Florent Molinier/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 4th, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often times aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. There are definitely yield-traps out there, trust me – I’ve owned a few that I’m not particularly proud of.

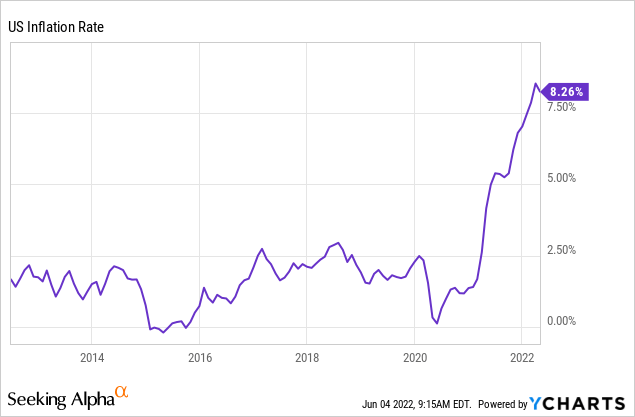

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the price erosion.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

All of this being said is important to understand my approach to dividend stocks and why screening of dividend stocks can be important for income investors. These are June’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As is the case with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

In the last month, inflation has actually ticked down from the 8.54% level and there are thoughts that we have hit peak inflation. Despite this, inflation remains at an unhealthy level.

Ycharts

Since the original publication, inflation has once again started heading in the other direction with the latest CPI at 8.6%. This has prompted the Fed to be even more aggressive.

The Parameters For Screening

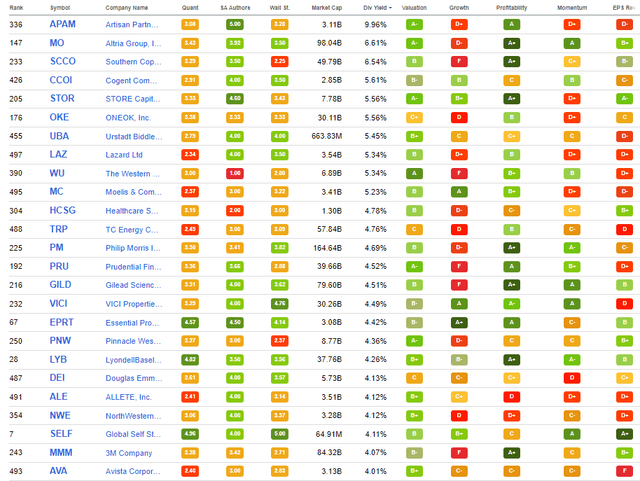

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising year after year, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means that there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 532 stocks at this time — an increase from May’s 445 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more obviously. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

From there, I will share the top 25 that showed up as of 06/04/2022.

Top 25 From Screen (Seeking Alpha)

Artisan Partners Asset Management (APAM) is certainly an interesting name that we’ve run across through this screening before. However, it pays a variable dividend. We are looking for more consistent payers, so we will pass on looking at that name for this screening.

Southern Copper (SCCO) is also a variable dividend payer but again looks like it could be an interesting name for other dividend investors.

We also want to see various positions covered from month to month. So I’ve taken out STORE Capital (STOR) and Urstadt Biddle Properties (UBA) due to being covered within the last two months.

That leaves us with Altira Group (MO), Cogent Communications (CCOI), ONEOK (OKE), Lazard (LAZ) and The Western Union Company (WU).

Altria Group (MO) 6.69% Yield

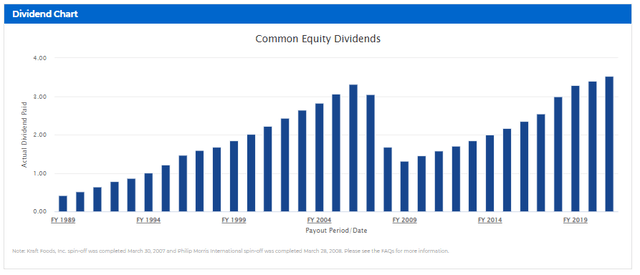

This is the first time MO is showing up on this screening. To think about it, it is a bit surprising, considering it is generally considered to be a quality, high-yielding stock by most investors. Additionally, we’ve seen Philip Morris (PM) show up several times. For those not familiar with these two tobacco companies, PM was a part of MO at one point. They spun PM off in 2008.

Despite it being quite a controversial stock, I continue to hold MO in my portfolio. Tobacco is definitely a tough industry when government policies are working against you. The public image at large is also a fairly negative one. This has all put pressure on the company as the users of their products are reduced year after year with fewer new tobacco users to replace them. It puts them in a challenging place to continue growing and rewarding shareholders.

The company has continued to try to venture into new businesses to diversify with limited success. That being said, they continue to boost their dividend to investors and grow slowly year after year.

Cogent Communications (CCOI) 5.86% Yield

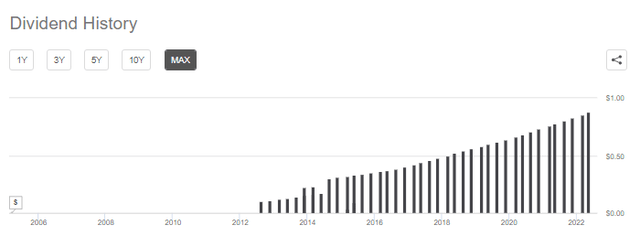

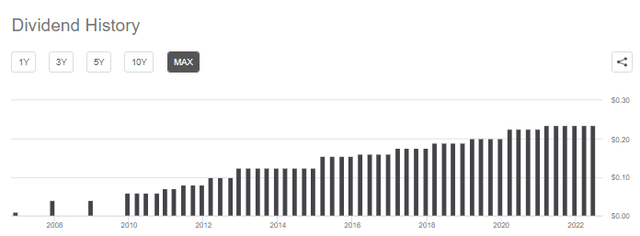

CCOI is a name we’ve run across several times. This is also a stock that I keep on my own watchlist. They grow their dividend every single quarter, which can be quite attractive for dividend growth investors. There are a select few companies that can accomplish this regularly.

CCOI Dividend History (Seeking Alpha)

However, as I’ve discussed before, there will come to a point where they either need to start growing earnings more aggressively or slow these increases. I believe this is the case because they’ve been growing earnings slower than they’ve been raising the dividend. In fact, their earnings aren’t enough to cover the dividend.

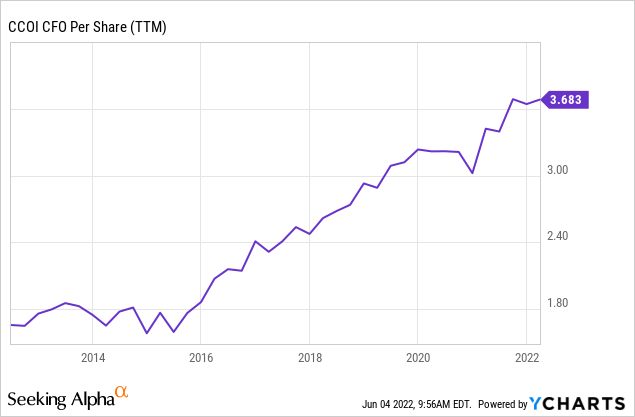

Due to the nature of their business, they have a lot of depreciation, so EPS isn’t necessarily the best figure to use. Instead, if we look at cash from operations, we can see they cover it. It is only slightly being covered but covered nonetheless.

Ycharts

Due to where the current price is around $60, I still think the risk might be worth it at this level. However, I wouldn’t consider it necessarily a “SWAN” type of stock.

ONEOK (OKE) 5.56% Yield

OKE is another name that we’ve run across previously. Most income investors have probably run across this name at least once in their search for what is out there to invest in. This is a midstream natural gas company. I know I have, and it continues to catch my attention.

OKE doesn’t raise its dividend every single year. There have been a couple of times now where they have frozen the payout at the same amount for over a year. We are actually in one of those times where they have raised since the COVID pandemic. However, they are still paying out a healthy quarterly dividend of $0.935, equaling a 5.56% yield at this time.

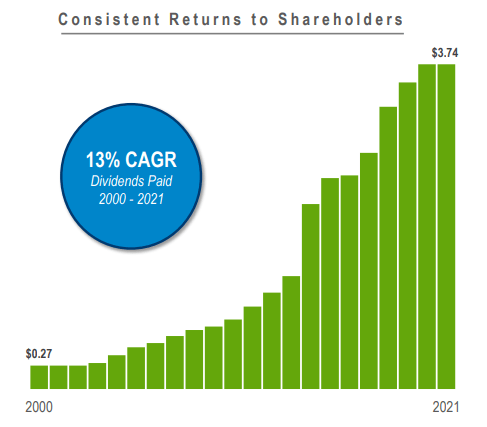

OKE Investor Presentation (ONEOK)

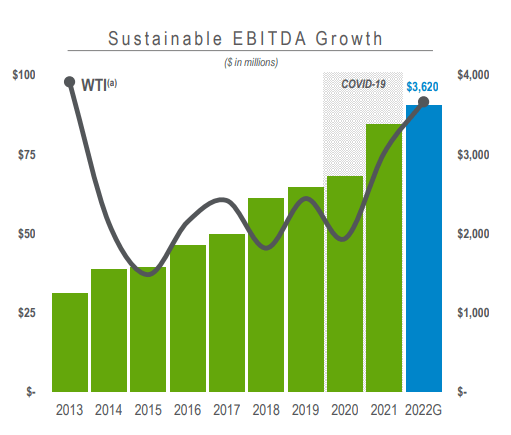

Their earnings are expected to grow quite considerably. That could lead to them rewarding shareholders more generously going forward. They’ve been increasing EBITDA for 8 consecutive years already.

OKE Investor Presentation (ONEOK)

Lazard (LAZ) 5.34% Yield

LAZ is another name that we’ve previously covered in these screening articles. The biggest headwind for this asset manager is the fact that investment valuations are falling. These are cyclical businesses based on how well investments are doing since they earn fees on the management of the assets. The more assets, the more fees generated – completely oversimplifying the business model.

LAZ is a relatively smaller player in the space. They might be popular and well-known but last reported an AUM of around $236.6 billion. That’s when they announced their AUM had declined primarily due to market depreciation and foreign exchange depreciation. That AUM can be compared with the BlackRock’s and Vanguard’s of the world with their trillions in total managed assets.

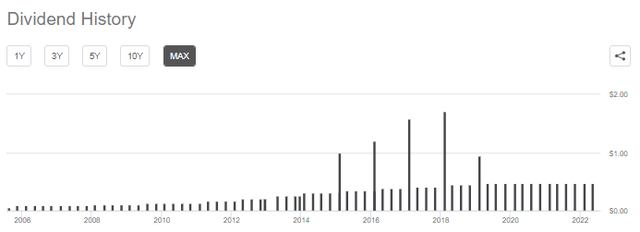

They, too, have been in a freeze on increasing their dividend. Although, they paid out several significant special dividends before freezing at the $0.47 quarterly amount for now. Of course, the yield is still quite attractive at the current level. I wouldn’t assume we would see them raise again any time in the next year or two with the current market circumstances.

LAZ Dividend History (Seeking Alpha)

LAZ is a K1 issuer. So some investors might not be interested in pursuing an investment in this position. I don’t believe that a tax form should automatically stop someone from investing, but it is a big deterrent for some.

The Western Union Company (WU) 5.34% Yield

WU is an interesting name that I don’t find too compelling at this time, but some others might. The primary reason is that their core business of transferring money just doesn’t seem sustainable given the amount of competition. Many different apps on a person’s phone can accomplish the same thing. Of course, they have their own app too. But it is the sheer number of competitors that makes the business difficult.

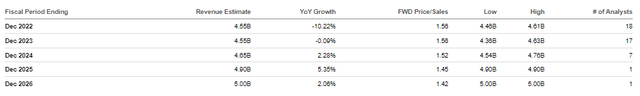

Revenue is expected to shrink over the next couple of years and then grow slowly after that. Except in 2025 and 2026, we only see one analyst’s opinion, so that should be considered. The company itself is expecting a 9 to 11% GAAP revenue decline for 2022.

WU Revenue Estimates (Seeking Alpha)

At the same time, the years 2023 through 2026 are still expected to see some EPS growth. The dividend payout ratio isn’t elevated either at 41.59%. Combining that with the fact that they’ve frozen their dividend for a year and a half now, and they can probably keep this payout going for years.

WU Dividend History (Seeking Alpha)

All this doesn’t mean that they won’t be successful. It is just something to watch a bit more closely for investors in this name.

Be the first to comment