Brett_Hondow

On Wednesday Just Eat Takeaway (OTCPK:JTKWY) published its half-year results, as expected growth wasn’t the greatest but I believe the results confirm that the Just Eat Takeaway thesis remains intact. Just Eat Takeaway is significantly undervalued, manages good food delivery assets, owns amazing food delivery assets and can drive significant shareholder value with proper capital allocation.

The recent 50% rally from all-time-lows is in my view just the start of what potentially can be one of the biggest turnaround stories on the European stock market.

Growth

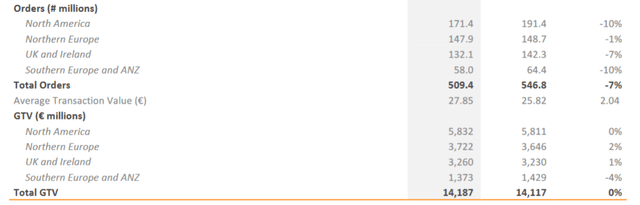

Growth was not great in most segments as the pandemic faded. Most markets experienced order growth of -7% to -10%. A positive outlier is Northern Europe which is the most profitable and had stable order growth. In the gross total value in euro growth rates, one can see the impact of the decline in the euro. As the euro has declined significantly against the Dollar, Canadian Dollar, Brazilian Real the GTV growth in euros has increased significantly. On the one side, this is problematic as it is more expensive for Just Eat Takeaway to invest in these markets, on the other hand, it makes disposals of these assets even more lucrative. The UK segment also experienced significantly higher GTV growth than order growth which I guess is mainly driven by growth in average order value – which is very positive for long-term profitability as larger orders are more profitable.

Cash is not a problem

Also important for the results was visibility towards profitability as cash is slowly but surely running out. One could say Just Eat Takeaway has already reached profitability now. 90% of the gross total value of the company comes from the North America, Northern Europe and UK Ireland segments which combined with 90% of the head office costs is currently breakeven in adjusted EBITDA. The North America segment also has fee caps imposed in some areas which negatively affect EBITDA by 73 million EUR. The fee caps imposed in San Francisco will be released by the beginning of 2023 and this can be seen as a directive for other lawsuits related to fee caps. Especially the New York fee cap has a huge impact on profitability and the settlement in San Francisco is a huge step towards releasing these unconstitutional fee caps in New York too.

The only reason why Just Eat Takeaway is not profitable is that it operates the loss-making Southern Europe ANZ segment – a big portion of losses are rumoured to come from Australia specifically which is a very competitive growth market. In the earnings call the CFO said that Australia finally created positive revenue minus order fulfilling costs. This statement alone showcases the size of the losses coming from this specific operation.

Currently, 882 million EUR cash and cash equivalents are present on the balance sheet but with 2.2 billion EUR in long-term debt (mostly convertibles) this is not a very strong balance sheet. Fortunately, a big portion of the debt is raised in Euros and Just Eat Takeaway can dispose of assets in better currencies. Over the last half year, Just Eat Takeaway’s net change in cash was -449 EUR million. This includes overinvestment in growth and a significant cash infusion into iFood. But as management is clearly pushing operational efficiencies and predicting profitability in adjusted EBITDA in 2023 I expect the cash burn to decline significantly and maybe even come close to breakeven for 2023. With the first debt repayment coming in at the end of 2023 the company’s financing is a bit weak.

As discussed in my previous articles Just Eat Takeaway owns a very valuable stake in iFood that makes up a very big chunk (50+%) of the company’s enterprise value, and also has the ability to dispose of other operations. After the Amazon (AMZN) deal, Grubhub is also still up for sale, the Amazon deal must have a positive impact on the price. Any proper refinancing of the company cannot keep the stock price at this absurd level.

Negotiations ongoing

During the call Jitse Groen told investors:

“Just a brief one on your current 2 participations, iFood and Grubhub. Jitse, maybe you could share with us the current negotiations, or if you have negotiations on maybe saying goodbye to these 2 assets, what the current status is in this respect?” ~Jurgen Kolb

‘I can only tell you that we have negotiations on both, but I’m not going to tell you what the status is.’ ~Jitse Groen

It’s a good sign that negotiations are ongoing with both assets, we will have to see how far these actually are. Disposing these assets at a fair value is a total game changer for Just Eat Takeaway.

Takeaway

Any money raised by disposals can be used to expand market positions in markets like UK, Southern Europe or defend very strong market positions in markets like Northern Europe and Canada.

I continue to view Just Eat Takeaway as significantly undervalued and think the stock will be a significant outperformer in the coming years.

Be the first to comment