Creating Outdoors/iStock via Getty Images

The beauty and serenity of nature is often most appreciated by those who fashion themselves as outdoor enthusiasts. This is a large market with significant potential for growth and, as such, it should come as no surprise to investors that there would be a number of players dedicated to providing goods and services aimed at meeting the needs of said enthusiasts. One such player in this market that investors should pay attention to is Johnson Outdoors (NASDAQ:JOUT). Historically speaking, the management team at the company has done well to grow it both from a revenue perspective and a profitability perspective. Performance was particularly strong during the 2021 fiscal year. But in spite of what management refers to as high demand, there are some problems that are leading to some pain for the company this year. Even if this pain is here to stay, shares look like they could be slightly undervalued. On the other hand, if this year marks just a bump in the road for the firm and financial performance eventually reverts back to the kind of levels we saw last year, the stock could warrant some nice appreciation. Because of this, I’ve decided to rate the company a ‘buy’.

An outdoor enthusiast’s dream

As I mentioned already, Johnson Outdoors is a leading producer of outdoor recreational products. While the company has its hands in a few different things, its biggest emphasis is on outdoor recreational products that focus on water. For instance, the largest concentration of business for the firm is its Fishing segment. Under this segment, the company has a few important brands. One of these is Minn Kota, which produces electric motors for quiet strolling or primary propulsion. It also produces marine battery chargers and shallow water anchors. Under the Humminbird brand name, the company produces sonar and GPS equipment used for fish finding, navigation, and marine cartography. And under the Cannon brand name, the company produces downriggers for controlled depth fishing. According to management, this segment was the most significant for the company in its recent fiscal year. In 2021, it was responsible for 73.3% of the firm’s revenue and for 83.2% of profits.

Next in line, we have the Camping segment. The company has only two key brands here. The first of these is Eureka!, which produces consumer, commercial, and military tents and accessories. It’s also responsible for the production of camping furniture and stoves, as well as other related products. And under the Jetboil brand, the company produces portable outdoor cooking systems. Last year, this segment accounted for 8.4% of revenue and for 9.5% of profits. The next segment is called Watercraft Recreation. Through this, the company produces Canoes and kayaks under both the Ocean Kayaks and Old Town brand names. It also produces accessory products like branded paddles under the Carlisle brand name. This unit made up 8.8% of revenue but just 1.2% of profits last year. And finally, we have the Diving segment. This is actually the second-largest segment by revenue but is the smallest segment by profits. According to management, this unit produces a complete line of underwater diving and snorkeling equipment under the SCUBAPRO brand name. Last year, this segment was responsible for 9.2% of the company’s revenue but for only 1% of profits.

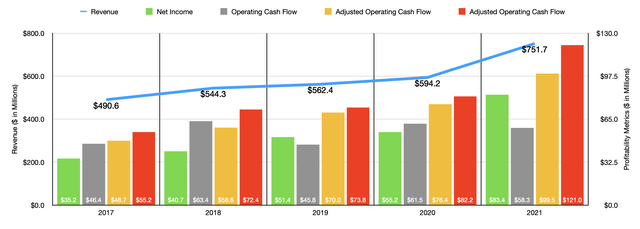

Over the past few years, the management team at Johnson Outdoors has done a good job growing the company’s top line. Revenue rose from $490.6 million in 2017 to $594.2 million in 2020. Then, in 2021, driven by strong demand, as well as by the success of new products, revenue jumped to $751.7 million. From a profitability perspective, the trend for the company has also been positive. Net income rose from $35.2 million in 2017 to $83.4 million in 2021. Other profitability metrics have followed a similar path. For instance, EBITDA increased from $55.2 million to $121 million over the same timeframe. Operating cash flow has been rather volatile, jumping around between $45.8 million and $63.4 million over the past five years with no clear trend. But if we adjust for changes in working capital, the metric would have risen consistently, climbing from $48.7 million to $99.5 million.

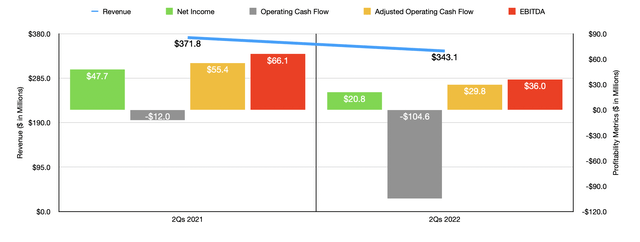

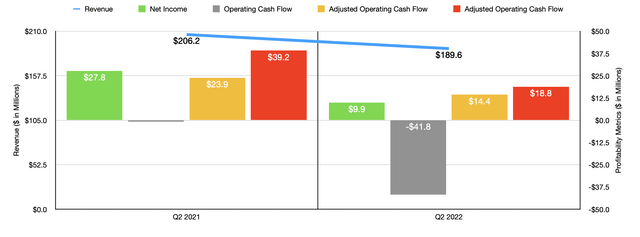

When it comes to the current fiscal year, the overall picture for the company does look less compelling. Revenue in the first half of the year has fallen, declining from $371.8 million in 2021 to $343.1 million this year. Management said that demand for its products was robust but that supply chain issues have made it difficult to meet this demand. Truth be told, this is difficult to digest. Economics 101 dictates that prices should increase when demand outstrips supply. So it is difficult to imagine this drop being attributed largely to supply chain issues unless the company is at a disadvantage to sourcing materials, distributing its products, or is just not as competent at adjusting prices to meet changing conditions as it should be.

To me, it looks like the company might lack pricing power. I say that because, despite the strong demand management claimed, profitability for the company took a hit so far this year. In the first half of the year, net income totaled just $20.8 million. That compares to the $47.7 million reported the same time one year earlier. Operating cash flow went from a negative $12 million to a negative $104.6 million. If we adjust for changes in working capital, it would have dropped from $55.4 million to $29.8 million. And finally, EBITDA for the firm declined from $66.1 million to $36 million.

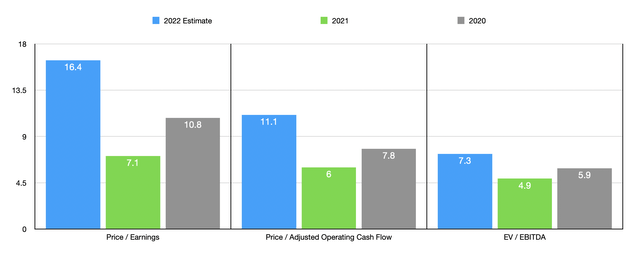

Management has given no guidance when it comes to the 2022 fiscal year. But if we assume that financial performance in the first half is indicative of what it will be in the second, investors should anticipate net profits for the year of roughly $36.4 million. Operating cash flow should be around $53.5 million, while EBITDA should be around $65.9 million. Using this data, shares of the company don’t look outrageously priced at all. The firm is trading at a forward price to earnings multiple of 16.4. The price to adjusted operating cash flow multiple is 11.1. And the EV to EBITDA multiple of the company should be 7.3.

Any event that financial performance does eventually come to look more similar to what the 2021 fiscal year looked like, then shares could be drastically underpriced. The price to earnings multiple for the company would decline to 7.1, while the price to adjusted operating cash flow multiple would decline to just 6. Meanwhile, the EV to EBITDA multiple of the company would come in at 4.9. If, instead, performance were to revert back to what we saw in 2020, these multiples would be 10.8, 7.8, and 5.9, respectively. To put the pricing of the company into perspective, I also compared it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.7 to a high of 63.5. Using the price to operating cash flow approach, the range was from 2.9 to 428.8. And using the EV to EBITDA approach, the range would be from 1.6 to 182.6. In all three cases, only one of the five companies was cheaper than Johnson Outdoors.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Johnson Outdoors | 7.1 | 6.0 | 4.9 |

| Smith & Wesson Brands (SWBI) | 2.7 | 2.9 | 1.6 |

| Clarus Corp (CLAR) | 26.2 | 57.2 | 22.1 |

| AMMO (POWW) | 14.0 | N/A | 9.3 |

| Weber (WEBR) | 8.0 | 33.0 | 182.6 |

| Traeger (COOK) | 63.5 | 428.8 | 124.8 |

Takeaway

At this point in time, it’s clear that Johnson Outdoors is having a bit of difficulty. Market conditions are definitely impacting the company and investors should expect this to continue in the near term. Even if that is the case, however, it’s difficult to imagine the company potentially being overvalued. And if financial performance can revert back to what the company experienced in 2020 or 2021, upside could be quite material. Because of this favorable risk to reward prospect, I decided to rate the business a solid ‘buy’ at this time.

Be the first to comment