Slimoche

“While there is continuity with the historical strategic pillars of Jumia, we will take more deliberate action and step-up execution intensity across all these areas.” – Jumia Technologies (NYSE:JMIA) Results Presentation Q3, November 17, 2022

Jumia Technologies’ newly appointed acting CEO Francis Dufay must be making a bid for the permanent CEO spot. In his first earnings report, Dufay laid out a comprehensive refresh of Jumia’s business strategy alongside a redux on cost discipline and return on investment that speaks to an ever-increasing urgency to convince investors that JMIA can one day soon become a profitable business. Results for Q3 showed more encouraging signs that the company is on the right path. However, a looming global recession means that JMIA must navigate a runway of potholes.

Strategy Refresh

Dufay’s strategy refresh delivered calls to action that address specific pain points and challenges. In summary, JMIA will commit to fewer initiatives, will further increase cost discipline, and will rationalize all of its operations. Here is my key list of issues that Jumia identified:

- JMIA Prime is too early in the market’s adoption cycle.

- First Party grocery e-commerce and logistics as a service are not economical in certain markets.

- Customer incentives and marketing do not provide sufficient returns in market growth. These returns are also highly channel-dependent.

- Technology investments require more rationalization.

- Commission rates charged to sellers on the platform have become quite high, enough to be a drag on seller activity.

There is a lot of business common sense in Jumia’s strategy refresh. On the e-commerce side, Jumia committed itself to “master the basics of e-commerce [of] selection, price and convenience.” Admittedly, I was a little unsettled by the implication that a company that is supposed to be the Amazon of Africa is still talking about learning and implementing the basics. The company also referenced well-known platitudes like increasing consumer value, improving the consumer experience, creating value, efficiency, developing strong supplier relationships, driving scale, etc. Yet, explicit statements of the issues and a commitment to specific actions help fuel investor confidence. Hopefully, the strategy refresh also reinvigorates the company even as staff reductions are sure to weigh on employee morale.

One particularly curious and surprising strategic shift comes with “core categories.” Suddenly, Jumia is pivoting back to phones and consumer electronics. Instead of doing less, Jumia will return to doing more in this area. In recent quarters, Jumia purposely reduced its sales volume in these products in favor of common, everyday goods (fast-moving consumer goods or FMCG). FMCGs sell at smaller price points but drive higher volumes and better margins. I will be closely watching this repivot since it risks re-introducing the issues that drove the company away from the business.

In the conference call, a surprised analyst asked about this pivot. Dufay’s answer suggested that the company figured out that it can actually sell phones and consumer electronics profitably alongside the FMCG products. From the Seeking Alpha transcript:

“…what matters to us is the whole equation with our logistics costs and our marketing costs. We know for a fact that on consumer electronics categories, our operating model works, and we can get very healthy economics across all of our markets from those categories. So we’re very confident in the fact that we need to develop or build and supply in these categories, and it does not conflict with our focus on everyday categories.”

One notable cost-saving measure involves Jumia’s central staff. Jumia will move these folks (senior leaders) from expensive Dubai real estate and back to African home countries. Such a move is consistent with replacing the previous Europe-based CEOs with someone with more experience on the ground in an African country. Dufay was CEO of Jumia Ivory Coast. (I hope the former CEO of Nigeria, Juliet Anammah, is being considered for the permanent CEO position).

Jumia Pay

Jumia Pay is the promise and potential that continues to come up just short. While total payment volume (TPV) increased 16% year-over-year on a constant currency basis, on-platform penetration as measured by TPV as a percentage of GMV (gross merchandise volume) barely budged from 27.1% to 27.7%. Total transactions were also essentially flat at 3.0M. Worst of all, transactions as a percentage of all orders plunged from 35.7% to 31.9% year-over-year. Management explained that a pullback in marketing incentives and investments helped to drive these languid results (in support of “unit economics”). However, I am now worried Jumia Pay is further away than ever from becoming a dominant growth engine for the company. It is a true “show me to make me believe” story at this point.

Overall Results

Overall results were a mixed bag of anemic user growth combined with strong growth in volumes. User count only grew 3% year-over-year, but order volume grew 11% and GMV grew 14% on a constant currency basis. Overall revenue soared 33% on a constant currency basis, mainly driven by marketplace revenues from higher commissions. This growth drove Jumia’s gross profit margin to an all-time high of 33.0%. Jumia is getting good leverage from new and existing users. Unfortunately, the sluggish user growth demonstrates that Jumia is not currently a high-growth company despite being well-placed in one of the planet’s highest potential upside markets. Moreover, the company has apparently squeezed as much as it can from higher commissions, so I do not expect such robust marketplace revenue results in the near term.

Indeed, Jumia suspended its GMV and gross profit margin guidance for the balance of 2022. The reiteration of guidance for sales and advertising expense and EBIDTA loss means that the strategy refresh and redux of cost discipline will not likely start showing evidence of working until 2023. In other words, investors will have to be yet ever more patient.

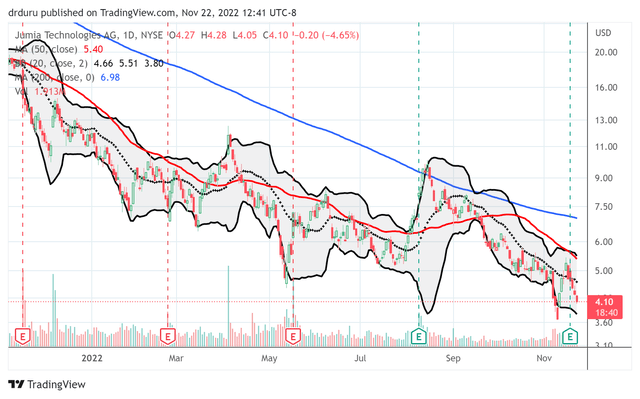

The Trade

With my expectations sufficiently tempered, I do not consider JMIA’s post-earnings losses as another buying opportunity. I am willing to continue holding my existing position (I remain rose-colored optimistic!), but I see no reason to invest further in the JMIA story until this strategy refresh delivers demonstrable evidence of altering Jumia’s trajectory and transforming it into a true growth story for markets across Africa. On the technical side, I want to see JMIA’s stock stabilize. A good start for stabilization would be a complete reversal of current post-earnings losses and then an end to the downtrend in place since August’s premature post-earnings excitement.

Post-earnings disappointment is sending Jumia Technologies (JMIA) back toward its 30-month low…with pandemic lows not far away. (TradingView.com)

Be careful out there!

Be the first to comment