Michael M. Santiago/Getty Images News

Red-hot inflation and rapidly rising interest rates will hurt the economy, with consumer spending likely to take a nosedive and soon lead the way to the next recession. Right?

The doom-and-gloom outlook doesn’t seem to be justified, at least judging by JPMorgan’s (NYSE:JPM) Q3 earnings report. The banking powerhouse delivered an all-around beat on YOY revenue growth of more than 10% and EPS of $3.12 that topped expectations by 23 cents. The stock traded about one percentage point higher in pre-market activity, minutes before the opening bell.

Due to a combination of macroeconomic fundamentals that remain resilient (at least for now) and JPMorgan’s signature ability to execute at the top of its game, I still consider JPM the best Big Bank stock to own today.

On JPMorgan’s Q3 earnings results

While CEO Jamie Dimon did not forget to mention the business risks associated with monetary tightening, the war in Europe and the lingering supply chain challenges around the globe, the tone of his narrative remained remarkably optimistic: “in the U.S., consumers continue to spend with solid balance sheets, job openings are plentiful, and businesses remain healthy”.

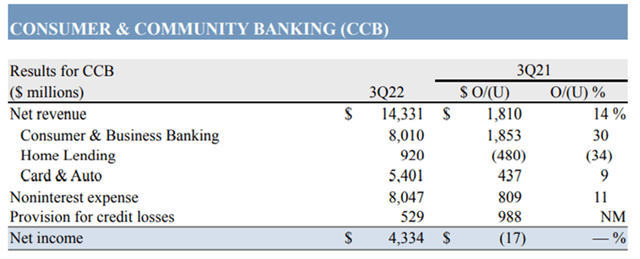

It was exactly JPMorgan’s consumer arm that helped the bank to deliver solid results this time. Debit and credit card sales increased 13% on top of what had already been an incredibly strong third quarter in 2021, at a growth of 26%. Deposits jumped 9%, likely helped by higher interest rates that attracted investments to cash – a positive for JPMorgan’s balance sheet and yet another sign that the U.S. consumer remains in good shape.

Below is a quick snapshot of JPMorgan’s consumer division’s impressive numbers in Q3 of this year compared to the 2021 results. Notice that net earnings growth did not look particularly exciting, but this was mostly due to a tough comparison against last year’s loss reserve release that reflected the decline in pandemic-related risks.

Even investment banking, widely expected to be a sore thumb for all banks this quarter, may have contributed to this Friday’s bullish reaction. To be clear, revenues of $1.7 billion were small as fees sank by a whopping 47% YOY. But keep the following in mind: (1) expectations were highly de-risked ahead of the print, with Seeking Alpha contributor Cavenagh Research bracing for a fee drop greater than 50%, and (2) JPMorgan, the top Wall Street player in investment banking, may have stolen some market share away from its competitors once again. Citi (C), for example, reported Q3 investment banking revenues that were an astonishing 64% lower YOY.

Going forward, things continue to look just fine at 270 Park Avenue (or 383 Madison Avenue, temporarily). The full-year 2022 guidance for net interest income ex-Markets was narrowed higher, from $58 billion-plus to approximately $61.5 billion. Meanwhile, the executive team sees buybacks resuming early in 2023, after the company chose to play it safe this year in the face of Basel III uncertainties.

On JPM stock

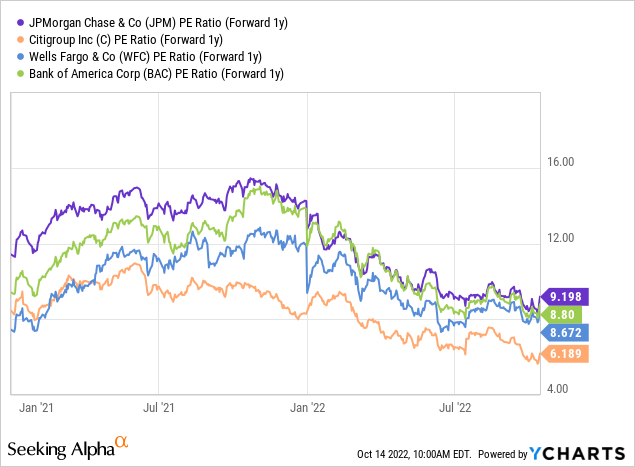

Sometimes, simplifying is best when making investment decisions. JPMorgan has consistently proven that its management team can deal with the ever-present macroeconomic challenges well and execute better than its competition. Primarily for this reason, not to mention the quality of the consumer banking book and the investment banking brand, I see JPM as a higher-quality stock to own in the Big Bank space – despite it persistently trading at a P/E premium relative to peers (see below).

In today’s uncertain market and global economic environment, I apply to the financial services sector the same rationale that I have recently used to assess the landscape in the airline industry: bet on the winners when the ground feels a bit shaky, and only speculate on the underdogs when the economic upcycle is beginning to form. At this point, especially with the stock being down a sizable 30% for the year so far, I think that JPM is the best pick among diversified U.S.-based banks.

Be the first to comment