Diego Thomazini/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on March 16th, 2022.

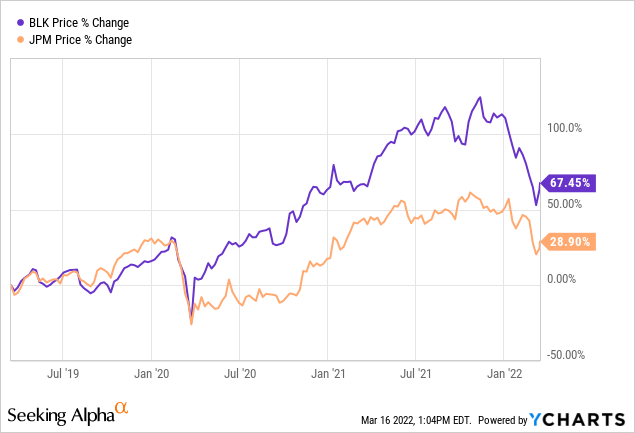

After their latest declines, JPMorgan (NYSE:JPM) and BlackRock (NYSE:BLK) are looking like much better bargains. As of typing this, BLK is down ~25% from its 52-week high – which is also its all-time high. JPM has held up a bit better, with a decline of around 20.5% as of March 16th, 2022. The 52-week high is also the all-time high for shares of JPM. That isn’t their only selling point, though, as earnings and dividend growth going forward make them attractive prospects.

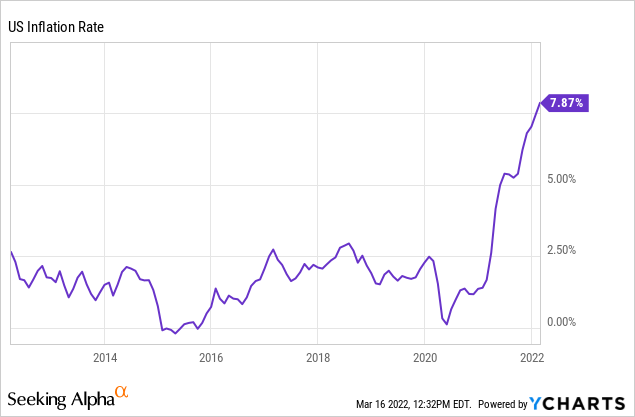

The whole market has been having quite the rough Q1 of 2022. That certainly didn’t help the share price of these two companies. Geopolitical risk as global companies and higher expected expenses can hurt both of these stocks. Inflation is rampant, and while that would mean higher interest rates, something that should benefit JPM, those higher expenses are expected to come in the form of higher labor costs.

An indirect impact for BLK with higher interest rates could be if they get pushed too far, which could mean a rapid slowdown in the U.S. economy. A recession or even decline in assets for BLK means reduced fees when AUM goes down. That is on top of an already highly competitive field where cutting fees on their ETFs are a regular occurrence. Not to mention that they are a large employer with over 18,000 employees too. If they want to fill vacant positions, they’ll have to be competitive on pay too.

That’s all the bad news out of the way, though. What makes these interesting names are those declines and that they are some of the largest companies in the world with rock-solid balance sheets. More specifically, BLK is the largest asset manager in the world, so the most significant player in its field. This has meant steady dividend growth for shareholders over the years.

With inflation at an elevated level, having exposure to financial stocks such as banks and even asset managers can be a natural hedge. Their growing dividends have been more than enough to outgrow the pace of inflation. This means an income investor in these two companies is increasing their buying power along the way.

YCharts

JPMorgan Chase & Co (JPM)

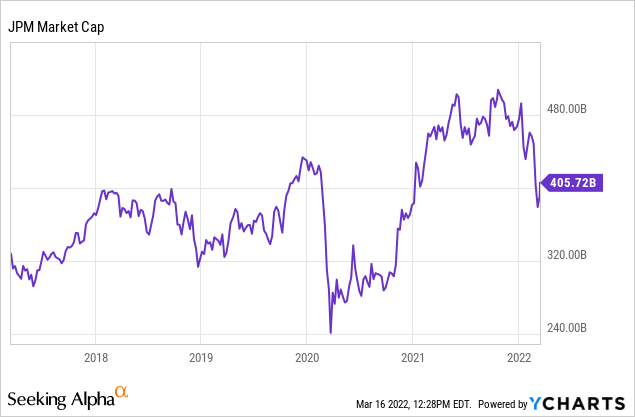

JPM is a massive bank with an over $405 billion market cap. Considering the latest drop in the stock share price, a lot of that has come down too.

YCharts

These declines have pushed the stock to trade around where it was pre-March 2020’s COVID-induced sell-off. Considering the fact that 2021’s EPS came in at $15.36 a share and 2019 came in at $10.72. A significant jump for this was credit reserve releases, which meant lower 2020 earnings. Revenue was up as that hit a record as well, and they reported a solid ROTCE.

Looking at the full year results on page 3, the Firm reported net income of $48.3 billion, EPS of $15.36, and record revenue of $125.3 billion. We delivered a return on tangible common equity of 23% or 18%, excluding the reserve releases.

Analysts estimate that earnings will fall materially from the current level for 2022. The consensus EPS is $11.13, which would still mark growth from 2019. A lot can happen after that, but in 2023 and 2024, analysts expect growth to continue at quite a healthy pace. They aren’t getting any credit for growth over the last two years. Not to mention that over the last 16 quarters, they have beaten EPS expectations for 13 quarters. Given the consensus EPS, that would put the forward P/E for JPM at around 12.36.

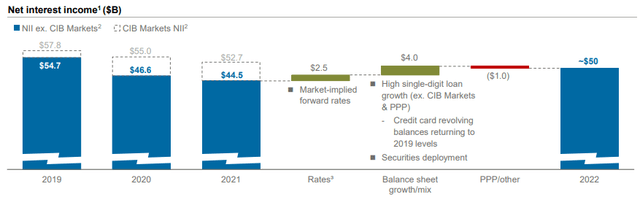

They are anticipating loan growth in 2022 to contribute to high net interest income.

JPMorgan NII Expectations (JPMorgan)

We won’t have to wait too long to see how things are looking as they are expected to announce their Q1 earnings on April 13th, 2022.

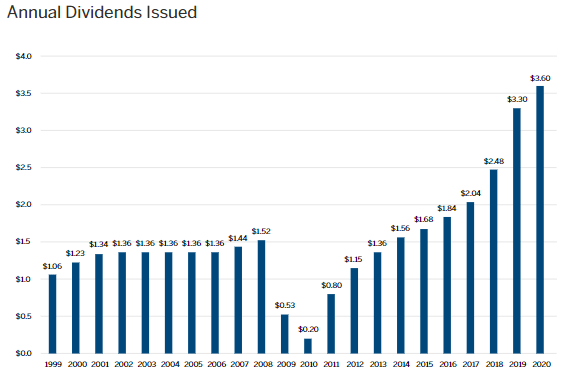

At the current price, the stock yields an attractive 3.02%. They had frozen their dividend through 2020, not by choice, but have provided 11 years of consistent dividend growth since 2010. Despite the freeze, the actual annual amount paid out still grew year-over-year.

As we all know, 2008/09 was incredibly tough on the financial markets. So it isn’t too surprising that we would see a massive collapse in what JPM was paying out at that time.

JPMorgan Dividend History (JPMorgan)

For 2021, they ended up paying $3.70 in dividends. Even if they held the dividend flat this year, it would come out to $4 in dividends based on the $1 paid over the last two quarters. This works out to the 10-year CAGR of 14.28% and a 3-year CAGR of 11.79%, according to Seeking Alpha.

BlackRock (BLK)

With their last earnings report, BLK hit a record high amount of assets under management, clocking in at over $10 trillion in total managed assets. The largest of this was in the equity ETF space. This put them well ahead of the second largest asset manager, Vanguard, with an AUM of $8.2 trillion. This will certainly be an interesting metric to see when they report their earnings in April.

As the stock hit an all-time high and the overall uncertainty of the market in general, it makes sense that shares have fallen quite precipitously as of late. I believe that is opening up an excellent opportunity to pick up shares at a much lower price than where we were just a few months ago. That’s easier for me to say, though, as a long-term investor. I don’t doubt the current headwinds could continue to keep shares of BLK under pressure – that goes for JPM too.

Unlike JPM, shares of BLK are still well ahead of the pre-COVID highs. In fact, their rebound was significantly faster than what JPM experienced. Of course, this has to do with their respective industries – while both operate in the financial sector – the actual underlying business is quite different. Below is looking at the last 3 years.

YCharts

The higher earnings for BLK haven’t only been asset appreciation. They have been receiving some massive inflows as well. For 2021, they noted that they had total net inflows of $540 billion. That helped translate into 20% higher revenue for the year and a 20% increase in diluted EPS. EPS from 2020 was $33.82, and in 2021, it came in at $39.18. Analysts are expecting for 2022 that BLK will see $41.40 in EPS.

Again though, the number of beats has been 14 over the last 16 quarters that they reported. They are also on quite the hot streak; they haven’t missed a quarterly EPS estimate since June 2019.

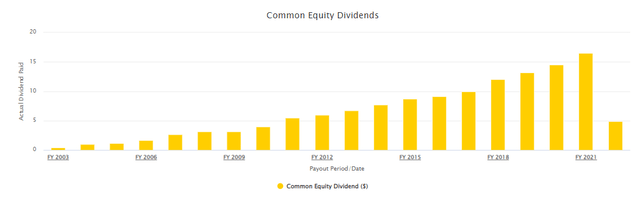

BLK’s dividend history has been a bit more consistent relative to JPM. They are going on 12 years of dividend growth. They did freeze their dividend for several quarters between 2008 and 2009. That resulted in a lack of annual increases, but they also didn’t cut their dividend through that period.

BLK Dividend History (BlackRock)

The CAGR for BLK has been weaker relative to JPM over the last 10 years, coming in at 11.87%. However, it comes in at a similar 11.56% over the last 3-year period. This is still well above the current inflation level, and the previous increase worked out to a massive 18.2% increase.

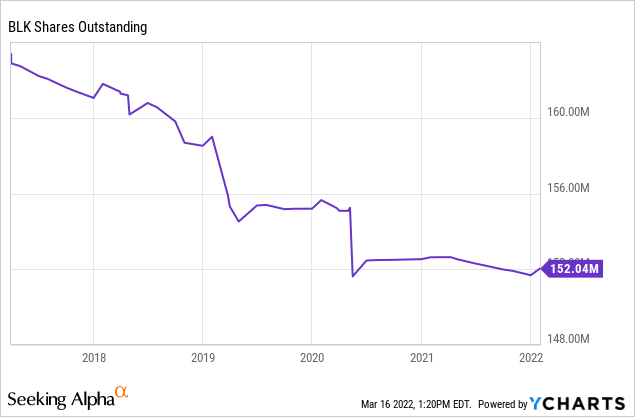

They have also been rather consistent with their share repurchases over the years. That also helps out that EPS figure.

YCharts

Conclusion

JPM and BLK are both solid names in the financial sector. Despite both being in the financial sector, their underlying businesses are quite different. At the same time, with the latest market declines, I believe that both of these names represent attractive entry prices for long-term investors. That is considering that in the shorter term, there could continue to be uncertainty which creates pressure on these stocks.

The growing dividends that beat out inflation are a huge selling point for a longer-term income investor. JPM might have cut in 2008/09 but grew rather consistently since. BLK survived by having to freeze its dividend during that period and has been growing consistently since.

Be the first to comment