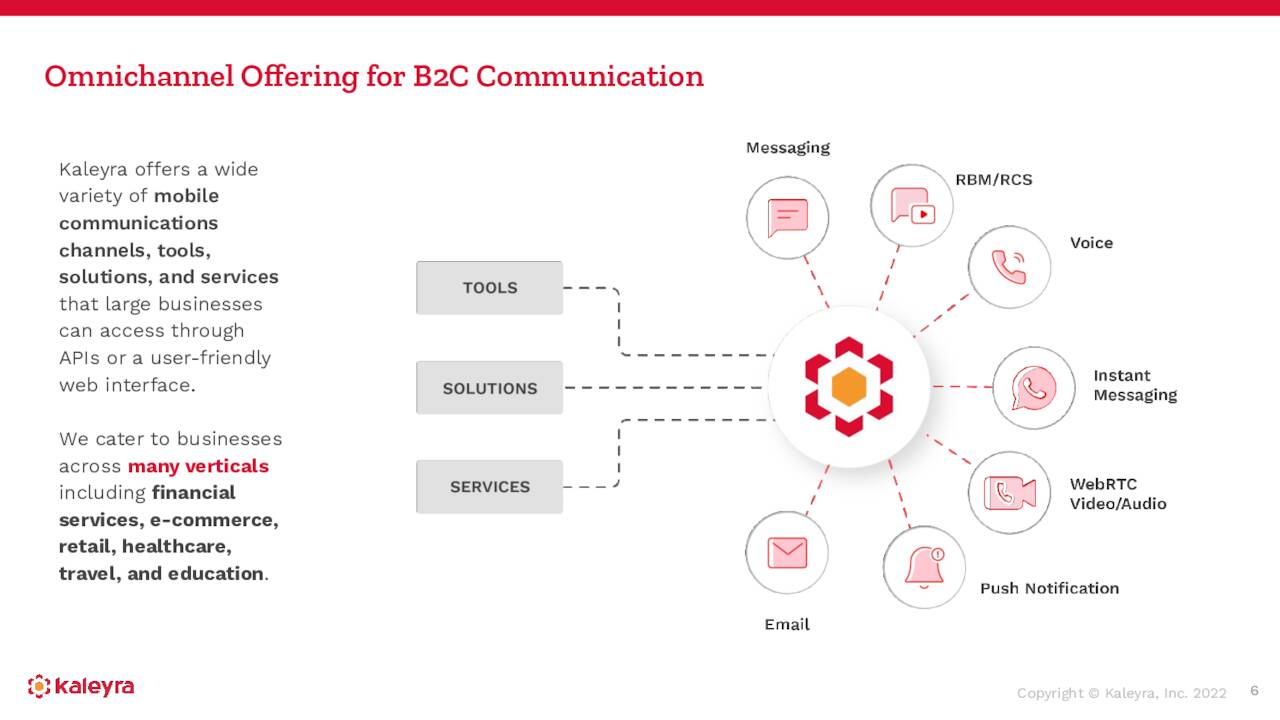

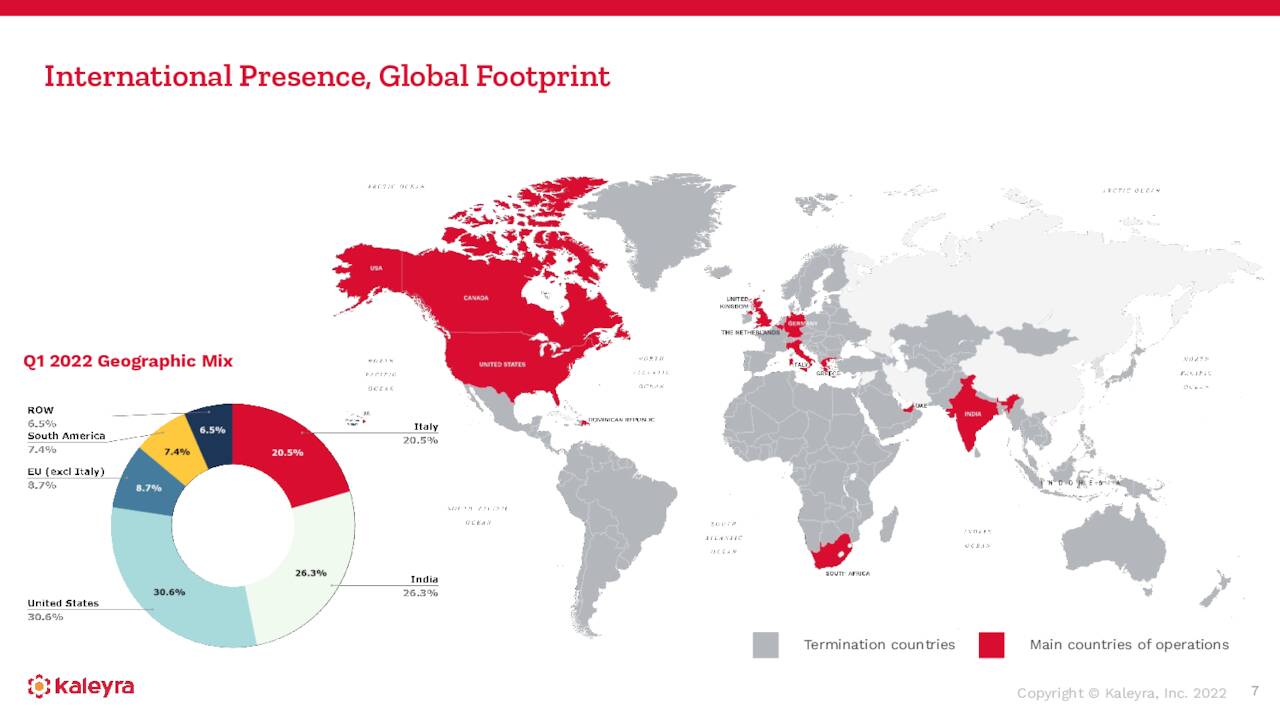

Kaleyra, Inc. is based in Milan, Italy. The company’s platform and Application Programming Interface (APIs) help manage multi-channel integrated communication services globally consisting of messaging, push notifications, e-mail, voice services, video capabilities, and chatbots. Kaleyra’s clients include financial institutions, e-commerce players, software companies, logistic enablers, healthcare providers, retailers as well as customers in other industries. Basically the company’s platform enables businesses to connect with their customers via different methods (emails, texts, voice, video, WhatsApp, etc..).

June Company Presentation

Currently the stock trades just below $1.50 a share and sports an approximate market capitalization of $65 million.

June Company Presentation

Second Quarter Results:

On August 8th, the company posted second quarter numbers. Kaleyra broke even on a Non-GAAP basis, 16 cents a share below the consensus. Revenues rose 50% on a year-over-year basis to just over $81 million, roughly in line with expectations. Kaleyra had a dollar-based net expansion rate of 103% during the quarter. The company delivered 13.4 billion billable messages and connected 1.8 billion voice calls during the quarter. This represents 58% and 32 growth over 2Q2021, respectively.

Management then ratcheted down forward guidance for both the third quarter and for FY2022, which the company said was due to the following on its earnings press release:

A slowing global economy with contraction in the United States and major European economies, increased caution from enterprise executives weighing new initiatives, and consumers who are facing food and energy costs that consume more disposable income than before. When combined with pressure from a strengthening U.S. dollar and industry-wide demand and pricing considerations, we believe that it is prudent to revise our revenue for the third quarter and full year to reflect the current global economic and geopolitical environment.“

The new guidance is as follows:

- Third Quarter 2022: Total revenue is expected to be in the range of $83 – $87 million, compared to $84.0 million in the comparable year-ago period.

- Full Year 2022: Total revenue is expected to be in the range of $345 – $350 million, compared to $267.7 million in the comparable year-ago period.

Analyst Commentary & Balance Sheet:

Since mid-July, Northland Securities ($9 price target, down from $18 previously), Oppenheimer ($6 price target) and Cowen & Co. ($10 price target) have reissued Buy/Outperform ratings while Craig-Hallum ($2.75 price target) have maintained their Hold rating on KLR.

Approximately seven percent of the outstanding float is current held short. Insiders have been frequent but usually small sellers of the shares throughout 2022. So far in the third quarter they have disposed of approximately $400,000 worth of stock in aggregate. After posting a net loss of $15.8 million in the second quarter, the company ended the first half of this year with approximately $75 million worth of cash and marketable securities on its balance sheet. The net loss was up from $4.5 million in 2Q2021 and was attributable mainly to the amortization of acquired intangibles and the accrued interest on convertible notes. It should be noted that the company has just over $200 million of long term debt.

Verdict:

The current analyst consensus has the company losing just over $1.10 a sharer in FY2022 as revenues rise to just under $350 million, in line with recent company guidance. Sales growth is projected to slow further to 13% in FY2023 as the company narrows its annual loss to some 75 cents a share.

One can argue that the stock is cheap on a price to sales basis even as the enterprise is still unprofitable at this point. One article on Seeking Alpha did so earlier this summer before the company posted earnings and reduced guidance. The stock is cheaper still now on that metric than it was then thanks to the decline in the shares since second quarter results and forward guidance came out.

June Company Presentation

With headwinds increasing both in Europe and the United States, a relatively high debt load, and continued unprofitability on the horizon, discretion is the better part of valor I think around Kaleyra at this time.

Politeness is organized indifference.”― Paul Valéry

Be the first to comment