pixelfit/E+ via Getty Images

Co-produced with Treading Softly

I don’t envy the rich, I really don’t. Most of those among us who qualify as rich have worked exceptionally hard and sacrificed greatly to achieve it.

No, I recommend you envy the wealthy.

Wait, aren’t those the same thing? The simple answer is no.

When we refer to someone, we may call them rich, or wealthy, or rich and wealthy. Did you notice how we compound those concepts? It means both individual words have a unique meaning adding to the description. Sadly, over time, we’ve caused rich and wealthy to be synonymous, losing the unique benefit of both.

Being rich means having a large net-asset value, in other words, you have plenty of money.

Being wealthy means having sustainable wealth. You won’t go broke if you spend some of your money and have plenty of excess income.

Often being wealthy will lead you to be rich as well. Being rich certainly makes it easier to become wealthy, if you are smart with your riches. However, it’s possible to get rich quickly and in turn, become broke quickly as well. Have you ever heard the horror stories of lottery winners who go broke?

I don’t want a bunch of rich people running around afraid to spend a dime because they don’t know how they’ll replace it in the future! I want investors and retirees to be wealthy, having sustainable wealth that continues to pour into their accounts and cover their expenses, and fund their lifestyles. This means owning assets that provide a recurring income.

The 1% have a wealthy lifestyle because they earn an abundant level of income from their assets and jobs. If they didn’t but spent as if they did – they wouldn’t be 1%-ers for long!

So it’s time to put your dollars to hard work earning income like a 1%-er would want their assets to do.

Let’s dive in.

Pick #1: XFLT – Yield 12.5%

Well, it happened. A major loan default of a loan that is held in CLOs. Revlon (REV) has filed for bankruptcy. OMG, run for the hills!

This is a great case study for how CLOs work because REV is publicly traded, the bankruptcy is getting a ton of news coverage and at $3.3 billion, it accounts for approximately 1/3rd of all loan defaults year-to-date.

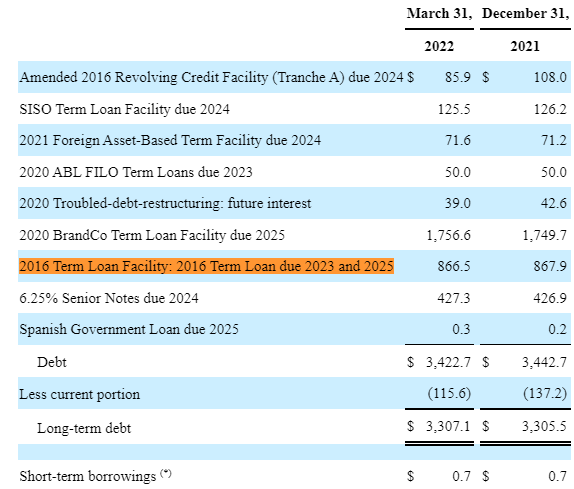

Here is what the leveraged loan looks like on REV’s SEC filings:

Revlon Q1 2022 10-Q

What does this mean for XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT)?

Well, let’s break it down. First, the entire $866.5 million is not in CLOs. On average, about 60% of term loans are put into CLOs. The rest are bought by retail funds, banks, and other institutional investors. In this particular case, roughly $300 million of REV’s debt is spread across over 100 CLOs. It’s likely below average because REV has been struggling for a while now, with the leveraged loan downgraded to Caa2 in April 2020. CLOs are limited in how many C-rated holdings they can have.

Does XFLT have any exposure to REV? Probably. They have three debt tranches in CLOs issued by Symphony, totaling $3.5 million. Symphony was one of the larger CLO managers with exposure to REV. We would assume that all three CLOs have exposure to REV – that might, or might not be the case.

You see, it isn’t like one entity holds the entire loan. The loan is split up among thousands of investors. Some hold it directly, others hold it through a CLO. CLOs typically don’t have positions that are larger than 0.5% of assets. These are vehicles where diversification is not only a practice, diversification is often enforced by the contracts. A CLO manager can’t just load up with 5, 10, or 20% of assets in a single bet.

Even if we assume that all three Symphony holdings have a 0.5% allocation to REV, for XFLT, that would mean 0.5% X $3.5 million = $17,500. Out of over $400 million in assets, that isn’t something we’re going to lose sleep over.

This is the power of CLOs! They insulate investors from the risks of single defaults. Even relatively large ones become quite insignificant thanks to the power of diversification.

Also, let’s not forget, that a default does not mean that the CLOs instantly have a loss on that loan. Apparently, some folks believe that REV’s common equity is going to have a decent recovery as the share price actually climbed a lot after the bankruptcy filing. The common equity won’t get a penny unless the leveraged loan receives 100% recovery, usually as new debt (usually at a higher interest rate) and maybe a partial payoff. We aren’t going to speculate as to how this particular bankruptcy plays out, but it likely won’t be a 100% loss for the senior debt, which is what the CLO debt is.

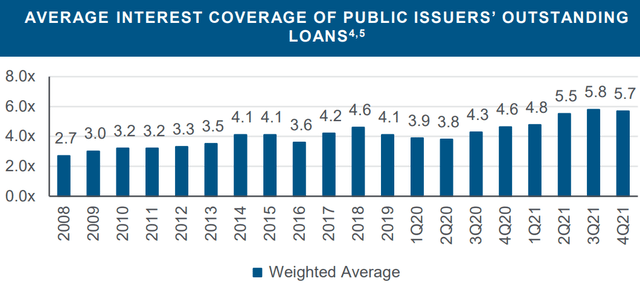

With the default of REV, the default rate of all loans year-to-date is now up to 0.6%, this remains well below average. Fitch is projecting defaults at only 2% in 2023, even with the risk of a recession next year. The historical average is 2.66%.

The bottom line is that most borrowers are much healthier than they have been historically, and interest coverage is near all-time highs, at 5.7x. (Source: XFLT Quarterly Webinar)

Rising rates will be a slight headwind to interest coverage, by raising interest expense, but there is plenty of cushions, and who does that extra interest expense go to? Lenders like XFLT.

XFLT invests in floating-rate loans that are at the top of the capital structure. If rates go up, they collect more! As shareholders, that benefits us through our dividends.

Pick #2: PDI – Yield 12.6%

When interest rates rise, fixed income falls. It’s a rule of the market. The main reason this is usually true is that “interest rates” are actually investments. You can invest in U.S. Treasuries and receive a “risk-free” return. By risk-free, we mean zero credit risk. You can still lose money by trading in and out, but if you buy a 10-year Treasury, you know exactly how much interest you will receive and exactly when it will be paid. You don’t have to worry about a default, the government will pay. On the off chance that the U.S. Government doesn’t pay, well the financial Armageddon that would follow is so severe that it doesn’t really matter where you invest, I just hope you have a good supply of Cinnabons. You will need them to trade with your crazy survivalist neighbor for some bunker space.

In investing, the rule of thumb is that if you can get the same return, with lower risk, you should always choose lower risk. While the market isn’t perfect, it does tend to somewhat follow this rule. So if Treasuries are yielding more (interest rates are up), then other fixed-rate investment options are relatively less attractive.

This is especially true for low-yield A-grade corporate bonds. That 0.45% coupon to lend to Alphabet (GOOG, GOOGL) might have looked great in 2020… Well, at least other people thought it looked great, we didn’t. Today, there are 3 years left on that bond and the 3-year Treasury is yielding over 3.1%. Over the life of the bond, you’ll collect about $13.50 in interest on $1,000. You’ll get about six times that in capital gains because the bond is trading well under par. The price had to decline so that it didn’t have a yield that is lower than U.S. Treasuries. Otherwise, investors could just buy the much more liquid and even lower-risk U.S. Treasuries.

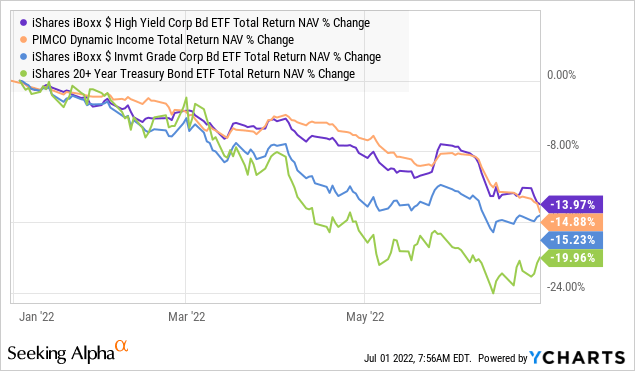

This is an extreme example, but it shows how rising Treasury rates impact all bonds. PIMCO Dynamic Income Fund (PDI) is a CEF (closed-end fund) that invests in bonds. PDI invests in higher-yielding bonds, so the impact of price isn’t as severe, but it still happens.

Here is a look at NAV for PDI, and the iShares ETFs for investment-grade bonds, high yield bonds, and treasury bonds. Note that the “safer” investment-grade and Treasury bonds actually declined the most.

What does this mean for investors? Well, it means that the price comes down. Whenever prices come down for a pick, I am inevitably asked “is the dividend at risk”? Investors frequently tie declining prices to increasing dividend risk in their minds. In reality, PDI’s dividend is much safer today than it was last year.

PDI invests in debt, distributing interest. As that debt matures, PDI will reinvest the principal at the prevailing market rates. If interest rates are higher, that means PDI will have higher yield opportunities. Price and yield are inversely related to each other. The lower prices, the higher yield is. The higher prices, the lower yield is. Higher NAV is a greater threat to the dividend than lower NAV.

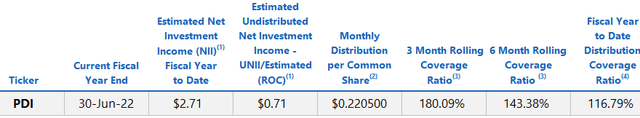

We can see this playing out with PDI’s UNII Report. UNII is the Undistributed Net Investment Income. This is the net income over and above the dividend, which PDI was struggling to cover last year.

Struggle no longer – over the past 6 months, coverage improved to 143%, and in the past 3 months, it was 180%. PDI’s UNII for the fiscal year climbed from -0.08% in November to $0.71 in May. This is because interest rates are going up!

Higher yields mean lower NAV, but it also means more income. Since I am investing for income, that is what matters to me. PDI yields over 12% and is covering its dividend by 140% year-to-date, plus it will likely pay out a special dividend to reduce that $0.71 in UNII.

Some investors run away, worrying about NAV. I’m happy to follow the money. Let other investors panic and sell, I’ll sit back and collect my dividends!

Shutterstock

Conclusion

With XFLT and PDI, we can invest in an oversold sector of the market with skilled managers on our side. Instead of buying individual loans, hoping our personal skills are enough to sleuth out which bond or loan is the best to hold, we can employ the best-in-class managers to oversee the portfolio of loans and CLOs for us. This frees up our time to enjoy the income our investments provide us.

Retirement shouldn’t be a time of worrying over budgets, scrimping to pay the power bill, and worrying whether you’ll outlive your savings. It should be a time to experience the world, see loved ones, and expand our skills into hobbies we’ve always wanted to try. So go learn how to ride a horse, learn how to weld, or improve the quality of your breadmaking. The options are endless.

This can all be supported and carried on the back of real-world wealth. sustainable, recurring, reliable, and ever-present wealth. Don’t aim to be rich – get wealthy, and the richness will come along for the ride.

That’s income investing.

Be the first to comment