Onfokus/E+ via Getty Images

Buying stock in a company that is undergoing a bit of pain can be a profitable endeavor. That is especially true if you can buy shares on the cheap with the idea that market conditions will eventually improve. At the same time, this strategy can also lead to some unfavorable results in the short run. For instance, if financial performance at the said company continues to deteriorate, irrespective of what the long-term outlook should be, additional pain could be experienced in the near term. A great example of this, in my opinion, can be seen by looking at Johnson Outdoors (NASDAQ:JOUT), an enterprise that focuses on the production and sale of outdoor recreational products. Recently, shares have fallen, largely because of a weakening in the company’s profitability. For the foreseeable future, that trend might very well continue. But even if it does, it’s difficult to imagine the company looking overvalued. And once the business does return to more normal levels, shares might experience a nice bit of upside.

More pain

The last time I wrote an article about Johnson Outdoors was in June of this year. In that article, I talked about the solid operating history that the company has demonstrated over the years. At the same time, I also acknowledged that it was experiencing a bit of pain so far this year. I was disappointed by that but still believed that the firm warranted some attention at that moment. This was because shares were trading cheap and, even if the painful trend persisted, I felt the worst-case scenario was that shares should be fairly valued. Ultimately, these conclusions led me to rate the enterprise a ‘buy’, reflecting my belief that returns for the business should ultimately come in stronger than what the market should see for the foreseeable future. Since then, things have not gone precisely as planned. While the S&P 500 has experienced an upside of 4.9%, shares of Johnson Outdoors have overseen a loss of 11.1%.

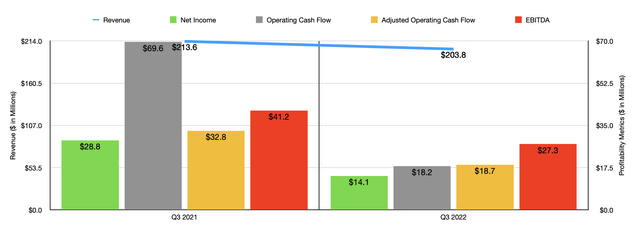

Given this significant return disparity, you might think that there is a fundamental cause that has been the driver. In this case, you would be absolutely right. When I last wrote about the company, we only had data covering through the second quarter of its 2022 fiscal year. Today, that data now extends for one additional quarter through the third quarter. During that quarter, sales for the business came in at $203.8 million. That’s down slightly from the $213.6 million generated one year earlier. Interestingly, the company actually experienced strength in most product categories. For instance, watercraft recreation sales for the business grew by 10.1% year over year, while sales associated with diving increased by 7.4%. The real winner, however, was the camping category. Sales there jumped by 32.2% year over year. Instead, the pain had to do with the company’s largest category: fishing. Sales there plummeted by 12.1% year over year, dropping from $155.3 million to $136.6 million. Management claimed that this decline came even in light of solid consumer and customer demand. Instead, the pain was because of supply chain disruptions and the resulting unavailability of certain necessary components that ultimately led to reduced sales. In particular, the company was hindered by the technical and electronic nature of certain products within this category and the supply chain problems centered around these types of products.

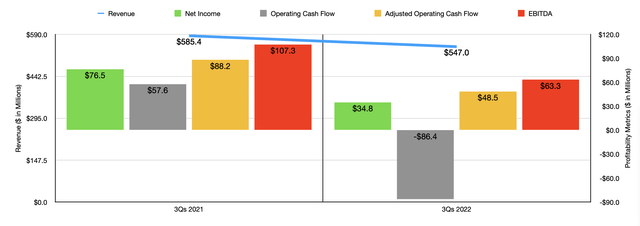

With revenue falling, profitability followed suit. Net income for the company plunged from $28.8 million in the third quarter of 2021 to $14.1 million the same time this year. This was driven almost entirely by the operating profits of the fishing category plunging by 58% from $39.4 million to $16.6 million. Higher raw material costs impacted the company across the board. But those cost items were particularly bad for the fishing category because of supply chain problems. This drop in net income also translated to weaker profits in other ways. Operating cash flow, for instance, dropped from $69.6 million in the third quarter of 2021 to $18.2 million the same time this year. Even if we adjust for changes in working capital, it would have fallen from $32.8 million to $18.7 million. Meanwhile, EBITDA for the company also took a beating, dropping from $41.2 million to $27.3 million. And as can be seen in one of the charts of this article, the weakness on both the top and bottom lines for the visitors also translated to weaker overall performance for the first three quarters of the 2022 fiscal year as a whole.

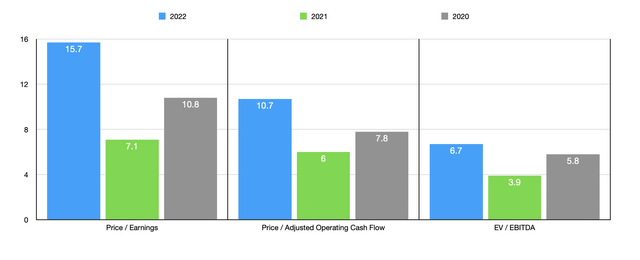

Unfortunately, we don’t really know what to anticipate for the entirety of the 2022 fiscal year. It is clear, however, that 2022 will not be anywhere near as positive as 2021 was. If we were to project out, using results seen for the first three quarters of the year, then we might anticipate net income of $37.9 million, operating cash flow of around $54.7 million, and EBITDA of roughly $71.4 million. These estimates are slightly greater than the prior estimates I calculated in my last article of $36.4 million, $53.5 million, and $65.9 million, respectively. Given these numbers, shares of Johnson Outdoors should be trading at a forward price to earnings multiple of 15.7, at a forward price to operating cash flow multiple of 10.7, and at an EV to EBITDA multiple of 6.7, respectively.

To put this in context, these multiples, using data from 2021, were 7.1, 6, and 3.9, respectively. And if the company were to revert back to the levels of profitability it achieved in the 2020 fiscal year, these numbers should be 10.8, 7.8, and 5.8, respectively. As part of my analysis, I also compare the company to five similar firms. On a price-to-earnings basis, using forward estimates, the range of these companies was from 3.9 to 25.5. Our prospect was cheaper than all but one of the companies and was tied with one another. Using the price to operating cash flow approach, only four firms had positive results, with a range of between 4 and 14.8. Two of the four were cheaper than Johnson Outdoors in this case. And when it comes to the EV to EBITDA approach, the range was between 3.3 and 9.8, with two of the companies being cheaper and another one being tied with it.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Johnson Outdoors | 15.7 | 7.1 | 10.8 |

| Smith & Wesson Brands (SWBI) | 7.1 | 14.8 | 3.3 |

| Clarus Corp. (CLAR) | 25.5 | 13.6 | 9.8 |

| AMMO (POWW) | 14.7 | N/A | 4.9 |

| Latham Group (SWIM) | 36.1 | 5.7 | 5.8 |

| Vista Outdoor (VSTO) | 3.9 | 4.0 | 3.3 |

Takeaway

Based on all the data provided, it is clear that Johnson Outdoors continues to have some issues. Depending on market conditions, that picture could stay that way for a little while or could even worsen further. At some point, the situation will improve, but it will take patience and time to get there. Even if financial performance in the future were to match what is being projected for 2022, I can’t imagine shares being considered any worse off than fairly valued. The company is especially aided by the fact that it has no debt and has cash and cash equivalents of $117.6 million. Relative to similar players, the company might be slightly near the low end of the scale, also indicating some upside potential most likely. In all, I still do believe the business is a favorable risk-to-reward prospect, leading me to keep my ‘buy’ rating on it for now.

Be the first to comment