bymuratdeniz/iStock via Getty Images

A guest post by Ovi

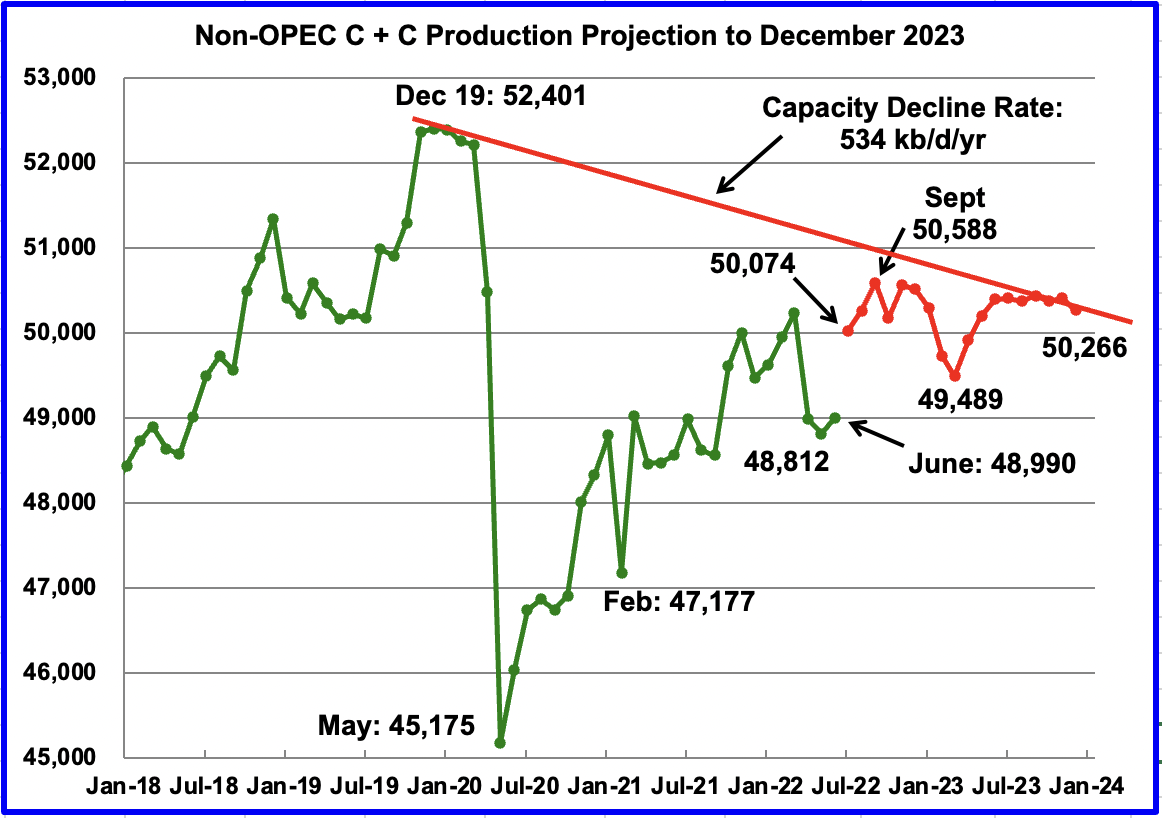

Below are a number of Crude oil plus Condensate (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to June 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short-term outlook for future output and direction for a few countries and the world. The US report has an expanded view beyond production by adding rig and frac charts.

Data: EIA

June Non-OPEC production increased by 178 kb/d to 48,990 kb/d. The largest increases came from Russia, 510 kb/d and the U.S., 201 kb/d. The largest offsetting decreases came from Kazakhstan, 381 kb/d and Norway, 285 kb/d.

Using data from the October 2022 STEO, a projection for Non-OPEC oil output was made for the time period July 2022 to December 2023. (Red graph.) Output is expected to be 50,266 kb/d in December 2023. This forecast is 608 kb/d lower than predicted in the September report due to significant downward changes in the October STEO.

The large increase in July is due to a 1,600 kb/d increase in all liquids over June forecast in the October STEO. The C + C projection reduces the 1,600 kb/d increase to 1,084 kb/d.

Note that the September 2022 high of 50,588 kb/d is the high for all of 2022 and 2023.

The red capacity decline line represents an average decline rate for Non-OPEC countries over the four years since December 2019 and is a combination of the natural decline rate plus possible reduction in exploration and production capacity/investment.

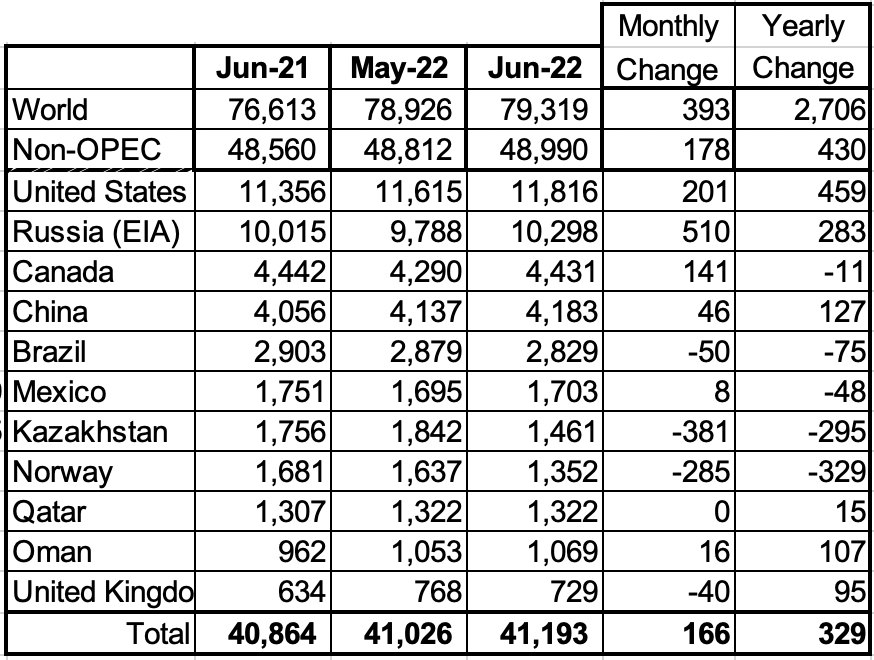

Non-OPEC Oil Production Ranked by Country

Data: EIA

Listed above are the world’s 11 largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The UK has been below 1,000 kb/d since January 2021. As can be seen the U.S. and Russian increases were offset by the Kazakhstan and Norway decreases.

In June 2022, these 11 countries produced 84.1% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 430 kb/d. World YoY June output increased by 2,706 kb/d.

Non-OPEC Production Charts

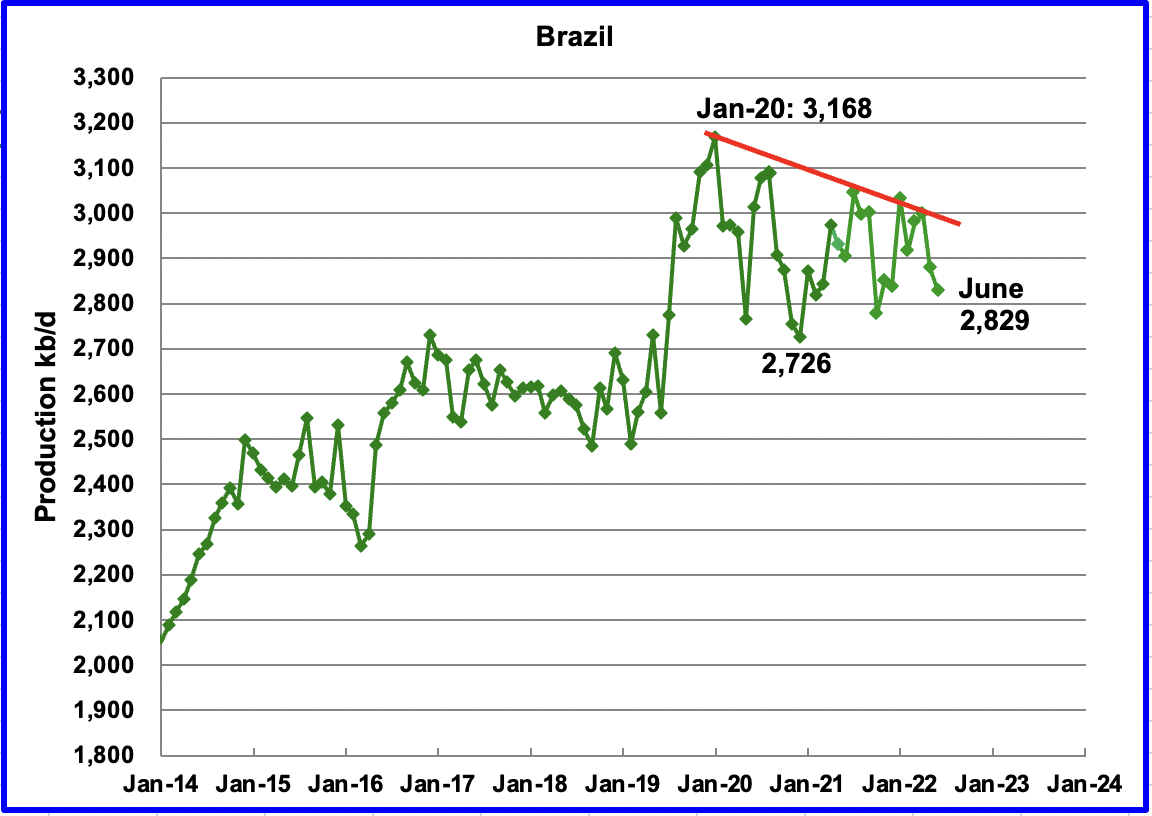

Data: EIA

The EIA reported Brazil’s June production decreased by 50 kb/d to 2,829 kb/d.

Unfortunately, Brazil’s National Petroleum Association (BNPA) has stopped reporting Brazil’s production so that no future months are currently available.

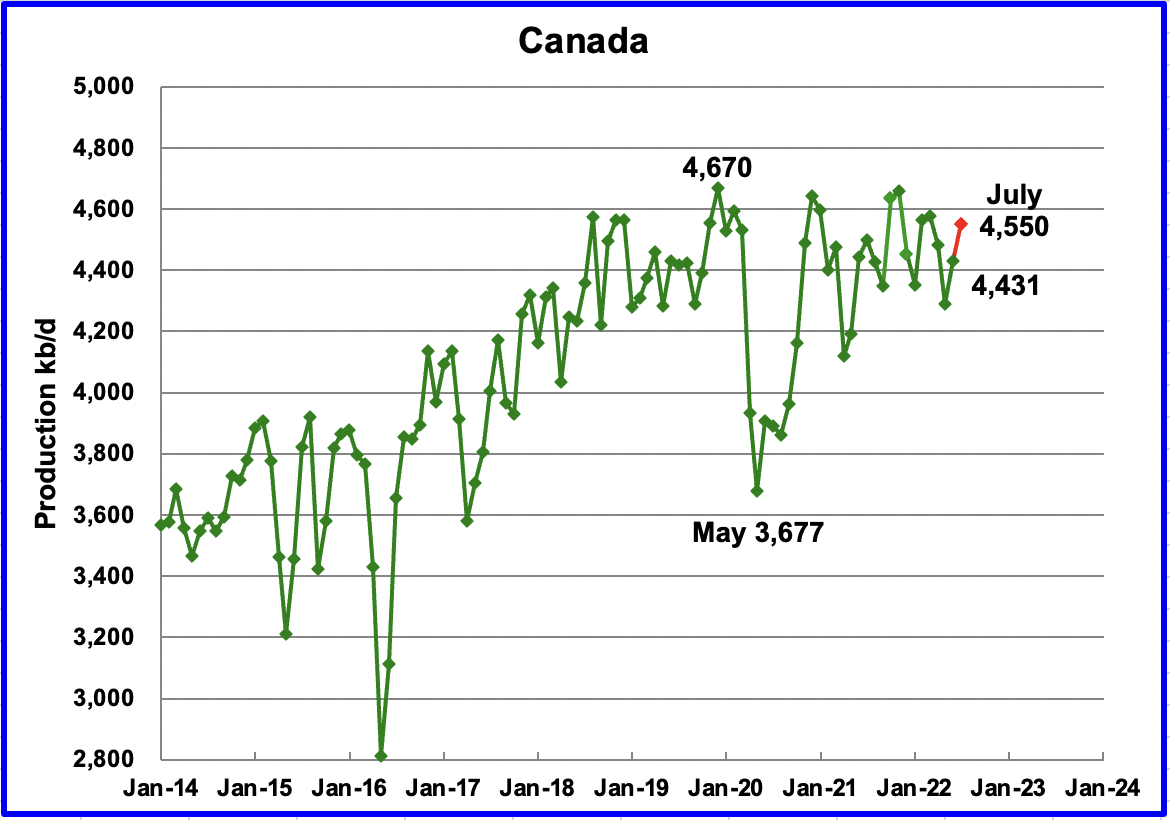

Data: EIA

According to the EIA, Canada’s June output increased by 141 kb/d to 4,431 kb/d. Preliminary data from the Canadian Energy Regulator (CER) indicates that July production was 4,802 kb/d. However, the EIA subtracts approximately 250 kb/d from the CER report. Accounting for the EIA’s reduction, Canada’s projected July output is then estimated to be close to 4,550 kb/d, an increase of 119 kb/d over June, red marker.

Rail shipments to the US in July dropped by 18 kb/d to 152 kb/d.

The current spread between Western Canada Select (WCS) and WTI has increased to $25/b from a more typical $12/b to $17/b. There is speculation the increase is related to the reduced demand from U.S. refiners due to the release of medium crudes from the SPR.

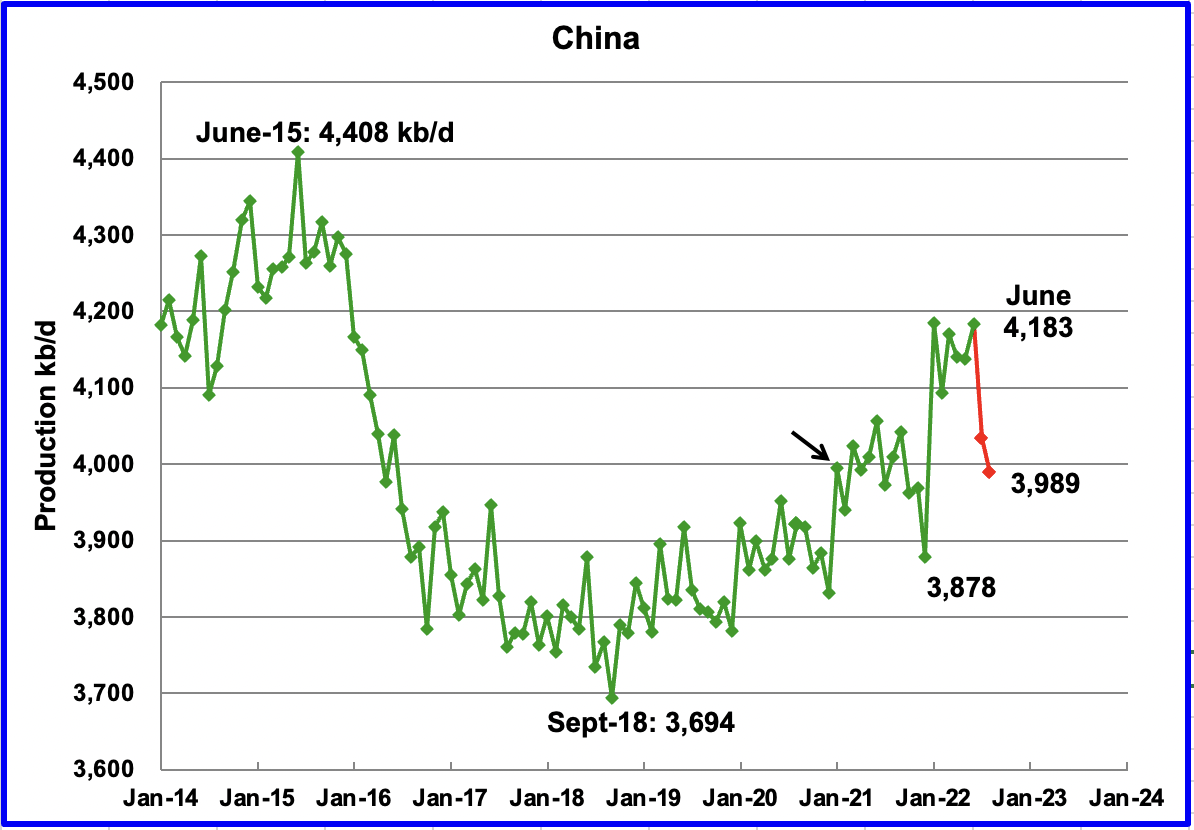

Data: EIA

The EIA reported China’s output increased by 45 kb/d to 4,183 kb/d in June.

China reported that its output decreased in July to 4,034 kb/d and again in August to 3,989 kb/d, a drop of close to 200 kb/d from June. (Red markers.)

China may be close to its current maximum production level of approximately 4,000 kb/d. To offset declines, the national oil company is investing in conventional wells and is also drilling for shale oil.

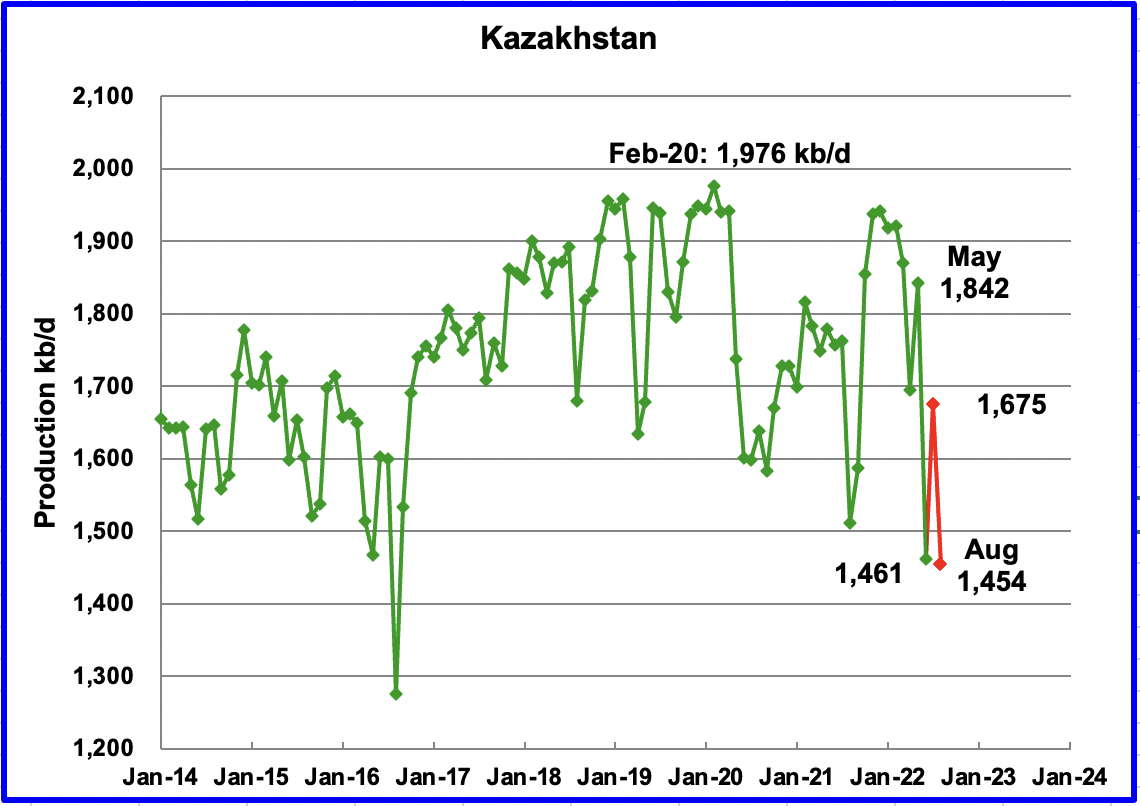

Data: EIA

Kazakhstan’s output dropped by 381 kb/d in June to 1,461 kb/d.

According to this source, August production fell after rebounding in July to 1,675 kb/d. The article just reports crude oil production. Consequently, the July and August production numbers shown in the chart are an estimate based on the percentage drop and a typical C + C to C ratio using earlier EIA data.

“The fall in output was due to a sharp decline in production in the giant Kashagan oil field after a gas leak early in August, as well as planned output curbs in the Tengiz field due to regular maintenance.”

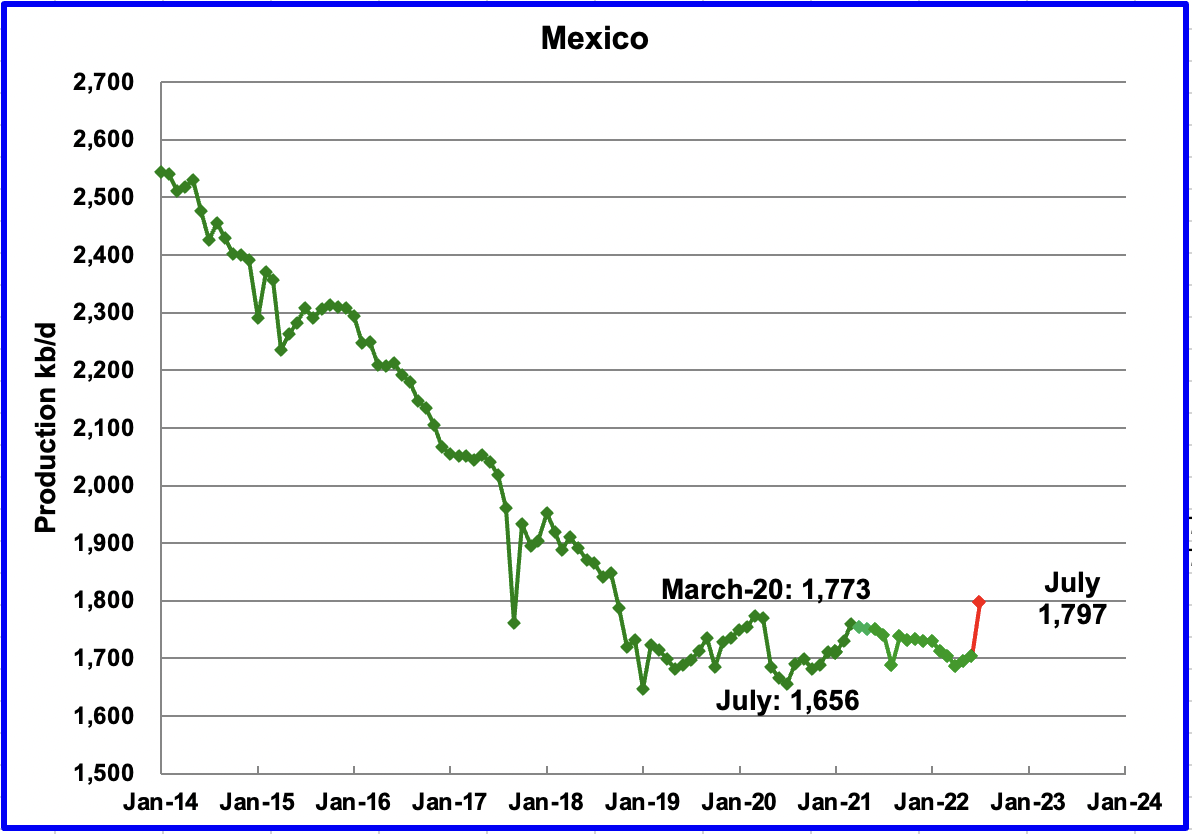

Data: EIA

Mexico’s production as reported by the EIA for June increased by 8 kb/d to 1,703 kb/d.

Data from Pemex showed that July’s output was 1,797 kb/d. However, the EIA is expected to reduce Pemex’s July oil production by close to 85 kb/d, to 1,713 kb/d, an increase of 10 kb/d over June, due to a different definition for crude plus condensate.

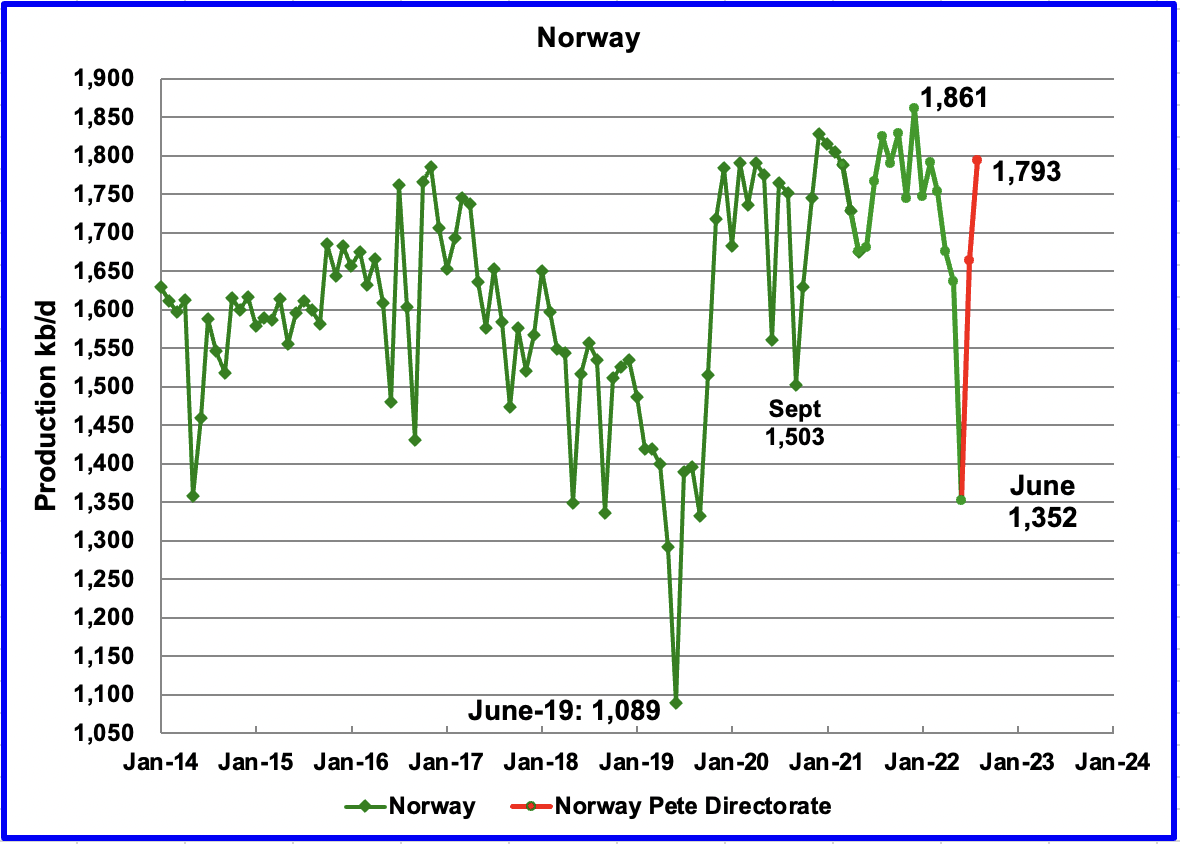

Data: EIA

The EIA reported that Norway’s June production decreased by 285 kb/d to 1,352 kb/d.

The Norway Petroleum Directorate (NPD) reported that production increased from June to August to 1,793 kb/d (Red markers). According to the NPD:

“Oil production in August was 3.1 percent lower than the NPD’s forecast and 4.7 percent lower than the forecast so far this year.”

Growth is expected in late 2022 and into 2023 when the second phase of the Johan Sverdrup field development starts production and other small fields come on line. According to OPEC:

“The Johan Sverdrup is projected to be the main source of increased output for the year. Neptune has also completed drilling at Fenja with the first oil on track for 1Q23. Fenja is expected to produce about 24 tb/d at peak production.”

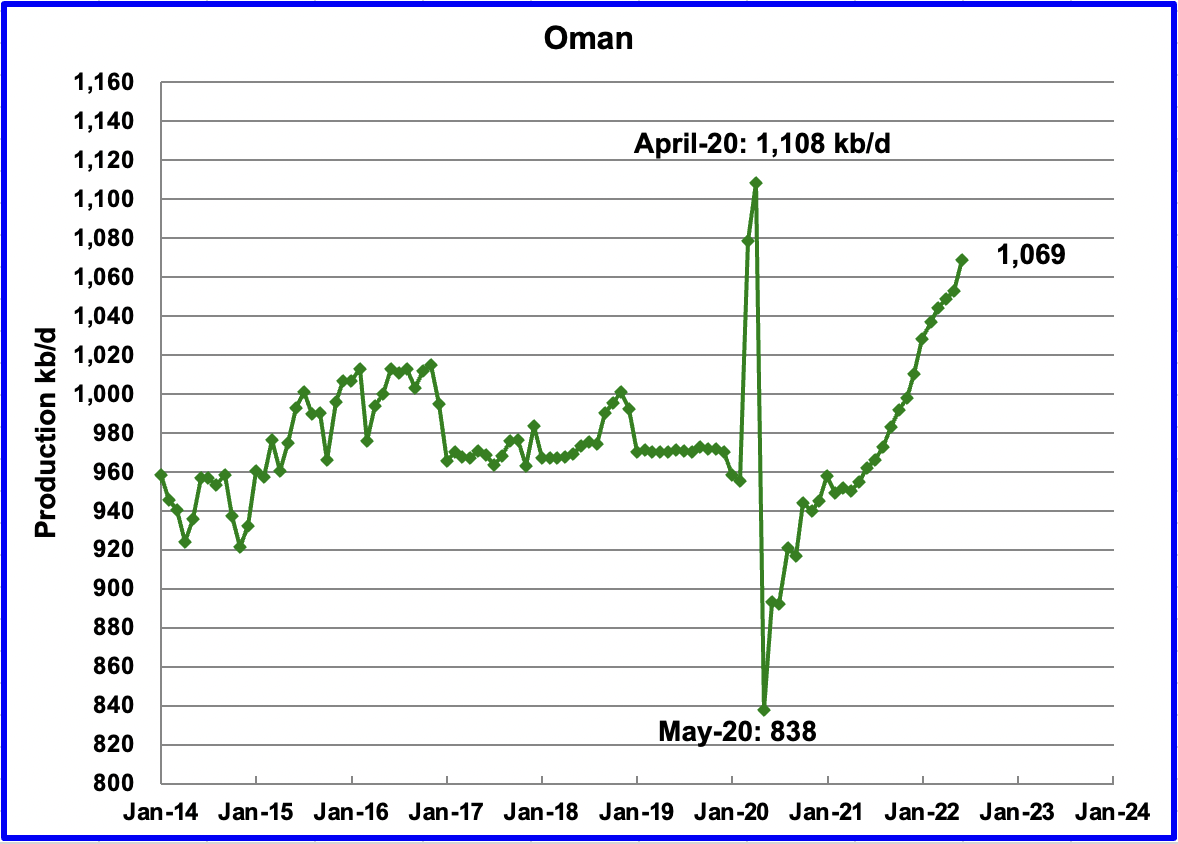

Data: EIA

Oman’s production has risen very consistently since the low of May 2020. Oman’s June production increased by 16 kb/d to 1,069 kb/d. It is 39 kb/d short of its pre-pandemic high.

Data: EIA

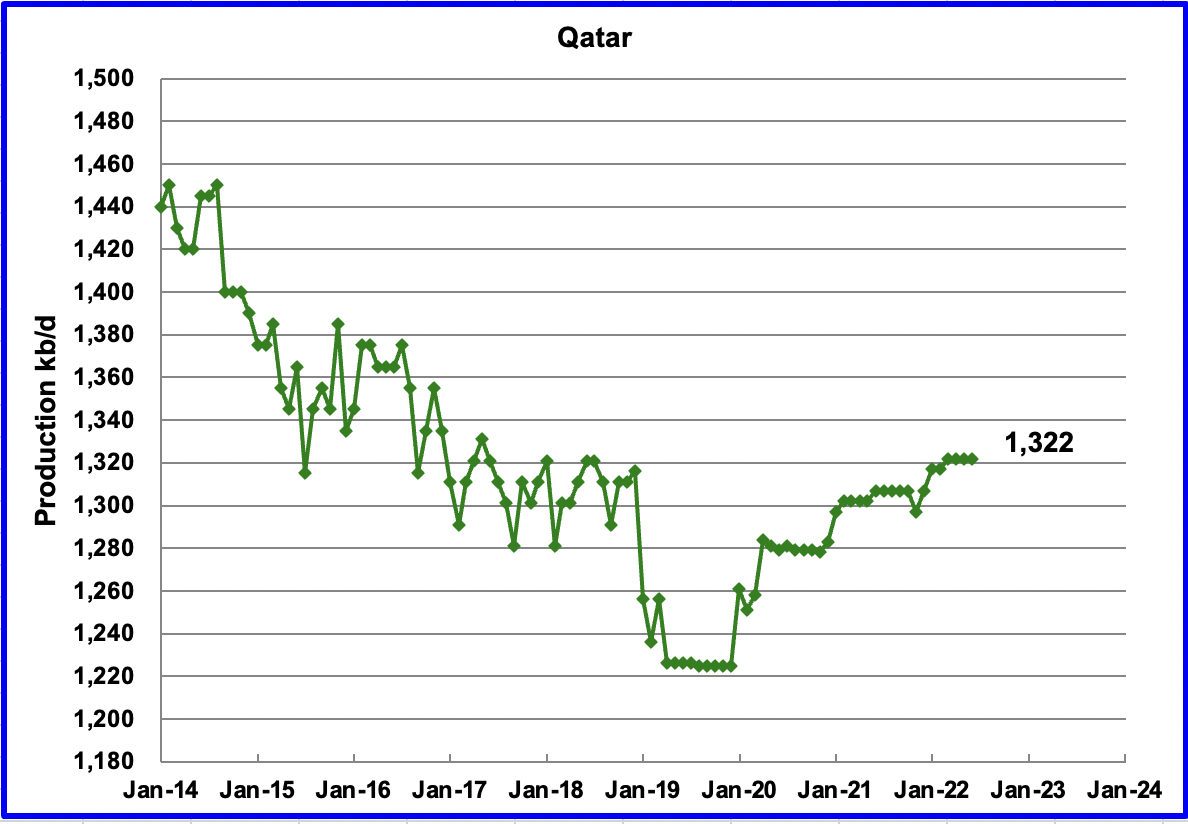

June’s output was unchanged at 1,322 kb/d.

Data: EIA

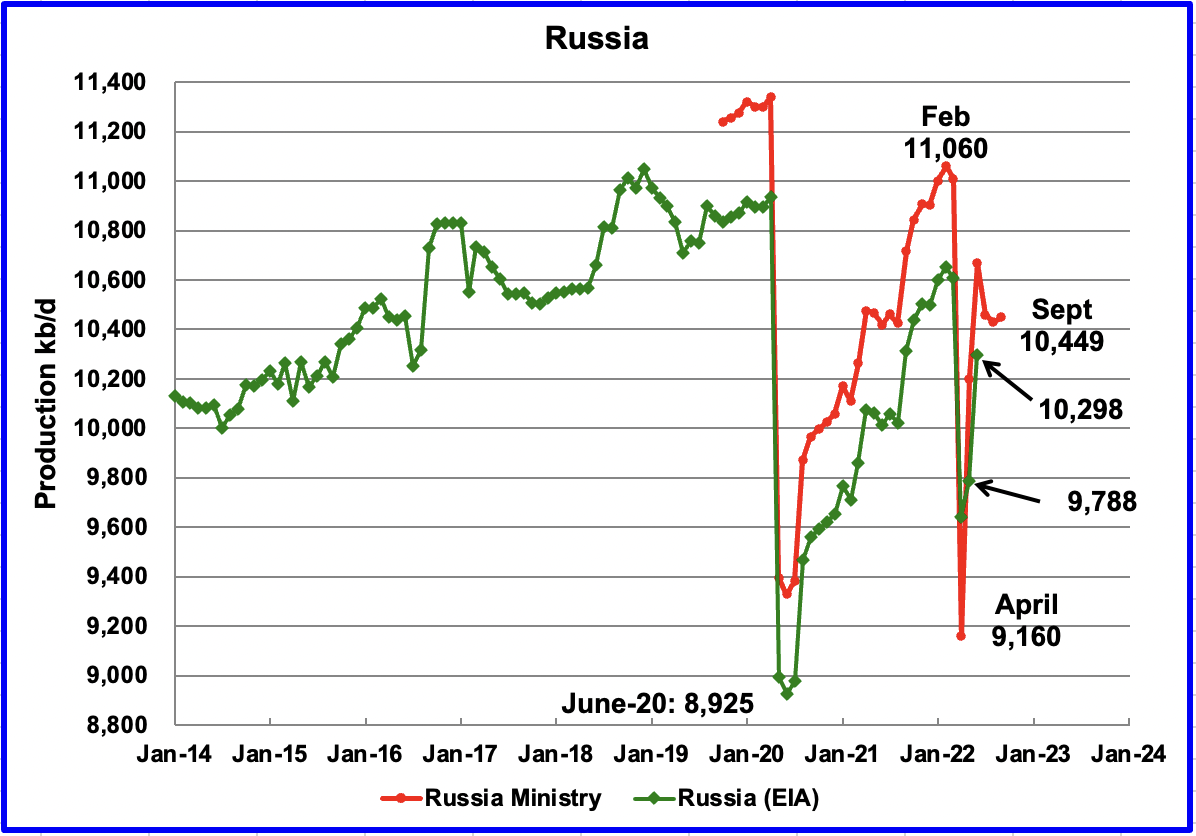

The EIA reported that Russian output increased by 510 kb/d in June to 10,298 kb/d. According to this source, September production increased by 345 kb/d to 10,775 kb/d. While the source states the production level quoted is C + C, it appears to be all liquids since the October STEO is reporting 10,885 kb/d for all liquids. Assuming the 10,775 is all liquids, and using 0.96 for the C + C to all liquids ratio, September’s output would be closer to 10,344 kb/d, an increase of 19 kb/d over August.

However the October OPEC report states:

A preliminary estimate for Russia’s crude and condensate production in September 2022 shows a further decrease of 0.1 mb/d m-o-m to average 9.7 mb/d, while around a 10 tb/d decline is expected for NGLs.

There is a gap of 600 kb/d between OPEC’s preliminary estimate and the production shown in the chart.

Data: EIA

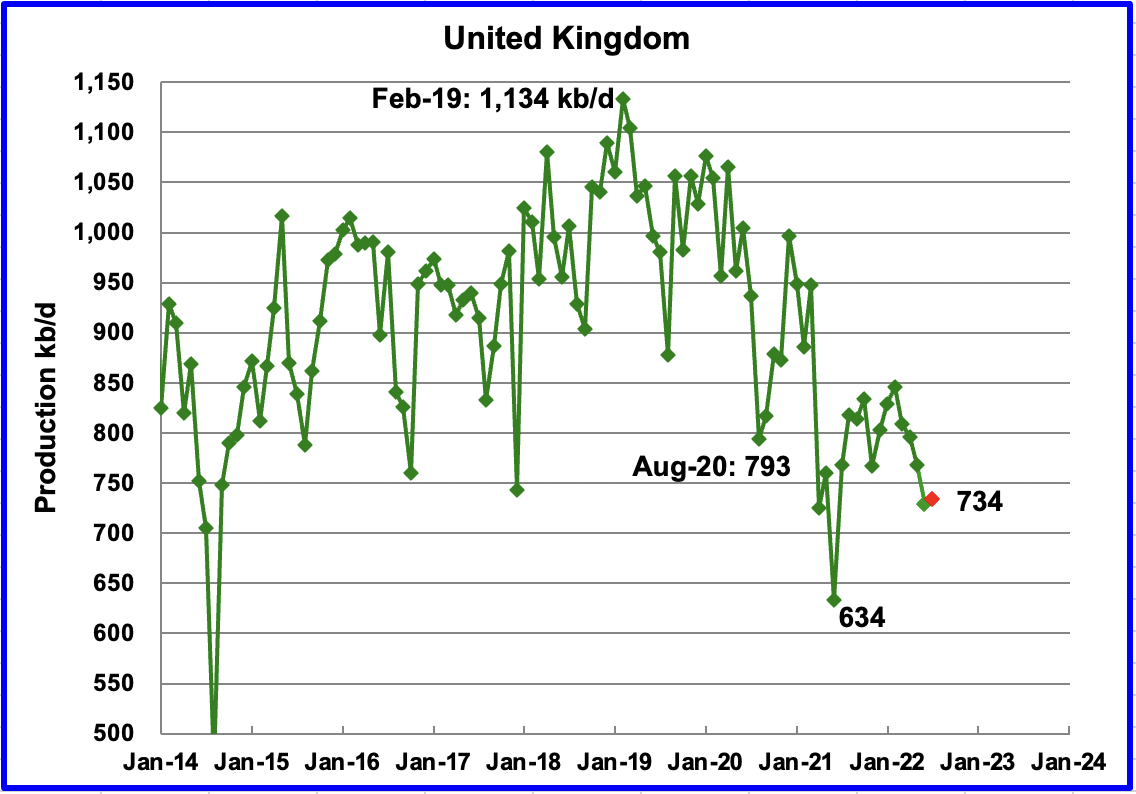

The EIA reported UK’s production decreased by 40 kb/d in June to 729 kb/d. According to this source, July’s production increased by 5 kb/d to 734 kb/d (Red Marker). The chart indicates UK oil production entered a steep decline phase starting in February 2019. On a YoY basis, July production is down by 34 kb/d.

Data: EIA

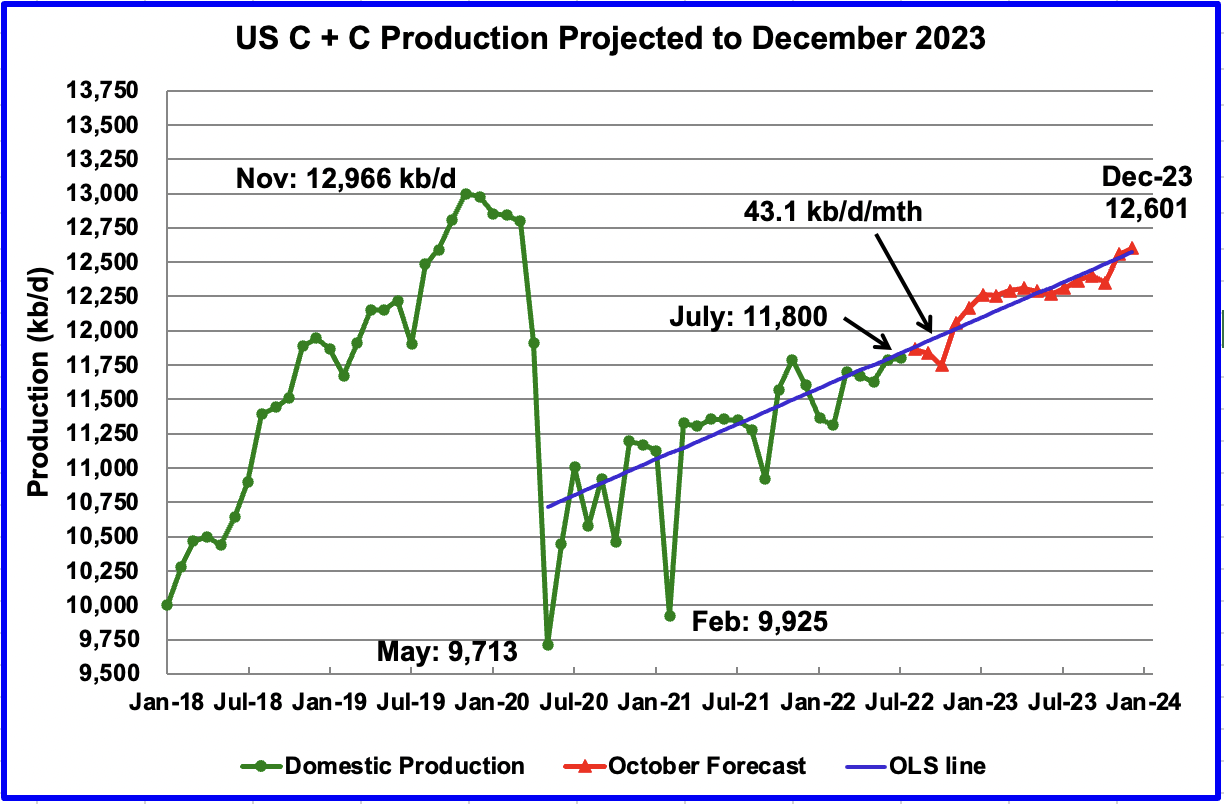

US July production increased by 12 kb/d to 11,800 kb/d from 11,788 in June. Note that the current EIA World report did not update June production to the most recently released rate of 11,788 kb/d from the original estimate of 11,816 kb/d.

The US chart also contains the October STEO projection for US output out to December 2023. In December 2023, production is expected to be 12,601 kb/d. This is a reduction of 385 kb/d from the September projection of 12,986 kb/d. Note how production from December 2022 to June 2023 is essentially flat at 12,250 kb/d.

The blue OLS line from June 2020 to December 2023 indicates a monthly production increase of close to 43.1 kb/d.

Data: EIA

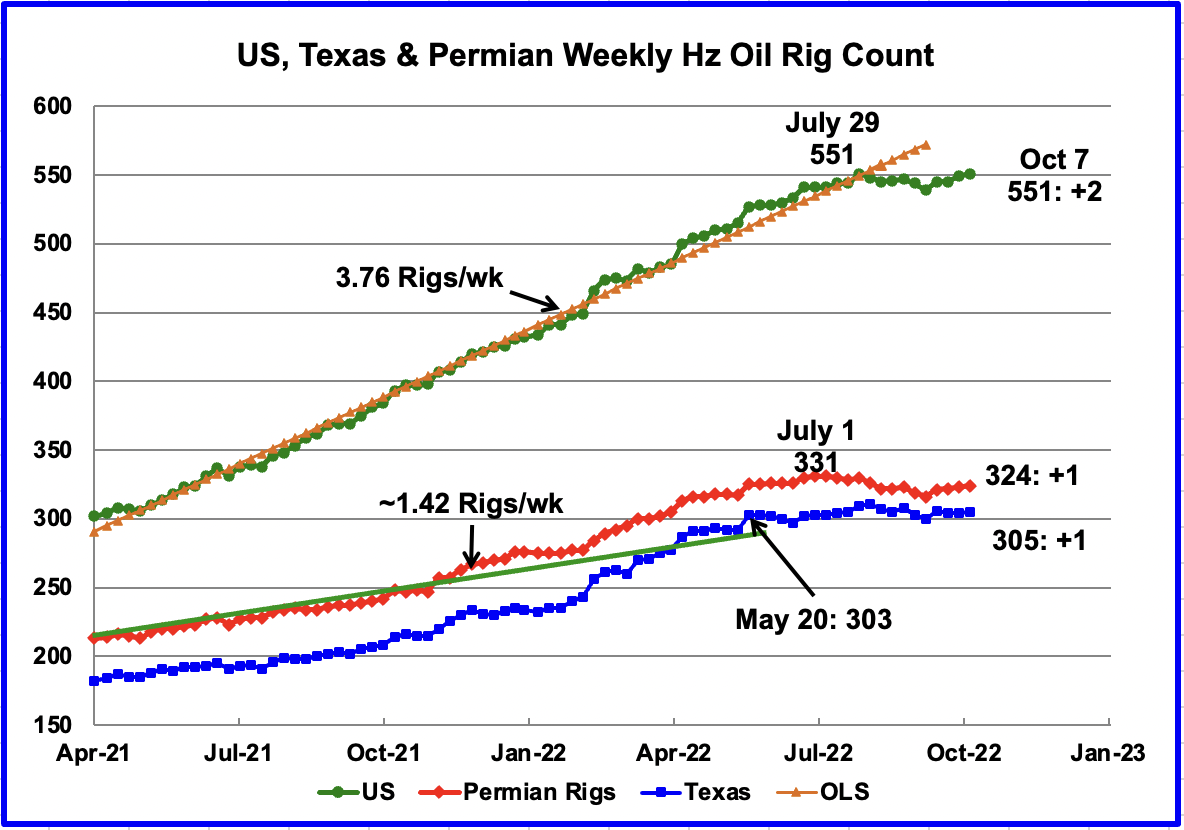

After the week ending July 29, the rate of rig additions slowed and has essentially stopped. Since then the number of operational rigs has been more or less steady at the 550 level. In the week ending October 7, the number of rigs increased by 2 to 551, the same numbers as in the week of July 29.

Data: EIA

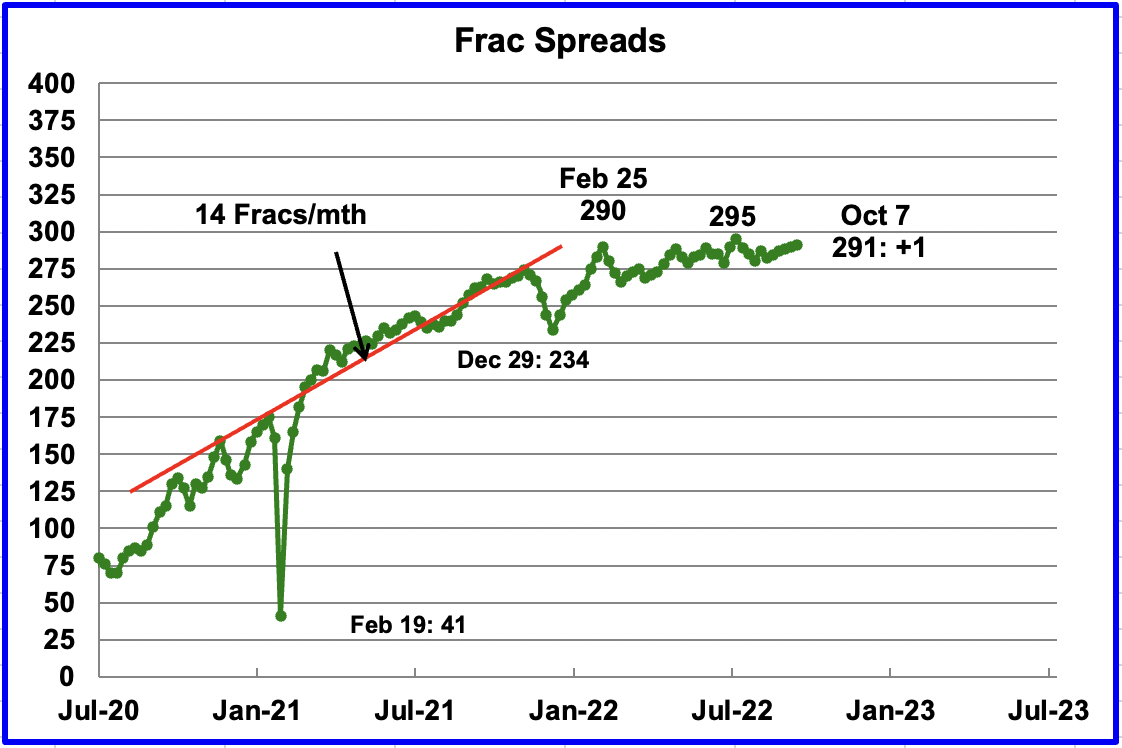

For frac spreads, the general trend since late February, when the count was 290, can best be described as essentially flat at around the 290 level. For the week ending October 7, the frac spread count increased by 1 to 291.

Note that these 291 frac spreads include both gas and oil spreads.

According to this source:

“The U.S. hydraulic fracturing market is “literally sold out,” Andy Hendricks, chief executive officer of oilfield firm Patterson-UTI said on Wednesday, as demand for equipment and services has outpaced available capacity.

Some fracking firms, including Liberty Energy, are reactivating pressure pumping equipment and deploying new fleets as prices have improved and demand has spiked. Patterson is running 12 frac spreads and on Wednesday said adding an additional fleet would be a challenge.”

Data: EIA

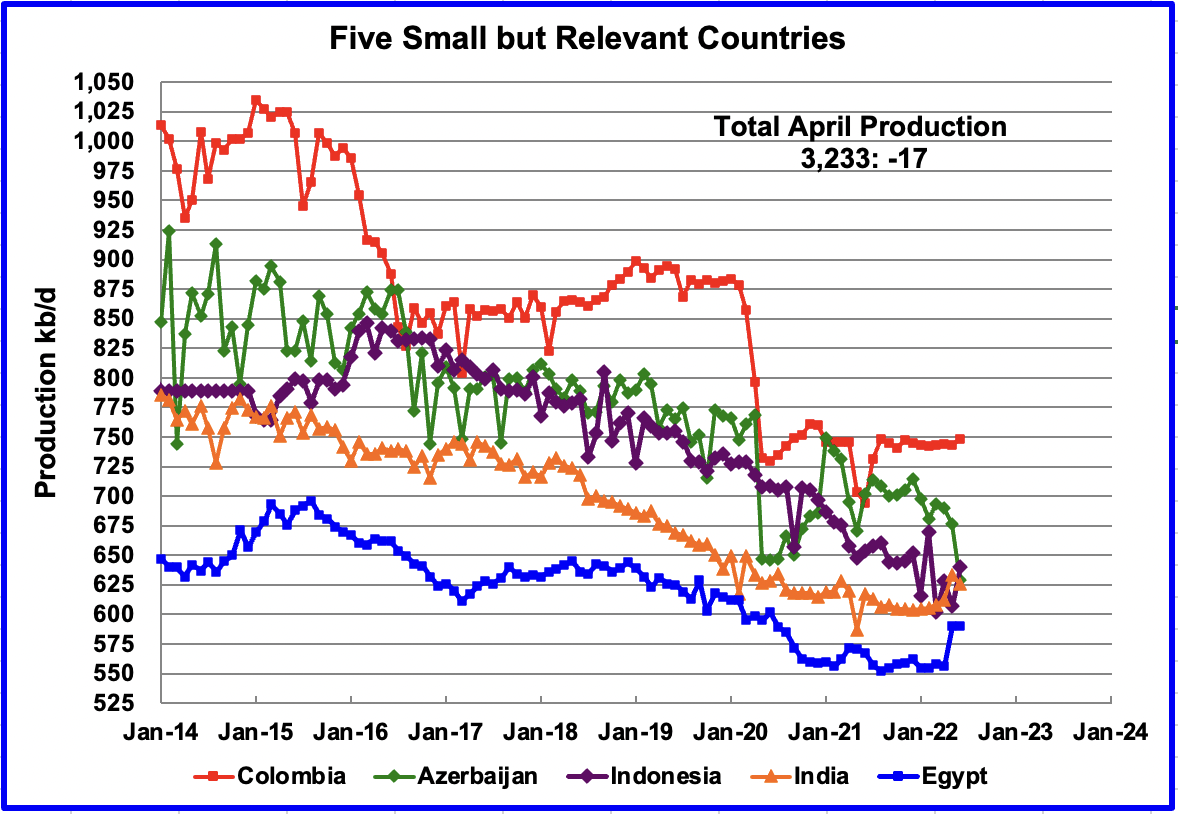

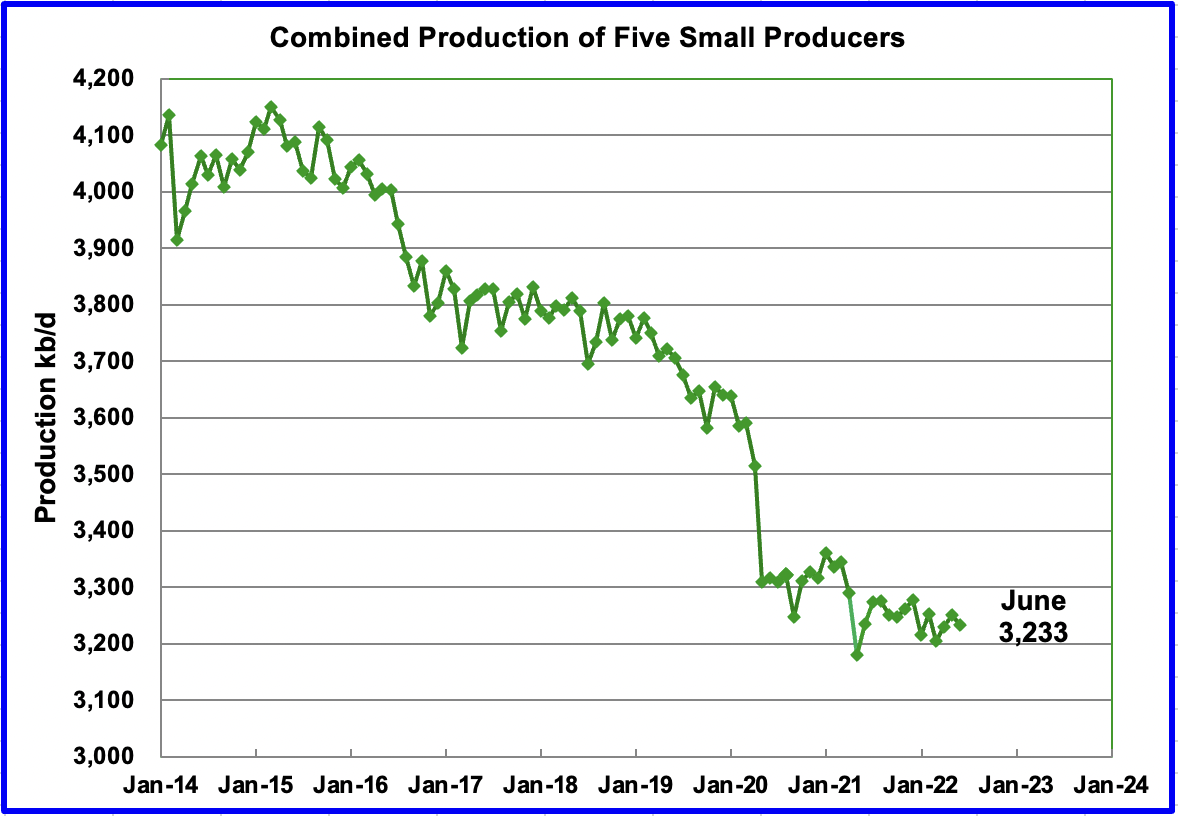

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined June production was 3,233 kb/d, down 17 kb/d from May’s 3,250 kb/d.

Data: EIA

The overall output from the above five countries has been in a slow steady decline since 2015 and the decline continues.

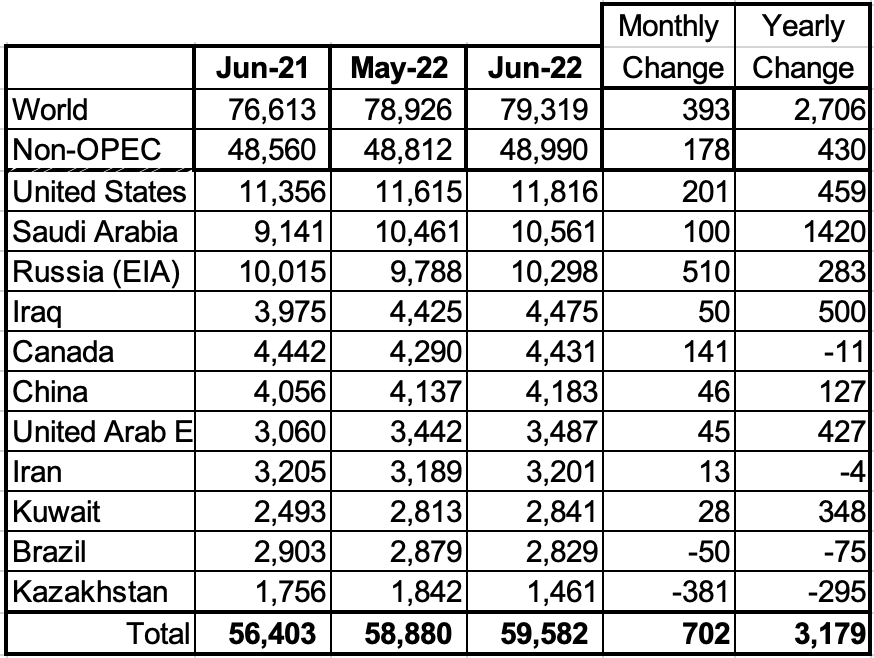

World Oil Production Ranked by Country

Data: EIA

Above are listed the World’s 11 largest oil producers.

In June 2022, these 11 countries produced 75.1% of the world’s oil. On a YoY basis, production from these 11 countries increased by 2,706 kb/d.

The largest increases came from Russia, 510 kb/d and the U.S., 201 kb/d. The biggest offsetting decreases came from Kazakhstan, 381 kb/d and Norway, 285 kb/d. Note that Norway fell out of the Top 11 table due to its big production decline in June.

World Oil Production Projection

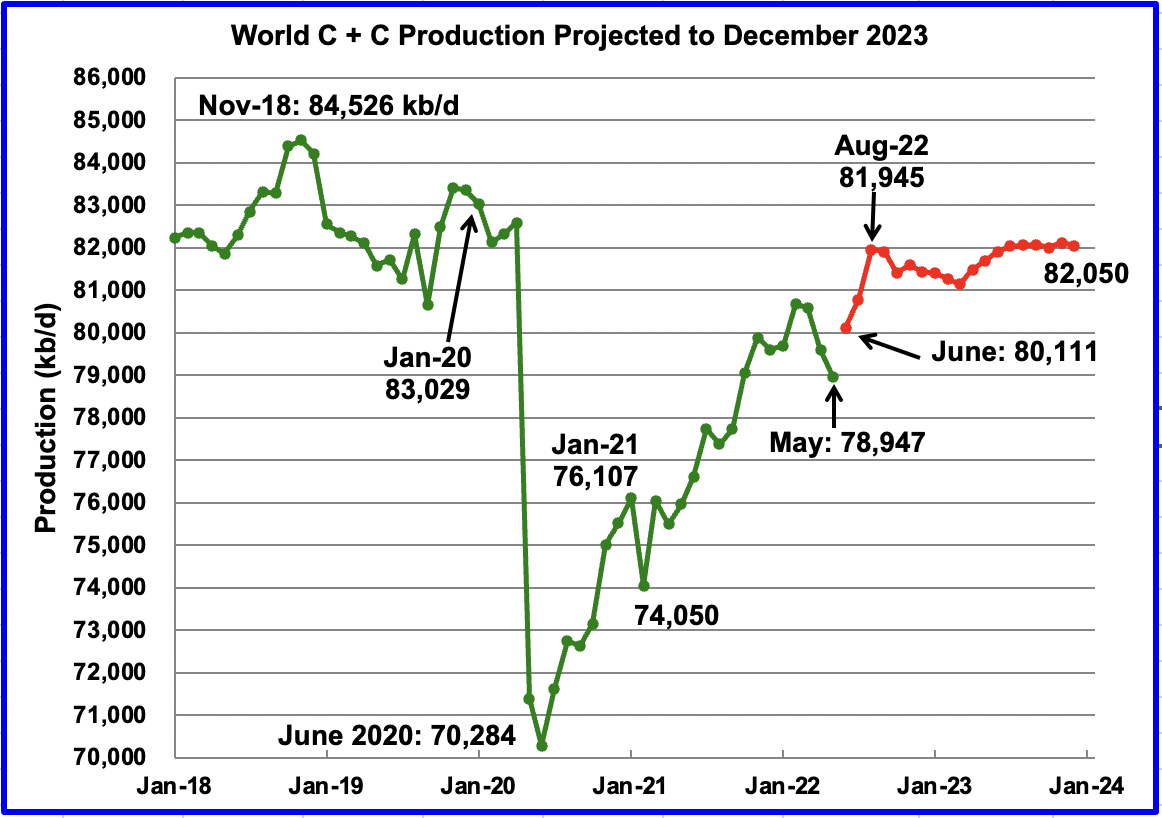

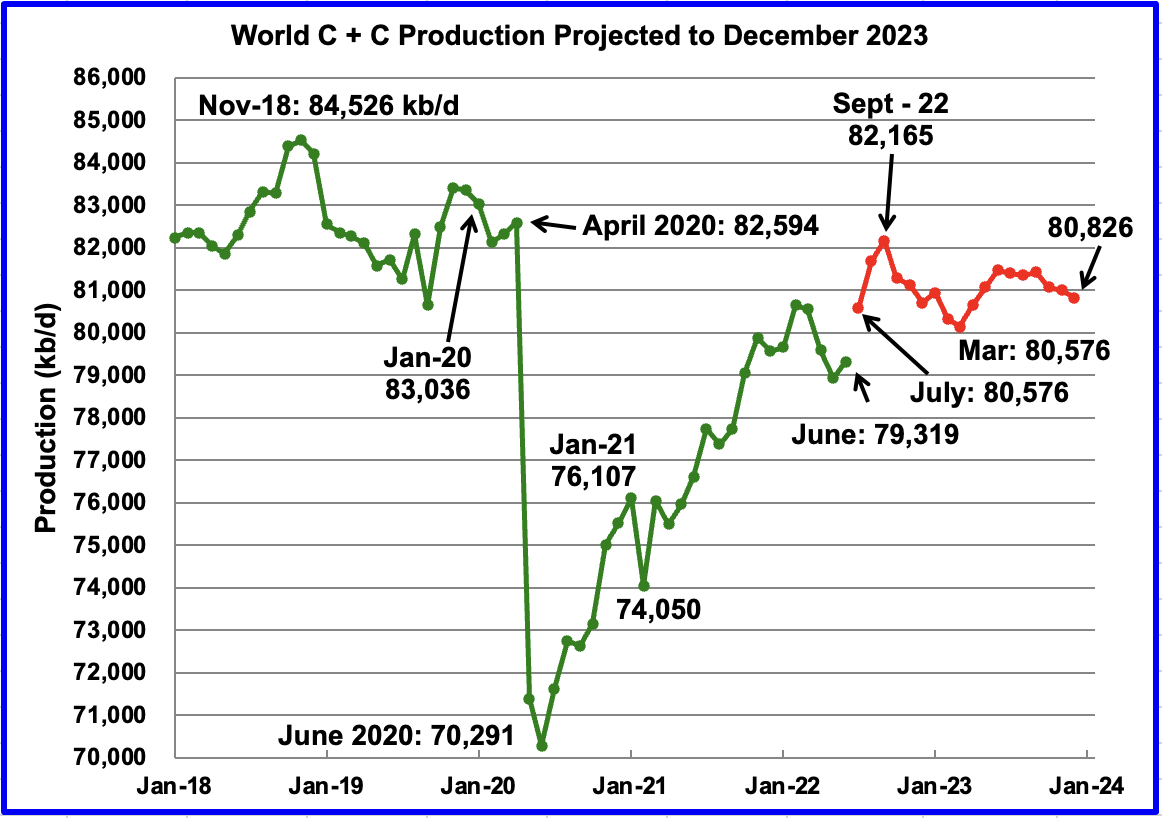

September Chart (Data: EIA) October chart (Data: EIA)

World oil production in June increased by 393 kb/d to 79,319 kb/d according to the EIA (Green graph).

This chart also projects World C + C production out to December 2023. It uses the October 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers.)

It projects that World crude production in December 2023 will be 80,826 kb/d, a decrease of 1,224 kb/d from the projection in the September report. For a comparison of the post August projection with the previous September projection, the September chart has been added before the October chart.

The large July increase of 1,257 kb/d is due to a 1,600 kb/d increase in all liquids over June. The December 2023 output is 3,700 kb/d lower than the November 2018 peak.

The rise of close to 2,846 kb/d from June to September seems aggressive. However, it is associated with projected US and OPEC + production increases. After September 2022, World production decreases and September 2022 could be the new post-pandemic high.

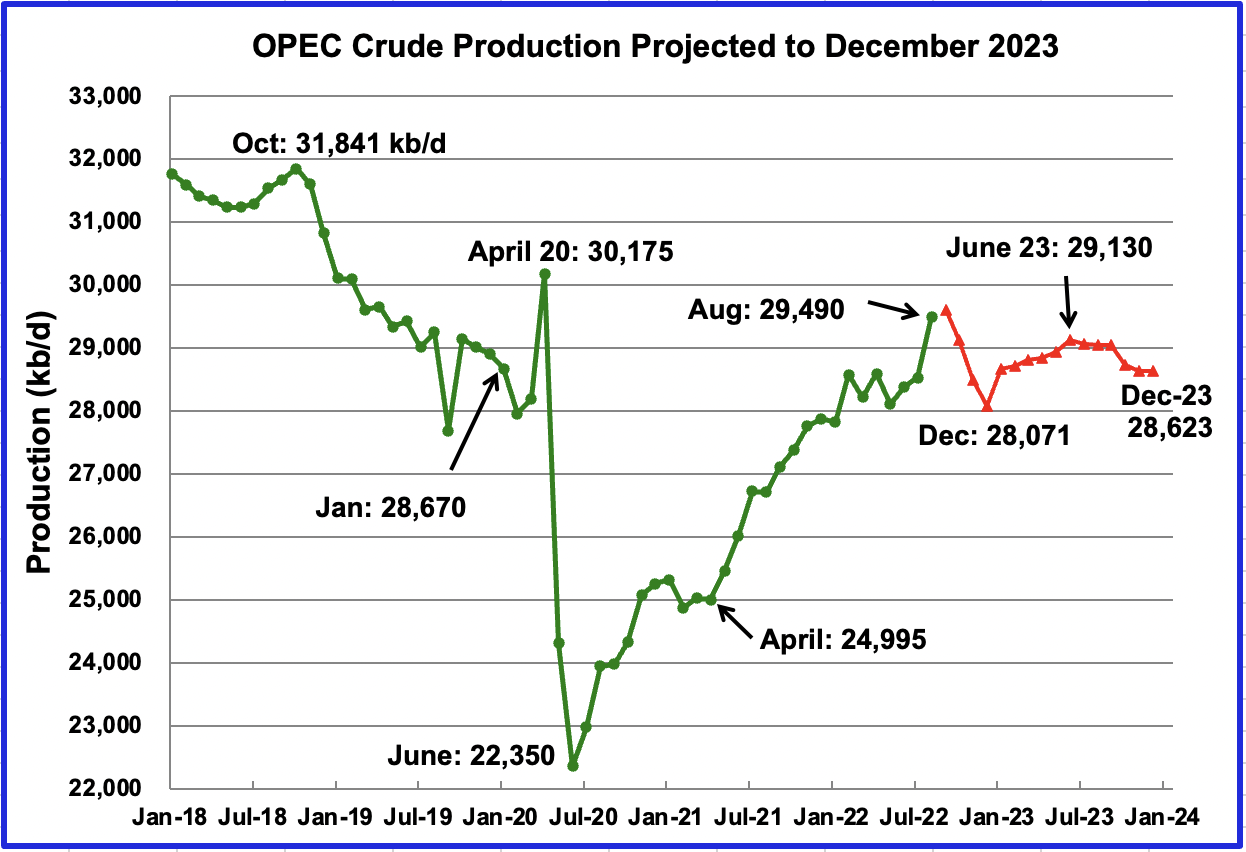

STEO OPEC Production Projection

Data: EIA

As noted above, part of the decrease in World oil production after September 2022 is due to the projected drop in OPEC production by the STEO, along with known cutbacks and sanctions. The August and September production levels are close to the current OPEC published figures.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment